With the PBOC’s apparent schizophrenia on display it is unsurprising that there would be another default. I don’t find any coincidence between the timing of that announcement, in Hong Kong, and the fact that the PBOC both “tightened” and “loosened” in the past few days. They have been pretty consistent about that going back to the initiation of “reform” in late 2013.

What is perhaps unique about the latest default is that the company, Kaisa Group, is missing interest on “dollar” bonds owed both onshore and offshore.

The default coincides with the expiration of a 30-day grace period on $52 million of missed interest payments on two dollar-denominated bonds, according to a Hong Kong stock exchange statement Monday. Kaisa, based in the southern city of Shenzhen, is struggling to service 65 billion yuan ($10.5 billion) of debt owed to both onshore and offshore lenders while becoming embroiled in President Xi Jinping’s crackdown on graft.

Here, too, there is not likely to be much randomness in how this has been worked into the flow. I maintain that the PBOC is doing whatever it can to squeeze and constrain bubbles and overly problematic (by its definitions) speculative excesses. The behavior of the yuan reference, pegged by PBOC policy, to the “dollar” float suggests that central bankers in China see this onshore/offshore “dollar” as one of the primary channels into bubble behavior. That has added “dollar” trading to the mix of policy decisions about “managed decline.”

Thus is created a sort of stop-go in the yuan as it surely seems like there is intent of “dollar” relaxation when each of these major default events gets introduced. The latest has been afforded, ironically enough, by the March 18 FOMC “dovishness” that dispelled the “dollar” tightening to that point.

The orthodox baseline cannot fathom a central bank, on the precipice of nasty recession no less, not undertaking any and all measures to obtain further financial bloat. Instead, there is a measured progression into what is unmistakably an attempt at correcting for past imbalances in any and all forms. The fact that Chinese officials would try such something like this speaks very plainly about what they must see as the risks of maintain the status quo (under decaying eurodollar standard and function).

We can even add the PBOC’s increase in the reference rate to the list of processes directed thusly. There seems to be lot of talk, again along the orthodox baseline, about how it would be best for China to devalue, yet the reference rate was last pegged upward regardless of the offshore floating value. That is confusing with respect to orthodox treatment of “export competitiveness” but it makes perfect sense when you realize that a greater spread between the reference rate set by policy and the floating rate makes this “dollar-driven” behavior more problematic and more “expensive.” Again, prioritizing squeezing bubbles over what economists think a central bank should do about growth.

The developer’s problems have rippled across the region’s debt market, where investors starved of yield elsewhere in the world have swooped in to boost returns. As the government’s anti-corruption probes widen, it’s raising concern that defaults will spread after overseas noteholders bought a record $21.3 billion of bonds issued by Chinese property companies.

“It’s been a canary that has been chirping for some time,” Gary Herbert, a money manager who helps oversee about $45 billion of fixed-income assets at Brandywine Global Investment Management LLC in Philadelphia, said in a telephone interview. “This is the beginning of an adjustment period in China that will see a lot of credit investors, who were chasing the promise of higher yields, ultimately disappointed.”

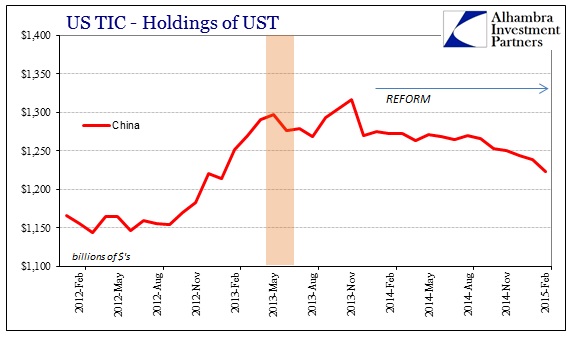

I’m pretty sure that is the intent here. But, as with all the rest of “reform”, the PBOC doesn’t seem to be completely inattentive. If you look at what China’s holdings via TIC shows, it certainly seems as if the PBOC is squeezing “dollars” on that side but then mobilizing its own reserves at the same time to offer at least a partial “dollar” cushion. Given the behavior of the PBOC throughout 2014, and so far in 2015, we can reasonably infer that those “reserves” are being given out only to those financial agents designated useful and non-bubble.

If there is any significance in these past few days it is that there reform processes seem to have been ratcheted further, now heading firmly into “dollar” territory. That would seem to suggest, as I read it, that despite the huge economic slide still building that there is yet any second thoughts on where this might all lead. The economy is still sinking and the Chinese appear as if they are still trying to manage the decline rather than throw back in with the orthodoxists. That they are now aiming at the “dollar” is where it really gets interesting.

Stay In Touch