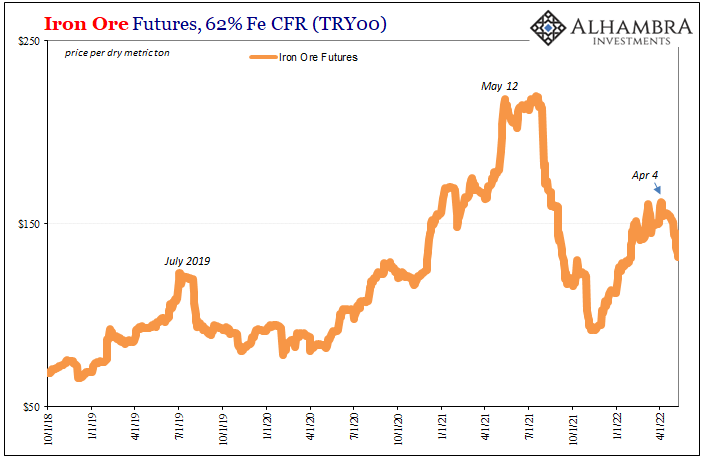

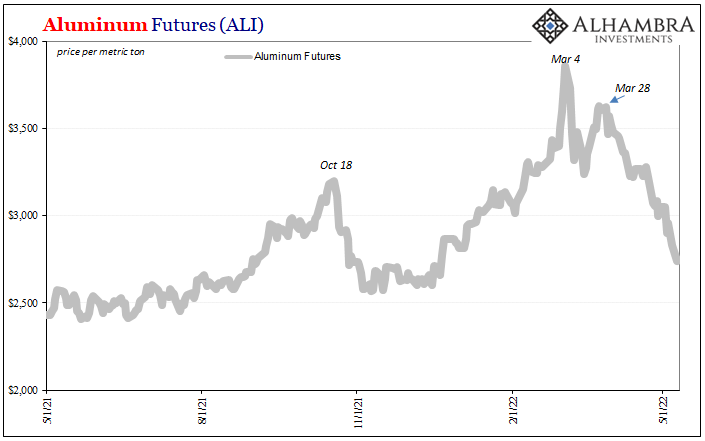

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April.

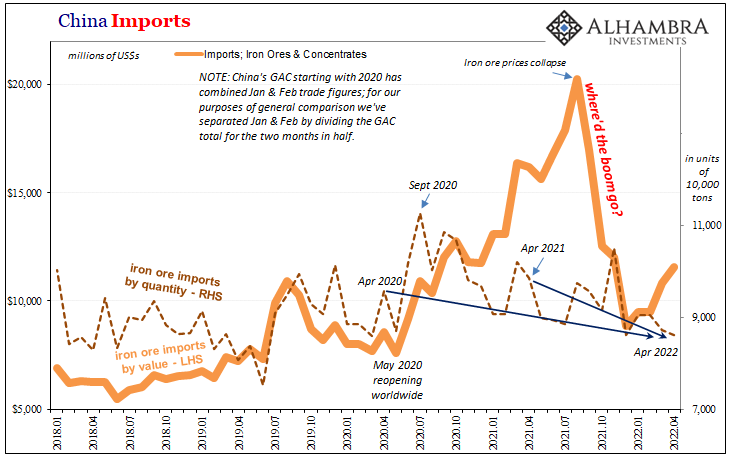

This despite supply bottlenecks and production shortfalls which continue to plague each. Copper has now fallen to its lowest since last October, while iron’s 2022 rebound came to a screeching halt as it heads downward again. As to the latter, the Chinese reported a serious decline in demand for the raw metal that goes a long way back before April 2022.

By value, China’s imports of iron bounced like the commodity’s price had, yet by volume imports last month were 13% less than the same month in 2021.

Had bad was that? Estimated physical imports of iron were “somehow” 10% below April 2020!

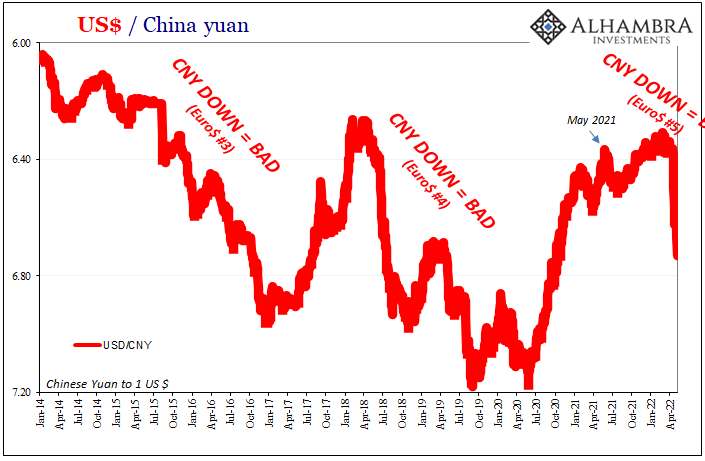

Lockdowns, they say. This is not what CNY reports, however. Questions aren’t being raised in these markets (eurodollar like industrial commodities) about short run demand as China grapples with more than its curious public pursuit of Zero-COVID.

As to aluminum, the Chinese didn’t want as much of that metal, either, imports down 4% year-over-year, even as those prior high prices had – small “e” economics – convinced China’s massive smelting scheme to put the pedal to the metal on production.

On top of that, soaring aluminum prices and disrupted exports from Russia helped Chinese smelters scale production to record levels. Once activity picked up, excess inventory would hit the global markets and pose a significant downside to prices.

Just as economic activity really starts to reverse.

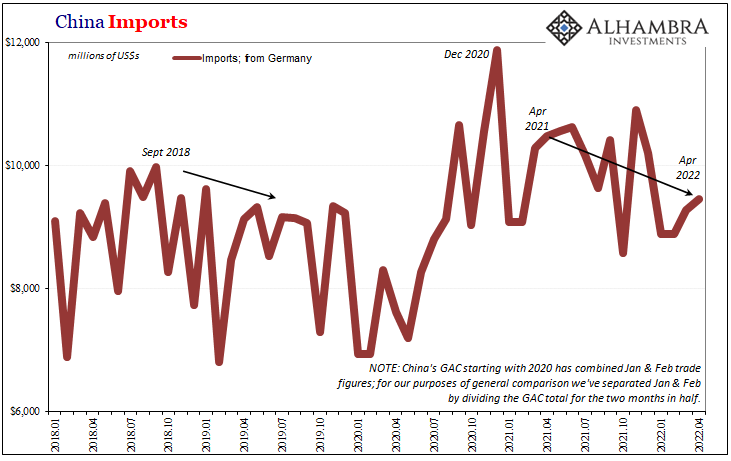

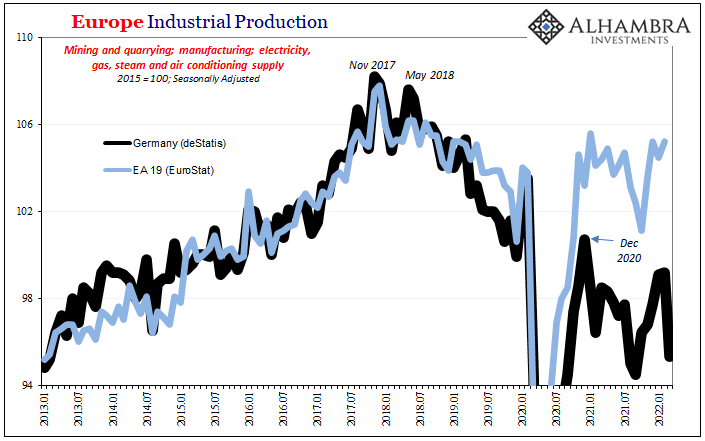

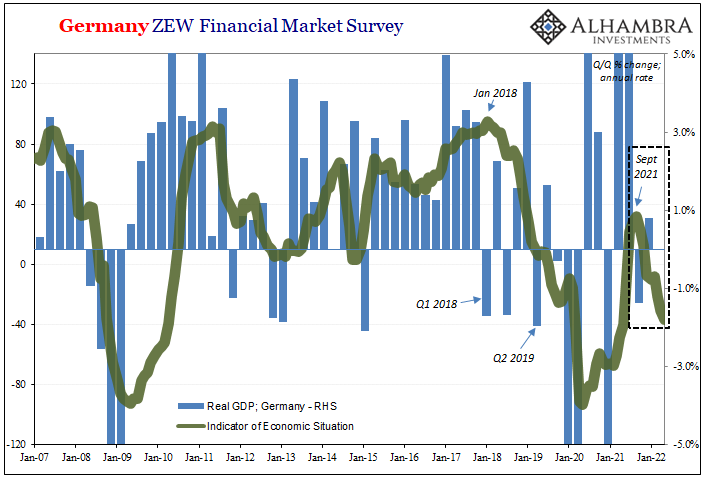

China’s plight is already being picked up elsewhere, notably Germany. The Germans have reported an almost continuous and likewise stream of awful economic results one after another. Though GDP managed a small positive in Q1, that won’t last – and falling output from Germany would be consistent with these other industrial price adjustments.

Industrial Production collapsed by 3.2% in March from February, the ZEW’s situation index continued its disturbing decline, there is no end in sight and not all of it should be laid at the doorstep of Vlad Putin. This has been coming since long before the invasion.

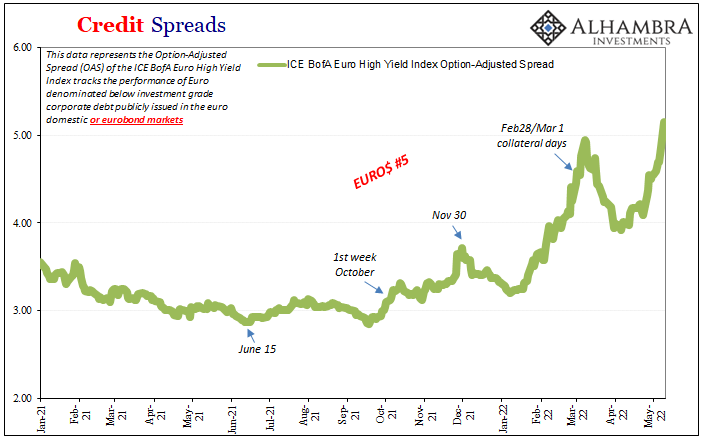

Euro$ #5, not rate hikes or geopolitics. The latter only adds to the already-tense global economic situation.

As with Eurobond prices and credit spreads, questions about actual demand have been raised – as was always going to be the case following last year’s supply shock. Add to the shock, to some extent because of it, Euro$ #5’s increasing worldwide drag (see: CNY) and it’s getting closer to the time to synchronize – and not just China to Germany.

Again.

Stay In Touch