Evidently, nothing causes this market to sweat. In mid-November, the S&P 500 ((IVV)) had just finished breaking its 200-day moving average on its way to a multi-year low at the 1343 level. Since then, the index has been on a tear, gaining over 16% in a little over 3 months. It finds itself at a critical stage though, battling to stay above support at 1550 level following a wild week for the markets. If the index manages to stay above the 1550 level, look for it to make new all-time highs. If not, 1516 is the next level of support. The S&P 500 is up 9.74% year-to-date.

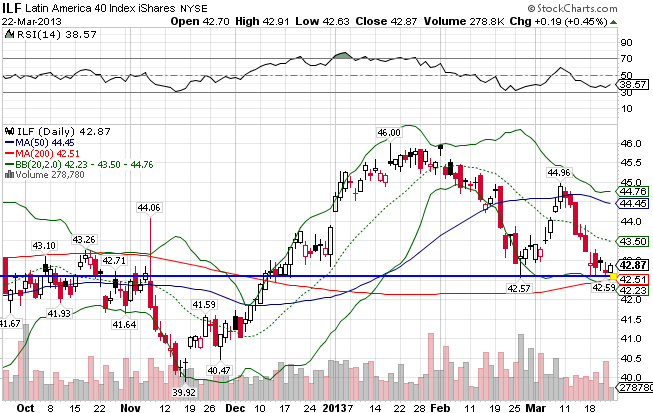

The Latin American market ((ILF)) scorching run has come to a sudden halt, as the index is breaking down technically. Over the course of the last month, the index broke its 50-day moving average before testing it and failing again. It currently sits atop strong support at the 200-day MA. It did manage to hold support on Friday, which is a huge positive in the short-term. The index has recorded a -2.21% loss so far this year.

The EMU Index ((EZU)), or the European Economic and Monetary Union, is also on the verge of breaking down, but not to the degree of Latin America. This coming week will be key to the future direction of the index, as a resolution for Cyprus’ banking crisis is expected on Monday or Tuesday, and it finds itself directly below its 50-day MA. The index is up only 0.66% for all of 2013.

The Middle East ((GULF)) continues to prosper despite tensions over Iran’s nuclear ambitions, instability in Israel, Iraq, Afghanistan, and Egypt, and a never-ending civil war in Syria. Add in a growing concern over the protection of oil and gas assets following the Algerian terrorist attack and French involvement in Mali and you would think the markets in the Middle East would be at the very least shaken. But nothing seems to tire this market, as the world’s insatiable demand for crude has created a floor for which any downward movement quickly diminishes and reverses. The index is up 8.70% YTD.

After a stellar run into the 30s, Africa’s market ((AFK)) has sputtered in 2013, now finding itself in a trading range from 30 to 32. The turmoil in Mali and Algeria, as well as continued upheavel in Egypt has managed to to a clamp on Africa’s run. The index finds itself under its 50-day MA, and is down for the year, losing -4.21%.

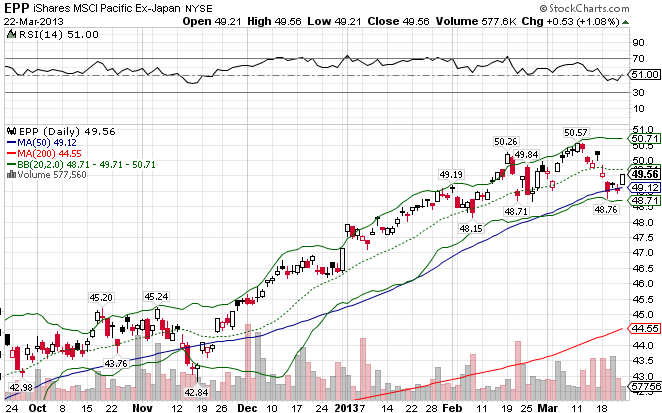

Despite a weakened Chinese economy and renewed threats and a successful nuclear test from North Korea, the Pacific x-Japan index ((EPP)) has performed remarkably. It has traded between the 43 and 45 range for a few months before finally blowing through the 45.25 level in December. Since then, the index has not let up, other than a few minor hiccups. It currently sits above support at the 50-day MA. It is up 5.13% YTD.

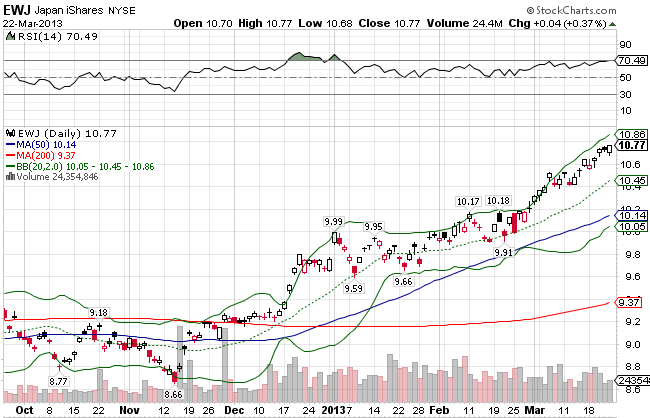

Japan ((EWJ)) was one of the worst performing markets in 2012 before a monstrous three-month run took hold beginning in mid-November. The index finds itself above both moving averages after retesting lows set in July. Look for this bullish trend to continue. The index is up 10.46% for all of 2013, the best performing market.

Stay In Touch