Neither Jay Powell nor Janet Yellen see recession risk. They’re coverage, though, ends at the US boundary, each thoroughly trained on the wrong idea the US economy is an island.

While it isn’t and it has its own very visible recession problems right now, properly speaking globally there’s no bigger recession risk-ignition than over on the other side of the Pacific. And I don’t mean Xi Jinping’s disease fetish.

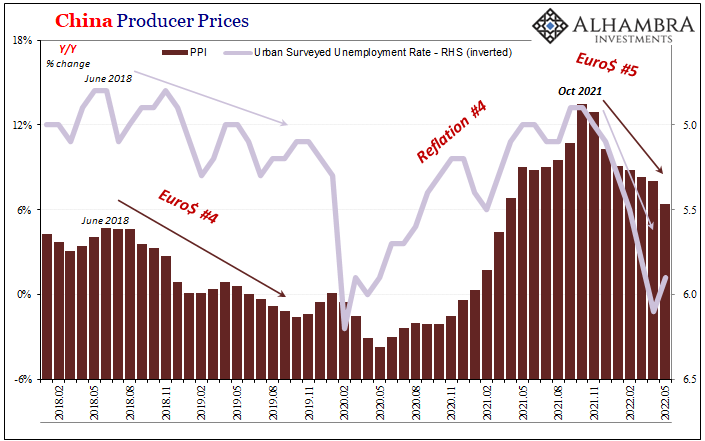

Abbreviated commentary from here regarding China’s late night (US time) release of that country’s Big Three (Plus One) economic accounts. There’s not much more to write that I haven’t already written recently, particularly about how the Chinese economy’s downturn into recession territory isn’t something new sprung up on Xi’s Zero-COVID madness.

Not the Fed’s stepped rate hikes, either.

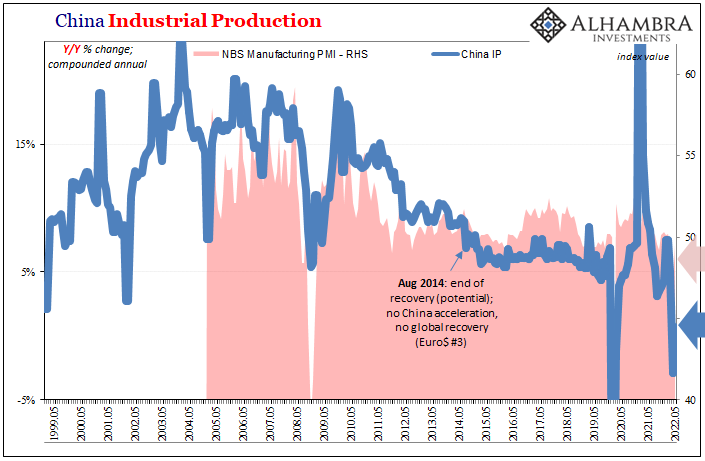

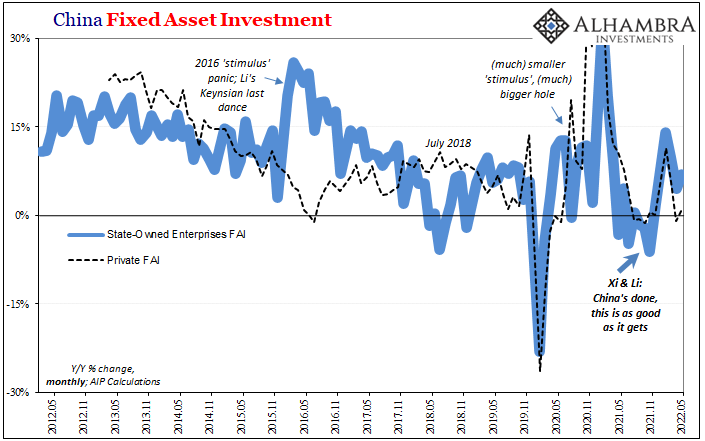

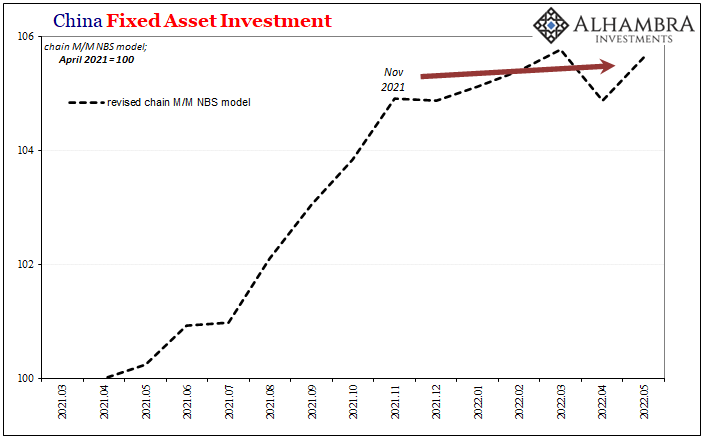

Whatever of those China accounts you like (though make sure to check out FAI, particularly the chained m/m trend), the answer is all the same. Reopening most of what was shut down led to an improvement in the figures, which always means spinning them as good no matter how bad they truly get to be.

The juxtaposition of mainly optimistic, often enthusiastic Western commentary against the utter and visible brutality of the actual figures themselves speaks for itself.

We are to celebrate and call recovery because IP managed to rise 0.7% instead of decline 0.7% according to analyst projections. Why? There isn’t a lick of difference between those two numbers, certainly not when it comes to Chinese industry whose even fake numbers seem like a long distant dream.

The numbers all tanked, but the commentary hasn’t.

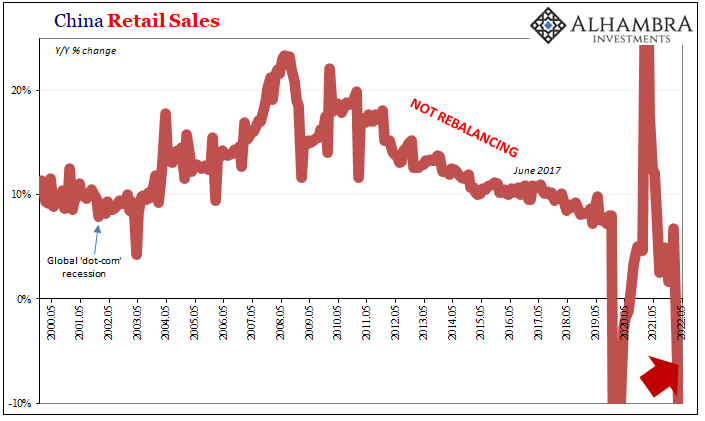

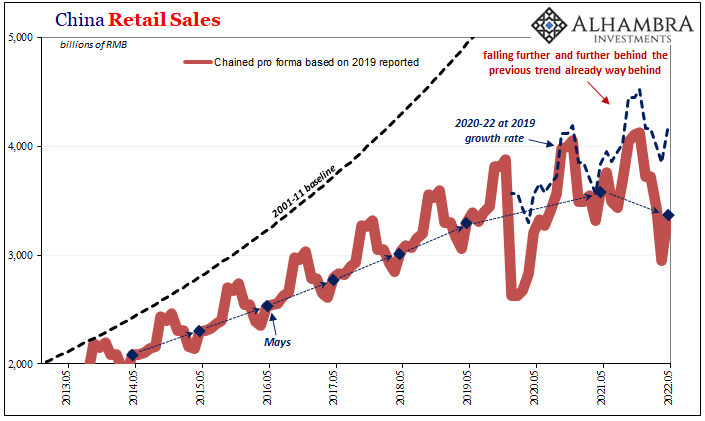

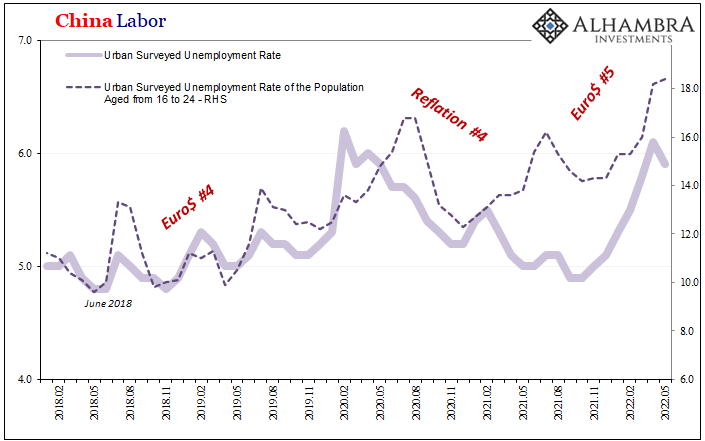

Retail sales are way off; FAI shows there’s no Xi rescue; and I’ll point to the tiny improvement in unemployment way less than full-throated recovery yet masking what is a really big and growing problem with youth unemployment over there.

I’ll leave it here by reiterating and reemphasizing October. October. October.

Stay In Touch