Last week started with investors focused on Jerome Powell’s testimony before Congress and any hints about future monetary policy. During the course of two days of testimony, which was deemed more hawkish than expected, the market priced in another rate hike and pushed out the possibility of a rate cut all the way to January 2024. The week ended with investors focused on the drama at Silicon Valley Bank. By the close of trading Friday, the expectation for another rate hike (or more specifically a 50 basis point hike at this week’s meeting instead of 25) was gone and the first rate cut was back to Q4 23.

I spent my weekend looking at bank balance sheets and I’m happy to report that I do not believe this to be a systemic issue a la 2008. On the other hand, some of the issues at SVB are shared by almost all banks. SVB services the VC community in Silicon Valley and a lot of startups put their VC funding money there. If they had lines of credit with SVB, they were required by the bank to keep a certain amount of their cash there. But as VC funding has dried up for these startups they have had to draw down their balances to continue operating. So SVB was faced with dwindling deposits to fund their balance sheet assets.

Those assets consisted mostly of Treasuries and agency MBS issued with much lower coupon rates. That’s important because they are high quality if low yielding. There isn’t an issue here with toxic assets. SVB – and a lot of other banks – bought a lot of Treasuries and MBS when rates were a lot lower. On the Treasury side, they weren’t buying TBills; they were buying longer-dated securities that have now lost value because current rates are higher. They have two buckets for those securities on their balance sheet:

1. Held to maturity and

2. Available for sale.

The first batch is carried on their balance sheet at cost. The second is carried at market prices. Because SVB lost deposits, they were forced to sell some of those available-for-sale securities at a loss of $1.8 billion. That was unfortunate but not disastrous. They planned to raise new capital to plug the hole and probably had commitments to do so. But sometime Thursday or Friday, some prominent VCs (Peter Thiel most notably) told their portfolio companies to pull their funds from SVB. It was a classic run on the bank. With more deposits going out the door – $42 billion Thursday and Friday alone – SVB faced the prospect of selling more securities and booking more losses and having to raise more capital. It was a spiral from which they couldn’t recover. The CA regulators and the FDIC closed the bank Friday.

So, the situation at SVB was somewhat unique in that their depositors were unique. Most venture-funded companies fail, so they get funded, put the money in SVB to operate and draw it down to zero over time and then fail. When VC money is easy (as it has been for a long time until recently), they get more funding and top off the SVB account and keep operating. Or, in some cases, they become successful and continue to bank with SVB out of loyalty. That was their business model and it worked for a long time.

But when the VC money dries up, as it has over the last year, so do SVB deposits. It should be noted though that VC funds still have a lot of undeployed capital. They can and probably will back their portfolio companies if they are not able to access all their uninsured deposits. They are going to protect their investments where it makes sense to do so.

There are certainly other banks out there with similar unrealized losses on their balance sheets. Indeed, the Fed itself has these losses (although they never have to realize the losses or mark to market). The big banks still have way more deposits than they need so there hasn’t been any urgency to raise deposit rates but smaller banks will now have to pay up (CDs, etc.) to keep depositors from just sending their cash to Treasury Direct.

Even if they haven’t been buying Treasuries – and most of them haven’t – they have issued mortgages at lower rates and those loans are on their balance sheets. Most local banks though hold loans to maturity so they are carrying them at cost. But still, they need a certain level of deposits to carry those assets so if deposits start to leave they could find themselves in need of capital. And it would be a lot harder for a small local bank to raise capital in the current environment. So, we may well see some small banks go under in the coming months if there is no relief on rates.

Even for the banks healthy enough to ride this out, the low-yielding assets on their books mean they are going to have to fund low-yielding assets with higher-yielding liabilities and that will be a hit to earnings. The question is how long it will take for the low-yielding assets to be replaced with higher-yielding ones. One also wonders what those higher-yielding assets might be. Could this perversely incentivize banks to make riskier loans?

This brings us to how this might affect Fed policy. The Fed exists to make sure the banking system doesn’t have problems. Indeed, that is exactly why it was founded, to provide liquidity when no one else would or could. So, they might let some small banks fail to send a message but they aren’t going to let this get out of hand. And it may force them to back off on the rate hikes as well.

The Fed can cure this problem at the banks by stopping the rate hikes now. Or maybe they have to cut some but the point is that the Fed can solve the problem with interest rates – assuming the markets go along. The difference between today and 2008 is that the assets today are high quality; we have a liquidity problem whereas in 2008 we had a solvency issue. Today, the Treasury note on the balance sheet may be down in price but holders will get paid. Same with the MBS. So the two periods are not comparable in that sense.

The question as I write this is what the Treasury, FDIC, and the Fed will do about SVB’s uninsured deposits. If this follows the script we’ve seen before in these situations, some large bank will acquire SIVB’s assets – in whole or in parts – and make good on the uninsured deposits. Who that large bank is or if SVB is sold off in pieces I don’t know yet. The fear right now is the unknown. I’ve done my own quick assessment of SVB’s balance sheet and I think a recovery of at least 90% is likely. And it could easily be 100%. But it would likely take weeks at the quickest and months at worst to find out. Markets can deal with a lot of things but not knowing is not one of them.

The impact on markets is impossible to predict right now without knowing how this will be resolved. It could be perceived as a positive if SVB is a one-off and the Fed pauses the rate hikes. Or if other banks start to see a similar dynamic it could be the trigger for the start of a recession. I don’t think we should discount the idea that other banks may face SVB’s fate. The most stunning thing about the collapse of SVB was the speed with which it happened. Mark Twain said that a lie can travel halfway around the world while the truth is putting on its shoes and that is more true than ever in the social media era. A tweet that goes viral about a bank, true or not, could create another run situation like SVB faced last week. Of course, SVB had a lot of large accounts, way over the FDIC limit, so it was easier to move a lot of deposits out quickly. That isn’t the case at most banks.

One last note is that SVB’s situation was unique in one other aspect – duration. SVB’s unrealized losses on its securities portfolio was equal to almost all of it is Tier 1 equity capital. For most banks, the unrealized losses would reduce Tier 1 Capital but not enough to create a need to raise capital. Of course, that could change if rates keep rising so it is worth keeping an eye on. One other thing to note is that JP Morgan’s CEO, Jamie Dimon, said at the beginning of 2022 that the Fed would raise rates more than the market believed and that as a result JPM would run a very conservative balance sheet. It isn’t a coincidence that their Tier 1 capital would barely be dented by any unrealized losses. I have been critical of Dimon’s market calls in the past but credit where it’s due; he got this one very, very right.

Environment

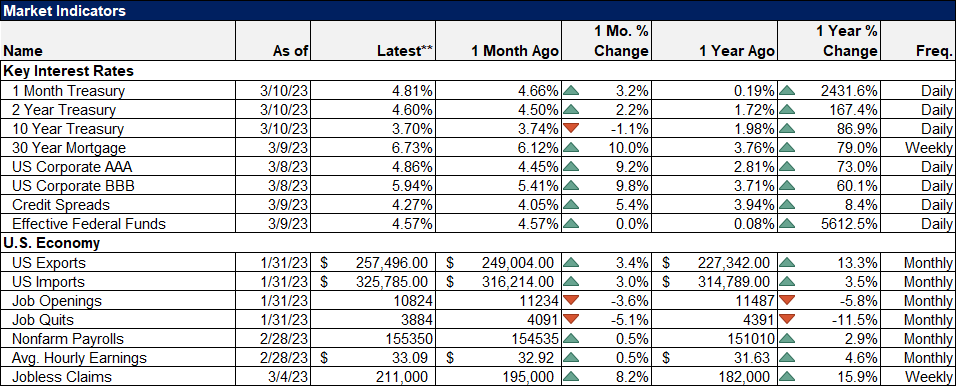

The short and intermediate-term trend for the 10-year Treasury did not change last week (both are still in uptrends). Early in the week, short-term rates did rise during Jerome Powell’s testimony before Congress with the 2-year note rising from 4.86% to 5.05% (19 basis points) but the 2-year yield ended the week down almost exactly the same as the 10-year (26 bps vs 27 bps). In other words, that yield curve was steady if still inverted. Remember, just prior to recession, we generally see the yield curve steepen as short rates fall rapidly in anticipation of Fed rate cuts. As of last week, we still aren’t there yet.

Most of the movement in rates last week was in response to Powell’s testimony which was quite a bit more hawkish than the majority expected. Another rate hike was priced in by midweek but with the SVB failure, it was priced right back out by Friday. But there was a change in expectations as peak rates were expected to be in Q4 23 and by the end of the week that had been moved up to Q3. And all of that happened after the SVB failure Thursday and Friday. The SVB failure has the market reassessing the timing of any recession, bringing it forward by a couple of months. I would expect that to change again this week as SVB is resolved one way or the other.

10-year TIPS yields fell 19 basis points on Friday but ended the week just a basis point from where they started. Inflation expectations, however, fell all week. Powell hiking rates more and a bank failure had the same impact on inflation expectations. What that says to me is that we are getting close – very close – to the end of the rate hiking cycle. Whether that is because inflation is well controlled or whether it is because more bank failures slow nominal growth I can’t say. But the market said pretty clearly that either event brings us closer to the end of rate hikes.

The dollar trend was also unchanged, continuing its short-term downtrend. It should be noted too that movements in rates and the dollar last week were not driven by economic data but rather, first Powell’s testimony and then the SVB news. Overall, though the economic news wasn’t that bad. Factory orders were down in January but we already knew that from the durable goods report earlier in the month. They were up ex-transportation which also just confirmed the earlier report.

Employment was obviously the big report of the week but no one paid it much attention with the banking drama. It wasn’t great but it was certainly solid at +311k and last month’s big gain was only revised lower by a little and still was over 500k. Private sector gains were 265k with 245k of those in services with just 20k on the goods side. That is just a continuation of the trend, the rebalancing we’ve been writing about for over a year. The biggest gains were in leisure and hospitality which also isn’t surprising.

But of course, economic data is about what already happened and the market looks forward. The resolution of SVB will likely set the tone this week and it will likely play a role in what the Fed does at the FOMC meeting. A more dovish Fed could well be seen as a positive for the economy no matter the current data. We do get two inflation reports this week but whether they matter will likely depend on the market reaction to SVB and whatever other drama we see from the banking sector.

Markets

There wasn’t a lot in the green last week but bonds and Japanese stocks did manage to eke out some gains. Commodities did slightly better than stocks but were still down. Gold, however, was higher by 0.8% as 10-year TIPS yields fell 19 basis points on Friday. It is interesting though that the change in real yields for the week was nil.

Stocks fell early in the week as short-term rates rose and another rate hike was priced in based on Powell’s testimony. Stocks fell late in the week as short-term and long-term rates fell due to the SVB mess. This just goes to show that interest rates have some impact on stock prices but when and how is dependent as much on psychology as anything else.

Value and growth stocks were both down on the week with little diffusion in returns. I think that’s called throwing the baby out with the bath water and may indicate we are nearer a bottom than on the verge of another leg down. That probably depends on the SVB resolution and I’m sure not going to try and predict the stock market based on whatever Yellen and Powell cook up over the weekend.

International stocks continued to outperform last week and if the dollar has truly peaked then one would expect that to continue. Of course, Europe faces its own inflation and central bank problems, in some cases worse than what we have here. The big difference is in valuations with Europe a lot cheaper than the US, especially large cap. US small cap and value, by the way, have larger allocations to financials than large cap and growth. But large-cap growth’s allocation to technology is 1/3 larger than value’s allocation to financials. So, pick your poison I guess. We continue to favor value.

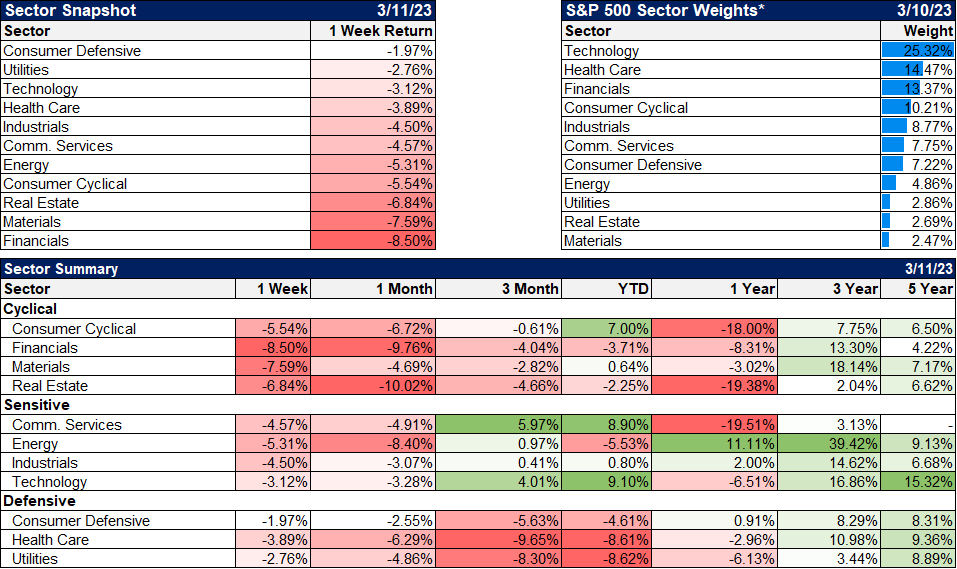

Defensive stocks and technology – yes, technology – were, not surprisingly I guess, the best performers last week. The best-performing sector this year though is still consumer cyclical and that doesn’t point to a weak economy. Neither do communications or technology, the other two best-performing sectors YTD.

As I said above, the economic data was pretty good last week. Export and imports were both up in January, confirming consumption figures from that month. Job openings and quits were both down, news I’m sure the Fed is happy about. Credit spreads widened modestly last week but there is still little stress there.

As I finish writing this evening, the Treasury, FDIC, and Fed have announced a plan to fully back all of SVB’s uninsured deposits as well as those of Signature Bank which was also closed by the FDIC over this extraordinary weekend. First Republic Bank also announced it has raised “additional funding” from JP Morgan and the Fed but provided no details about the form of such funding. US stock market futures are trading up about 1% in early Asian trading. We’ll see if that holds through to the open in NY.

One of the ways the regulators justified their actions tonight was to declare SVB and Signature as “systemically important”. I have my doubts about that but the decision has been made. I personally don’t agree with it and think depositors should have to live with the consequences of their actions. If Roku is dumb enough to leave nearly a half billion dollars in cash sitting in one bank, they deserve to take a haircut. There are some innocents in this who should probably be made whole but it shouldn’t be across the board. But that is not, of course, how these things work and they are not my decisions to make. We’ll just have to work with the world we have rather than the one we want.

Over time, we will find out what the unintended consequences of this action are and yes, there will be unintended consequences. There always are, but we may not know what they are for years. Maybe this does incentivize banks near the threshold to make riskier bets to try and work their way out of trouble. Or maybe banks become overly cautious and too conservative. Or maybe it sets off a wave of consolidation – of deposits if nothing else. There seems little incentive at present to stick with your local bank when JP Morgan’s sitting over there with a pristine balance sheet.

One thing I think this should emphasize to everyone is that you need to diversify your risks and that doesn’t just apply to your portfolio. I think we all need more than one banking relationship especially if you are a business owner. No way should you have your personal assets and business assets at the same bank. There’s no reason to panic but there’s also no reason for complacency. There are only so many things you can control with your money and investments but this is one of them. So go kick the tires on a new bank this week.

Joe Calhoun

Stay In Touch