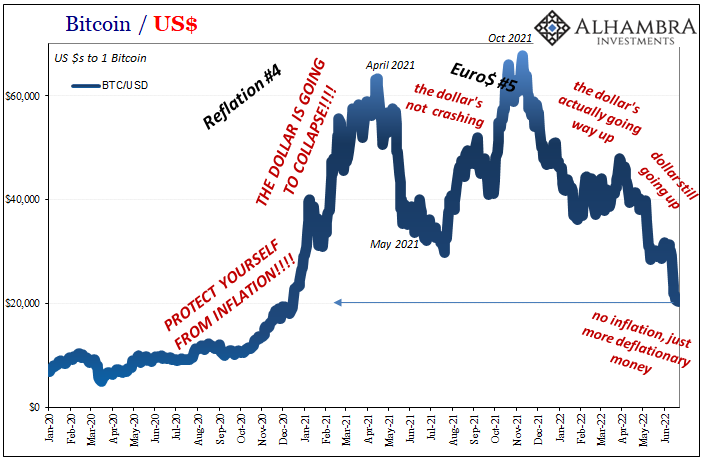

Over the weekend, Bitcoin tumbled again. Reaching an ultra-ugly low of $17,641 (before retracing back above $20k), even the self-styled premier digital “store of value” has thrown in the towel. As I wrote last week, winter isn’t coming it is here.

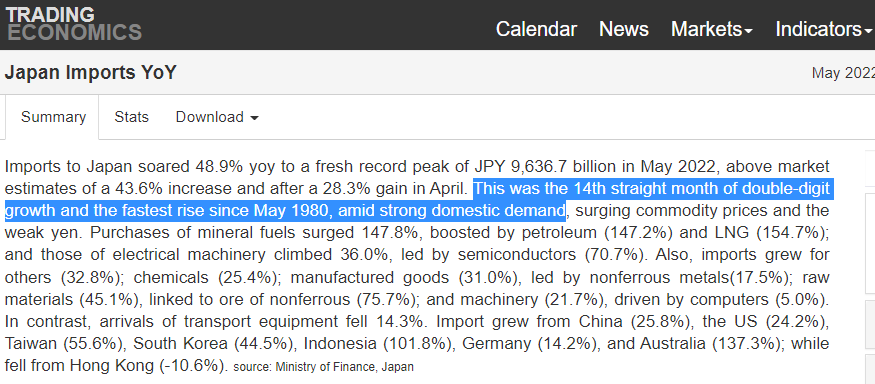

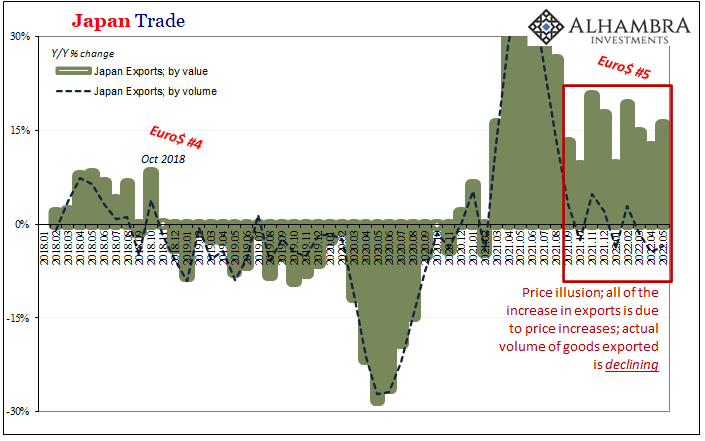

One crucial reason why, the Japan’s Ministry of Finance reported last week how imports into that country during the tumultuous month of April surged by a frankly ridiculous 48.9% year-over-year. It was the biggest annual gain since 1980, very much like US CPI rates the highest in four decades.

With numbers like those, most mainstream outlets can’t help but characterize them as “strong domestic demand.” It’s an understandable if still egregious error.

Winter Is Here for crypt. Sad. Predictable.

— Jeffrey P. Snider (@JeffSnider_AIP) June 19, 2022

Prices were deviously detached from potential by this same easily disproved belief the dollar is dead from too much money printing.

Digital future is medium of exchange not store of value.https://t.co/2BrgZ9GaXM pic.twitter.com/HagwxeaPu8

Surging domestic “demand” here and elsewhere, this all seems like it should be supporting Bitcoin or any other “real” store of value from real estate to commodities. How is this anything other than inflationary?

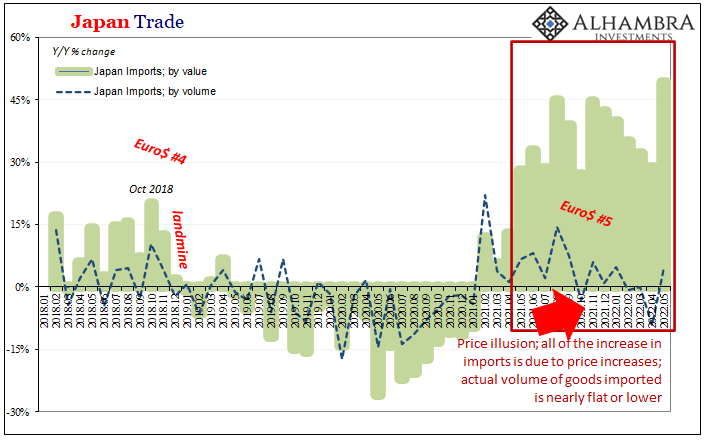

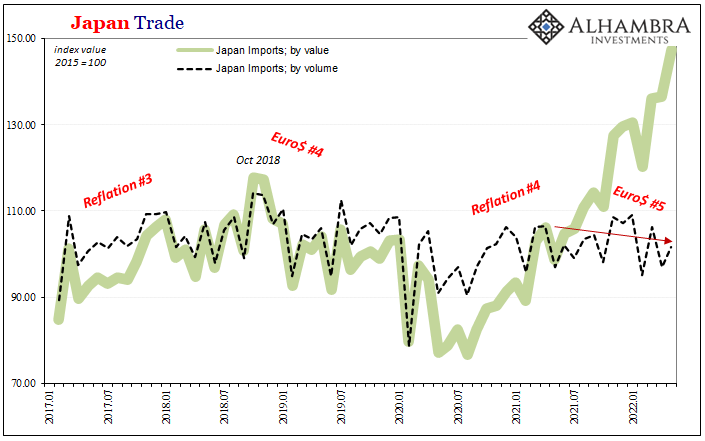

For that we turn to the opposite side from nominal imports (or exports). Far from celebrating a burning economy, this kind of price imbalance is pure suicide. Whereas the nominal change might have been about 50%, by volume the rate in April was nearly zero.

Paying 50% more to get about the same amount of stuff is a killer for any one person, or one business. An entire economy? Big, big trouble, nothing whatsoever like “strong domestic demand.” In fact, this level of price illusion is the stuff of pure future deflation and global recession.

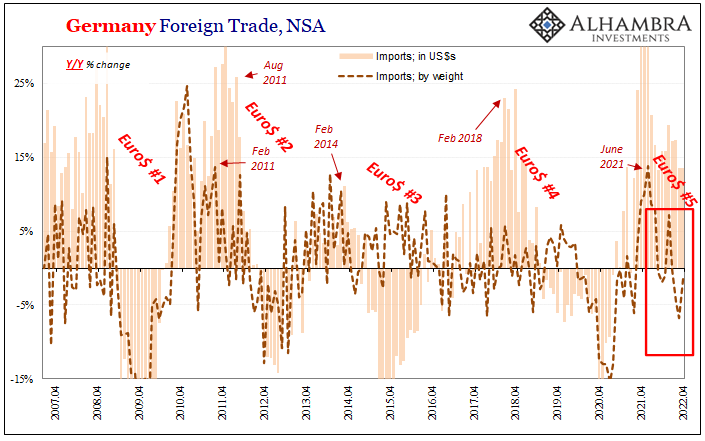

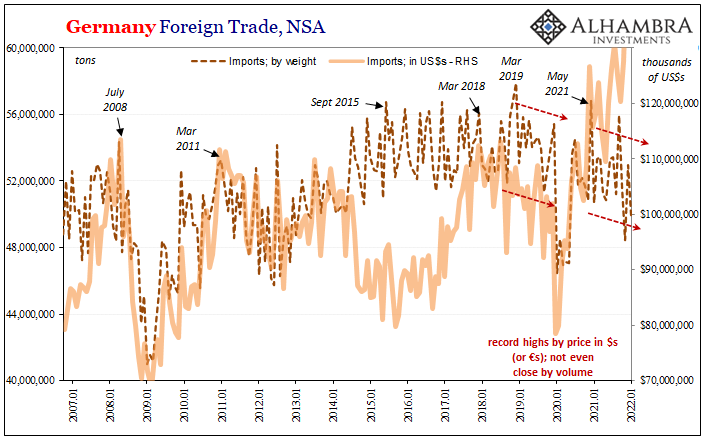

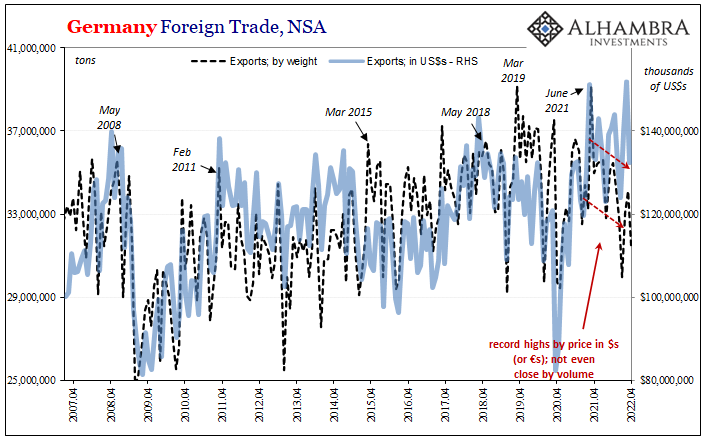

These killer economics aren’t just for the Japanese to sort. From America to Germany, pay more, get less. Updated estimates for the latter, the Germans as one other trade bellwether, imports into that country by US$ were up by a seemingly-healthy 14.7% year-over-year in April. In euros, almost as “strong domestic demand” as what for Japan: up 25.8% y/y.

By volume, nothing of the kind; down another 1.5% y/y in April after having declined 6.8% y/y in March.

This “inflation” is just the cover for the harmful redistribution of last year’s global supply shock (not money printing dollars). And now it’s coming home to roost, markets have been recognizing while publicizing how CPIs (or HICPs, in the case of Germany) were not the same thing as each economy’s underlying condition.

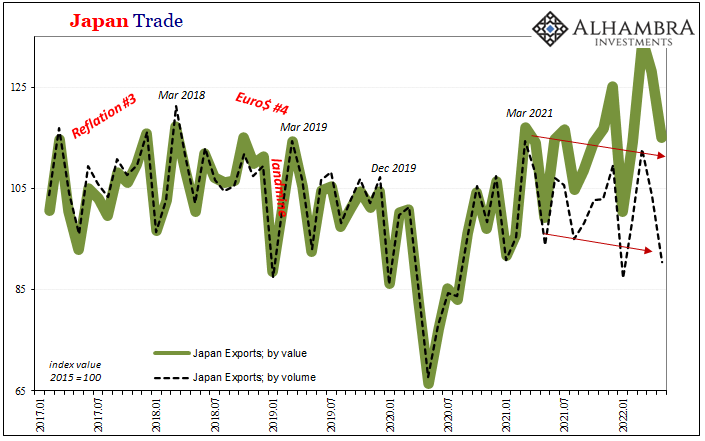

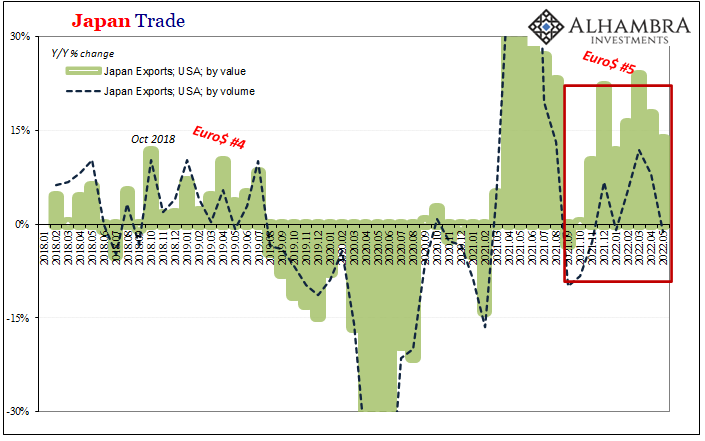

As such, the deflationary infection is spreading worldwide. Back to Japan and its continued reliance on Japan Inc for any hope at marginal expansion, exports from that country were up 15.8% year-over-year by price yet down 3.5% by volume.

Perhaps most alarming of all, exports to the I’ll-take-any-inventory-at-any-cost United States finally declined, too, in April. With all the other major warning signs, this one’s not just about America nor exports from Japan to America.

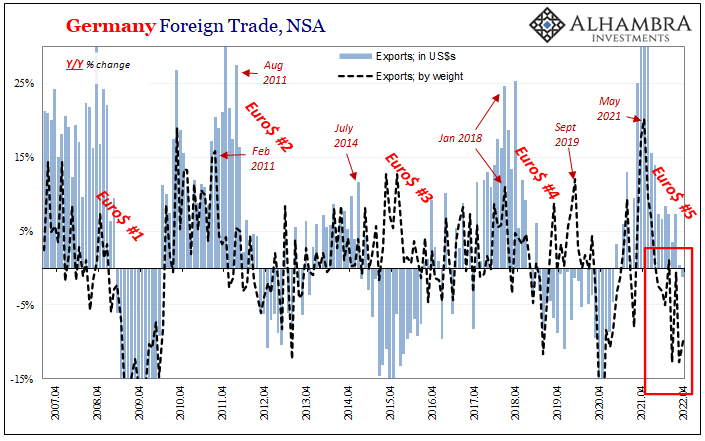

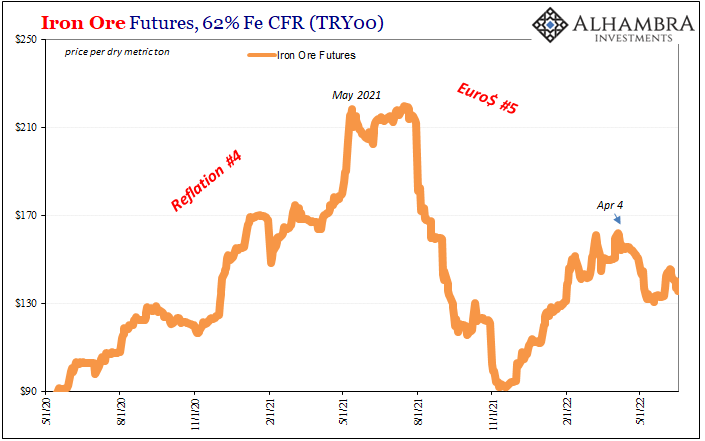

Euro$ #5 is easily visible on both sides here; as it is in the German export estimates, too.

Like Japan, trade looks much better when only considering “inflation.” However, unlike Japan, German exports in nominal US$s during April were down, too, falling 1.3% for the first decline since October 2020. By volume, Germany’s exports crashed by just about 10% y/y, the fourth straight month of declines, seven out the last eight.

The 6-month average for German export volume is a recession-like -6.7%.

Given all these numbers and what they actually represent, Bitcoin’s dive into another frozen abyss only makes too much sense once you step outside the inflation hysteria. Divorced from the Fed and all the mainstream, removed from the hype and hustle of crypto’s unneeded “stores of value” and the plethora of scams every asset bubble unleashes, the truth’s been out in the open all along.

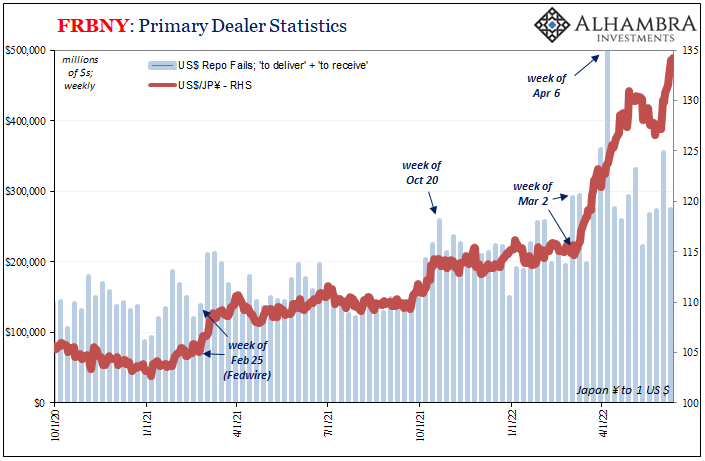

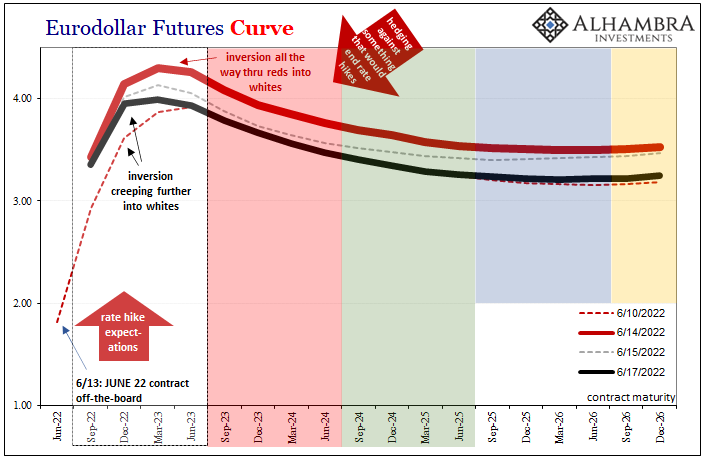

Rather than siding with Powell on CPIs, they’ve [digital assets] been shown the cold light of truth on the various unswerving curves. Recession and disinflation if not deflation (again) draws near; eurodollar futures, as of this writing, all but certain it happens and hits this year.

It’s not Bitcoin winter rather monetary midwinter for the entire global system, bringing digital currencies along for the harrowing sleighride.

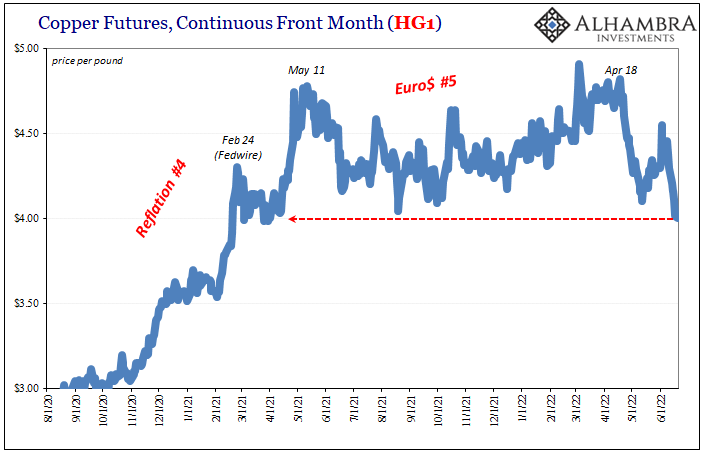

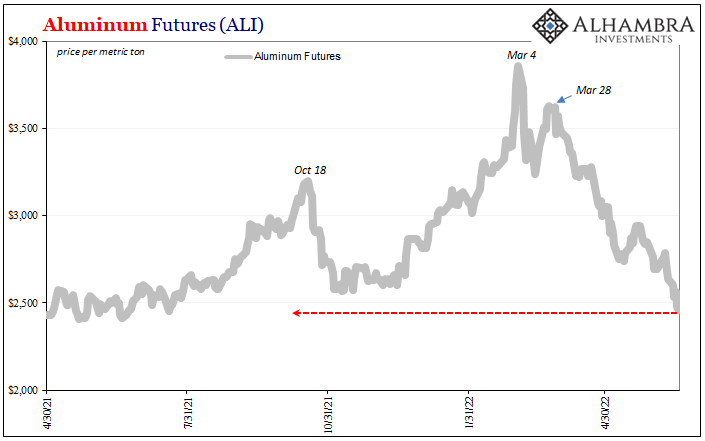

To those already enjoined in the sled, we can add some key commodities to the lengthening snow-side list. Copper traded under $4 per pound for most of today before finishing right at that round number. Aluminum flirting heavily with the wrong side of $2,500, while iron ore moving back toward recent lows with steel prices down sharply (China).

Given the actual situation presented by these leading global trade economies, is it any wonder all these increasingly deflationary prices?

T R A N S I T O R Yhttps://t.co/5pvX6ihqGe

— Jeffrey P. Snider (@JeffSnider_AIP) June 18, 2022

The global economy is clearly hitting the wall of the supply shock and reacting just as markets and curves have been pricing for well over a year. In terms of the price illusion itself, we’re still yet to see its full effect; the discounting and inventory liquidations haven’t even begun while canceled orders throughout global manufacturing just now reaching the statistics (like Germany factory orders, or the same from the US Philly Fed regional manufacturing survey).

This isn’t the end of the crypto story, however; far from it. What’s really underlying digital evolution was never really about store of value and money-printer-go-brrr.

We see every day more and severe deflationary money indications – T-bill rates again after this latest rate hike are insane, meaning they’re insanely low – leading toward higher, nastier recession possibilities.

And while Jay Powell’s supporters will more desperately try to reposition the Fed into Paul Volcker (he’s not helping them, at all), even a brief glance on the Bitcoin chart, or copper, you can’t help but notice last May and Euro$ #5. It’s in the trade data, too.

More and more it is becoming obvious and undeniable there was never an inflation crisis, only the price illusion of “inflation.” If only that was somehow better, no comfort to anyone trying to live in the eurodollar’s world.

Stay In Touch