The S&P 500 Cap-Weighted Index ((IVV)) has had an scorching start to the year, surpassing its all-time highs set in 2007. The index bounced off the 50-day moving average in emphatic fashion, blowing through the 1400 level en route to the 1550 level in a little over two months. The index is up 9.18% for all of 2013.

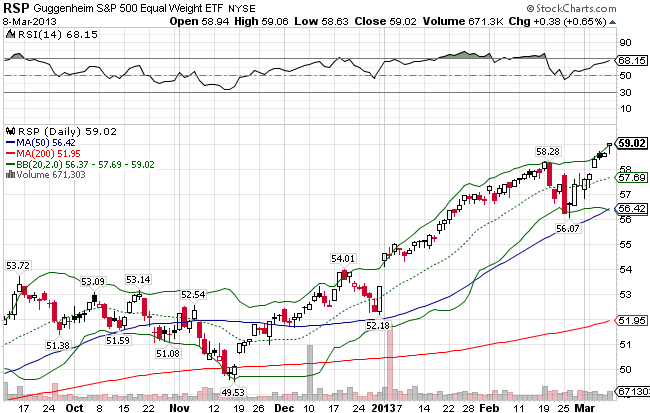

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index in the last decade. Once breaking resistance at the 54 level, the index has been on a tear, reaching levels also not seen since 2007. It’s up 10.69% year-to-date.

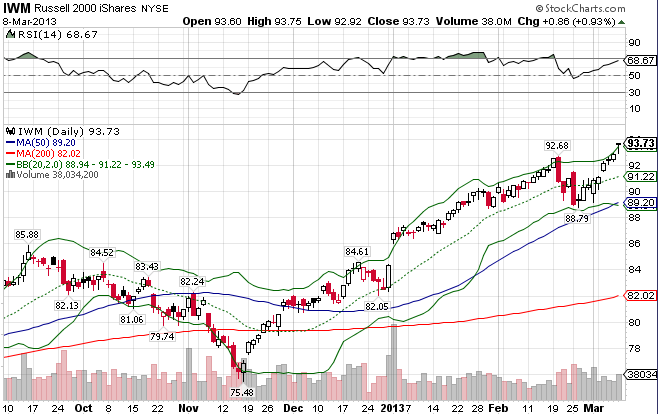

Given the out-performance of the S&P Equal-Weighted Index, one of the themes for the past few years has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks . That out-performance has strengthened as of late, as evidenced by the recent performance of the S&P Mid Cap 400 Index ((IJH)). It’s up 11.22% YTD.

The Russell 2000 Small Cap Index ((IWM)) is also up for the year, at a 11.16% clip.

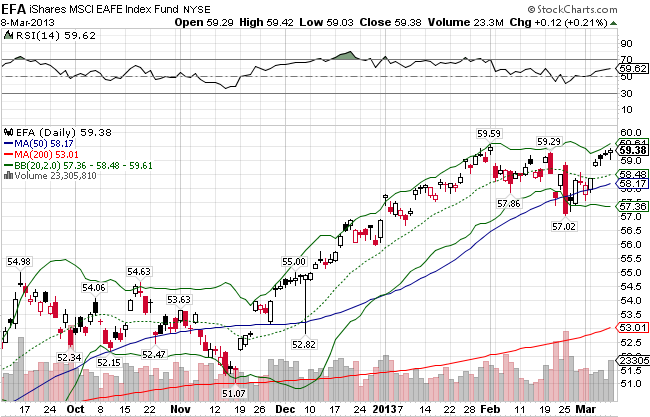

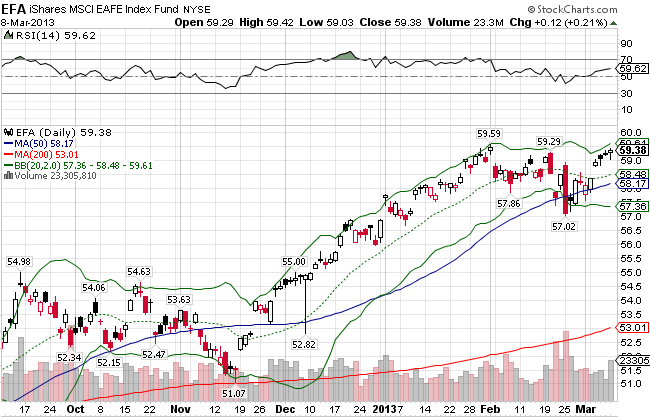

It’s no surprise that the MSCI EAFE Index ((EFA)) lags behind the world in economic performance, given the well-known and widely-reported circumstances.What is a surprise is the fact the the index actually out-performed the US stock market in all of 2012, and even started the year off on a good note before suffering a minor setback in the past month, waffling between the 57 and 59 levels. It’s up close to 5% year-to-date and currently sits atop both moving averages, with the slope of both moving averages firmly positive.

The MSCI EAFE Small Cap ((SCZ)) has performed slightly better, with a YTD return of 6.51%.

Stay In Touch