The S&P 500 Cap-Weighted Index ((IVV)) hit new all-time highs this past week, and looks likely to continue doing so this coming week. The index has been on a tear this year, breaking through any and all resistance on its way through the 1700 level. And this despite the fact that the fundamentals are not as strong as a market at all-time highs would suggest. What drives this market up is anyone’s guess at this point, as an environment with rising interest rates is not conducive to a rising stock market, yet that is the case. The S&P 500 is up an outstanding 21.24% for all of 2013.

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index this year and in the last decade. Since breaking resistance at the 54 level back in the beginning of January, the index has also been on a stellar run, breaking resistance at the 65 level on its way to new all-time highs. The index is up 24.26% year-to-date, significantly better than the cap-weighted index.

As evidenced by the out-performance of the S&P Equal-Weighted Index, one of the themes for the past few years has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks. That trend is also seen in the performance of the S&P Mid Cap 400 Index ((IJH)). It’s up 23.84% YTD.

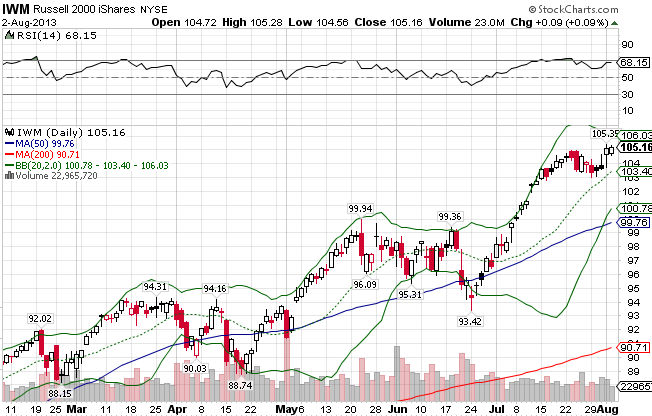

The Russell 2000 Small Cap Index ((IWM)) is the best performing major domestic index, up 25.62% for the year. This might not be all peaches and cream though, as this maybe a sign that people are disregarding risk aversion in favor of returns. Low quality or speculative smaller-cap stocks tend to lead the market near the end of a bull phase.

It’s no surprise that the MSCI EAFE Index ((EFA)) lags behind the world in economic performance, given the well-known and widely-reported circumstances.What is a surprise is the fact the the index actually out-performed the US stock market in all of 2012, and that it is fast approaching levels not seen since 2008 after achieving healthy returns for the current year. It now finds itself above its 50-day moving average and above critical resistance at the 61.50 level after a rough two months. It’s up a solid 10.62% year-to-date, about half that of the US market.

The MSCI EAFE Small Cap ((SCZ)) has performed significantly better, with a YTD return of 14.17%.

Stay In Touch