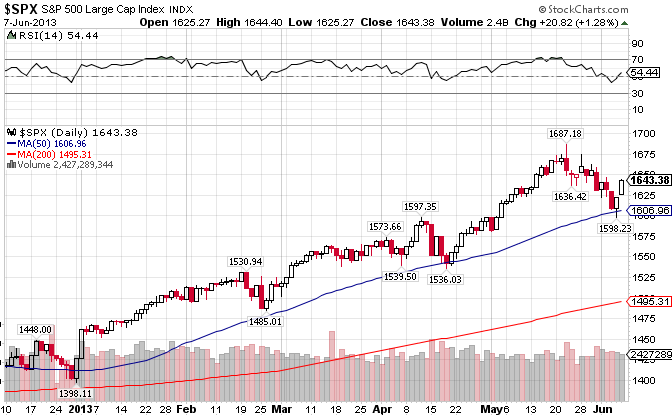

The Standard & Poor’s 500 is a stock market index based on the common stock prices of the biggest 500 publicly traded American companies. The S&P 500 ((IVV)) successfully bounced off its 50-day moving average this past week on after a rough couple of down weeks. This is the fifth time it does so, giving credence to the buy-on-dips mentality. The index is up 16.26% year-to-date.

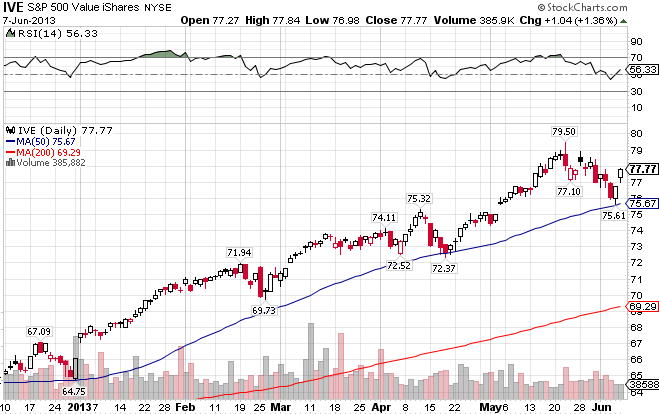

The S&P 500 Value Index ((IVE)), which consists primarily of US large-cap value stocks in the financial services, industrial, and consumer cyclical industries, tend to have lower price to earnings ratios and higher dividend yields than the market as a whole. This index looks solid based on the charts, on a slow but steady trajectory pointing higher. After breaking out past the 75 level in early May, the index continued its spectacular run. Compared to the S&P 500, the index is outperforming slightly, returning 17.75% for all of 2013.

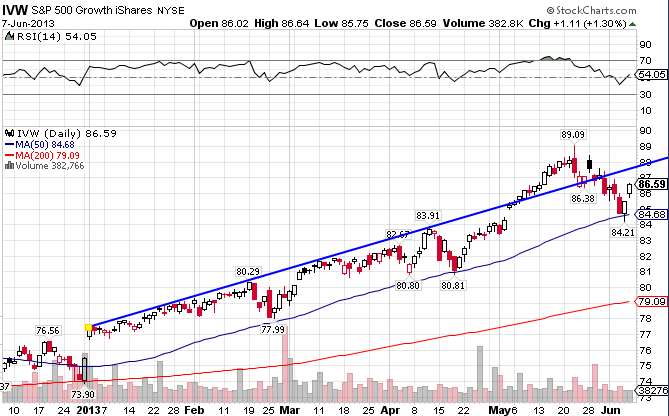

The S&P 500 Growth Index ((IVW)), which consists primarily of US large-cap growth stocks in the tech, healthcare, and energy industries, tend to have higher earnings growth rates, higher earnings multiples, and little or no dividend yields. The index is struggling to maintain pace with its value counterpart, as seen on the second chart. Since the start of the new year, the index is up 14.78%, less than the overall market.

In the past few weeks, a short-term trend of value stocks outperforming growth stocks has re-emerged.

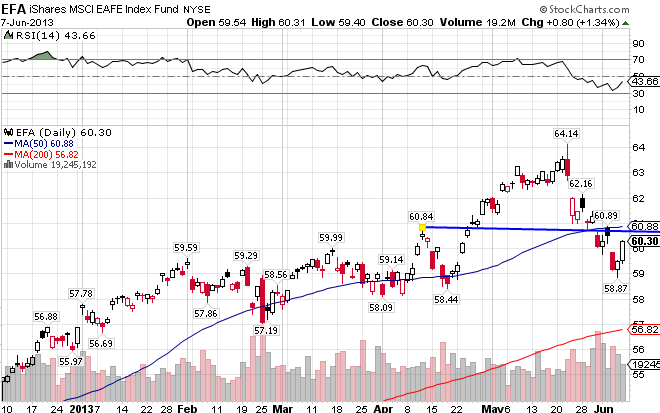

The MSCI EAFE Index ((EFA)), a global developed market index that encompasses Europe, Australasia, and the Far East, has fallen harder and faster than the US market. As the negative chatter surrounding China and Europe has ticked up in the past month, the index fell below its 50-day moving average before finding support 58-59 level. It could be short-lived though. The index is up 6.05% YTD.

The MSCI EAFE Value Index ((EFV)), which consists primarily of low P/E international large-cap value stocks in the financials, energy, and communications industries, broke resistance at the 51.50 level on its way to support at the 50 level. The 51.50 level now becomes resistance, as does the 50-day moving average. The index is up 5.47% for all of 2013.

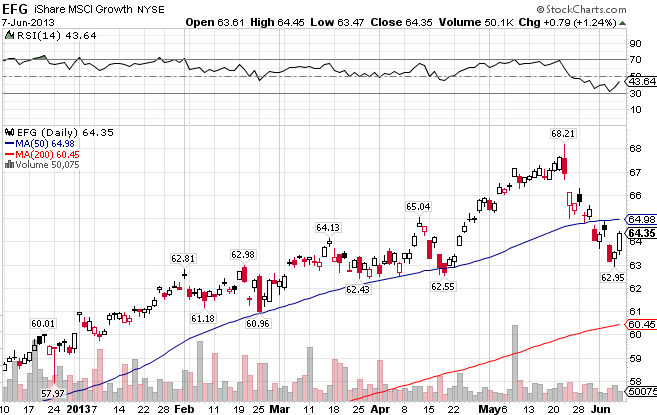

The MSCI EAFE Growth Index ((EFG)), which consists primarily of high-growth international large-cap growth stocks in the industrial, healthcare, and consumer cyclical industries, has slightly outperformed compared to the value index, unlike its American counterpart. The index is up 7.18% YTD.

Stay In Touch