This whole “inflation” scenario isn’t really that difficult to piece together, effect from cause. Sure, Jay Powell’s trying to nuke it by hiking the federal funds rate, but no one really uses fed funds and the problem isn’t the unsecured cost of borrowing bank reserves (not money) that are literally overflowing.

For one, the FOMC’s efforts aren’t going to get more gasoline out of refiners who aren’t getting enough crude oil from producers who still think this is all too familiar for them to climb aboard the red-hot-economy narrative so as to restart Drill Baby Drill.

The other huge piece of consumer prices is the online shopping craze. Already a serious trend before 2020, once reluctant Americans agreed to stay in their homes for the government’s overreaction to the coronavirus pandemic, boredom along with the conveniently-timed Uncle Sam’s depositing got everyone hooked on online shopping. It’s not a coincidence that Amazon’s fortunes surged when prices began to.

Online spending has meant buying stuff made elsewhere and having it shipped in a different way than traditional brick and mortar. The latter has an established supply chain and existing middlemen like procedures to handle goods traffic; while the former required a massive retool at a time when the ability to accomplish rearranging (and managing the redirected flow of) everything was at its lowest point.

Supply shock simple economics (lower case “e”); rightward shift in demand, inelastic supply, therefore prices.

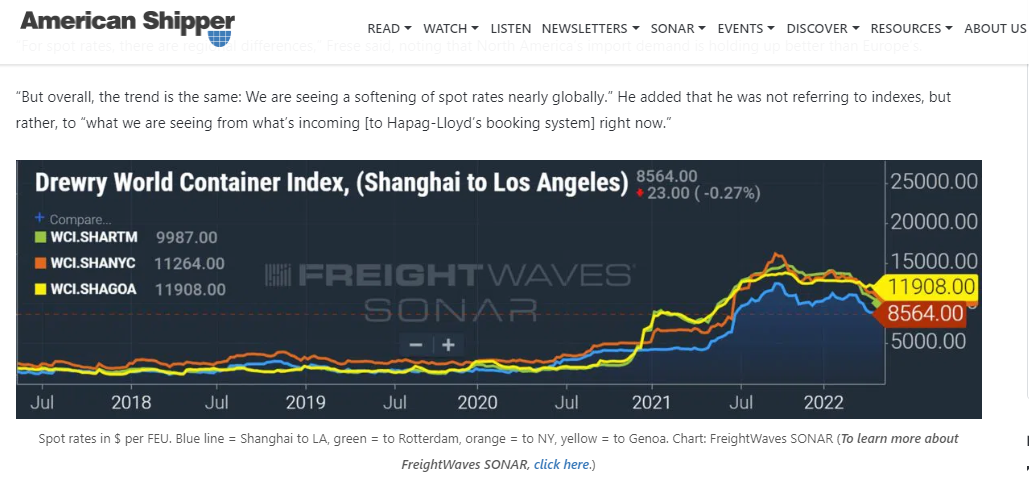

The biggest beneficiary of this imbalance has been the shippers. They’ve been shipping the same amount of product if not less than before, but are getting paid a King’s Ransom because of literal impatience and what appears to be a permanent addiction to the Amazon app.

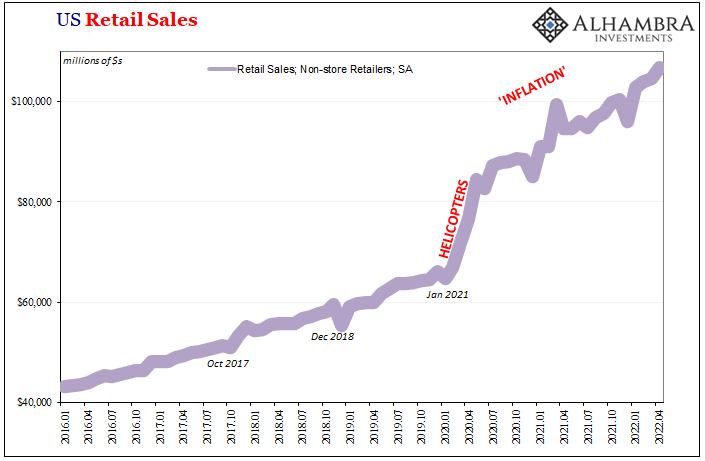

According to the US Census Bureau, retail sales in America recorded by these Non-store retailers continue to climb just as they have ever since Uncle Sam’s Helicopters #2 and #3 January and March 2021. While the online sales of goods may be robust, or appear to be, since these figures are not adjusted for price changes, shipping companies, though, have changed their outlooks in spite of all this.

Consumer sentiment is changing over time. Consumer behavior is changing. Inflation is going up. Disposable income is pressured. We see volume growth lower than previously expected due to … consumer sentiment. We all feel it.

The “we” here begins with Germany’s Hapag-Lloyd, the world’s fifth-largest container line operator, who is unofficially speaking on behalf of the company’s other peers.

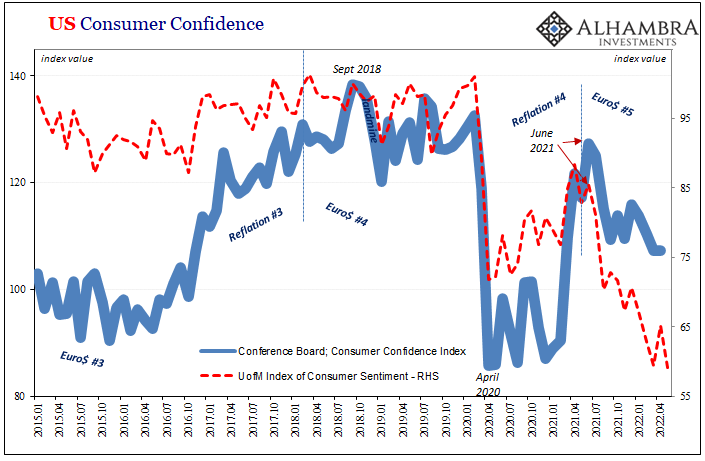

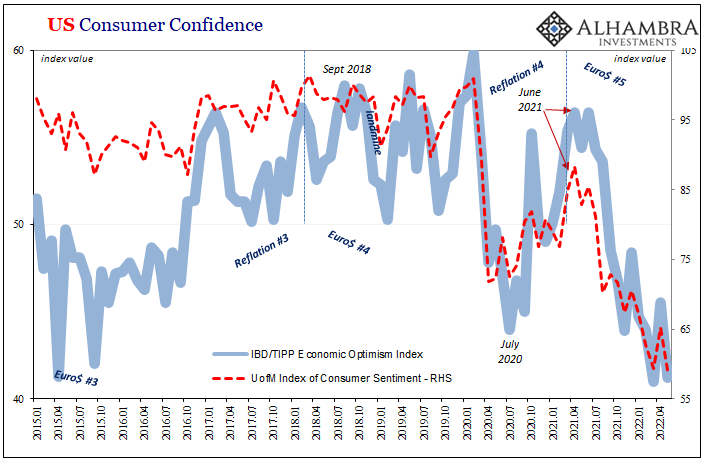

And what’s said is absolutely true, in the US and around the world (particularly Europe where spending is already falling off). Sentiment, at least, has tanked given the sustained price increases and the inability of shippers (unwillingness, perhaps?) to help bring down costs, reduce frictions and delays, thereby create more elasticity in the entire supply chain.

How’s Jay Powell going to help out here?

The economy may not need him as it may already be too late. As the Germans were lamenting, consumer sentiment indices across the US retail landscape are indeed seriously depressed. The Conference Board’s is the best of them, only down somewhat from last year’s Euro$ #5 transition, though that’s after having failed to rebound more fully from the 2020 recession.

The University of Michigan’s consumer survey, like IBD/TIPP’s, each the lowest in many years, all the way back to 2011.

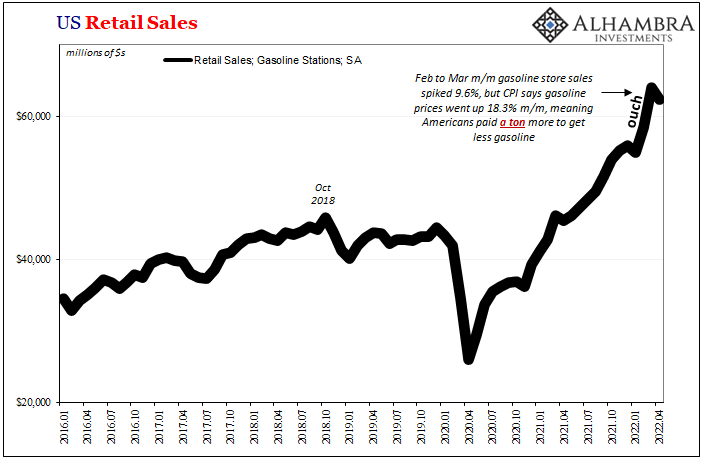

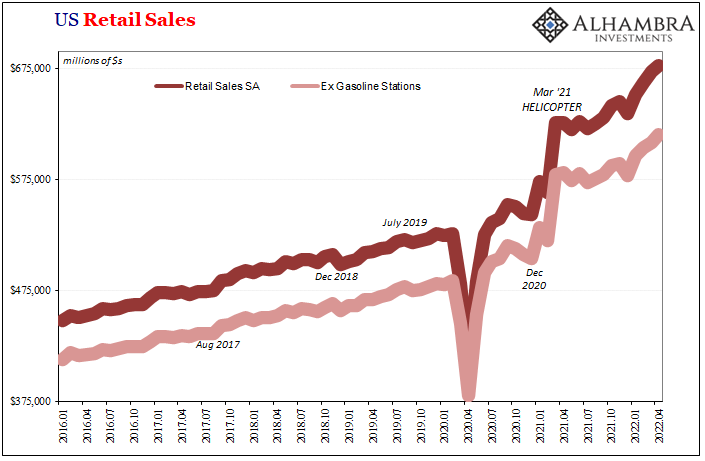

However American consumers may feel, retail sales continue to climb. The Census Bureau’s latest data show solid gains outside of the virtual shopping malls, too. Headline sales (seasonally adjusted) rose much more than expected in April 2022, increasing 0.9% from March’s upward revised estimate.

It wasn’t all gasoline, either, when excluding sales of gasoline stations retail sales were ever better, up nearly 1.3% on the month.

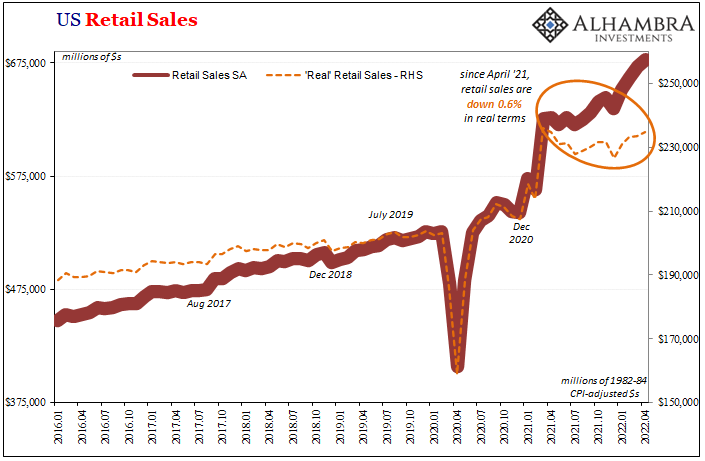

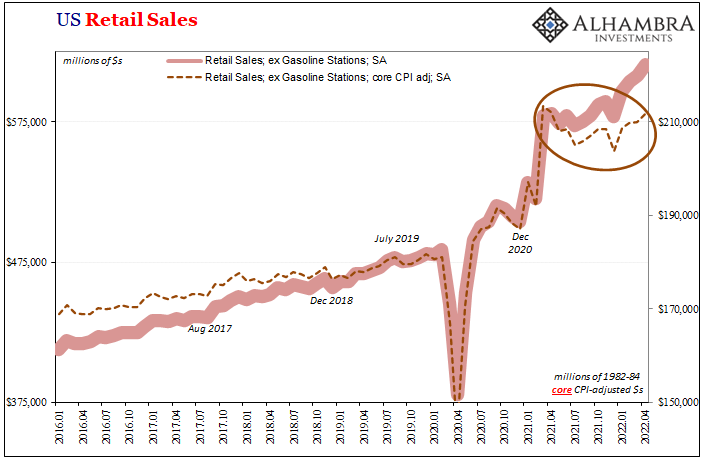

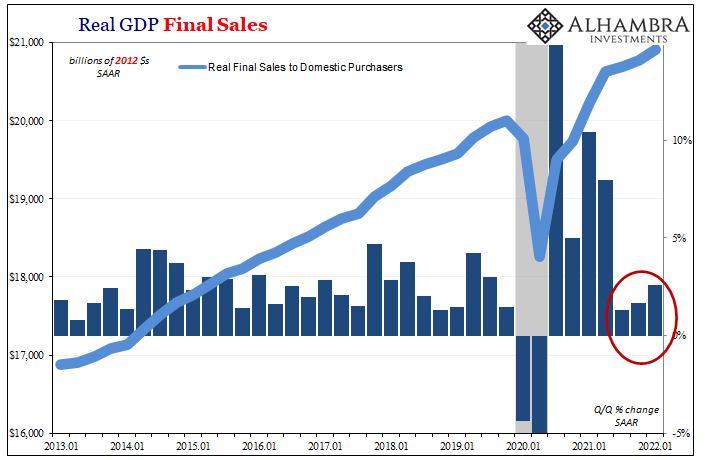

The catch, though, is pricing. Why are consumers spending so much though so gloomy about doing so? In real terms, spending isn’t growing nearly as quickly – if at all. Real retail sales (or deflated ex-gasoline sales) are somewhat lower than they had been at the start (and peak) of the helicopter-led demand shift (into that supply inelasticity).

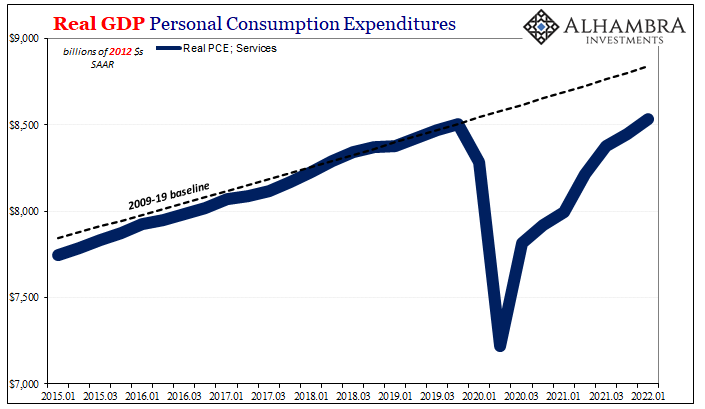

And that’s only where the trouble begins. Consumers are paying a lot more and getting a little less than last year, furthermore this has come at the expense of spending on services which you don’t see in retail sales (but do elsewhere like GDP).

Fewer services, fewer goods, paying more for all of it. Consumer sentiment likewise as simple as “inflation.”

The question now is, how long – if at all – this begins to impact nominal spending on goods, too. This might be a good question to ask someone who is and has been at the center of the whole “inflation” dynamic. Some person who knows a thing or two about prices and consumer/business demand. An expert or two in the business of goods, even if they might speak German.

Obviously, not Jay Powell.

Stay In Touch