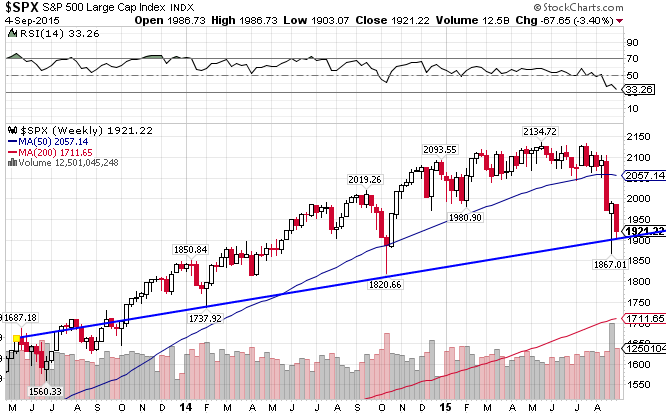

The S&P 500 Cap-Weighted Index ((IVV)) held support at the 1900 level (at least temporarily) after its crushing meltdown from the 2130 level over the last month. If the index manages to hold here, we may test resistance at the 50-week moving average, which was once strong support. If it doesn’t hold the 1900 level, we are looking at the previous lows made in October, the 1820 level. The direction of the market will likely be predicated by this coming week’s market action. The S&P 500 is down 5.41% for the year.

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating the market-weighting growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index in the last decade. So far this year, the index is down 6.39% year-to-date, slightly underperforming the cap-weighted index.

One of the themes of the past decade has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks. That trend is intact for 2015, even as the bottom has fallen out from under the Russell 2000 index ((IWM)) over the past few weeks. IWM is outperforming the large cap index, and is down 4.94% YTD.

The S&P 500 versus the Russell 2000 Index, Weekly Chart. It seems that the large cap index has broken out in the past couple of months. A big move was expected, and that is now coming to fruition.

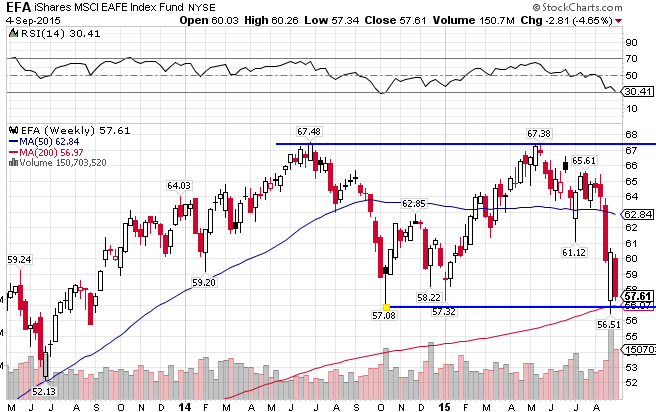

Looks like the troubles in Greece and a weakening Chinese economy coupled with a deflated the MSCI EAFE Index ((EFA)). The index is down 3.71% since the beginning of the year, significantly better than its US counterpart, but not as much as it was earlier in the year.

The MSCI EAFE Small Cap ((SCZ)) has performed significantly better, impressively holding onto a gain of 2.65% for the first part of the year. Like the US markets, international small caps are outperforming the large cap index.

EAFE Large Cap Index vs EAFE Small Cap Index, Weekly View. It’s been a steady small cap outperformance since October of last year.

Stay In Touch