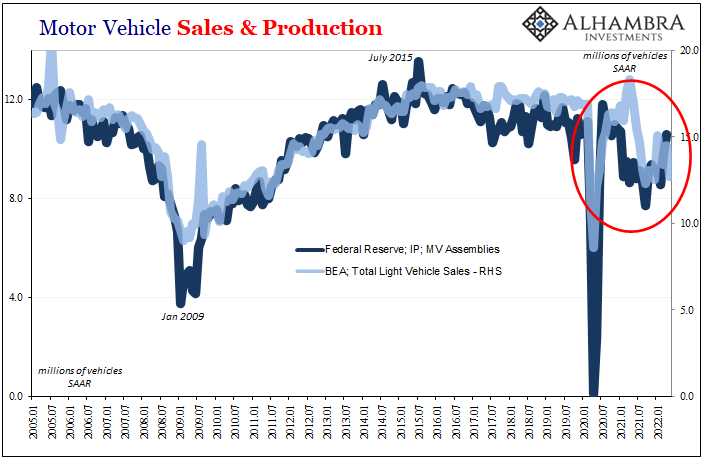

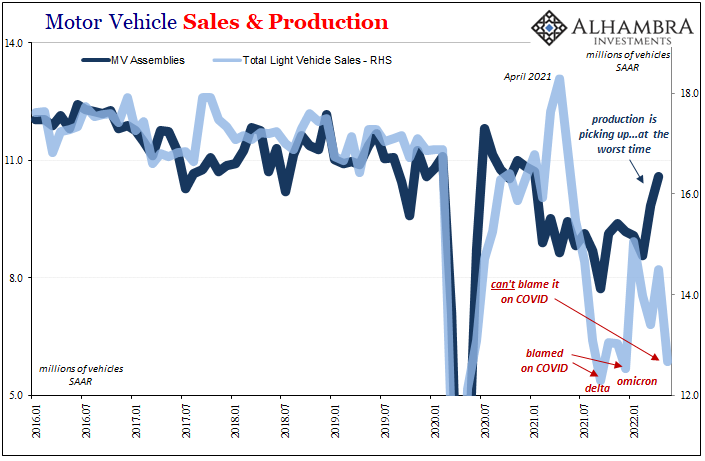

Inconvenient timing, to say the least. Auto sales in the US last month were, well, not good. According to the Bureau of Economic Analysis (BEA), the government agency responsible for GDP, unit sales of light vehicles tumbled to a seasonally-adjusted annual rate of 12.68 million in May 2022. That’s the lowest since December, down substantially from a not-too-high 14.50 million pace in April and third worst since 2020.

The other two months with lower sales than May had been September and December 2021, both COVID-plagued (delta then omicron). Like so many other indications around the world of late, we can’t use the pandemic as an excuse this time.

As I wrote earlier, demand wasn’t supposed to be a problem rocking the middle of 2022 what with sky-high CPIs making it seem the US economy was on fire.

For the ailing auto industry, if demand really is a growing concern, and it sure seems to be, this couldn’t have come at a worse time. Ever since the first overreaction to COVID, supply inelasticity particularly the perpetual shortage of semiconductors has left manufacturers scrambling; production levels limited.

According to the Federal Reserve’s estimates, as well as industry anecdotes, it seems as if the semiconductor supply is attaining some elasticity at last. The Fed’s IP figure for April 2022 put domestic Motor Vehicle Assemblies above 10 million (SAAR) for the first time since January 2021 – just as sales are going the other way for decidedly economic reasons.

Many are going to write this off as the application of rate hike “tightening” across the US economy. However, as I wrote last Friday, the Fed’s rate hikes don’t reach either Germany or Japan (certainly not China) yet the same demand questions have popped in each of those places, too.

They are mostly pandemic-free like we are in the US.

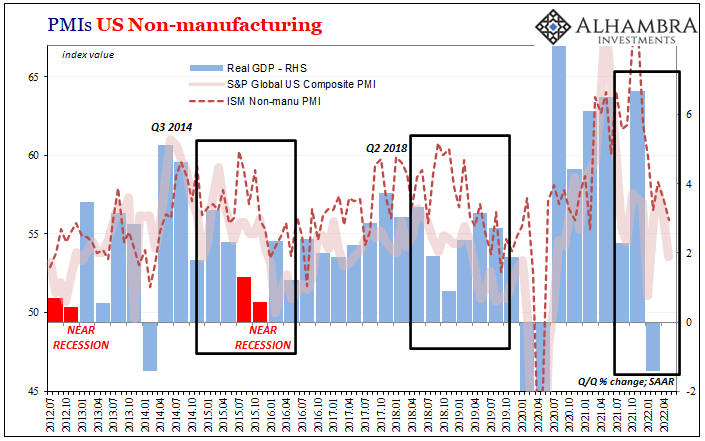

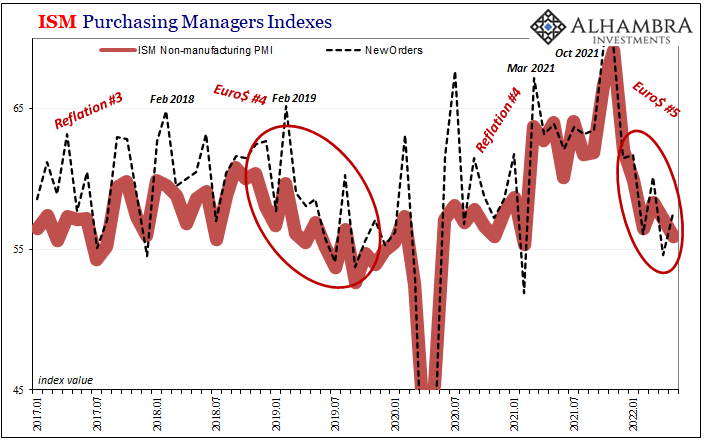

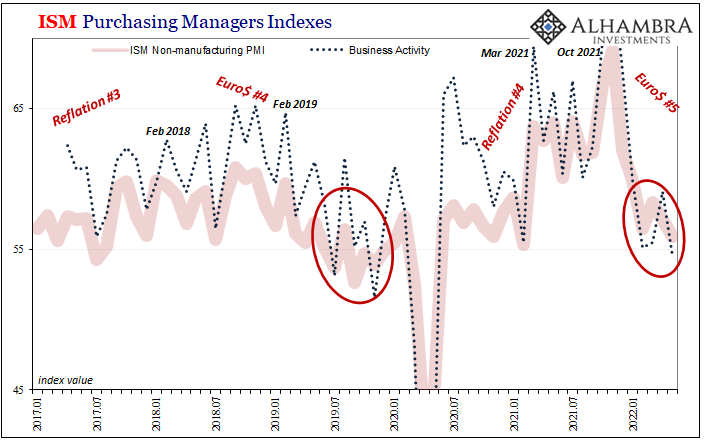

Far from automobiles as an isolated case, last Friday the ISM’s Non-manufacturing index and its components got lost in the at-least-it-wasn’t-as-bad-as-feared payroll sigh of relief. The headline for the services ISM dropped a little bit further into mid-2019 territory – the same as when the Fed last time had long before ditched its hikes and was already cutting rates.

While the New Orders estimate rebounded a tiny bit, monthly noise, the business activity index dropped by nearly 5 pts; going from 59.1 to 54.5, the lowest since, you guessed it, May 2020.

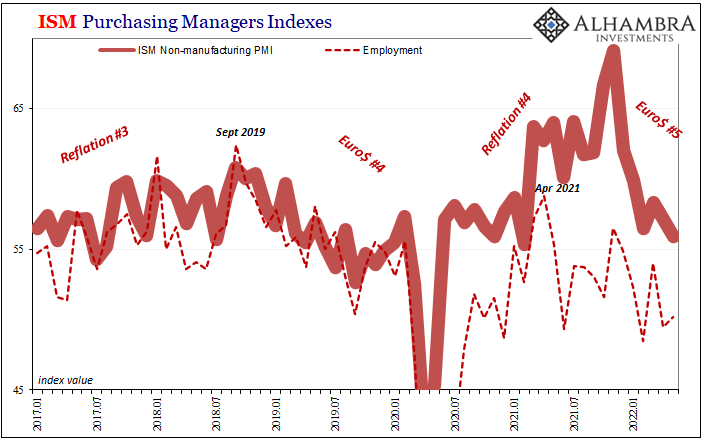

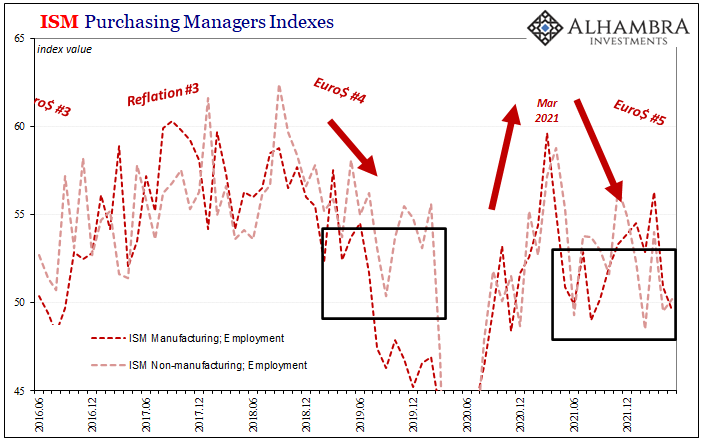

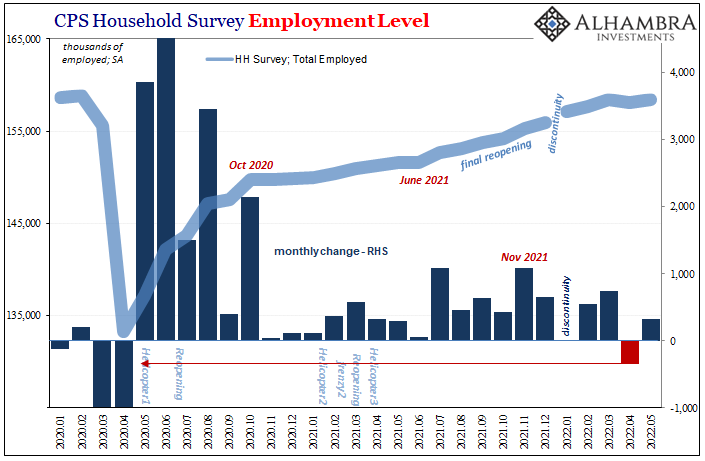

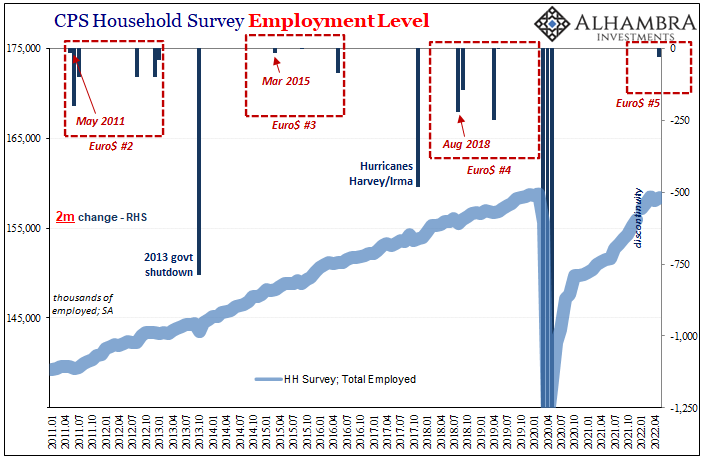

Beyond that, the employment number just barely squeaked above 50 after having been slightly below the magic dividing line in April; 49.5 to 50.2. Both those months consistent with the material slowdown in employment the full range of BLS labor data had actually displayed last week.

Here again another set of indicators which demonstrate the lack of full recovery in the labor market before now getting to the same slowdown (as a start).

Instead, like everywhere else (including China), Japan and Europe are left with the unmistakable signature of Euro$ #5. Pandemic. No Pandemic. Not rate hikes. Doesn’t matter interest rates. Just globally synchronized.

Everywhere you look, weak, fragile economy, serious and growing questions about demand and sustainability. It’s not supposed to be like this, CPIs made it seem like a booming economy needs to be cooled off. There’s a vast difference between that and what’s actually been going on this whole time.

Euro$ #5.

Stay In Touch