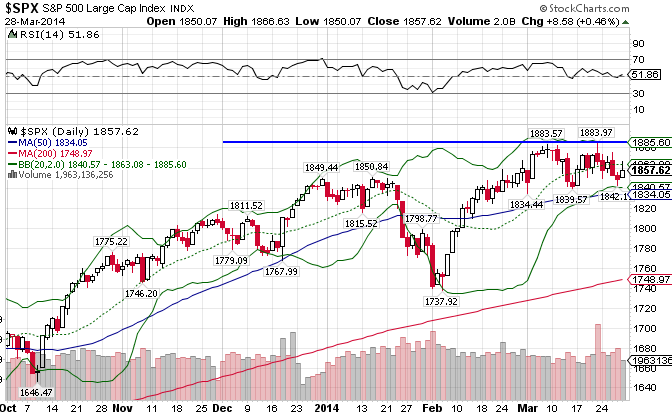

The S&P 500 Index (IVV) went on a stellar run this past year, gaining just over 32% on its way to new all-time highs. After rebounding from a sharp but brief sell-off in January, the index has staggered over the past two months and is having trouble crossing through the 1883 level. This coming week will be key for where the markets will ultimately head. If it doesn’t break through to new highs, it will have formed a dreaded double top. If that’s the case, look for the index to hit support at the 1800 level at the very minimum. The S&P 500 is up 0.94% YTD.

The Latin American market ((ILF)), lagging technically for about a year now, broke out to the upside in the last two weeks. While it broke through both the 50-day and the 200-day moving averages, it has encountered resistance at the 36.50 level. Given the bullish nature of the commodity markets as of late, and the fact that this region’s economy is uber-dependent on the various commodities, breaking through this level is not completely out of the realm. The index has recorded a -2.16% loss so far this year.

The EMU Index ((EZU)), or the European Economic and Monetary Union, also broke out to the upside following a volatile first part of the year. The index had significantly outperformed its US counterpart in the past month, after staggering for much of the last quarter of 2013. The index is up 1.74% for all of 2014.

The Middle East ((GULF)) continues to defy the odds, despite deepening tensions throughout the region. A strengthening crude oil market is helping the cause. After breaking out at the 18.50 level in November, it hasn’t done anything but ride higher. The index is up 13.38% YTD.

After a hiccup at the end of the last quarter of 2013, Africa’s market ((AFK)) has been trading in tight range, but has managed to form a short-term uptrend line. Continued upheaval in Northern Africa and a weakening global economy has managed to put a clamp on Africa’s run for much of last year, but the market is really trying to break through. Africa is up for the year, gaining 1.13%.

The Chinese economy, along with the Indian and Southeast Asian economies, have been trending up of late and now find themselves above short-term support at the 47 level. The Pacific x-Japan index ((EPP)) managed to hold support at both moving averages in the past two weeks on its way to making this new uptrend. The index is up 2.29% YTD after a torrid February.

Japan ((EWJ)) was one of the best performing markets in 2013 before staggering for much of the end of the year. That all came crashing down in mid-January though, as the index lost 10% in a little over a week. While it has bounced up some since, the index now finds itself under both moving averages. If it fails to break the 11.60 level, the index could be in for a rough downdraft. Japan is down 6.66% for all of 2014.

Stay In Touch