Top News Headlines

- BIS Quarterly Report: China slowdown, strong and rising dollar threaten emerging markets.

- European migrant crisis continues; Germany tightens border security.

- Stocks rally 2% ahead of Fed meeting.

- Apple unveils new products

Economic News

- Brazil’s debt rating cut to junk.

- IMF adds its name to very long list of Keynesians begging Yellen to hold off on rate hikes.

- Oil prices fall 2% for the week. In case you were in doubt, the Saudis are winning the price war with shale.

- JOLTS: Job openings up sharply.

- Import and export prices still falling.

- Consumer sentiment takes a dive.

Random Thought Of The Week

What would interest rates be today had the Fed gone on hiatus the last few years? What if there had been no QE3 or 4 or whatever number we’re on, no jawboning, no taper tantrum? That is an incredibly hard question to answer but one that is critically important. If rates are higher now than they would have been absent intervention then the Fed’s policies have been at least somewhat effective. But if rates are lower than they would have been in our Fed-less world, then their policies have been harmful. The Keynesians of the world believe the former and that the Fed just hasn’t done enough. The other side is made up of what most people think of as monetary cranks, gold bugs. Of course, it was once the Keynesians – and whatever you called them pre-Lord Keynes – who were considered the nuts, outside the mainstream. When will the worm turn?

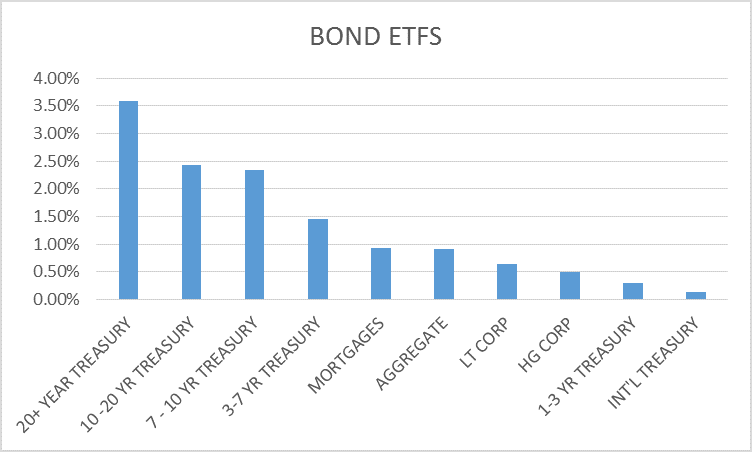

Chart Of The Week

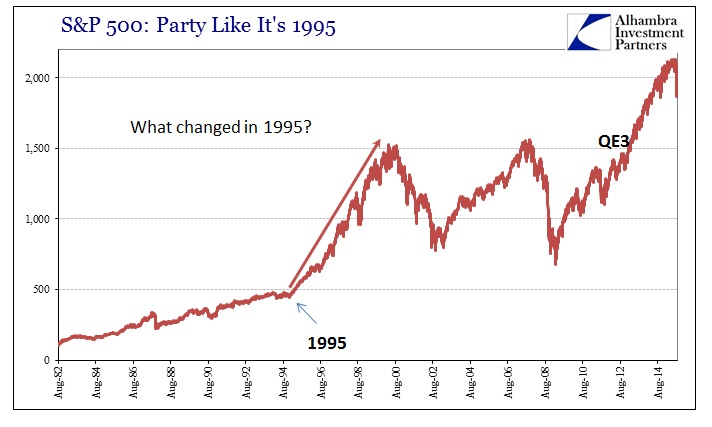

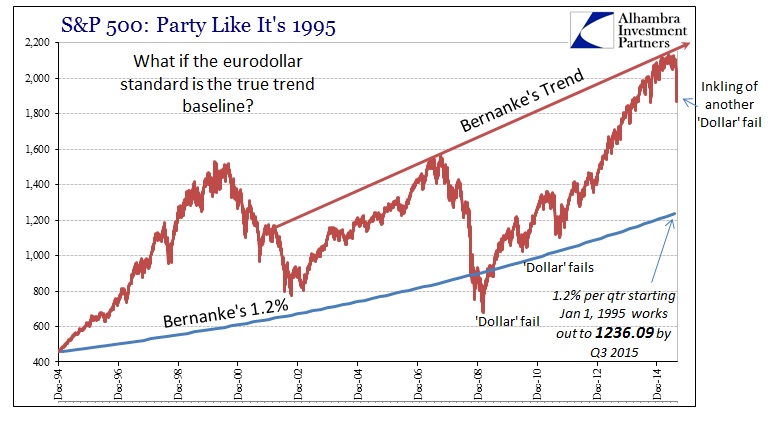

This week’s chart of the week is actually two charts from my colleague Jeff Snider in this post. The post and the charts are essentially a rebuttal of Ben Bernanke’s view that stocks are valued appropriately based on their previous trend. As Jeff points out, Bernanke’s choice of starting point is serendipitous indeed.

Stay In Touch