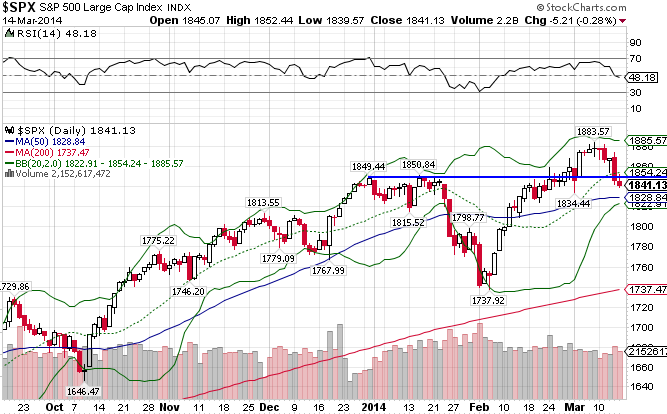

The S&P 500 Cap-Weighted Index ((IVV)) has finally been showing signs of wearing down this year, breaking through support at the 1850 level this past week, while also coming perilously close to breaking strong support at the 50-day moving average. Are the market technicals finally catching up to what the economy and the market fundamentals have been telling us? The S&P 500 is now flat for the year after making new all-time highs just a week ago.

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index this year and in the last decade. Since making new all-time highs just a week ago, the index has also hit a rough patch, but hasn’t broken any support at this very moment. The 71 level is key. The index is up 1.28% year-to-date, slightly better than the cap-weighted index.

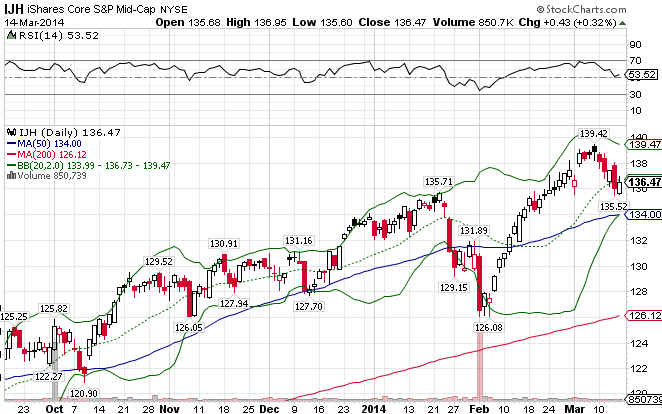

As evidenced by the out-performance of the S&P Equal-Weighted Index, one of the themes for the past few years has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks. That trend is also seen in the performance of the S&P Mid Cap 400 Index ((IJH)), as the index is up 2% YTD, better than the overall market.

The Russell 2000 Small Cap Index ((IWM)), the best performing major domestic index in 2013, is up 1.89% YTD. After years of investors disregarding risk aversion in favor of returns, this index is due for a pullback. Low quality or speculative smaller-cap stocks tend to lead the market near the end of a bull phase. We’ll keep an eye on this.

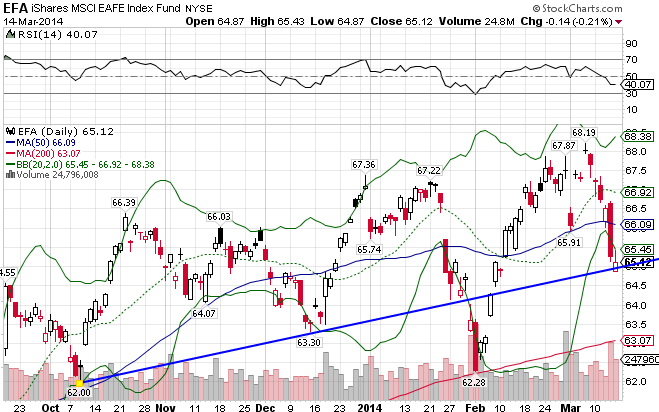

The MSCI EAFE Index ((EFA)) is lagging behind the US stock market, given the well-known and widely-reported circumstances in Europe, the currency problems in commodity-centric economies of Australasia, and stunted growth in Japan. Since October, the index has been extremely volatile, but has generally trended higher. This is the third time that the index falls below its 50-day MA during that time period, and this despite the fact that the dollar has been weakening.. It now finds itself at its short-term uptrend and must bounce off this level if it wants to continue its run. The index is down an unhealthy 2.94% since the beginning of the year.

The MSCI EAFE Small Cap ((SCZ)) has performed significantly better, with a YTD return of 0.14%.

Stay In Touch