Be fearful when others are greedy and greedy when others are fearful.

Warren Buffett

People are always asking me where’s the outlook good, but that’s the wrong question. The right question is: Where is the outlook the most miserable?

Sir John Templeton, The Principle of Maximum Pessimism

I don’t know if we’re at the point of maximum pessimism yet but there certainly isn’t a lack of it right now. The S&P 500 fell 5% in two days last week on basically no news. The CPI report on Friday was the most often cited culprit, the year over year rate of inflation clocking in at 8.6% with the core (ex-food and energy) at 6%. Those are not good numbers obviously but I’m not sure all that much has changed. The year over year change in core CPI peaked in March and is coming down, albeit slower than we’d all like to see. And I see no reason it shouldn’t keep falling. The biggest rise is still in vehicles (new and used) where we have started to see some good news on the supply side. A number of auto manufacturers (Hyundai, Daimler, BMW, VW) have recently said the chip shortage is easing and their plants are running normally. The biggest contributor to core inflation is shelter (rent) which is really a function of house prices (via Owner’s Equivalent Rent) and with higher mortgage rates doing what they do, I think we can probably count on that rate coming down in the future as well.

As for energy, the reasons to be long energy are numerous, obvious and well known. Crude oil is up 31% since Russia invaded Ukraine while natural gas prices are up 93%. Yes, the world has made some very poor policy choices recently that exacerbate the situation but the runup since the end of February is really mostly about Ukraine. While that mess doesn’t look as if it will be resolved anytime soon, I stand by my original assertion that Russian oil will get to the market even if it goes to new customers (China, India). But in the short term, oil, like a lot of other things, is priced based on emotion. And right now, the predominant emotion is fear -fear that the supply of energy isn’t going to be able to keep up with demand. Part of that is because the major suppliers don’t particularly like the US and part of it is that demand just isn’t slacking off despite some slowing in the global economy. Having said that, the contrarian in me is intrigued by the complete lack of skepticism in the energy trade right now. Everyone is long and that usually means we’re due for some kind of correction.

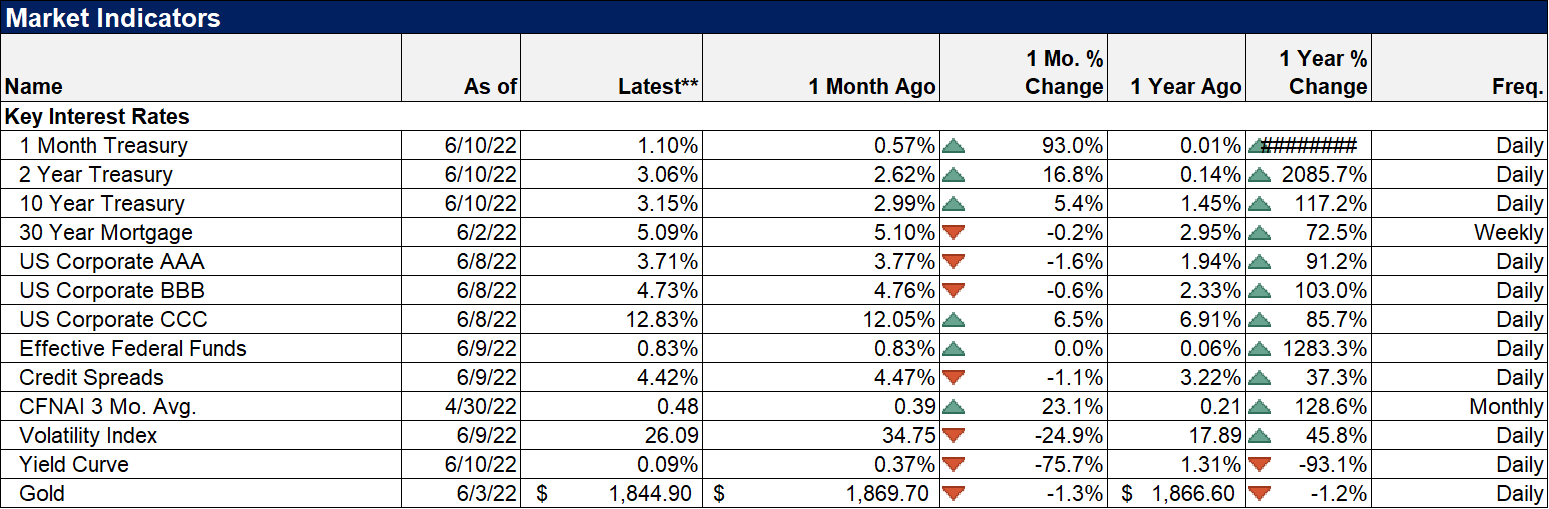

Market expectations for inflation were also basically unchanged on the CPI news. The 10 year inflation breakeven was up all of 1 basis point Friday, unchanged over the last week and still well down from the peak in late April. Five year, five year forward inflation expectations actually fell on Friday. The five year breakeven did rise by 5 basis points but is also well below its late March peak. In short, the bond market’s expectations for inflation didn’t really change last week. That may be because the money markets priced in a little more Fed tightening but even so, the change was minor.

The macro picture didn’t change last week. The economy is slowing in some areas and inflation is still high but probably peaking. That’s the same as it was the week before and neither is surprising but the Fed meets this week and there is a fear, rampant fear, that they are going to hike rates too far and put us in recession. I don’t have much – any – faith in the Fed but I don’t think we should underestimate the economy either. What is happening with the economy is not only unsurprising but necessary. Does anyone think that house prices should continue to rise at 20% per year? Is that healthy in any way? I don’t think so and the only way that was going to change was by slowing the housing market until supply can catch up with demand. Mortgage rates up from 3 to 5% are doing exactly that and while there may be some pain in the short term, this had to happen. 5% mortgage rates are not onerous and buyers, sellers and homebuilders will adjust.

Retail sales growth has also slowed but, again, is that a bad thing? Retail sales have been running well above the pre-COVID trend since early 2021 due to Biden’s American Recovery Act and the rate of change was not sustainable or, again, healthy. But falling back to a slower trend from an artificially high one is not a bad thing, especially if it also brings inflation down with it, which it most certainly will. The short term impact on the economy is certainly negative but how negative? Will retailers have to adjust inventories? Well, yes, some retailers find themselves overstocked in certain items right now and they’ll do what retailers always do – have a clearance sale or sell to liquidators. They misjudged consumers’ desires and they’ll pay a price for that. Are all retailers in the same boat? I suppose it could turn out that way but it hasn’t so far. Will there be layoffs as the economy slows? Will jobless claims rise? Of course they will. They are still at lows last seen decades ago when the population was a lot smaller. If claims rose to around 300,000 that would put them around the lows of all the previous business cycles back to the 1970s. Looking at the last JOLTS report, maybe that wouldn’t be such a bad thing.

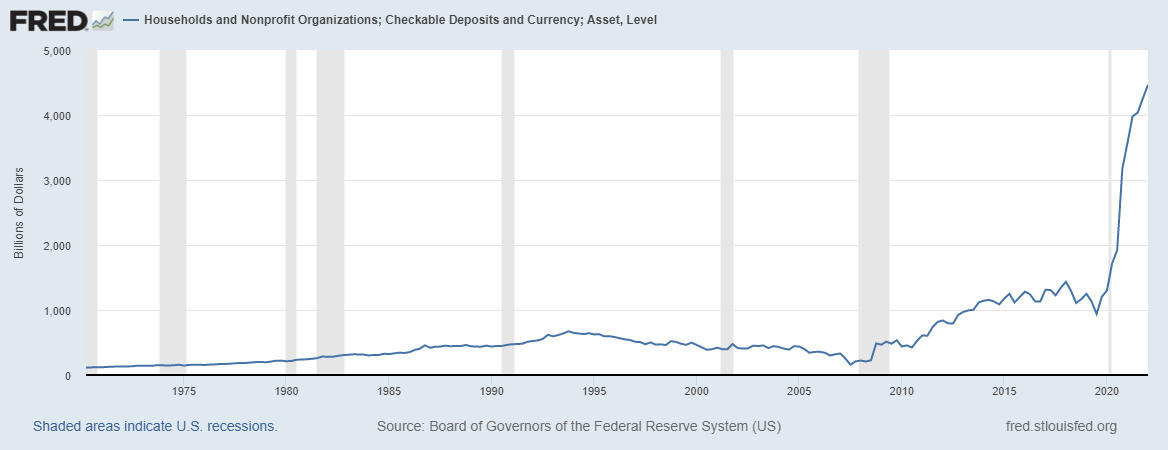

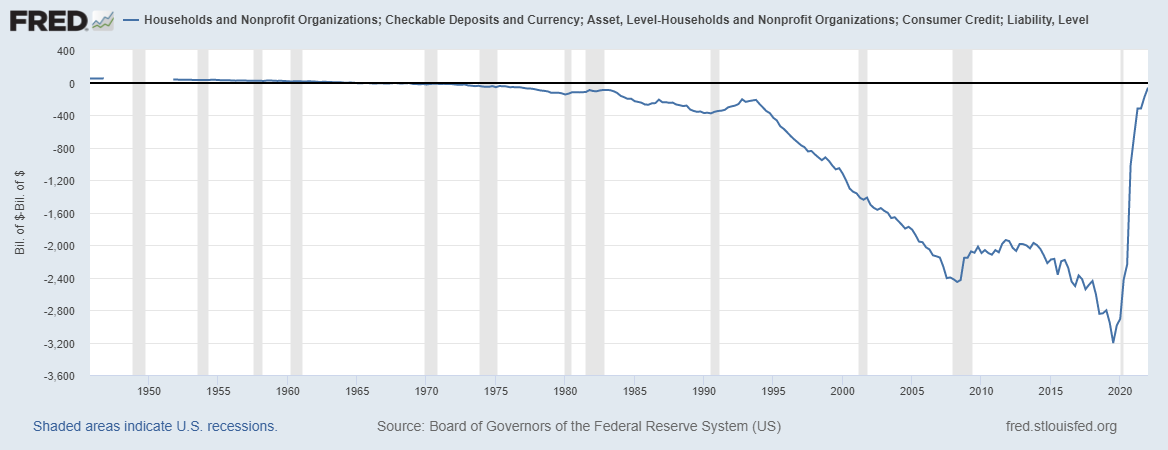

Household balance sheets are in better shape today than they’ve been in a long time. The flow of funds reports were updated last week and while the numbers are for Q1, they show that, in aggregate, households still have a lot of cash left over from their COVID savings:

And while consumer credit usage has recently shot up that doesn’t necessarily mean consumers are in trouble. Consumer credit balances (liability) are actually only slightly more than checkable deposits shown above (asset). This is just one asset and one liability but in aggregate, individual balance sheets are in very good shape.

I am not some blind optimist though. Aggregates like this obscure as much as they reveal. Lower income households may still have more savings than they did prior to the COVID payouts but it probably isn’t a big difference. And with gasoline at $5/gallon and grocery prices up nearly 12% year over year according to that CPI report, there is no doubt some pain out there. Balance sheets may have deteriorated some in Q2 but not by all that much; the savings rate is down a lot but it is still positive. The vast majority of Americans’ finances are in pretty good shape and we shouldn’t minimize that.

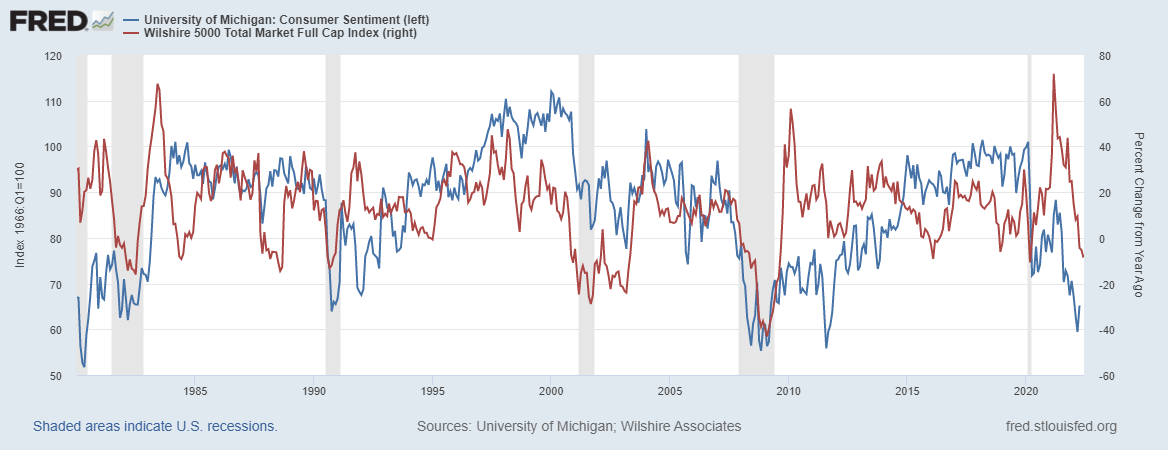

Of more direct bearing on the words of Mr. Buffett and Sir John was the release last week of the preliminary June University of Michigan Consumer Sentiment survey. I have said before that I don’t think much of how this survey is conducted but it does have its uses. Mostly it is useful as contrarian indicator that will help you do what Buffet and Templeton say you should – buy when everyone else is gloomy:

Note: The last data point on FRED’s chart is for April when the index was at 65.2. The last full monthly reading was for May at 58.4. The preliminary numbers aren’t final.

I don’t think this requires a lot of explanation but the red line is the Wilshire 5000, a broad measure of the US stock market. The blue line is the U of Michigan consumer sentiment survey. Consumer sentiment is a pretty good contrarian indicator, an indication of when “others are fearful”. Maybe we aren’t at maximum pessimism yet but if the preliminary June figure is confirmed at month end, it will be an all time low. Could stocks sell off more? Yes, they certainly could, but with sentiment at an all time low I think you have to at least consider buying some. You aren’t going to get the timing perfect; even Warren Buffett says he’s a terrible market timer. But buying stocks with sentiment at an all time low surely puts the odds in your favor.

One last thing. I got some feedback last week on my question about whether you wanted to “buy now or wait for full price?”. Some readers seemed to take that as “spend all your cash right now and go to all stocks”. I just don’t understand this mentality that if you think stocks are attractive you have to put every last nickel you have in them today. If you’ve been reading these commentaries for any length of time, you know that isn’t how I do things. It’s that “all or nothing” attitude that gets investors in trouble. Take your time and stay diversified for goodness sakes.

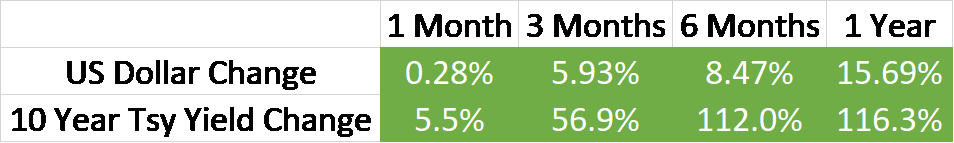

The dollar index and 10 year Treasury rate uptrends continue. Both are near their recent highs and there seems little reason for either trend to end. Moderate? Maybe but that’s going to require a change in expectations regarding future Fed policy which we’ll get an update on Wednesday after the FOMC meeting. I have no idea what Powell will say but I wouldn’t expect any big surprises. The market has already priced in a series of rate hikes that I think are highly unlikely but politics dictates that Powell focus solely on inflation and that’s what he’ll do one way or the other.

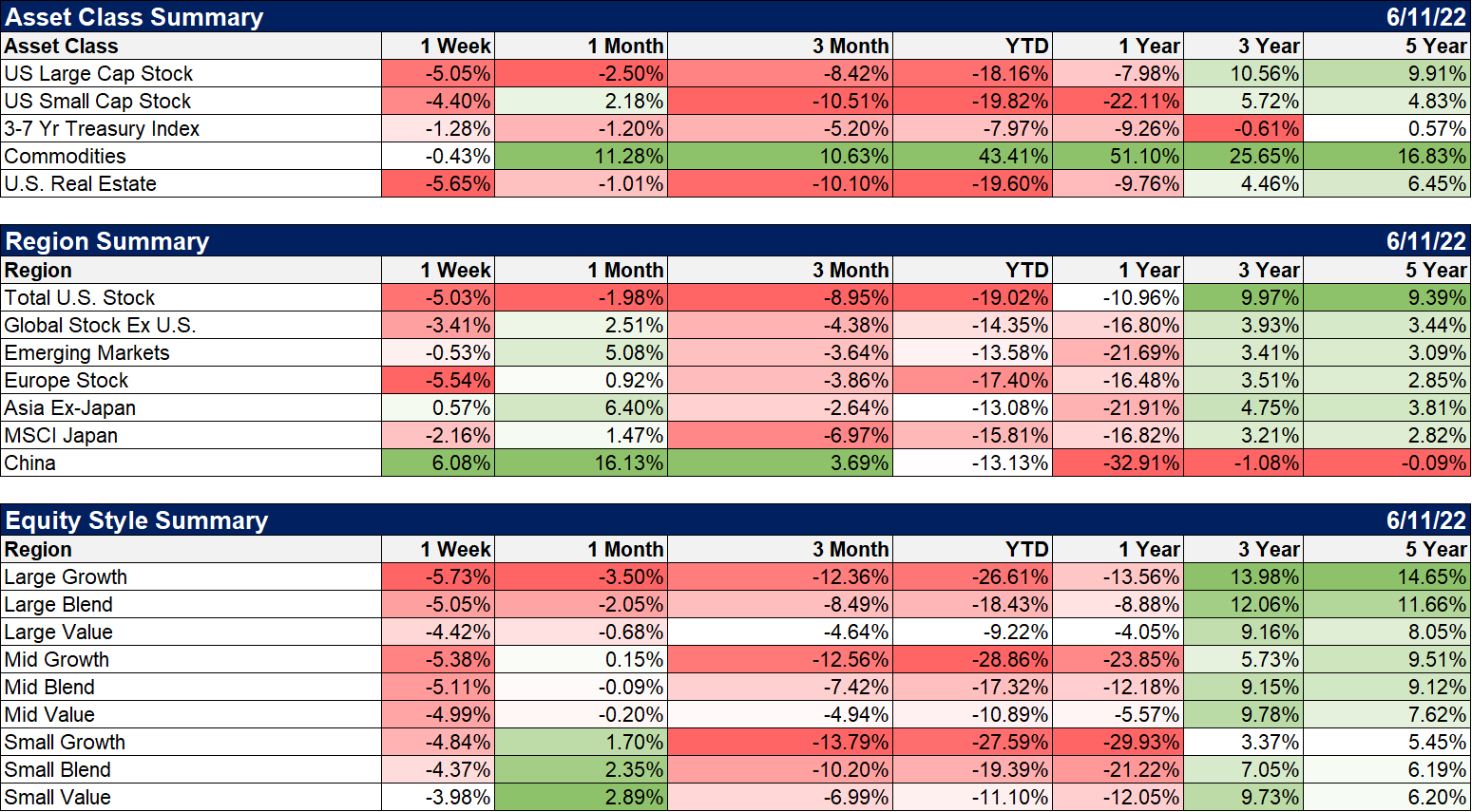

Everything was down last week except Chinese stocks which had their fourth straight up week. That could prove short lived if Shanghai goes into full lock down again which might be as early as this week.

US stocks are nearing the magical 20% down level that defines a bear market. We’ve been here before – and lower – in mid-May but it was an intraday thing that for some reason doesn’t count. Friday was the closing low for the year on the S&P 500 but not for most other indexes. The NASDAQ 100, the Russell 2000, Emerging markets, Latin America, Asia Ex-Japan, Hong Kong, Japan and Europe are all above their previous closing lows. Of course, some of those were closed when the US market was doing its post-CPI nosedive on Friday so that may change this week but it is interesting to see so many non-US markets outperforming YTD given the strong rise in the dollar.

Bonds were hit hard last week after the CPI report but the very long end of the curve did outperform a little. Bond yields are starting to look pretty attractive relative to stock dividend and earnings yields these days and inflows to bond funds continue unabated. My inner contrarian is at least a tad uncomfortable with that but to my knowledge no one has ever been able to predict anything from fund flows. You can get around 4% for intermediate to long IG corporate bonds these days and nearly 3% tax free on intermediate munis. Of course, if you think inflation is going to continue at the current pace those rates aren’t all that appealing but I suspect with the benefit of hindsight those yields are going to look pretty good.

Commodities also fell some last week but it would have been quite a bit worse if not for natural gas and crude oil, both of which were up (3.8% and 1.5% respectively). The list of commodities lower on the week was longer though and with sentiment off the charts bullish, I think we’re in for at least a pause soon. If we do, expect a relief rally in bonds to accompany it.

Value continues to outperform but with small and mid cap value both down double digits now, that is small comfort. Large value is close to joining that club too but I don’t think it will catch growth anytime soon.

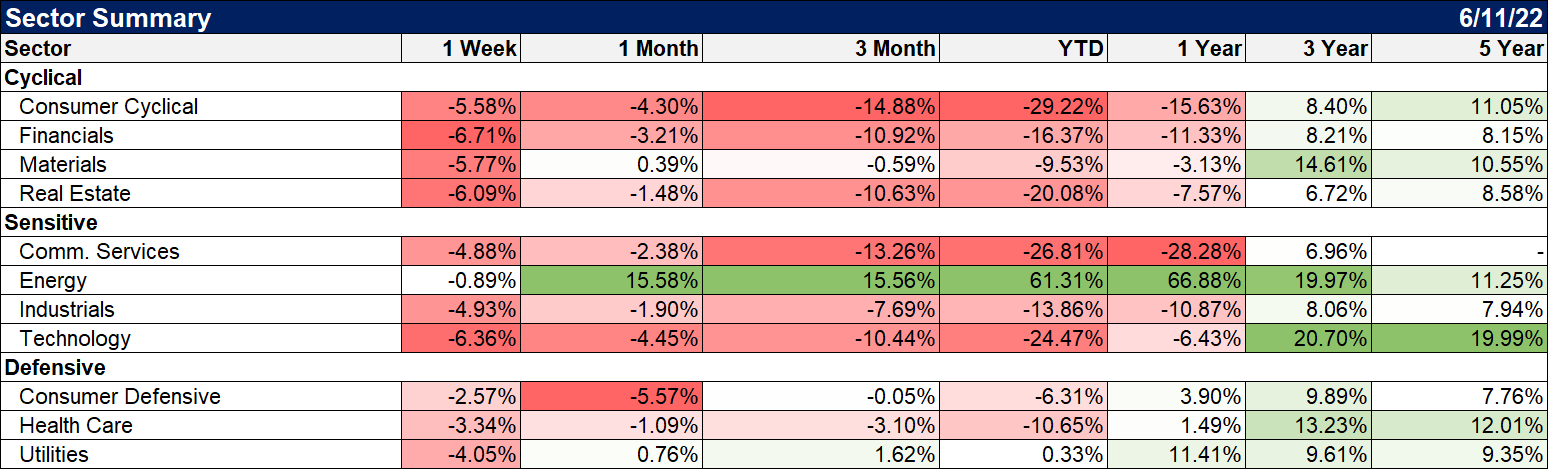

Energy was the “winner” last week, down less than 1% but if the commodity indexes do peak, that epic run may come to an end. What I said above about commodity sentiment generally applies doubly to energy stocks. Energy stocks have gained so many fans that there are now 5 of them in the MSCI Momentum factor index versus just 1 in the MSCI Value factor index.

The other outperformers last week were defensive sectors.

So, no, if you have been smart or lucky enough to keep some cash on hand, don’t go out and blow it all at once. I did some buying last week of a few individual stocks, small initial positions:

- A precision manufacturer with 3 year average annual revenue growth of 11%, net income growth of 21%, an ROE of 16% with no debt at a P/E of 16.

- A beverage company with a 4.5% dividend with an ROE of 14 at 1.1 times sales and 4 times cash flow.

- A biotech company with net margins of 55%, 22% revenue growth over the TTM and a pipeline of promising new drugs at 1.5 times sales and P/E of 8.

- An apparel company with 9% revenue growth, net margins of 10%, 19% ROE at a P/E of 8 and 4 times cash flow.

Those are companies with well known brands and solid prospects for growth at reasonable – cheap – valuations. Will their stock prices go down more? Maybe. But these are sound investments made at a time of deep pessimism.

There are a lot of things I don’t like about our economy. I don’t like the inequality that is, primarily, a result of lousy monetary policy. I don’t like the lack of productivity growth that is a direct result of low investment in our economy. I don’t like our immigration policies which have a direct bearing on economic growth. I don’t like our tax system which provides a raft of wrong incentives. I don’t like our government budget deficits and debt and more than that I don’t like how we spend what we borrow (which is the real problem, not the debt itself). I don’t like that we’ve become a nation of gamblers – in markets or sports. But I am constantly surprised at the ingenuity and resilience of Americans and our economy. Don’t get too pessimistic about America. We might just surprise you too.

There is no doubt that the economy is slowing right now – as it should. But we seem to be expecting every slowdown in growth to turn into an other 2008, our views of the economy forever colored by that awful experience. Don’t extrapolate every short term trend to its nth degree – in either direction. The economy was never going to keep growing at the pace it did last year and seeing the result of it – CPI – we shouldn’t want it to. Acknowledge the current slowdown and respect it but don’t fear it. Buy low, sell high is a tough philosophy to execute. But you sure can’t do the latter if you don’t do the former.

Joe Calhoun

Stay In Touch