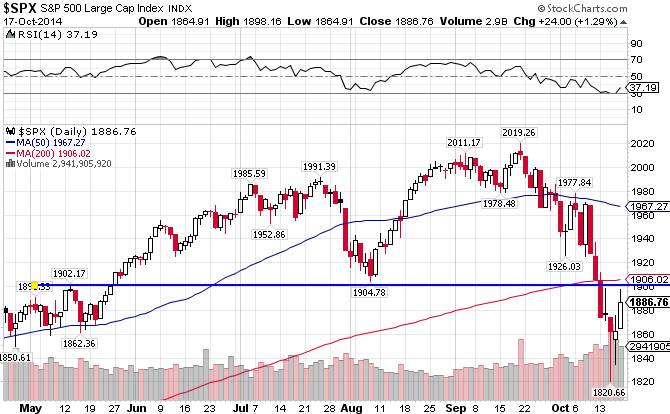

After a slow, stubborn march forward to the 2000 level, the S&P 500 Cap-Weighted Index ((IVV) has broken down in the last couple of weeks. Although not exactly a surprise, the index broke both moving averages on its way to support. If it wants to limit the technical damage, which is already pretty grim, the index must get above the 1900 level this coming week. We might be in for a rough patch if we can’t hold above that level. The S&P 500 is up 3.63% for the year.

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index in the last decade. The index is up 3.33% year-to-date, slightly behind the cap-weighted index given that small-caps have underperformed.

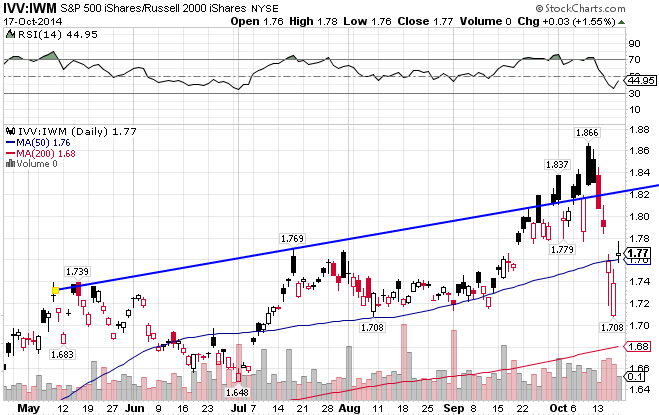

One of the themes for the past few years has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks. That has not been the case this year, as the Russell 2000 Small Cap Index ((IWM)) is down 5.97% YTD compared to the almost 4% gain for the S&P 500. After years of investors disregarding risk in favor of returns, this index is now taking it to the chin. Low quality or speculative smaller-cap stocks tend to lead the market near the end of a bull phase. We’ll keep an eye on this.

The S&P 500 versus the Russell 2000 Index. The Large Cap Index has outperformed since March.

Unlike the US markets, the MSCI EAFE Index ((EFA)) has staggered and stumbled throughout the year, and now finds itself substantially below both moving averages. The index is down 7.40% since the beginning of the year, significantly behind its US counterpart.

The MSCI EAFE Small Cap ((SCZ)) has performed significantly worse, with a YTD loss of 9.10%. On par with the US markets, in the short-term international small caps are underperforming the the large cap index.

EAFE Large Cap Index vs EAFE Small Cap Index. It’s been a steady large cap outperformance, although both indices have been weak.

Stay In Touch