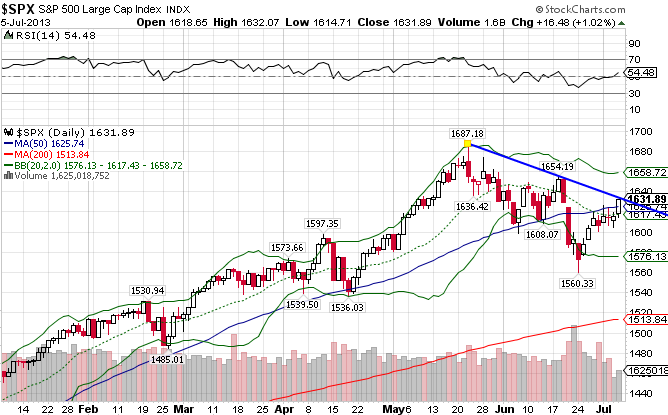

After a scorching start to the year, the S&P 500 Cap-Weighted Index ((IVV)) finally pulled back some, about a month and a half after setting all time highs at the 1687 level. The next move hinges on this coming week’s market action, as the index rebounded through its 50-day moving average but has encountered resistance at the 1630 level. A breakout through the 1630 level will probably lead to a retest of the all-time highs established in May. The S&P500 is up 15.63% for all of 2013.

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index in the last decade. Since breaking resistance at the 54 leve lback in the beginning of January, the index has also been on a tear, reaching all-time highs until this past week. It’s up 17.70% year-to-date.

Given the out-performance of the S&P Equal-Weighted Index, one of the themes for the past few years has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks . That trend has is also evident in the performance of the S&P Mid Cap 400 Index ((IJH)). It’s up 17.17% YTD.

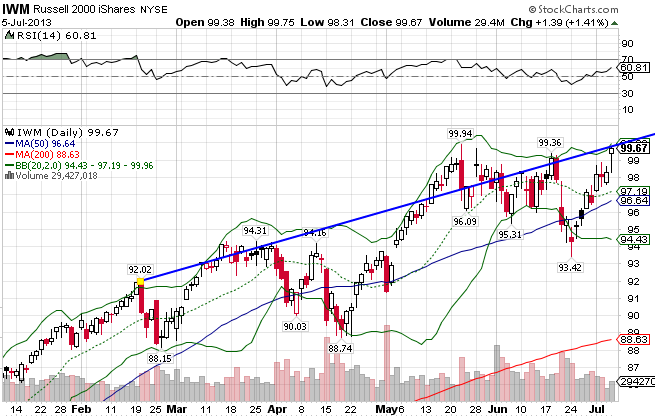

The Russell 2000 Small Cap Index ((IWM)) is also outperforming for the year, up 19.6%. It’s also just under its all-time highs and seems poised to knock that out this coming week.

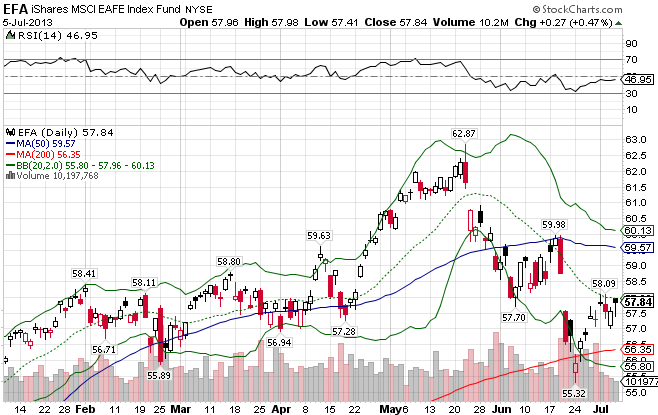

It’s no surprise that the MSCI EAFE Index ((EFA)) lags behind the world in economic performance, given the well-known and widely-reported circumstances.What is a surprise is the fact the the index actually out-performed the US stock market in all of 2012, and even started the year off on a good note before staggering in May. It now finds itself below its 50-day moving average and under critical support at the 58 level after a rough two months. It’s up only 3.76% year-to-date, less than one-fourth that of the US market.

The MSCI EAFE Small Cap ((SCZ)) has performed slightly better, with a YTD return of 6.30%.

Stay In Touch