Inevitable

adjective

incapable of being avoided or evaded

I heard that word a lot last week. There is now a fully formed consensus that the US, and indeed the world, now faces an inevitable recession. It can’t be avoided. Central banks will have to keep hiking rates because that’s the only way to kill inflation. Yes, the inflation is due to supply constraints and the Fed can’t pump oil or produce fertilizer but they can raise rates and reduce their balance sheet. That will – inevitably – put the global economy into recession but at least the pain of higher prices will stop. I suppose it is axiomatic that we are headed to recession since by definition, if we are in an expansion, we are always moving toward the next contraction. But the idea that the next recession will be caused by a Federal Reserve that does too much, that goes a rate hike too far, is not credible. Inflation will end when aggregate supply and aggregate demand balance but we’ll reach that state despite what the Fed does, not because. Will that involve recession? Maybe. Maybe not. But whatever the Fed does will be dictated by the market, not the other way around.

Our rising price problem is, more than anything, a supply problem, and reducing demand is certainly one way to tackle it. I don’t think it makes a lot of sense but then no one asks me about these things. The idea that unemployment is preferable to employment but on a tight budget just doesn’t make any sense from a societal or fiscal point of view. A stated policy of reducing demand through monetary policy also presumes that the Fed has such control, that they can just move rates around and balance demand with existing supply and thus stabilize prices. Even if the Fed controlled interest rates – and they most certainly do not – the idea that they could actually figure out the proper setting for short-term interest rates that achieves this magical balance is ridiculous.

I have said repeatedly since the onset of COVID that when all the COVID distortions were gone, we were likely to find ourselves right back where we were. We entered COVID with economic growth that averaged 2.1%/year over the previous decade. During COVID we did nothing to positively change the factors that affect growth but we did add a lot of government debt in the process. And so, when all the distortions are past, the logical conclusion is that we will be back to growing at 2.1%/year and maybe somewhat less because of the added debt. And that is where we seem to be headed today as spending patterns appear to be reverting to pre-COVID norms (see Target and Walmart). There may be some catch-up to do yet on the services side – mostly with travel – but in general, we seem to be falling back to where we started. And that makes perfect sense no matter what Jerome Powell & Co. decide to do or not do.

But returning to the pre-COVID growth rate doesn’t mean we are headed to recession, that contraction is in our immediate future. There are certainly signs of slowing in the economy as I and Jeff and everyone else expected. We were not going to keep spending at the pace produced by the monetary/fiscal policy helicopter drops that started under Trump and that Biden felt compelled to copy. But I don’t know if the slowdown – which isn’t much as yet – will turn into outright contraction and neither does anyone else, no matter how forcefully and earnestly they make their pronouncements of doom. We do have some warning signs right now but so far they haven’t been sufficient for us to make big changes to our portfolios. We have certainly made changes and I think we prepared for this bear market – or whatever you want to call it – pretty well.

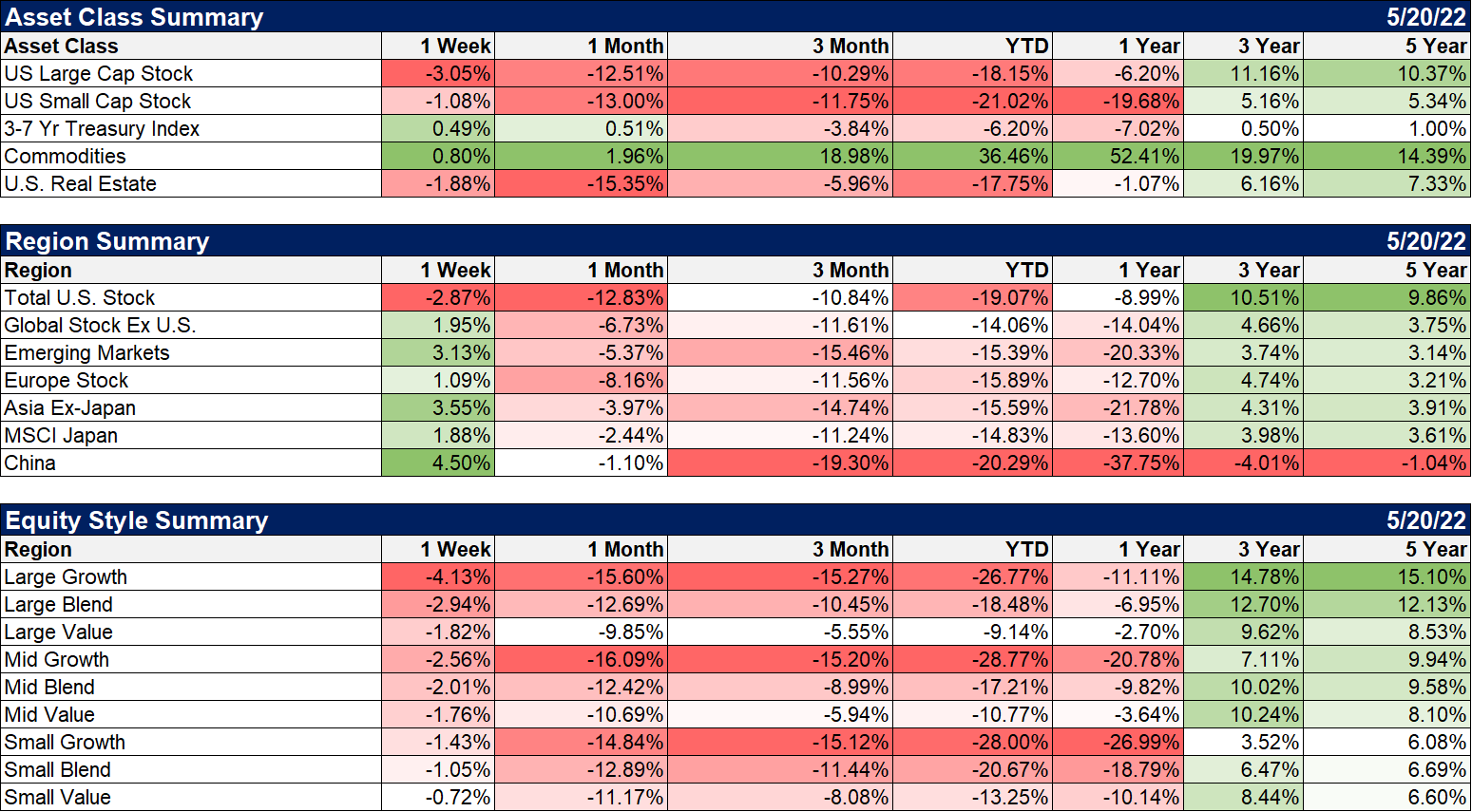

We shifted our equity exposure to all value and dividend factors last year and I went so far as to call the S&P 500 uninvestable. We only have some small legacy positions in the S&P 500 and none in the growth indexes (IVW or QQQ). We kept the duration of our bond portfolio short to intermediate term (37.5% ST, 62.5% IT) while rates were rising from the summer of 2020 until last quarter. In this quarter we increased duration, first with a shift to more intermediate and more recently to longer durations. Those moves were incremental and dictated by our investment process. They were not changes predicated on a recession, just a slowing in growth and a moderation of inflation expectations, both of which are happening now. Our bond allocation and equity allocations have outperformed by a wide margin this year. As a long only, strategic investor (we’re never completely out of the market), I’m not sure what else we could have done given the available information.

We have also had exposure to commodities which has been beneficial although I would have loved to own more. We have, more recently, been taking some profits. We have also had exposure to real estate – it’s a strategic investment for us so we’ll always have some – which has hurt us this year. REITs are down almost as much as the S&P 500 so we took our lumps there. But we have also maintained a higher than normal cash level and continue to do so. Versus our strategic targets, we are underweight equities (small and large cap), underweight Real Estate, underweight gold/commodities, and full weight on bonds (12.5% ST, 75% IT, 12.5% LT). We have been positioned for this slowdown all along and we have been rewarded for doing so.

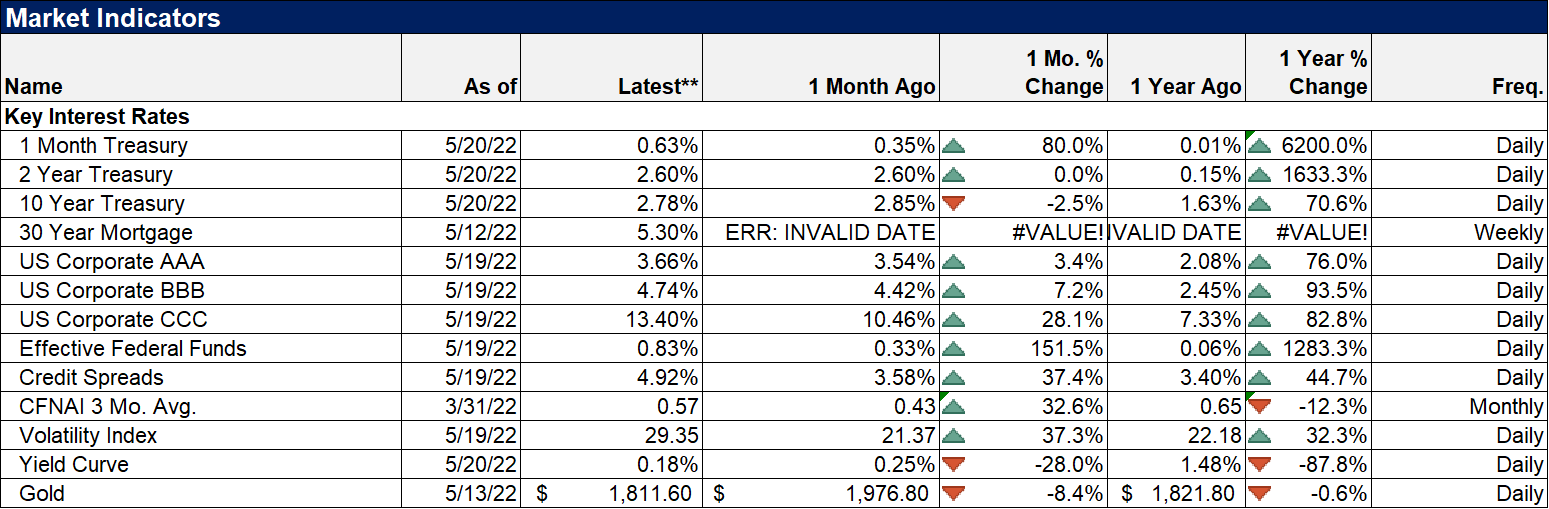

As I said we have had some warnings about the economy. The yield curve inverted very briefly and, more recently, credit spreads have widened somewhat. There are also inversions in money market futures (Eurodollar and SOFR) which show rates peaking in summer to fall next year. But none of those are warnings of imminent recession. At worst, right now, what the markets seem to be saying is exactly what I said above, that growth will slow back to pre-COVID rates. What we haven’t seen yet is for current interest rates to start discounting something more immediate. The 2-year Treasury yield has stalled but is still in an obvious uptrend. Same with the 10-year Treasury yield. I expect those rates to pull back some in the coming months but that’s mostly because they’ve overshot; the rate of change was just too steep and had to moderate. I would also expect the inflation reports to improve in the coming months, if for no other reason than base effects, and that should ease investors nerves. I expect the 2-year rate to pull back to the low 2s and maybe even the high 1s. For the 10-year, my target is 2.25 to 2.5%. Neither of those moves would break the ongoing uptrend in rates. What happens after that will be determined by the state of the economy at the time and I can’t predict that. We’ll see when we get there.

If we were headed for recession soon, short and long-term rates would be falling and the yield curve would likely steepen. The bull steepener is the recession signal, not the inversion that precedes it, and we haven’t seen it yet. If history repeats, both of those rates will fall well ahead of any Fed action. In the last cycle, the 10-year yield peaked in early November 2018 at 3.24% and fell to 1.5% before the Fed ever lowered the Fed Funds rate. Same with the 2-year yield which peaked at the same time at 2.94% and fell to 1.5% in August of 2019, the curve inverting that same month. The recession hit 6 months later when we shut down for COVID. Whether it would have come anyway is not something we can know but up to that point, markets were moving as if recession was on the way. The Fed is a follower of rates, not a leader.

There are a variety of other indicators we follow that aren’t even near warning levels. We monitor the Philly Fed’s State Coincident Indexes which currently show all 50 states expanding over the last month and three months (through March). As you near recession, the number of states expanding drops; we get concerned if it drops under 40 and really worried if it drops under 30. In the 2007/8 recession, it fell under 40 in June of 2007 and under 30 in August. Even with a reporting lag, that still provided ample warning of the recession that started in December. We also track the CFNAI and the Atlanta Fed’s GDPNow, both of which provide timely information if interpreted properly. Neither is even close to triggering a warning right now.

It is also important to remember that the market is not the economy and the economy is not the market. Markets anticipate and right now, as I just said, bond markets are not anticipating a recession. You might think stocks are pointing to something bad but as Paul Samuelson said so many years ago, the stock market has predicted 9 of the last 5 recessions, about as great a line as an economist ever uttered. I have no doubt that stock investors are scared; that is borne out by almost every sentiment indicator I monitor. But whether that is due to fear of recession or higher interest rates or something else I can’t say. And frankly, it doesn’t matter; stock market investors are not known for their sober assessment of the facts. Sour sentiment is a reason to think about buying not selling; the trick is identifying the point of maximum sourness. We may not be there yet but we’re a lot closer than we were in March when stocks made their last rally attempt. With everyone utterly convinced that things can only – inevitably – get worse, you should probably start thinking about what it would mean if somehow, someway, they didn’t.

Environment

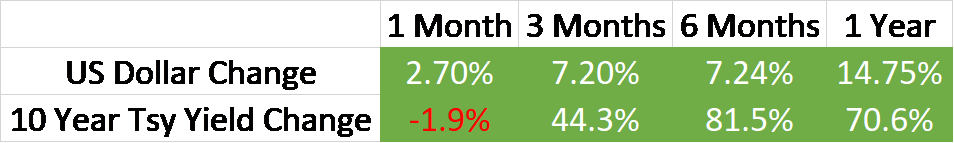

The uptrend in rates and the dollar both took a breather last week. The 10-year Treasury yield has fallen from the intraday 3.16% high to 2.79% in the last two weeks. The dollar fell 1.4% last week and now sits just below the highs set in early 2017, 2020, and 5 days ago. Like so many other things recently, the dollar moved too far, too fast and a break was due. A move down to the 101 level would be very normal and within the context of an ongoing uptrend. That could even extend down to 98 and the dollar would still be in an intermediate-term uptrend. Such a move would likely coincide with softer US economic data or better inflation data or both.

Markets

US stocks and REITs were down last week but most everything else was up. International equities were higher with Asia and EM leading the way on the back of the weaker dollar. Gold was modestly higher on the week (+1.87%) and commodity gains were broad (Nat Gas +5.5%, copper +2.4%, Palladium +1.8%, Platinum +1.3%). The commodity indexes only made modest gains because crude oil and some of the Ags were down.

Japan and Europe stocks were higher. International value, which I’ve mentioned in this weekly note several times recently, is still leading. Value continues to outperform in the US as well. That trend looks more durable by the day.

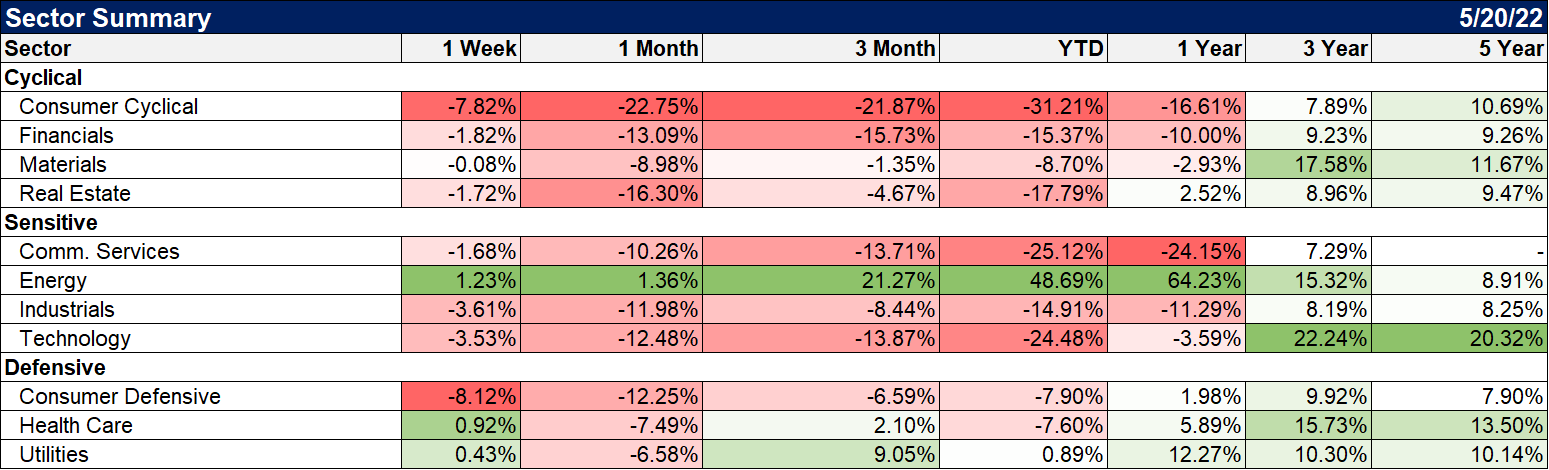

Consumer defensive stocks – staples – got killed last week on the Target/Walmart news. Whether that makes sense or not I’m not sure – probably not but valuations for that group were pretty steep anyway – but the damage was swift and widespread. Other defensive sectors such as healthcare and utilities were higher along with energy..again.

Tis impossible to be sure of anything but death and taxes.

Not Ben Franklin even though I was sure it was

We will eventually have another recession. When I don’t know but, like death and taxes, it will come. But soon? There is scant evidence to support that view at present. Positioning your portfolio for recession now is premature at best. It is easy to be bearish right now. That’s the consensus, the comfortable place to be, and, of course, the consensus is right a lot of the time. But if you want to outperform you are going to have to do some things that are uncomfortable, that are outside the consensus. At extremes, it pays very well to buck the crowd. Maybe it isn’t quite time yet. I’m certainly not jumping in with both feet yet; there are sentiment indicators I watch that could still get more extreme. But not by much. What I am doing is research. When the time comes, you need to have a plan, you need to know what you are going to buy and sell and how it all fits into your strategic framework. There’s an old saying on Wall Street that tops are a process and bottoms are an event. That has certainly been true in my career and it probably will be when this bear heads back to its den. Be prepared.

Joe Calhoun

Stay In Touch