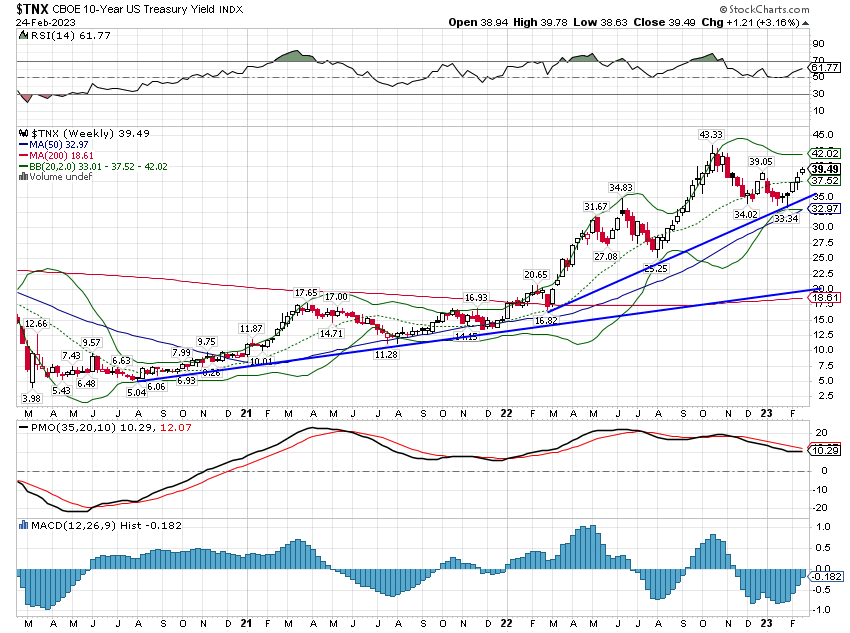

I think everyone can agree that stocks and bonds sold off last year because interest rates rose. You might get some argument about why rates rose but the fact they did is sufficient to explain the drop in stocks and bonds. It doesn’t matter if you think rates went up because the Fed raised their target rate on Fed funds or if you believe it was because of rising inflation or improving growth, you got the same result. And all investors know this because they saw the result in their portfolios.

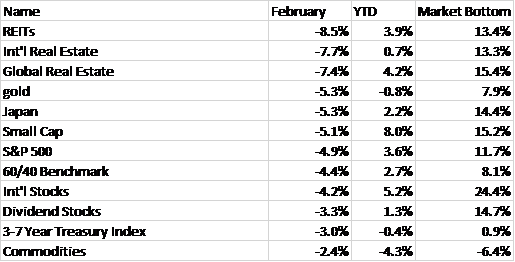

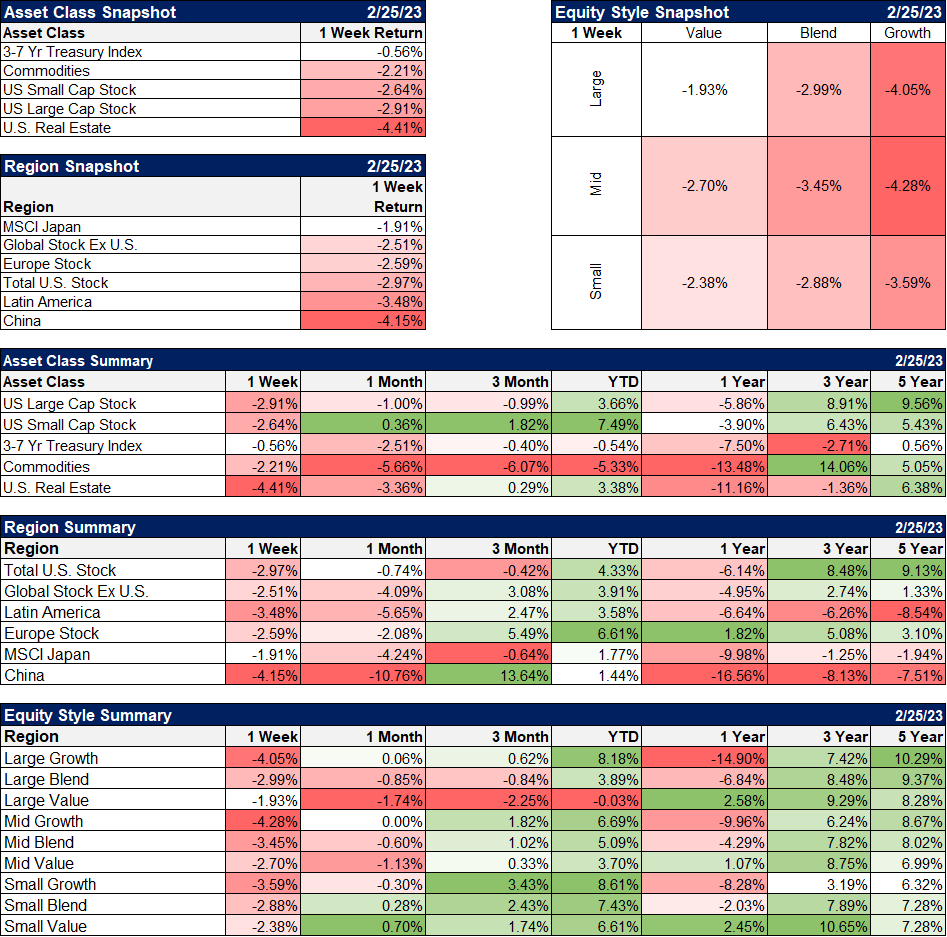

The start of this year saw stocks and bonds rise as interest rates fell. Interest rate-sensitive REITs were up over 10% in January while the S&P 500 rose 6.3%. Small cap and international stocks did better, up over 9% to start the year. Investors learned a lesson from last year, namely that if rates are falling you need to embrace risk and if they are rising you need to take cover. Except that’s probably the wrong lesson and it seems it is getting repeated in February.

The fall in rates at the beginning of the year had nothing to do with expectations regarding inflation. The 10-year Treasury yield fell 50 basis points during January and 10-year TIPS yields fell right along with them (44 basis points). What that means is that the change in rates was more about economic growth than inflation. Growth expectations fell in January and stocks, real estate, and commodities rose. That may not be as crazy as it seems if you believe the Fed is having a big impact on growth, but the evidence of any impact from Fed rate hikes is hard to find outside the housing sector.

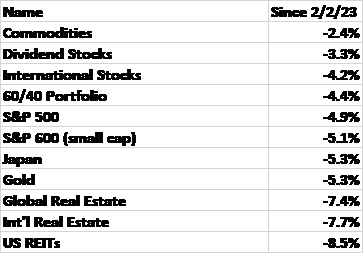

The 10-year Treasury rate hit its low on February 2nd this year at 3.4% Since then, rates have risen 55 basis points to 3.95%. And most everything an investor can own has gone down over that time, the more interest rate sensitive the greater the loss.

Again, what’s interesting is not that interest rates rose but why. Just as in January, the move in rates this month is more about growth than inflation. 10-year inflation expectations have risen 14 basis points in February so far but the 10-year Treasury yield is up 49 basis points and 10-year TIPS yields are up 35. The bulk of the rise in nominal rates was matched by the rise in real rates. In February, real growth expectations rose and stocks, real estate, and commodities sold off. Again, it doesn’t seem all that logical unless you assume that economic growth causes inflation.

I say that because the market has been quickly pricing in more Fed rate hikes this year and any cuts have been pushed into 2024. Coming into this year the highest probability was for two more 1/4 point rate hikes and then a pause until late in the year when rates were expected to be cut. Rates would peak at 5-5.25% and fall back to 4.75-5% by the end of the year. Now, the highest probability is for three more 1/4 point hikes to 5.25-5% and no cuts in 2023.

Of course, actual inflation data has been somewhat hotter than expected but I haven’t seen anything that makes me think things have changed all that much. Last week we got the most recent reading on the PCE deflator, the Fed’s preferred measure of inflation, and it was a bit higher in January than in December, but the trend is still down. Apparently, there are a lot of investors out there who thought inflation was just going to fall in a straight line. Two or three steps forward and one back seems a more logical expectation but then no one said markets had to be logical.

Last year inflation expectations rose in the first half of the year to just over 3% by April. Once the Fed started hiking rates, expectations fell through the end of the year. As inflation expectations were falling, nominal and real interest rates were rising; real growth expectations were rising. But it was when recession fears arose in June and July – and real rates fell – that stocks hit their first nadir of 2022. We saw a bit of that in December as well. But most of the year stocks were falling because rates were rising – or were anticipated to rise – no matter the reason.

For stocks, there is a tension between higher rates and higher growth. A higher discount rate pretty obviously reduces the present value of a future stream of cash flows (earnings). But higher growth raises those future cash flows. It is the rate of change and uncertainty around those future cash flows that drives prices. Last year, with rates rising a lot and future growth very uncertain, rates won the day and stock prices pushed lower.

But we aren’t in the same situation today. Interest rates, even if they move as far as the market currently expects, don’t have much higher to go. Growth, on the other hand, seems to be rather more robust than expected just a few months ago. If rates calm down, better growth may win this round.

I think what is driving the current selloff is fear that we’re about to get a repeat of last year with the Fed hiking farther and faster – again – than everyone thought at the beginning of the year. That seems more likely to just be recency bias at work than anything else. Investors and generals are always fighting the last battle.

A little perspective seems appropriate here. Interest rates have certainly risen of late but they are still below the peaks of last year and almost unchanged since stocks made their low on October 12, 2022. Investment returns are still positive this year, if a little down from January’s peak and they are very good since the October lows.

It would be hard to guess that is the case based on the rate at which sentiment has soured this month. At the end of January, options market bets were overwhelmingly on the bull side. Meme stocks were in the news again. The VIX was trading below 20 and active money managers were nearly fully invested. The AAII poll turned in a week with more bulls than bears for the first time in over a year. Now? Wall Street’s favorite new trade is buying calls on the VIX, a bet that things are about to get a lot worse and soon. Most of the other sentiment measures we follow show a similar flight of the bulls.

The rise in rates this month is being driven by better economic data, better growth expectations. Last year that meant higher rates faster and stocks didn’t like it one bit. But at current interest rates, the positive of better growth may be more important than the negative of slightly higher rates.

Environment

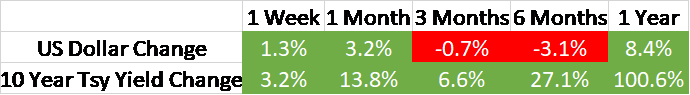

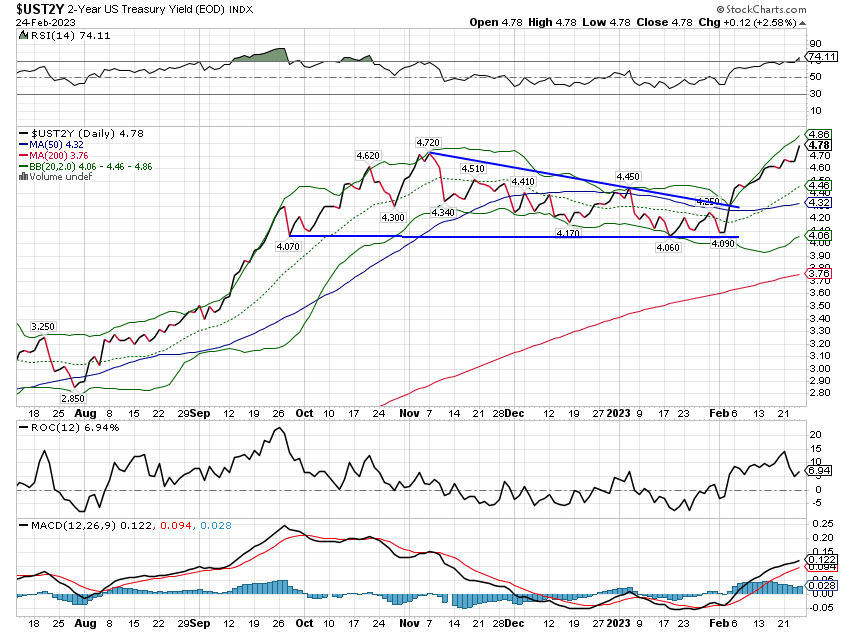

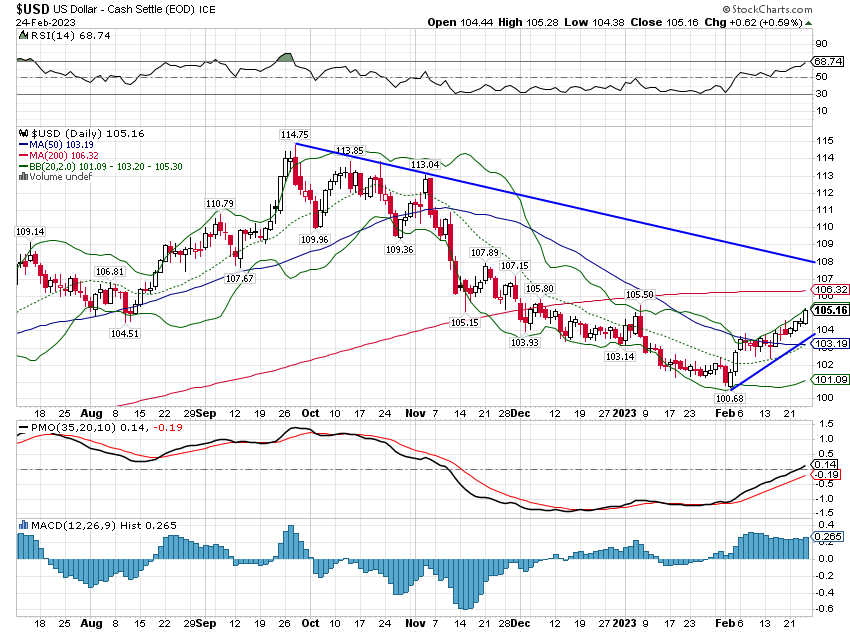

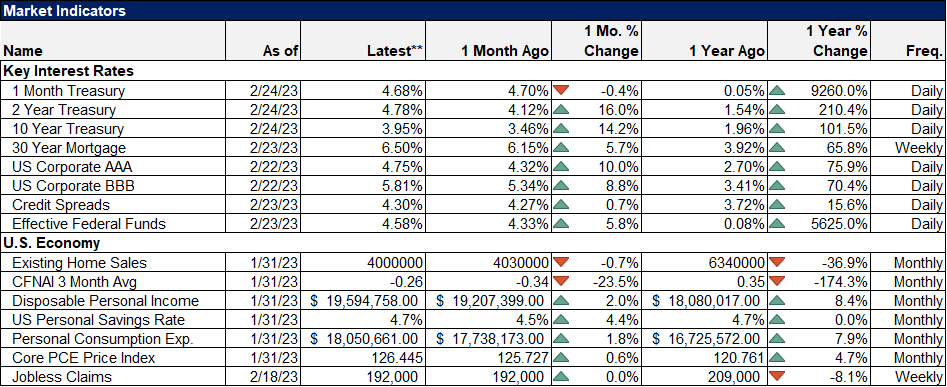

Interest rates and the dollar rose for the third straight week but no trends changed. Interest rates are in a short and intermediate-term uptrend. That includes the 10-year, 2-year, and 3-month Treasuries although the rate of change on the last one is moderating.

The dollar is still in a short-term downtrend while the intermediate and long-term trends are up. The dollar is, however, rallying on a very short-term basis as expected. I told you three weeks ago to expect a move to 105/106 and here we are at 105.2. Because the move up was so rapid, I’d probably push up that short-term target to 107 or so but I wouldn’t expect a return to the very strong dollar of last year.

Markets

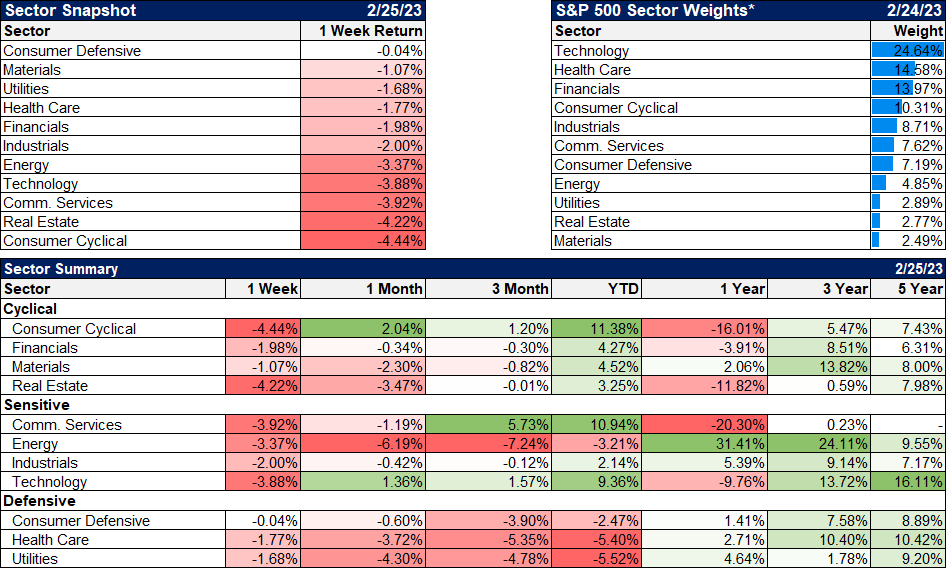

It was an ugly week for…everything. It isn’t a coincidence that interest rates and the dollar have been rising for three straight weeks and that risk assets have been falling for the same period. Stocks, bonds, real estate, and commodities are all sensitive to changes in interest rates with the last particularly sensitive to changes in real rates which have moved higher recently. The good news is that the move in real rates means that most of the recent move up in rates is a reflection of higher real growth expectations, not inflation.

One interesting shift in the 1-year returns is that commodities are now the worst-performing asset class over that time frame. That is so because last week was the one-year anniversary of the Russian invasion of Ukraine and the subsequent spike in commodity prices. Obviously, the impact on commodity prices was not lasting and general commodities are now no higher than they were just prior to the invasion. I don’t think though that the longer-term uptrend in commodities is over. That will depend to some degree on the direction of the dollar but rising real growth can be positive for general commodity prices (although not for gold) too.

Value outperformed last week after several weeks of growth taking the lead. The value > growth trend started at the beginning of 2022 and that trend is still intact but it is looking a bit shaky. While I suspect the long-term trend has shifted to value, we may see a consolidation of that trend over the coming months.

The defensive sectors outperformed last week which seems odd since the move in rates has been more about better growth than worse inflation but it’s just one week. If economic growth continues to surprise to the upside, it would make sense for the economically sensitive sectors to follow suit.

Economic Indicators

Remember all those economic commentators over the last year who were talking about how the falling savings rate was proof that people were dipping into savings to support spending? And that this supported their contention that the US economy was in or near recession? The savings rate did indeed fall but that was never evidence that people were spending down their savings. They were just saving at a lower rate. But it sounded good.

So, what will all those bearish economic commentators say now that the savings rate is rising again? How long before we see a “research” report that claims that rising savings is negative for growth because it means consumers are spending less? The fact is that you can’t get much useful information from the savings rate but you get even less when it is unchanged over the last year, as it is as of last week’s personal income report.

We’re all affected by recency bias (or availability bias which is similar). When the last bad thing – or good – that happened to you starts to repeat, you naturally expect a similar result. But you need to be sure it is really the same thing happening again and not something that just looks similar on the surface. When rates have to rise nearly 5% in a year, it is very negative for stocks, as we found out last year. When they might rise another 1% in the next year, you might not get the same effect.

Over the last month, the market has priced in another rate hike for this year because economic growth isn’t slowing as the Fed apparently wants. One of the things that has made this economic cycle hard to figure out is the distortion of prices. When the Fed says they want slower growth, I don’t think they mean they want less real growth. What they want is a slower pace of nominal growth, with the reduction concentrated in inflation rather than real growth. I don’t know how much credit to give the Fed, but that’s exactly what happened after inflation peaked in June. Inflation fell, real growth accelerated and interest rates, nominal and real rose. Inflation expectations fell while real growth expectations rose.

Does that mean we should throw caution to the wind? Of course not. There are still reasons to be cautious. A friend recently described the economic data released this year as “weird” and I wholeheartedly agree. I’ve said for a long time now that the post-COVID economy is hard to analyze and it isn’t getting any easier. A lot of COVID-induced economic changes – work from home for instance – are proving persistent. How all these changes affect the economy and the economic data (seasonal adjustments may be off) is impossible to say at this point.

I take the data at face value since I have no way of knowing if it is right or wrong or by how much. And based on that there is little doubt the economy has accelerated in the early part of 2023. And markets are starting to price in more for the balance of the year. Maybe stocks will continue to fall if interest rates keep rising but at some point, good news is good news.

Joe Calhoun

Stay In Touch