For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him? Whatever the case, there’s truth to what’s written if only because interest rates haven’t been rising based on rising inflation/growth expectations.

Quite the contrary, actually. It’s all FOMC and the politics behind its rate hikes.

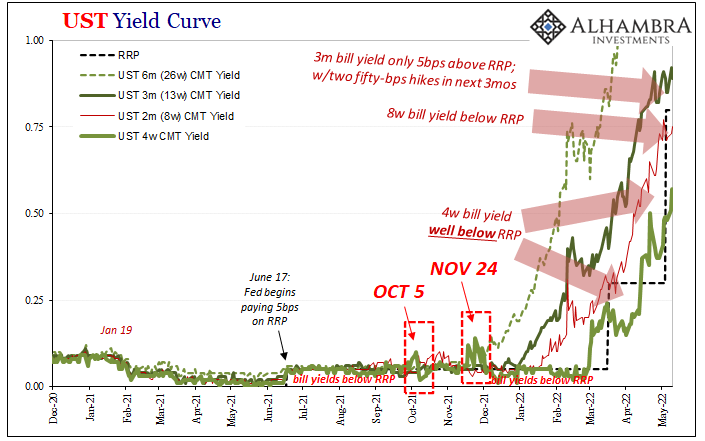

Rate hikes are demanded from up on high so that the government can appear to be doing something about “inflation.” If, however, the rate of consumer price change begins to decline, so might the political pressure, therefore the end of rate hikes and likewise should end the yield curve’s upward thrust before it goes too far.

This is inversion, after all.

But the mainstream view is one where the Fed’s rate hikes are the problem being priced in markets right now. Should Powell be set free to acknowledge these growing issues, we’re supposed to believe he’ll be able to right the ship in time for a close save.

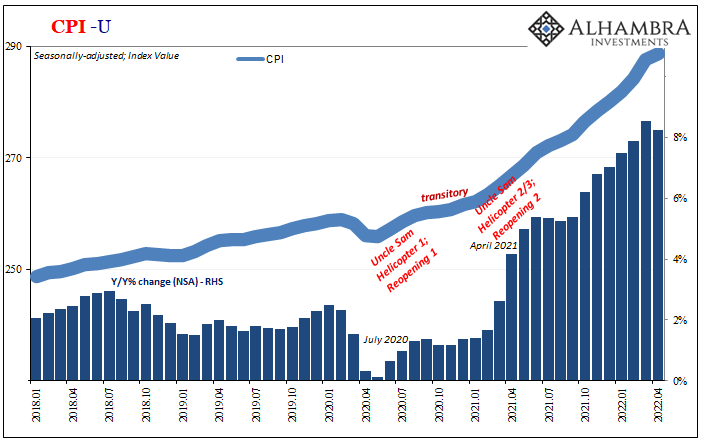

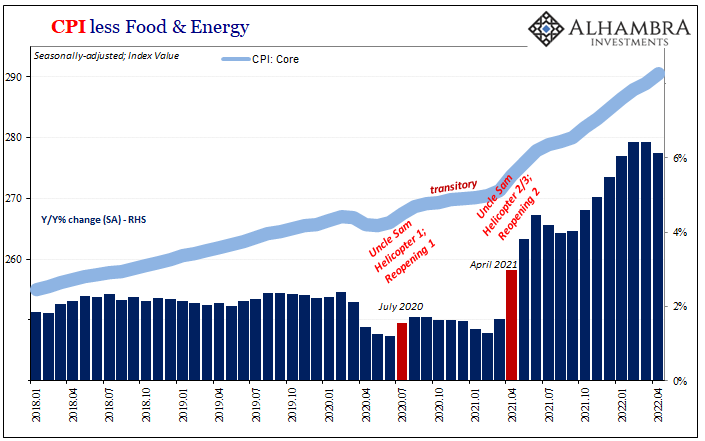

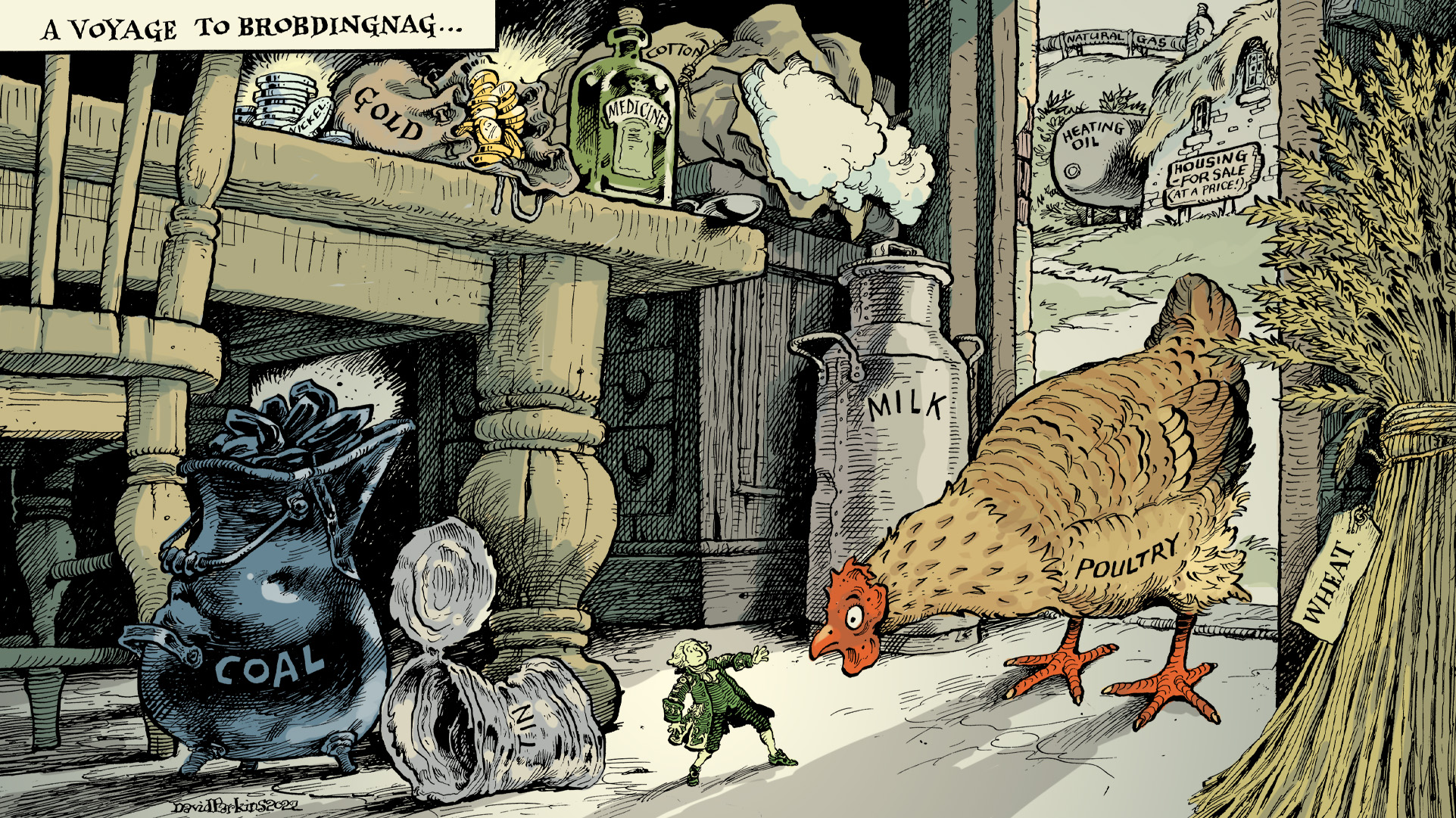

It all starts with that question: has “inflation” peaked? For one month, it might seem this way. The latest CPI figures released just today have the annual rate finally rolling over after seven (additional) months of painful acceleration. The headline year-over-year change (NSA) dropped slightly from 8.54% in March to now 8.26% for April 2022.

Yet, the math here doesn’t necessarily add up to transitory. To start with, this update was a lot of base effect. If last year you had to predict the month when “inflation” would begin to calm down, the easiest guess, just a blind stab in the dark, was always going to be April 2022 if for no other reason than it being compared with April 2021 (when the consumer price rampage began).

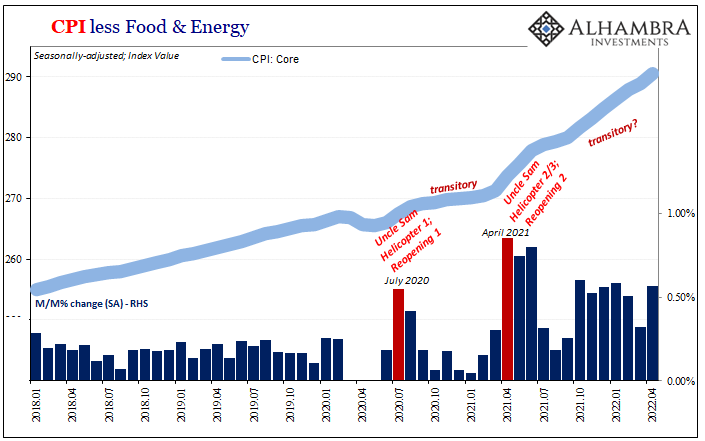

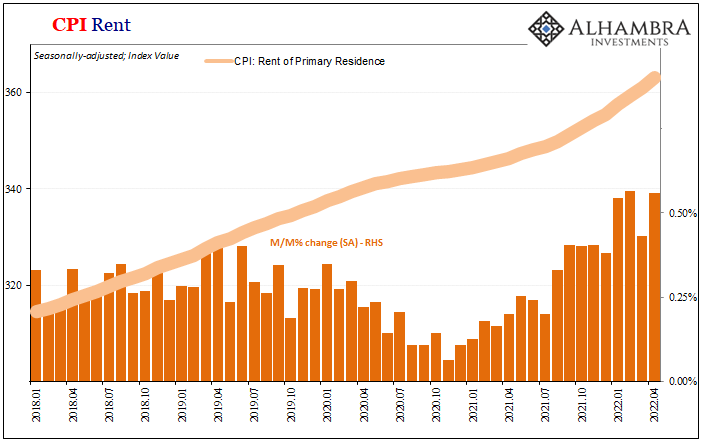

Gasoline prices may have declined March to April, as did used car prices for the third month in a row, but those along with favorable base effects couldn’t quite offset especially rent. It is the latter here which is causing great additional harm, another stiff month of fast core index growth even if its annual rate, too, like the headline, decelerated.

In other words, there’s still a lot of pain in the CPI even if the headline made it seem like improvement. It’s highly unlikely the FOMC will throw in the towel now based on nothing more than the simple arithmetic of any annual comparison.

The FOMC may not have to as markets continue to suffer “volatility.” Bond yields today, for example, initially surged when the “hot” core rate (month-over-month) confirmed ongoing consumer pain (again, largely rent) which would’ve added more to the justification for the Fed’s rate hikes.

But then yields dropped considerably, as did stock prices and even crypto, as markets worry about potential demand destruction (along with other problems, like an obvious collateral shortfall and growing generalized risk aversion) rather than strictly Fed hikes.

It is interesting (in a rather obvious sense) how despite US consumer prices being so far out of control compared with other places around the world, such as Japan or China, yet it is the US dollar which has surged against both the Japanese and Chinese currencies which have tank. It’s supposed to be the other way around.

Something’s way off here.

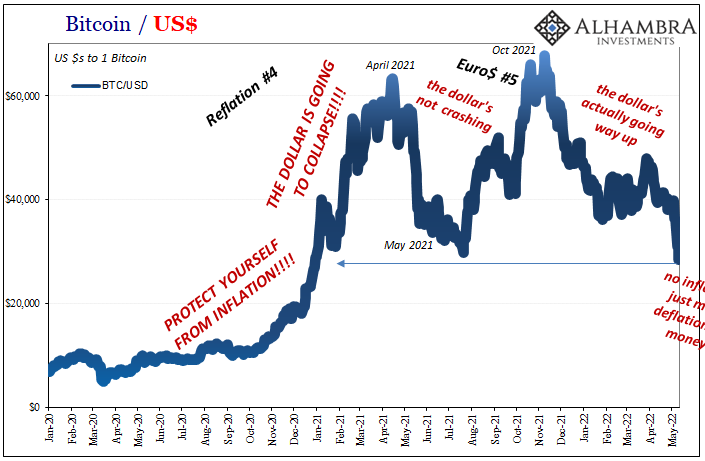

Similarly, crypto prices like Bitcoin – digital gold, they say – continue to suffer despite these CPI numbers that are still very close to 40-year highs. In other words, markets sure aren’t acting like inflation is going to continue to spiral after all. Worse, they don’t seem to be positioning as if rate hikes will be the reason for it to end.

I wrote back in January about how we’ve seen this before:

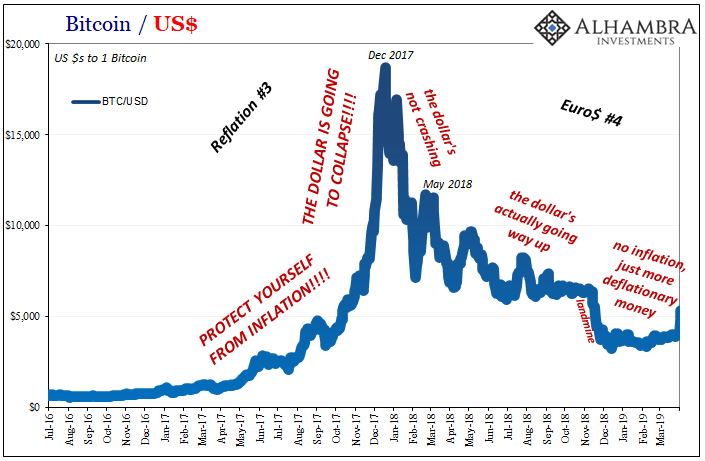

My high(er) level view on BTC is relatively simple. The public, by and large, has bought into it along with other cryptocurrencies based on a misunderstanding of the actual monetary situation therefore the true balance of risks.

Economics as a discipline along with the financial media have each done an exceptionally poor job of educating people as to how the monetary system actually works (because neither actually knows). Most have been left to believe wholeheartedly in the money-printer-go-brrrr meme without any pushback anywhere; the claim goes unchallenged and unchecked across the entire landscape.

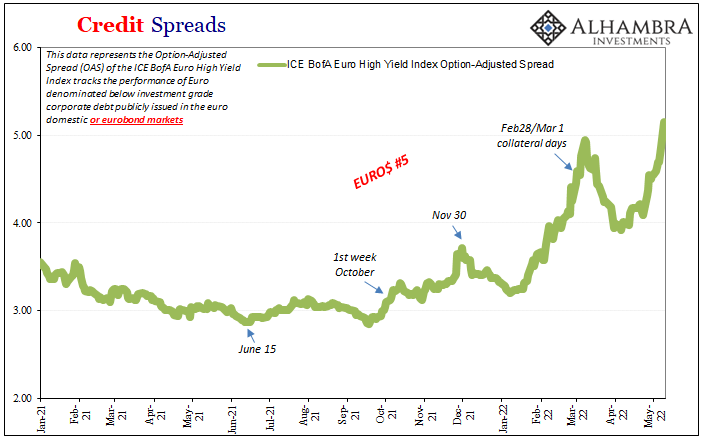

Except, once 2017 turned to 2018, meaning Reflation #3 exited and gave way to Euro$ #4, it didn’t really matter what the US or European CPI did from there. The (euro)dollar took charge and as it rose crypto prices plummeted once those prior retail assumptions underpinning Bitcoin prices didn’t just dissipate, they did so in obvious fashion with every charge upward in the dollar’s exchange value.

The higher it went, the more you couldn’t help but notice everything about those assumptions had been way off.

The difference this time is high consumer price rates actually showed up for once. So, why are people who piled into Bitcoin piling right back out of it like it is 2018 again? In all the important ways, it is.

The dollar “should” be falling rapidly. It surefire is not, rather the CPI details like the markets’ behavior in reaction to them perfectly describe how it was never inflation to begin with, on the contrary, we’re now seeing the end of last year’s supply shock was maybe inevitably going to produce demand destruction.

Rising rents will only add that much more to it even if annual consumer price changes start to back off from here on.

Everything, even Bitcoin, is pointing to Euro$ #5 rather than inflation – as if right on cue.

That leaves the Fed’s staring straight into what will likely become an involuntary rate hike termination not as a matter of several CPIs moving a tiny bit lower on technicalities, but as the reality being priced widely in ways that leave nothing whatsoever consistent with genuine inflation.

There are many reasons to look back suspiciously to last October for all those, from the flattening now inverted curves and even Bitcoin perhaps heading toward what just printed as a multi-year low. And it was October when the US CPI truly accelerated. These markets have been pricing that as pain – not inflation – ever since.

The CPI is very likely coming back down for real and not just base effects. Whether that reversal began during April is equally as likely a moot point for reasons that don’t have much to do with the Fed.

Stay In Touch