As it now stands, the World Bank isn’t currently forecasting recession sweeping across the globe. Instead, the organization is merely warning this is a growing possibility. Econometric models abhor making big changes to projections within small timeframes, yet the regressions employed here couldn’t be helped this time.

Back in January, at the last issue of the World Bank’s Global Economic Prospects, the math worked out to the best of all worlds. As I just wrote earlier, multipliers greater than one are presumed in every econometric instance. Last year was the mother-of-all “stimulus” efforts, combined globally.

Big results in 2021, with generally the same robustness if only slightly less on tap for 2022 as some of the “froth” fades. In terms of its numbers, the institution had projected worldwide GDP to expand by a healthy 4.1% this year after 5.7% last year. Advanced economies including the US were thought to reach 3.8%, having posted better than 5%, too, previously.

Compared to post-2008 times, simply awesome.

That was January. Now in June, the numbers are nothing like those. Again, models aren’t so easily changed in big chunks, so you have to wonder what really went into these updated estimates which resist large downgrades. Rather than the 4.1%, best guess for world GDP is today 2.9%.

And while that may not sound like too much change, it’s the biggest short run downgrade in eighty years for the World Bank.

Global recession, yes, got that part right.

— Jeffrey P. Snider (@JeffSnider_AIP) June 7, 2022

Many years of above-average inflation, oh boy. Is it too much to ask the World Bank to understand, you know, banks?

Staffed by Economists. There's the problem. https://t.co/krFHwQUNU1

The organization’s leader, David Malpass, simply admitted that while it isn’t the current set of projections, “Many countries will have a hard time avoiding a recession.” No kidding. Eurodollar futures already said as much six months ago.

They blame Russia. But they really blame inflation.

Is it too much for the World Bank to understand banking, to truly get money? Yes, yes it is too much because these places are all run by Economists.

Rising recession probabilities aren’t the product of genuine inflation, rather the price illusion and its insidious practices including artificial redistribution. That’s what we’re seeing across-the-board, the demand destruction associated with two very misunderstood, seemingly opposing factors.

High CPI rates had fooled most, including the World Bank, into thinking there was legit global recovery when it was never any such thing at any point. The rhetoric got overheated while the economy never once did (it was all the imbalance specifically in goods that were hard to make but more so harder to move).

So where consumer prices accelerated for non-economic reasons, this masked the underlying lack of recovery pretty much everywhere. CPIs said it was overheated, actual volumes showed it couldn’t have been.

Yet, to mainstream Economics which hasn’t studied money and real inflation for decades, there was no valid means for Economists (therefore the media, then public) to distinguish one from the other; to tell inflation from what was really “inflation.”

This despite, oh boy, the most obvious unreconcilable discrepancy since Paul Volcker screwed it all up in his day. From the World Bank:

The current juncture resembles the 1970s in three key aspects: persistent supply-side disturbances fueling inflation, preceded by a protracted period of highly accommodative monetary policy in major advanced economies, prospects for weakening growth, and vulnerabilities that emerging market and developing economies face with respect to the monetary policy tightening that will be needed to rein in inflation. However, the ongoing episode also differs from the 1970s in multiple dimensions: the dollar is strong, a sharp contrast with its severe weakness in the 1970s…

It sure looks like the seventies, except, you know, why is the dollar going in the wrong direction?

There is nothing today which resembles the Great Inflation except for last year’s/this year’s bout of consumer prices, and even that hasn’t been much of a repeat. “Highly accommodative monetary policy” is both accommodative and monetary in name only; the Volcker Myth lives strong in Economics if nowhere in reality.

What the World Bank has figured out is that the global economy has seriously weakened between January and today – as markets predicted by pricing. What it can’t figure out is why; thus, blaming inflation and Putin. Picking up correlation and confusing causation is what Economics should be best known for. That, too, goes right back to Volcker.

Yield curve inverted. Fed cutting bank reserves. Big money questions. Consumer prices a huge problem.

— Jeffrey P. Snider (@JeffSnider_AIP) June 4, 2022

2022?

No, 1981.

Powell wants to put his name up next to Volcker's. Careful what you wish for, Jay.https://t.co/3UjkO31dzq

We are going to keep revisiting the Volcker Myth because:

— Jeffrey P. Snider (@JeffSnider_AIP) June 4, 2022

1. So many parallels to today.

2. There's so much easy pickin's; the whole period is chock full of confused, incompetent central bankers bumbling from one mistake to the next.https://t.co/3UjkO31dzq pic.twitter.com/WFBlCOSRkG

Volcker Myth in its most basic form sounded good: restrict bank reserves thereby undercutting depository money which would constrain bank credit therefore get a handle on inflation.

— Jeffrey P. Snider (@JeffSnider_AIP) June 4, 2022

Fed stumbled on the first part in '79, by '81 kept pressure on reserves.https://t.co/3UjkO31dzq pic.twitter.com/SsiplSsUZy

Fed pressured reserves, drove costs (fed funds) into the stratosphere. Deposit money growth slowed, really slowed. Success?

— Jeffrey P. Snider (@JeffSnider_AIP) June 4, 2022

Not remotely.

*Non-deposit* money skyrocketed. Why wouldn't it? Govt makes one kind of liability more costly, turn to another.https://t.co/3UjkO31dzq pic.twitter.com/qIeF0VOJqJ

https://twitter.com/JeffSnider_AIP/status/1533193876453961728

So, what do you do if you are supposed to be a central bank but find banks have created a monetary system that doesn't need your reserves? You conjure a myth that everything that happens must’ve been by skillful execution of a purposeful design.https://t.co/3UjkO31dzq pic.twitter.com/mGjUOA6fhv

— Jeffrey P. Snider (@JeffSnider_AIP) June 4, 2022

For anyone who thinks the Fed is a central bank, this guy was right:

— Jeffrey P. Snider (@JeffSnider_AIP) June 4, 2022

“MR. MORRIS. I really don't think we will ever, from now on, be able to have a concept of a transactions balance in which we can have the same confidence we used to have in the old M1.”https://t.co/3UjkO31dzq

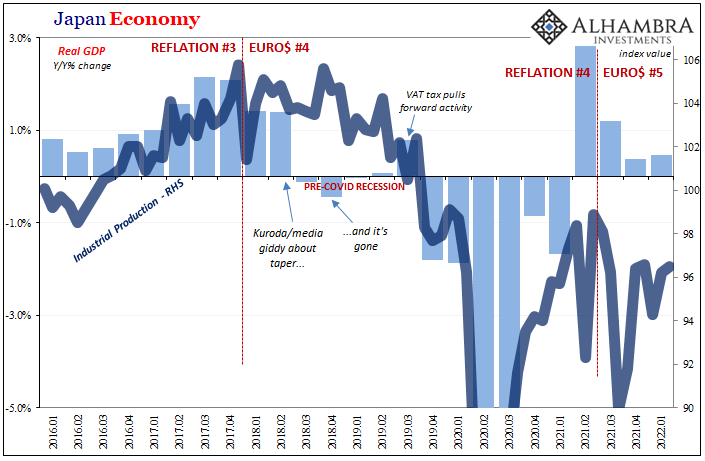

Demand destruction folks. Without actual recovery, the insidious work of the supply shock has been left to its destructive devices, a fragile economy pushed one step too far. We see it increasingly in American consumers, German consumers, Japanese merchant traders, etc.

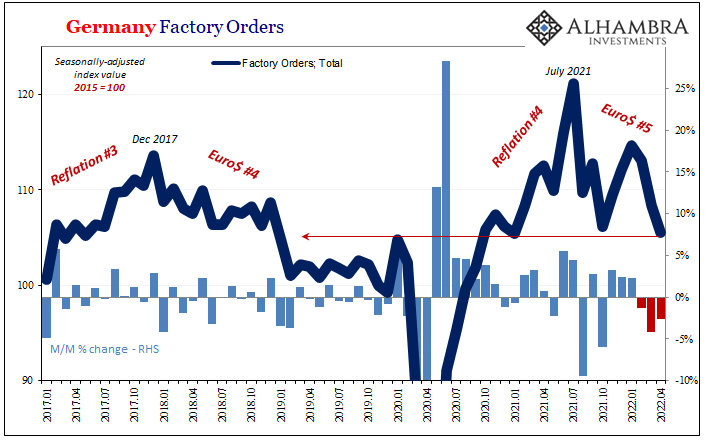

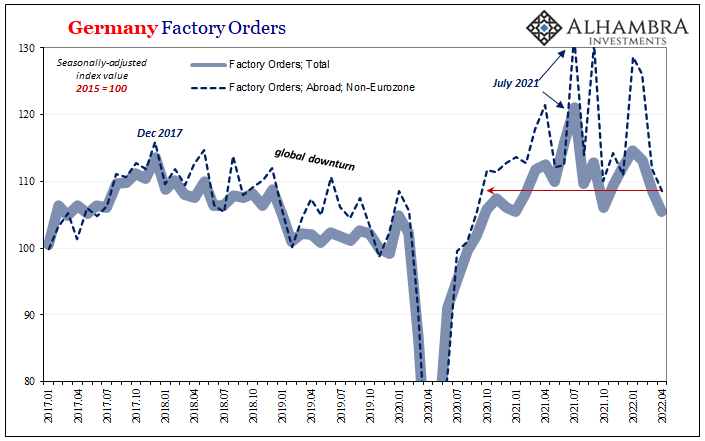

As inventory in the US builds up to an historic flood just when spending falls down, the ripple effect ripples worldwide. German factory orders, for example, fell for the third straight month in April, according to just-released data from deStatis. Down almost 8% in just those three, it’s now the lowest level of forward orders since January 2021 (which was, as everyone said, COVID).

The biggest source of weakness for Germany’s vast export-oriented industry has been suddenly questionable demand from overseas. Locked down China, sure, but also other places including an inventory-saturated United States.

What did we say about the bullwhip?

It can’t be the Fed’s rate hikes. There’s no corona-panic this time. This was coming long before Putin foolishly scheduled his parade in Kiev. The World Bank wants to blame it on inflation when its own missive examination excludes that very possibility.

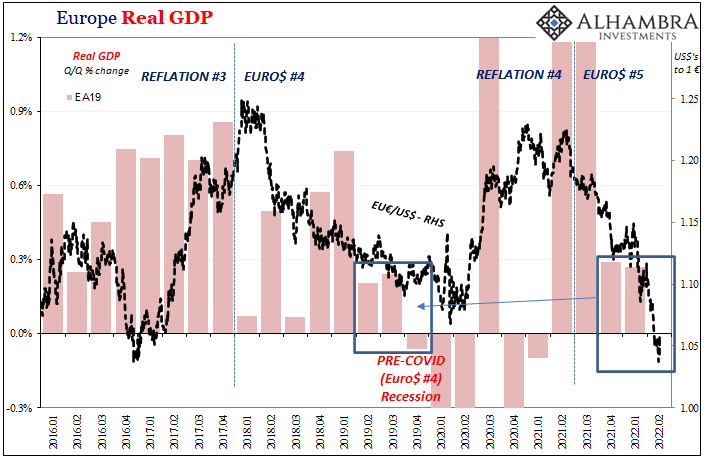

Why does the dollar go up at these times? A fifth time, for those keeping score. Globally synchronized money, globally synchronized price illusion, globally synchronized recession possibilities.

They all said multiplier better than one, but now they’ve got to figure out how it’s not happening. Maybe the multiplier was never greater than one because “stimulus” wasn’t “accommodative money” at any point, and all governments had done was push the demand curve to the right for a brief, transitory (in macro scales) moment.

The predictable downside is becoming more evident by the week. Even the intellectually blind and bankrupt Economics Establishment can see it. What might that tell you?

Stay In Touch