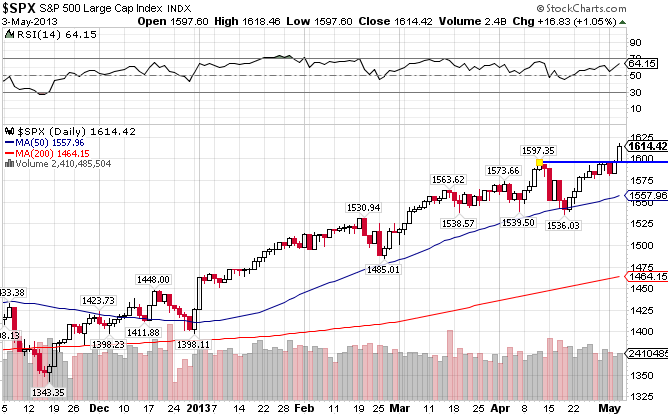

The S&P 500 Cap-Weighted Index ((IVV)) has had an scorching start to the year, breaking the 1600 level and in the process surpassing its all-time highs set in 2007 in this past week. Since correcting in the middle of April, the index bounced off support at the 50-day moving average in emphatic fashion, finally clearing resistance at 1597 with news of Friday’s Jobs report. It seems likely that the index will continue the momentum upward at least in the early part of this coming week. The index is up 13.81% for all of 2013.

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index in the last decade. Since breaking resistance at the 54 level, the index has also been on a tear, reaching all-time highs. It’s up 15.49% year-to-date.

Given the out-performance of the S&P Equal-Weighted Index, one of the themes for the past few years has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks . That out-performance has weakened as of late though, as evidenced by the recent performance of the S&P Mid Cap 400 Index ((IJH)) vs the S&P 500 in the last month. It’s up 14.72% YTD.

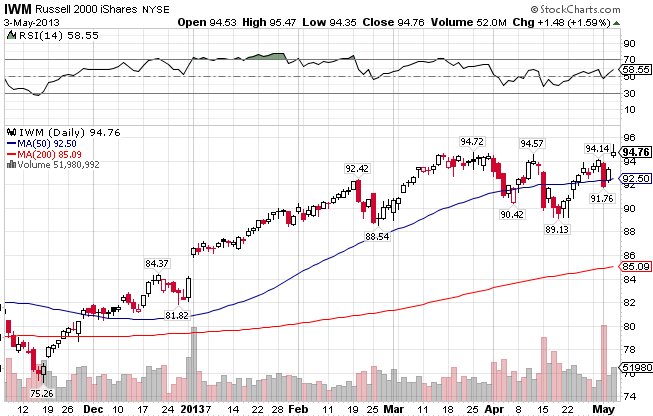

The Russell 2000 Small Cap Index ((IWM)) is also up for the year, at a 12.70% clip.

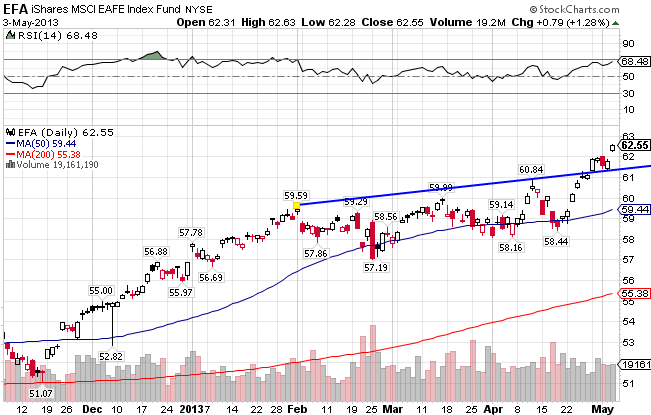

It’s no surprise that the MSCI EAFE Index ((EFA)) lags behind the world in economic performance, given the well-known and widely-reported circumstances.What is a surprise is the fact the the index actually out-performed the US stock market in all of 2012, and even started the year off on a good note before staggering since February. But since mid-April, the index has been playing catch-up, breaking resistance at the 61 level on its way to breaking out. It’s up 10.01% year-to-date and currently sits atop both moving averages, with the slope of both moving averages firmly positive.

The MSCI EAFE Small Cap ((SCZ)) has performed slightly better, with a YTD return of 13.02%.

Stay In Touch