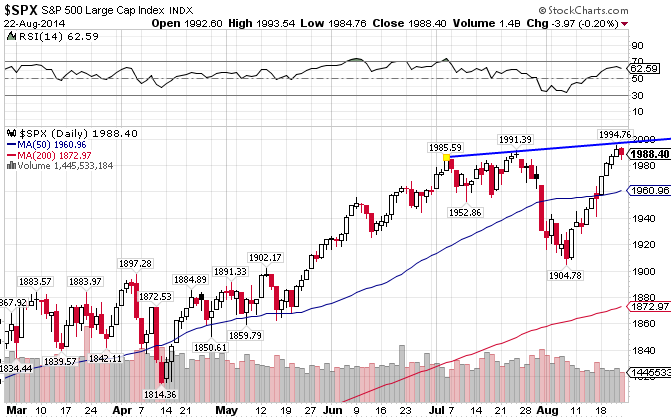

Despite geopolitical risks such as Ukraine, Iraq, and Gaza, the S&P 500 Index (IVV) managed to make new all-time highs, inching ever so closer to the 2000 level. After staggering in late July and into August, the index has come roaring back, gaining over 4% while also taking back the 50-day moving average. But beware of the dreaded double top… The S&P 500 is up 8.96% YTD.

The EMU Index ((EZU)), or the European Economic and Monetary Union, has broken its short-term trend line and both moving averages in the last two months. news out of Europe are pretty grim right now. It looks like it’s the end of the line for the once-heavily-favored European stocks. The index has greatly underperformed its US counterpart for much of the last year, and is down 2.98% for all of 2014.

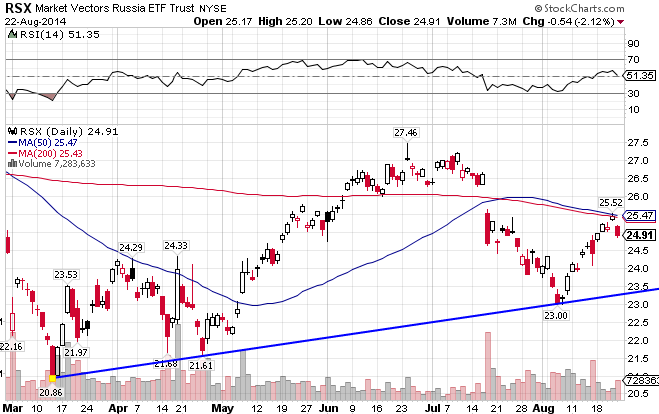

The Russian Index ((RSX)) finds itself just below moving averages. If Russia continues to provoke and antagonize, expect the index to fail and these levels. RSX is down a harsh 13.72% year-to-date.

The Middle East Index((GULF)) looks tired and seems to be running out of gas (pun intended), after several years of solid gains. A strengthening US Dollar is not helping the cause. Neither is the Israeli war in Gaza. The index is up 23.37% YTD.

The Latin American market ((ILF)) broke out in March in emphatic fashion. It broke through both the 50-day and the 200-day moving averages on its way to a 18% gain in a little over a month and a half. It hasn’t stopped going higher since. The index has recorded a 10.96% gain so far this year.

Africa’s market ((AFK)) has managed to grind higher for most of 2014. Continued upheaval in Northern Africa and a weak global economy hasn’t dampened Africa’s run for much of last year, but the market is starting to look worn down. Africa is up for the year, gaining 7.44%.

The Chinese economy, along with the Indian and Southeast Asian economies, have been trending up of late and now find themselves above both moving averages. The Pacific x-Japan index ((EPP)) managed to hold support at the 50-day moving average a few times over the past 3 months. The index is up 11.35% YTD after a torrid 1st quarter.

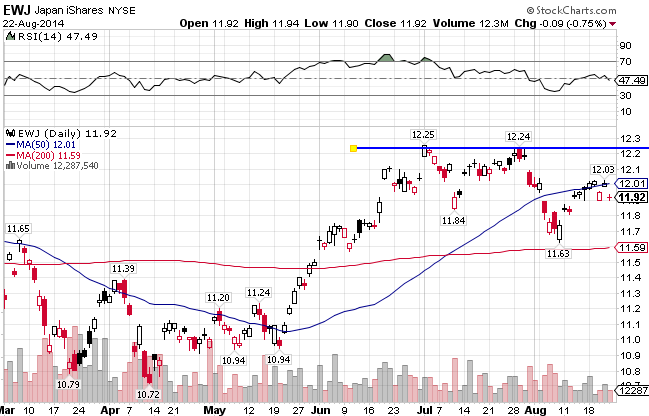

Japan ((EWJ)) broke out to the upside in late May and now finds itslef consolidating those gains. It must now climb and hold above the 50-day moving averages in order to continue its run. Japan is down 1.13% for all of 2014.

Stay In Touch