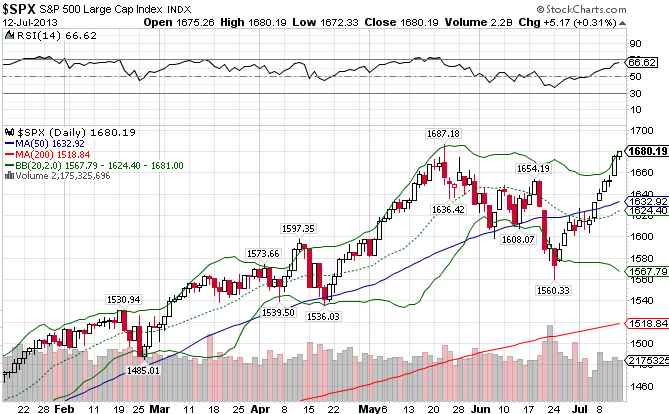

The Standard & Poor’s 500 is a stock market index based on the common stock prices of the biggest 500 publicly traded American companies. The S&P 500 ((IVV)) has been on a tear since blasting through resistance at the 50-day moving average in the beginning of July. The index is now only half a percent from its all time intraday high at 1687. The index is up 18.80% year-to-date.

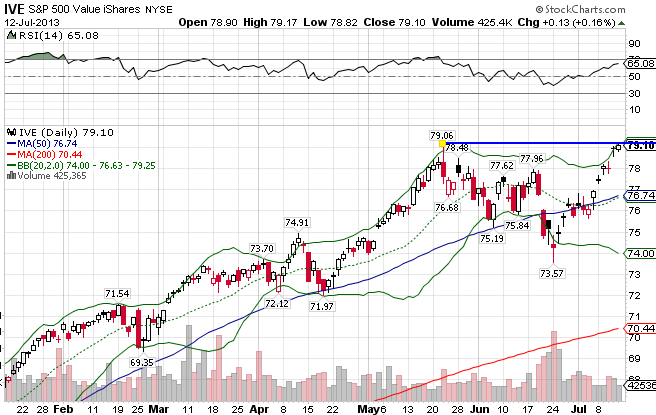

The S&P 500 Value Index ((IVE)), which consists primarily of US large-cap value stocks in the financial services, industrial, and consumer cyclical industries, tend to have lower price to earnings ratios and higher dividend yields than the market as a whole. This index looks solid based on the charts, having already hit all-time new high territory. Compared to the S&P 500, the index is outperforming slightly, returning 20.42% for all of 2013.

The S&P 500 Growth Index ((IVW)), which consists primarily of US large-cap growth stocks in the tech, healthcare, and energy industries, tend to have higher earnings growth rates, higher earnings multiples, and little or no dividend yields. The index is struggling to maintain pace with its value counterpart, as seen on the second chart. Since the start of the new year, the index is up 17.41%, less than the overall market.

In the past few weeks, a short-term trend of value stocks outperforming growth stocks has re-emerged.

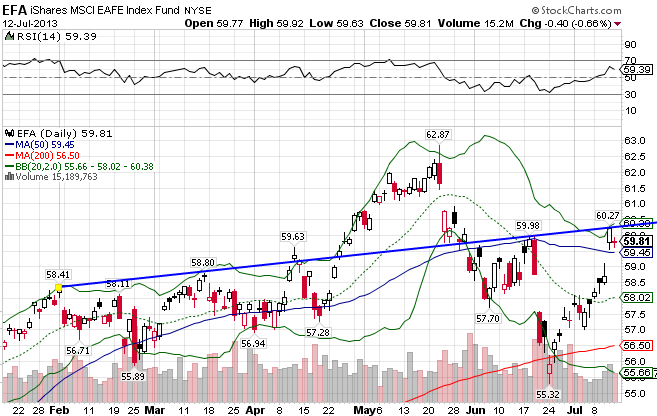

The MSCI EAFE Index ((EFA)), a global developed market index that encompasses Europe, Australasia, and the Far East, had fallen harder and faster than the US market, and has struggled to make up the losses on the rebound. As the negative chatter surrounding China and Europe has ticked up in the past month, the index fell below its 50-day moving average before finding support at the 200-day. The index seems to be on firmer footing though, having broken past through resistance at the 50-day this past week. The index is up 7.30% YTD.

The MSCI EAFE Value Index ((EFV)), which consists primarily of low P/E international large-cap value stocks in the financials, energy, and communications industries, also broke resistance at the 50-day this past week, but trails the overall index. Unlike the US markets, international value stocks trail growth stocks by a wide margin. The index is up 6.11% for all of 2013.

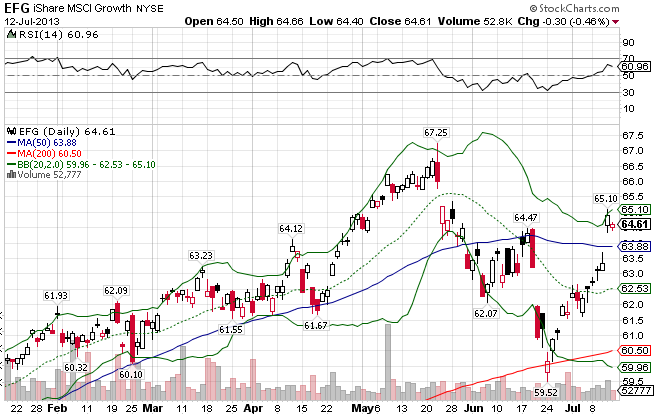

The MSCI EAFE Growth Index ((EFG)), which consists primarily of high-growth international large-cap growth stocks in the industrial, healthcare, and consumer cyclical industries, has outperformed substantially compared to the value index. The index is up 9.13% YTD.

Stay In Touch