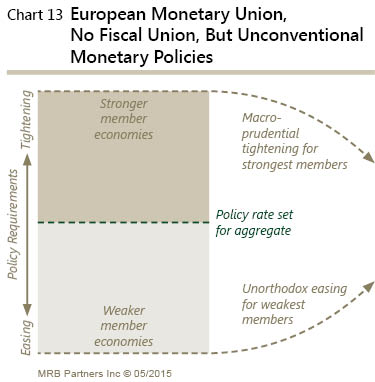

The difficulty of being a central banker in Europe is that you face the challenge of dealing with the structure of a monetary union with no fiscal union. At any given time, the economies of different countries will require different monetary policy. So, while Greece may be begging for easy monetary conditions, Germany may not require or even desire such loose conditions and may, in fact, desire a tightening of money. Chart 13 below shows graphically what is desired by the ECB.

The difficulty of being a central banker in Europe is that you face the challenge of dealing with the structure of a monetary union with no fiscal union. At any given time, the economies of different countries will require different monetary policy. So, while Greece may be begging for easy monetary conditions, Germany may not require or even desire such loose conditions and may, in fact, desire a tightening of money. Chart 13 below shows graphically what is desired by the ECB.

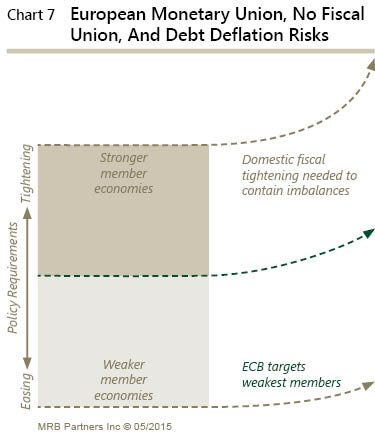

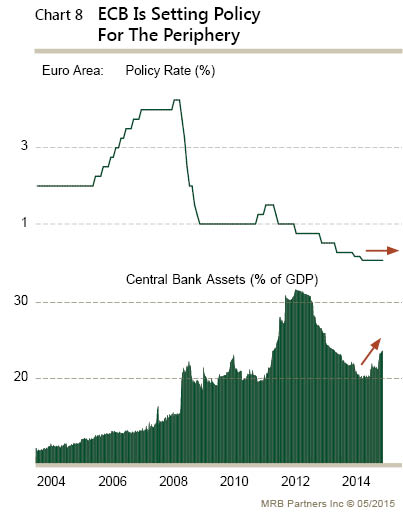

Unfortunately the ECB only possesses a conventional tool which is regionally agnostic. We thus see, in Chart 7 below, stronger Euro countries getting further away from their desired neutral position. The resulting imbalances wind up causing bubbles which look like piles of debt in countries like Greece and asset inflation in Germany.

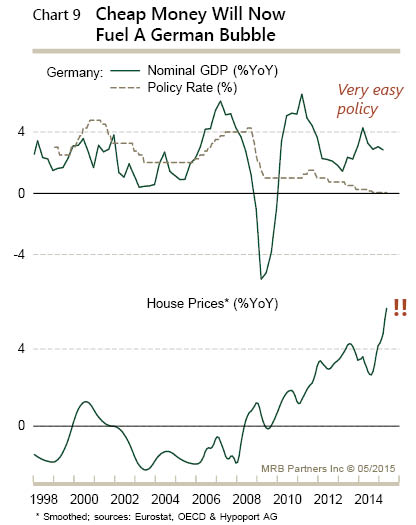

Although headwinds exist because some of the issues from the last cycle have yet to be resolved, Greek default. It does appear that current ECB policies are too easy in Germany and are causing what was described above. While eyes are squarely on Greece and the ECB strives for more accommodations, there are effects afoot in the background like the German housing appreciation seen below.

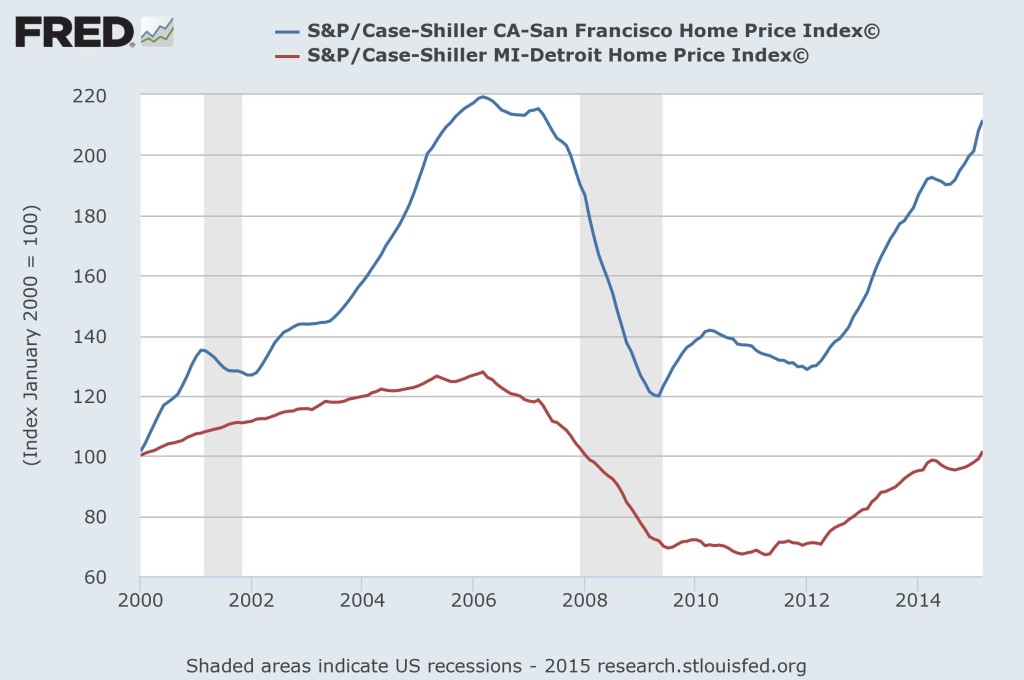

This is no different than what occurred in our country on a much smaller scale. Headlines about Silicon Valley private equity boom sit along side news of Detroit bankruptcy. The chart below shows house prices in the 2 regions. Detroit prices have appreciate a total of 1.5% over the last 15 years while San Francisco prices are up over 210%.

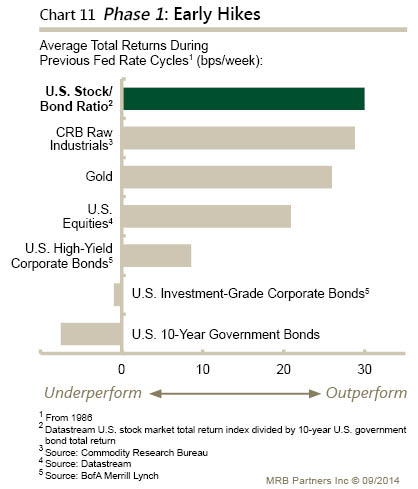

Currently the US monetary needs are not signaling as clear as in Europe. The rhetoric is teetering between easy policy needed to battle deflation versus tighter policy needed for a heating economy. If rate hikes are to come this year, which appears likely, the following graph is a historic representation of typical returns during the early rate hike stage and can serve as a guide. The early rate hike stage defined as the first hike until a level defined as neutral is reached.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Past investing and economic performance is not indicative of future performance.

Stay In Touch