January 2021 was, it may have seemed, only the start of something big. Huge. Colossal. Coronavirus vaccines had been discovered, publicized, and rolled out, meaning for the first time a real shot at ending the pandemic. The world could quickly get back to normal, the economy recovering its footing, and between January and that bright future Uncle Sam was going to flood not just the US but much of the rest of the world (starting with US imports) with Treasury’s cash.

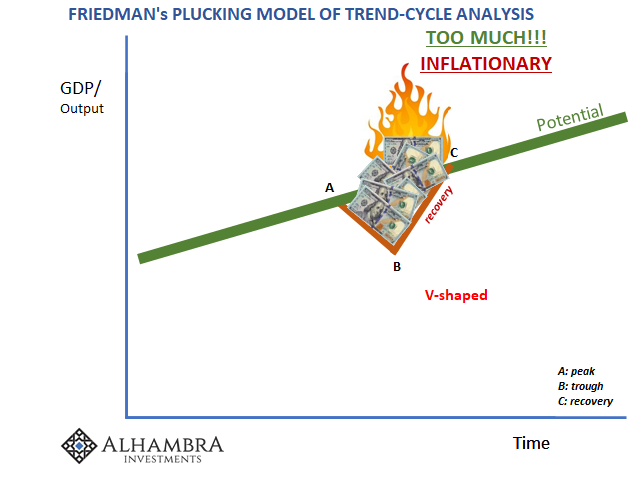

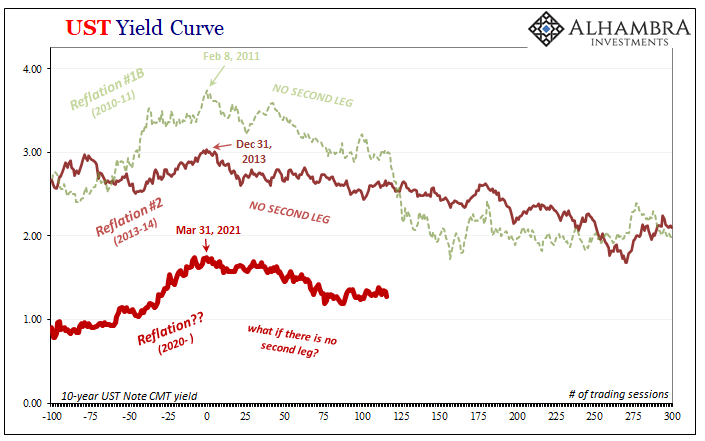

Everything appeared to be going just right, if not in danger of being “too much.” This latter was the phrenzy, a second bout of inflation hysteria which extrapolated (in a straight line) what would never be anything more than a minor bond sell-off into the biggest thing since the Great Inflation; if not Weimar Germany.

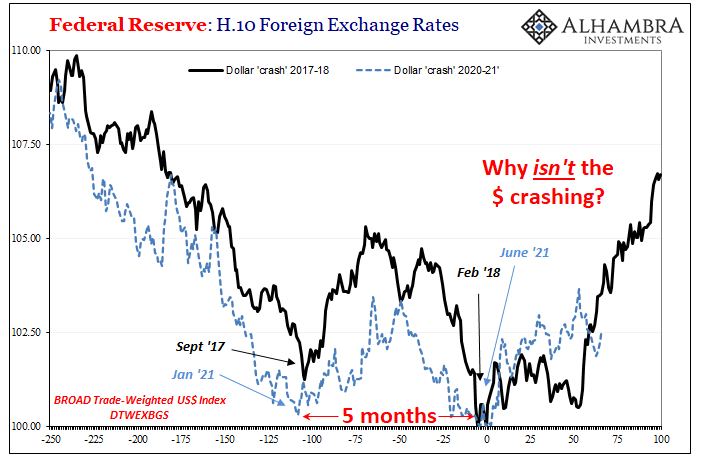

Yet, while the hysteria was just ramping up, everyone casually dismissed and ignored the dollar which had been “crashing” yet suddenly stopped and began what eight months later has been a multi-month process of bottoming out while moving higher. Something was up besides its exchange value, a shadowy caution that maybe not much had actually changed in any meaningful sense beyond the short run being filled to the brim with the federal government’s digital checks.

It is a pattern we’d seen before, and not all that long ago. The eurodollar already back on its nose even at that early time:

There weren’t nearly the same obvious issues in January 2021 like there had been four Septembers ago. On the contrary, after early January it seemed as if for the first time in forever all the good things had been lined up just perfectly for the world to finally right itself. Vaccines, stimulus, you remember all the unchallenged positives.

Funny thing, though, just like September 2017 the dollar curiously stopped “crashing.” Defying all the certitude with which this latest dollar downtrend had been called its demise, seemingly out of nowhere it stopped right in its tracks.

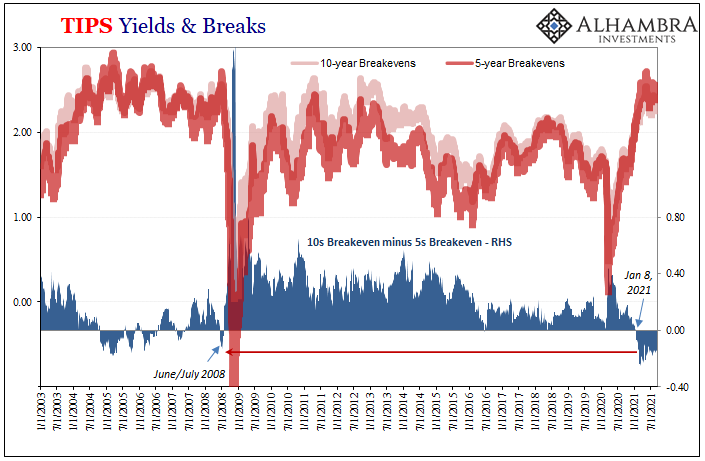

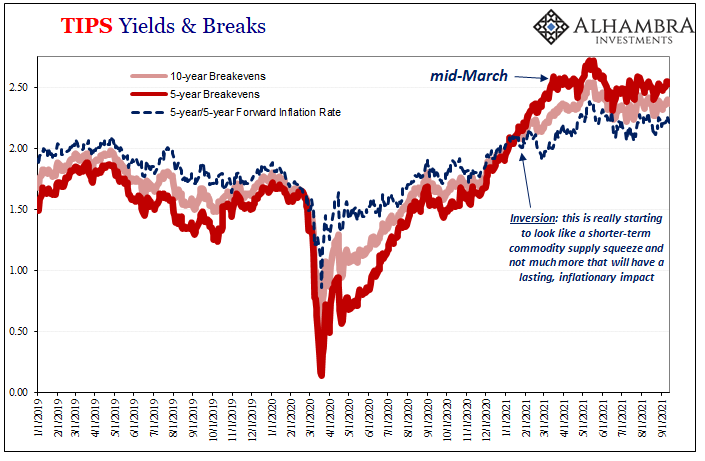

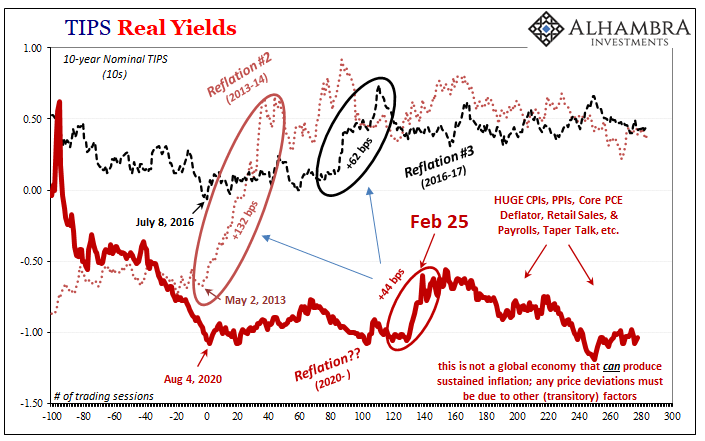

Not just Return of the King Dollar (where “king” means the same for the rest of us as it always had with whichever Kong), there were other contrary indications which appeared “out of nowhere” at the same time as the dollar’s inflection. A big one showed up in TIPS.

Only a few days apart.

When the dollar bottomed out (according to several broad exchange trade-weighted indices) on January 6, TIPS inflation expectations inverted a mere two days after. That is, the 5-year inflation breakeven (the difference between the disgustingly low real nominal yield and the same maturity nominal UST) on January 8 was a bip more than the inflation breakeven at the 10-year maturity. These are supposed to be the other way around (upward sloping).

This was the first time inflation expectations in TIPS were upside down since…the summer of 2008.

Such inflation “inversion” didn’t propose how the world might be poised to repeat everything terrible about that earlier period, instead that when it came to consumer prices represented by the US CPI the market was more and more thinking any possible rise and increase just wouldn’t last very long.

Summer ’08, you might remember, was desperately weird in this same sense; underneath the last time there were 5% CPI’s was a still smoldering dollar shortage which remained poised to wreck things. It only took a few months before that inversion – the inflation expectations market – proved accurate; the Great “Recession” bout of “inflation” soon disappeared as no inflation at all.

Transitory. The eurodollar ruled.

This ongoing January 2021 TIPS inversion has always indicated something similar; generally speaking, temporary. Though the conditions are quite different (still dollar shortage, as represented by the dollar itself), the market suspected that even though producer and consumer prices were about to receive a major boost, like 2008 it wouldn’t last, either.

It couldn’t last.

Though inflation breakevens continued higher for a time, they did so at these diverging speeds leading very quickly to a record level of TIPS inversion by the middle of February. At the same time “everyone” was getting more confident, hysterically so, about inflation breaking loose, the bond market’s inflation-focused section was itself becoming much more confident this would never happen.

I wrote at that point, the day before Fedwire:

Going back to the commodity surge around early January 2021, the TIPS curve has shifted (inverted) toward pricing future scenarios that incorporate the commodity-based influence more exclusively in the shorter end before becoming (far) more modest even downbeat expectations further down it. In other words, yeah, that big jump in oil and copper will have an impact on prices in the near-term, but it’s not as large as is being claimed nor is being priced to produce a lasting one.

Why not a lasting one?

As captured by the dollar’s sudden “strength”, there were already developing negatives deep inside the world’s vast monetary shadows. Balance of probabilities, over time “something” about them would spoil the inflation show before it ever truly got going.

Once Fedwire struck, it was all the reminder anyone in the shadows would need.

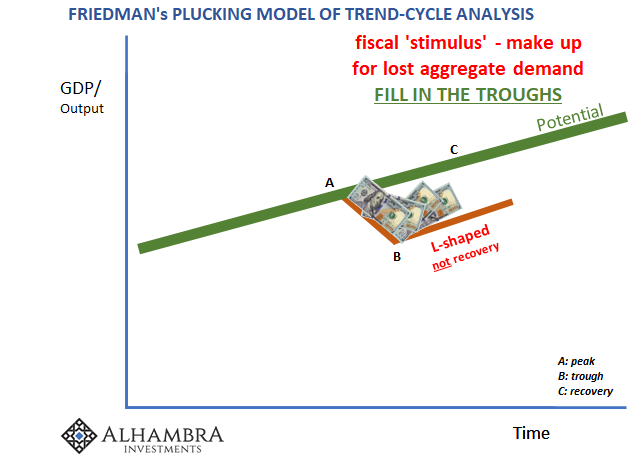

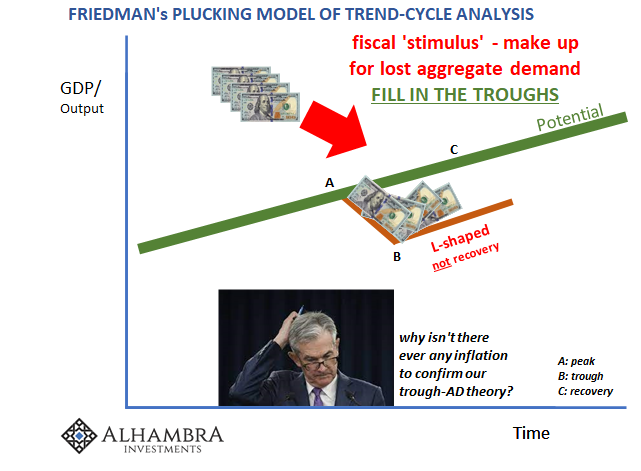

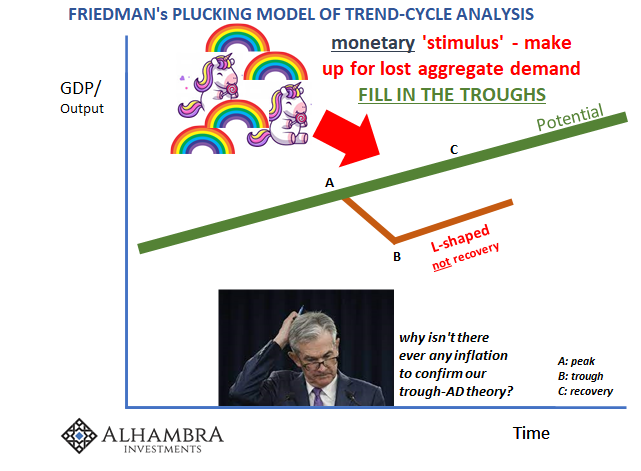

What that would mean is the same as we’d seen four times prior to 2020; nothing ever better than insufficient reflation because by context of a growing dollar shortage (like late 2017/early 2018) it would sap more and more reflationary economy to the point that eventually it would sink all over again. In terms of prices, demand would inevitably disappoint and they would have to turn back around.

Rising deflationary, not inflationary, potential

Back in ‘18, globally synchronized “growth” quickly evolved into a globally synchronized downturn “no one” saw coming. Certainly not Powell. Not Kuroda. None of them.

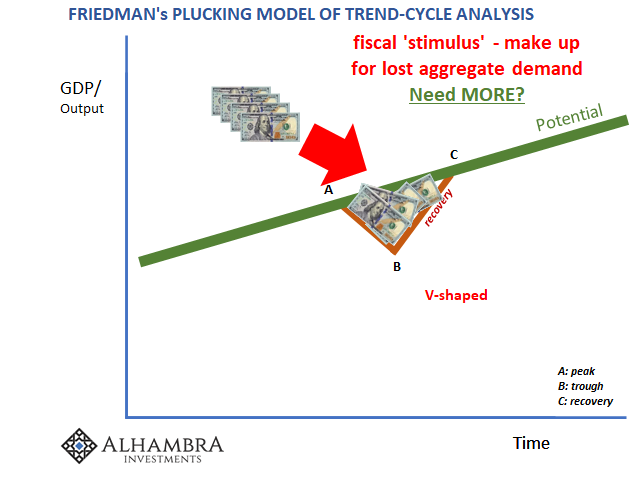

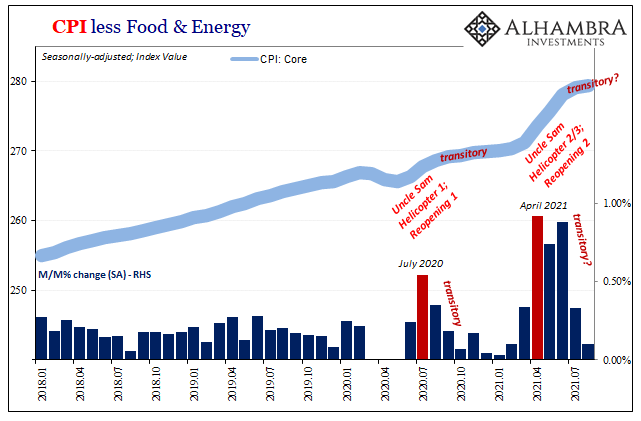

In 2021, such potential for demand disappointment was only heightened by what was really boosting it the most at the time: the feds (not the Fed; never the Fed or its counterparts). Inflation had actually stood a better chance in 2018 because at least then its potential, though slim to near none, was based on real economic progress (a minor upswell) rather than being almost wholly artificial like this year.

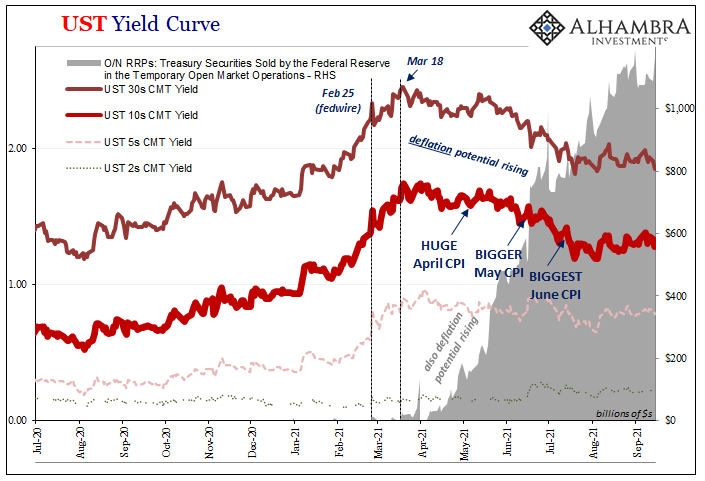

When reality slammed into the whole market, mid-March pursuant to the initial rumble at the Fed’s reverse repo window (RRP), inflation expectations also followed the entire shift into a deflationary trend. In other words, breakevens stopped rising altogether from then onward even as they’ve maintained their inverted relationship.

It didn’t hit the front pages, of course, inflation potential was already breaking down before the huge CPI’s were even published several months later. Hysteria built anyways because, like always, these warnings are dismissed, ignored, rationalized as something else other than a very clear and very powerful sign the mainstream has it all wrong. People want inflation for various reasons, so they block out everything else and commit the same error time and again.

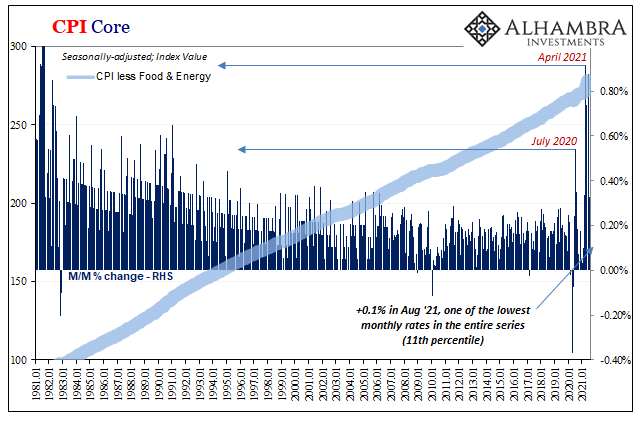

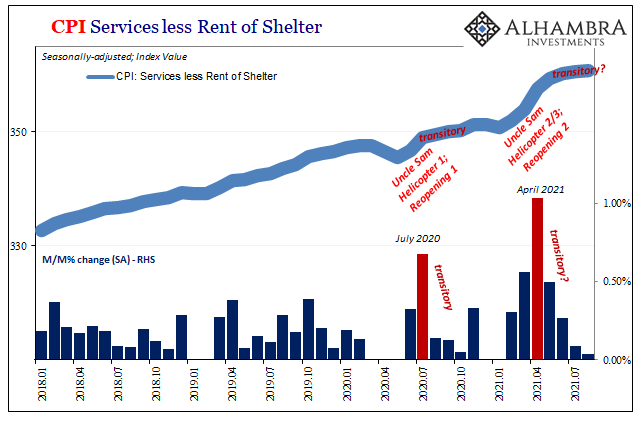

Yet, as the market (not stocks, obviously) had told you since January, even the US CPI’s up in the stratosphere would eventually disappoint rather than continue farther up toward Weimar. This began to happen around the edges of the BLS data a few months ago, and today with the estimates for August 2021 consumer prices, the situation has become even clearer.

Not just predictable but literally predicted, not inflation.

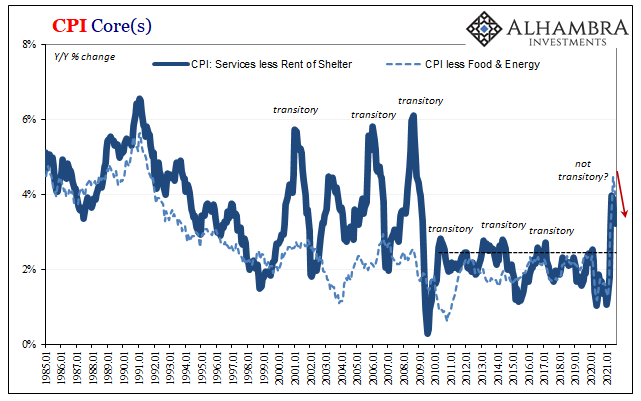

The headline CPI was up 5.25% year-over-year during August, but that’s the third straight month of deceleration (though only a small bit). This despite continued huge contributions from the energy sector; the energy bucket was up 24.2% year-over-year and accelerated slightly in August, mostly based on motor fuel which was 40.2% higher also faster in August.

What that means is the further you get away from that very narrow if important slice of the economy, the more the other side of transitory hasn’t just begun to set in, it is here.

Demand, quite simply, is breaking down across more and more of the (global) economy. As those government helicopter drops fade, the condition what’s left underneath isn’t the one envisioned during the hysteria (“stimulus” just doesn’t stimulate). On the contrary, we’re seeing far more sustained weakness which is only a surprise if you think low bond yields are due to QE rather than reflecting shockingly low growth and inflation expectations beyond the influence of Treasury depositing.

Nothing has really changed, including the mainstream’s collective ability to misconstrue what’s meaningful. Yes, Uncle Sam was huge – but ultimately, like always, futile in the sense of “stimulus.” Instead of focusing on that, the markets told you the economy wasn’t really recovering in large part because deflationary money potential never went away. In truth, despite Jay Powell’s “flood”, it really didn’t diminish all that much even at reflation’s best point late February/early March.

Exactly as the other side of TIPS, the continuously awful real yields, have been pricing the entire time.

Stay In Touch