Top News Headlines

- House Speaker Boehner resigns

- Pope visits the US, speaks to Congress

- VW cheated on emissions tests, CEO resigns

- Chinese President Xi visits US. Fires trip planner as Pope steals the spotlight

Economic News

- Existing home sales dip, new home sales rise

- Manufacturing data continues weak; Richmond and KC Fed surveys negative, durable goods disappoint

- Chicago Fed National Activity index in negative territory

- China flash PMI at 47…and falling

Random Thought Of The Week

The Fed is increasingly trapped by its own language, hoisted on its own verbal petard. The openness, the transparency in the making of monetary policy that Bernanke started and Yellen has taken to an extreme has not produced the desired outcome. It was supposed to make monetary policy surprises less likely by providing forward guidance – what other kind of guidance could they give? Backward guidance? – as to how policy would develop. Unfortunately for the Fed what it has really done is reveal that the bankers have no clothes. In describing the path of policy in the future the Fed must also describe a path for the economy, something it is becoming more obvious by the day that they can’t do any more accurately than the local palm reader. For a lot of investors, who had ascribed vast imaginary powers to the Fed over the economy and markets, this must sure come as a nasty surprise.

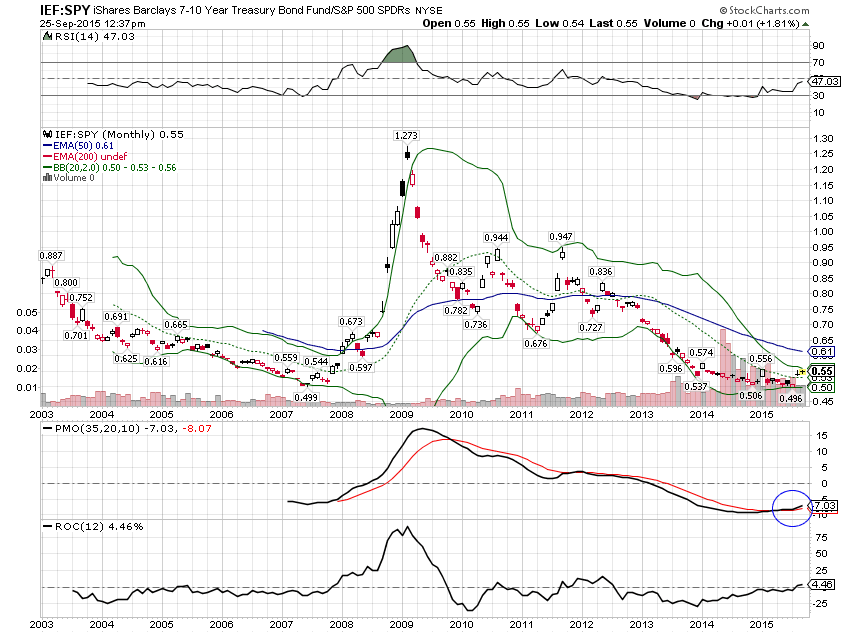

Chart Of The Week

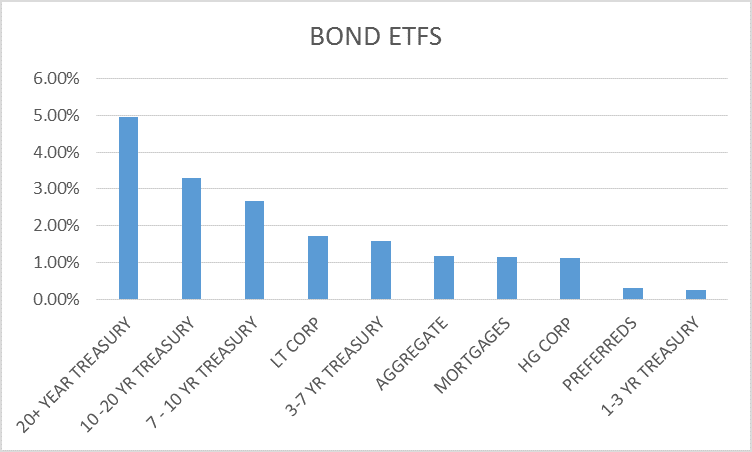

Momentum is shifting to Treasuries from stocks. Assuming bonds don’t collapse before the end of the month in a few days, this momentum technical indicator will give its first buy signal since late 2007. We’ve seen a recent buy signal in gold vs the S&P 500 as well. In other words, momentum is shifting to safe havens. The appetite for risk, after 5 years of gorging, appears to have finally been satiated. Why do I keep thinking of Mr. Creosote?

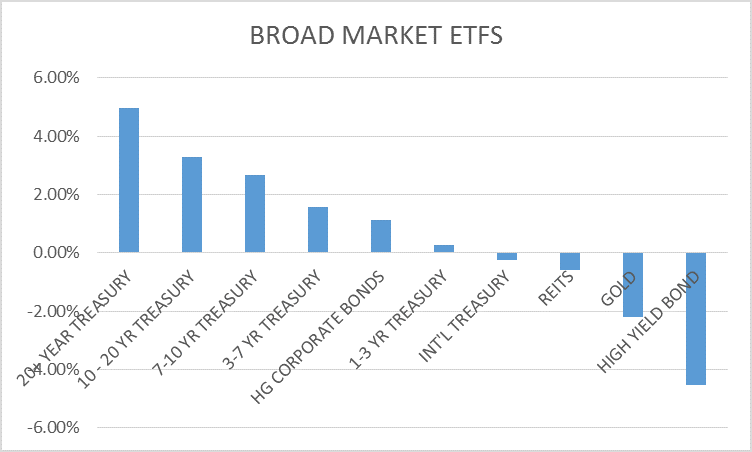

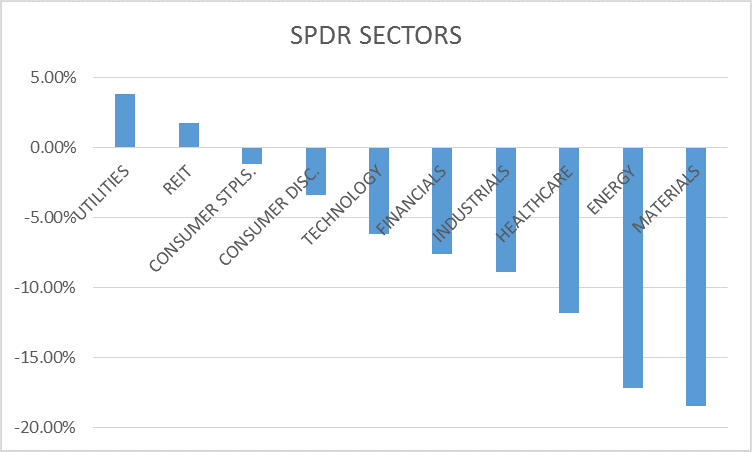

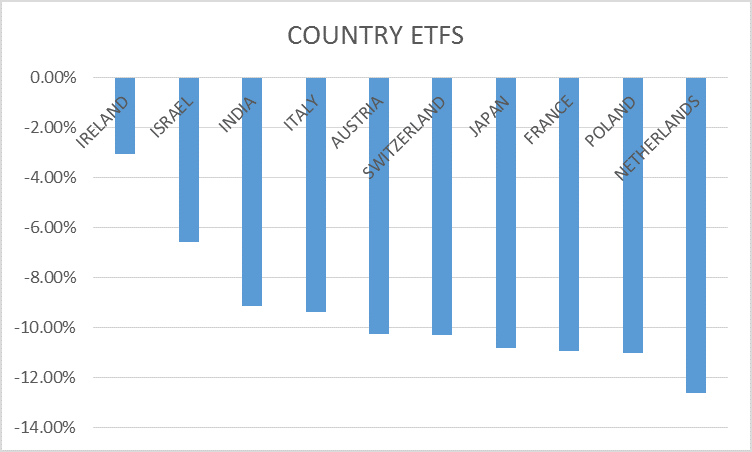

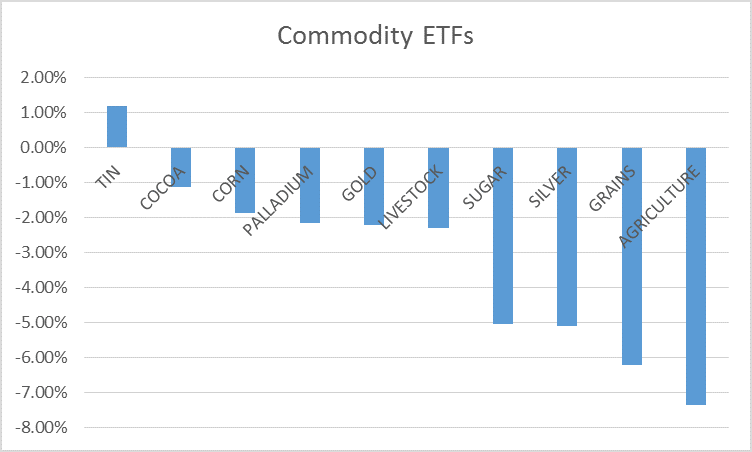

Broad Market Top 10 – 3 Month Returns

Stay In Touch