Research notes from Macro Research Board:

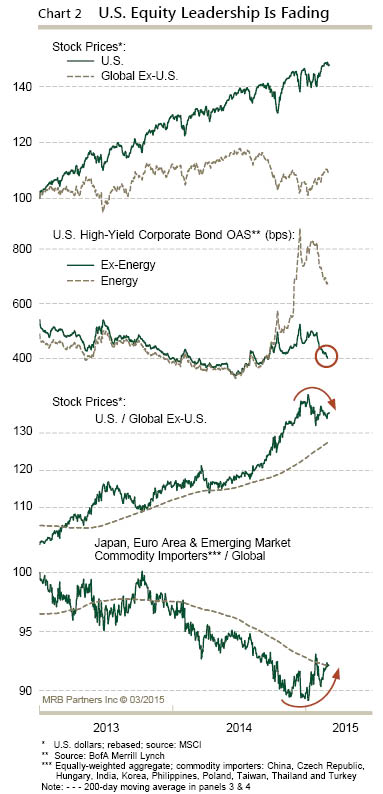

- While non-U.S. equity markets have massively underperformed the U.S. in recent years, especially in U.S. dollar terms, there are signs of a reversal in a number of key bourses.

- Our favored non-U.S. markets (EM commodity importers, the euro area and Japan) have recently edged higher in relative terms, even adjusting for their currency weakness.

- In addition to less tension in the oil pits, the corporate bond market has calmed. Non-energy high-yield corporate bond spreads have narrowed markedly, which typically coincides with sustained equity rallies.

- A pro-growth investment stance is still warranted, despite recent sizable gains, supported by very reflationary global monetary conditions and gradually improving economic activity.

At Alhambra, we are starting to contemplate removing currency hedges.

As always, please feel free to contact me with any questions or concerns.

Find out about your personal risk profile and working with Alhambra

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product.

Stay In Touch