The FOMC meets next week, with everyone everywhere expecting a 50 bps rate hike to be announced on Wednesday. Yesterday’s “unexpected” and “shocking” negative GDP is unlikely to deter anyone on the committee. Most have already dismissed it as nothing more than quirky, temporary factors, not unlike when they did the same to Q1 2014’s similarly negative result.

At least that one had the Polar Vortex (uh oh).

Jay Powell’s group can’t see beyond the US border, doesn’t care much about inventory, and doesn’t seek counsel from markets. While Euro$ #5 rages up and down the curves, unleashing the wrecking ball of US$ exchange value (and already audible groans mewling in Chinese or Japanese), US policymakers remain steadfastly committed to “inflation” for the time being.

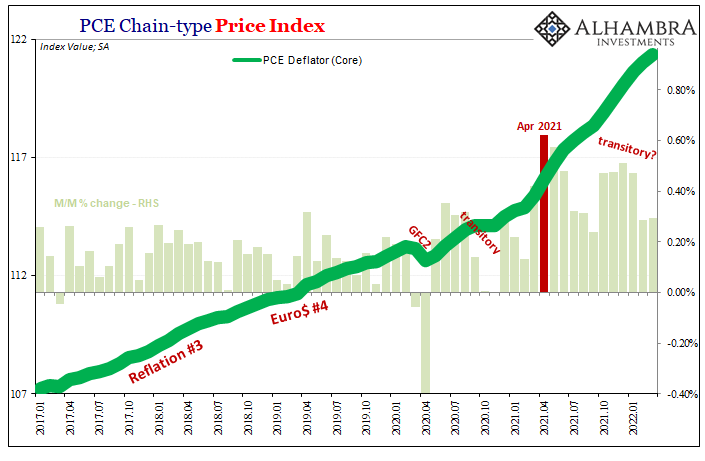

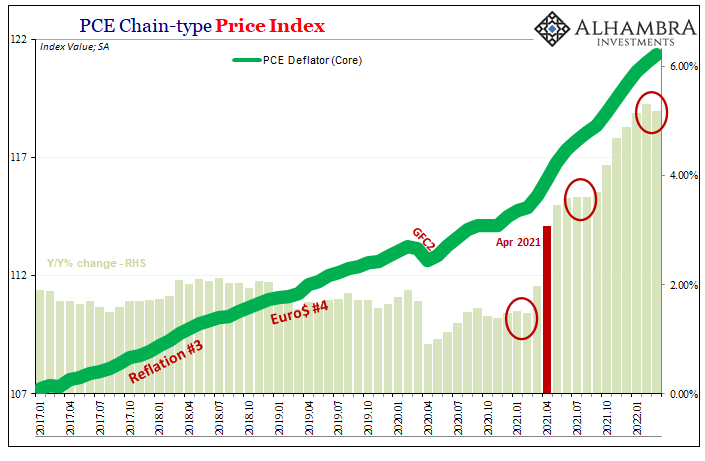

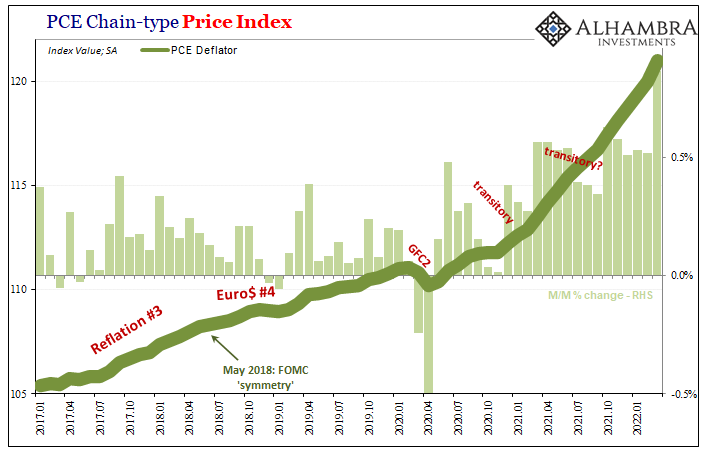

When it comes to consumer price data, however, those at the Fed choose the PCE Deflator and particularly its core number as the most truthful representation. Should anything at this stage dissuade policymakers, about the only thing would be a miss in the core rate.

For the second straight month, the month-over-month change to the seasonally-adjusted core index was rather normal, actually. Two in a row at 0.29% wouldn’t have been out of character for 2018; though, back then, Jay Powell’s FOMC thought inflation was set to be on the loose, too.

Year-over-year the index rose 5.18%. For the first time in some time this was not a 40-year high, the annual rate down from February’s (revised) 5.31%. It was the first detectible deceleration since last February (the rate did decline ever-so-slightly in August 2021 from July, but you have to go out to three decimal places to see it).

The FOMC already chickened out in its hawkishness back in March, beginning with hike cycle with a whimper of 25 bps given the huge uncertainties surrounding the Russia/Ukraine situation. Slowing down in the core isn’t going to dissuade them again.

Those Eastern European consequences only added more to the headline PCE Deflator in the form of an even worse gasoline/oil effect; the main consumer price index jumped 0.87% month-over-month, up a new multi-decade high of 6.59% (compared to the CPI which reached 8.54% y/y).

Even that, however, serves to highlight this sudden difference, the amount of strictly oil contributions to March’s “inflation” picture compared to much tamer (though not fully tamed) food-less, energy-less core rate.

It very well could be that what the core PCE Deflator shows is consistent with GDP (not just in the US, also Europe, plus Japan, as well as China; basically, every last one of the world’s largest economies) and the blistering Euro$ #5 screaming more and more across market and currency watchers’ price sets.

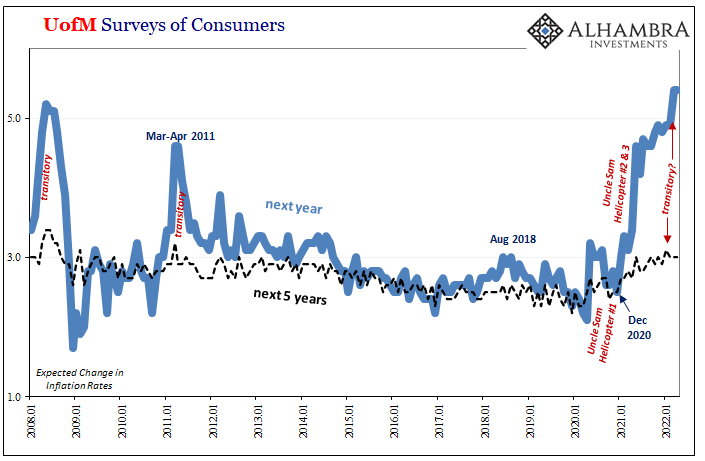

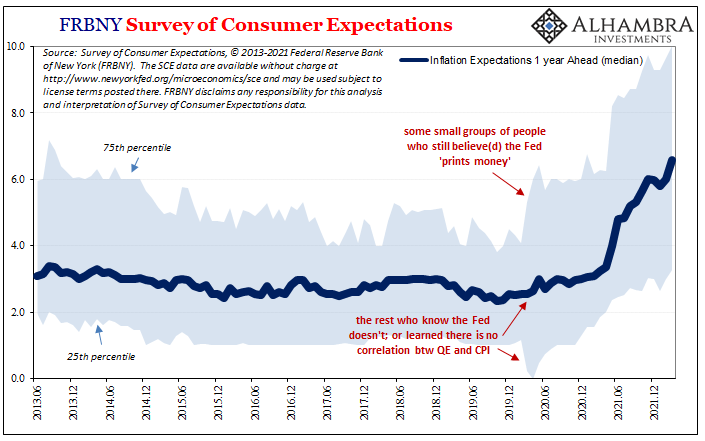

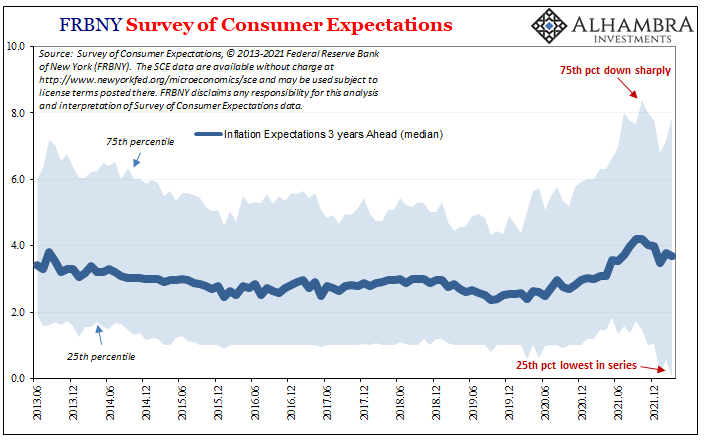

That particular possibility might better explain such persistently stubborn consumer expectations. The University of Michigan showed no change in its surveyed “inflation” estimates for April despite the huge headline CPI and now PCE Deflator. The 5-year forward expectation itself remains at nothing more than 3%.

As noted on previous occasions, even FRBNY’s own consumer survey results have trended more decisively toward a not-inflation future, also since October.

Are consumers thinking five, too? Probably not thinking Euro$ #5; feeling its effects.

I doubt any of these doubts and contrary indications will be near enough to back officials off now, easy enough for them to set aside the slight slowdown in the PCE core as monthly, high frequency noise while at the same time looking down on market prices and consumer surveys with the usual Economics disdain to not follow closely behind the Fed’s conventional “lead.”

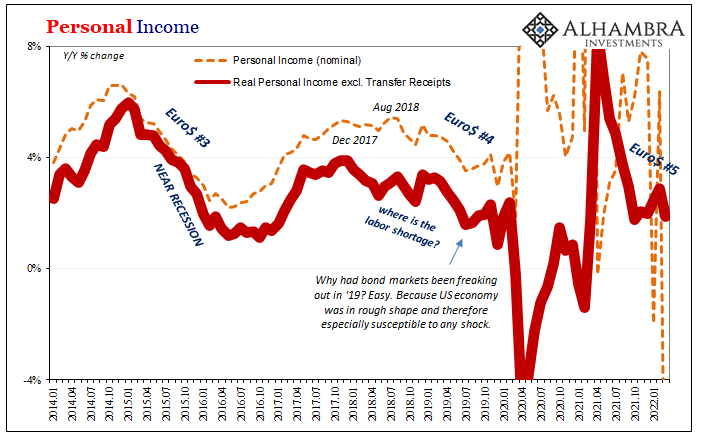

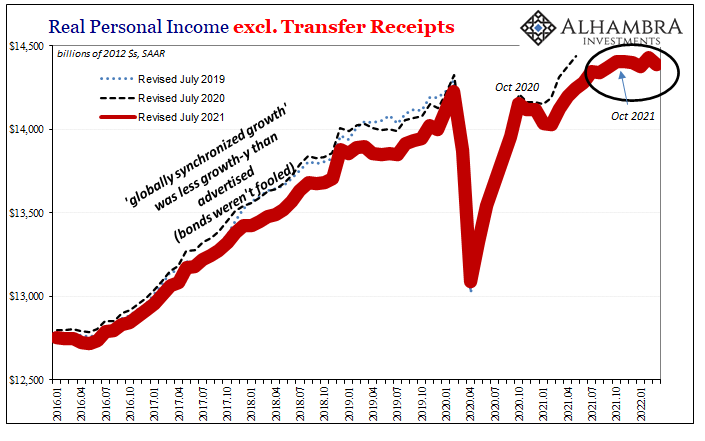

But it’s not really about the data, rather the appearance of doing something about “inflation.” A single 25 would never be enough to call a halt to the mistake. At least not until that mistake becomes, sorry, widely unmistakable. And that could be some time, even if key economic data (below) already has long leaned in the same direction as Euro$ #5 markets.

Outside the Fed bubble, economic concerns are increasingly divergent, already very different. Far more of recent data (since October) joining that side than not.

Stay In Touch