Joseph Gomez, Sr. Investment Advisor

Joseph Gomez, Sr. Investment Advisor

As of today, the S & P 500 is up 11% for 2012, a 4 year high. I believe we are within weeks/months from the point where investors will exit the “dis-belief stage” of a bull market (marked by historically low volumes) to the “acceptance stage” (marked by increased volume and an asset allocation adjustment out of bonds and into stocks).

As most people are aware, about every 5 years US stock market goes through one cyclic bear market, and we just exited one of the worst cyclic bear markets in history. In addition, markets also have much longer “secular” cycles that average around 17 years. The cyclic bear market in a secular bear market tends to be much severe than the cyclic bear market in secular bull market.

The word “secular” means long periods of time, and indeed the secular bear is well-deserving of this moniker. Throughout history, secular bears have had average durations of 17 years each! These great bears follow great bulls, which also happen to average 17 years. One complete secular-bull-to-secular-bear cycle runs 34 years, a third of a century.

– Secular Bull Market, 2011 – ?

– Secular Bear Market, 2000 – 2011, (11 years)

– Secular Bull Market, 1982 – 2000, (18 years)

– Secular Bear Market, 1966 – 1982, (16 years)

– Secular Bull Market, 1949 – 1966, (17 years)

– Secular Bear Market, 1929 – 1949, (20 years)

– Secular Bull Market, 1921 – 1929, (8 years)

– Secular Bear Market, 1905 – 1921, (16 years)

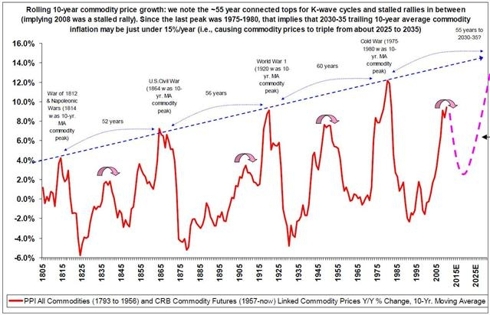

Commodity cycles:

Stay In Touch