The volatility and negative price movement in capital markets this week is a symptom of a money system void of principle. The morally bankrupt system ignores the demand for money and just supplies it at continually cheaper levels. Unfortunately, the recipients of the cheap money are not inclined to use it for productive purposes. Idle cash, disruptive capital flows, and the sale of assets to deleverage one’s investments are all aspects of this financial system. It is my belief that these market movements are, presently, a side show to the real economy. But history shows that the financial economy not only creates false signals, but also creates volatility. And, in a world of debt capital, the volatility can become a real problem. The purpose of the financial sector is to enhance the real economy. But, with cheap debt capital, the financial sector tends to crowd out the real economy, create imbalances, distort pricing mechanisms and forge a path toward volatility. The financial economy becomes the real economy’s belligerent peer. In the past, he has become extremely disruptive and has, on occasion, completely Crashed the real economy.

The volatility and negative price movement in capital markets this week is a symptom of a money system void of principle. The morally bankrupt system ignores the demand for money and just supplies it at continually cheaper levels. Unfortunately, the recipients of the cheap money are not inclined to use it for productive purposes. Idle cash, disruptive capital flows, and the sale of assets to deleverage one’s investments are all aspects of this financial system. It is my belief that these market movements are, presently, a side show to the real economy. But history shows that the financial economy not only creates false signals, but also creates volatility. And, in a world of debt capital, the volatility can become a real problem. The purpose of the financial sector is to enhance the real economy. But, with cheap debt capital, the financial sector tends to crowd out the real economy, create imbalances, distort pricing mechanisms and forge a path toward volatility. The financial economy becomes the real economy’s belligerent peer. In the past, he has become extremely disruptive and has, on occasion, completely Crashed the real economy.

I am still hopeful that, as the financial economic leaders look to unwind the unconventional stimulus, the markets adjust with out too much disruption. Global monetary policy will remain accommodating; but, nearly 8 years post the financial crisis, the stimulants will no longer be free, keep calm.

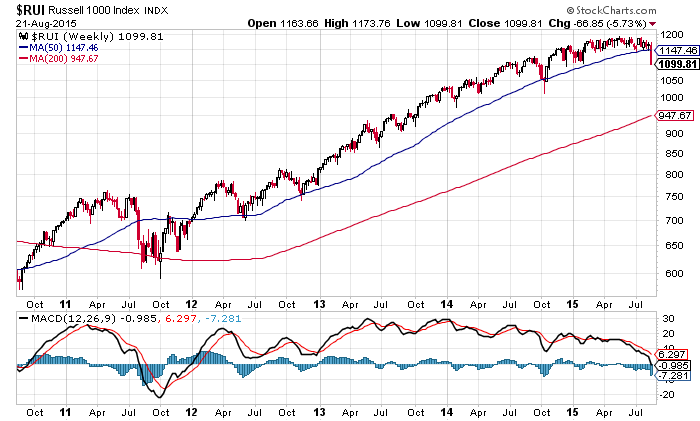

So yes, investors are wise to be wary here. But, let’s remember, there are also positive headlines from the real economy. Here are some highlights of the positive economic data that came across the tape in a week where US stocks lost 5.75%.

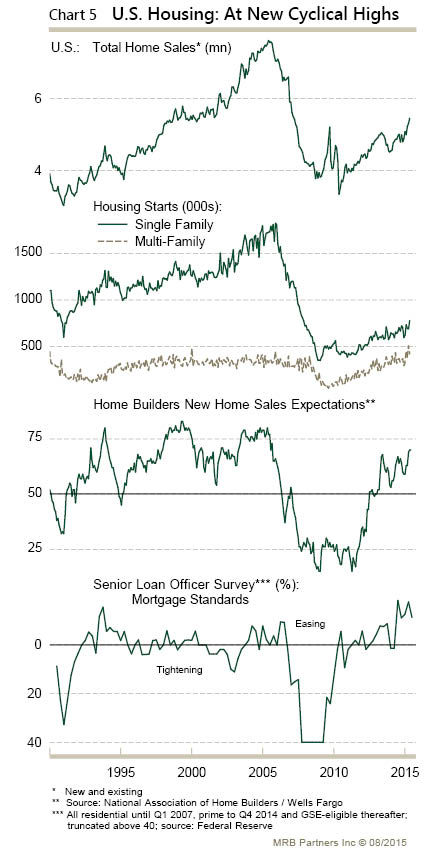

US Housing heats up:

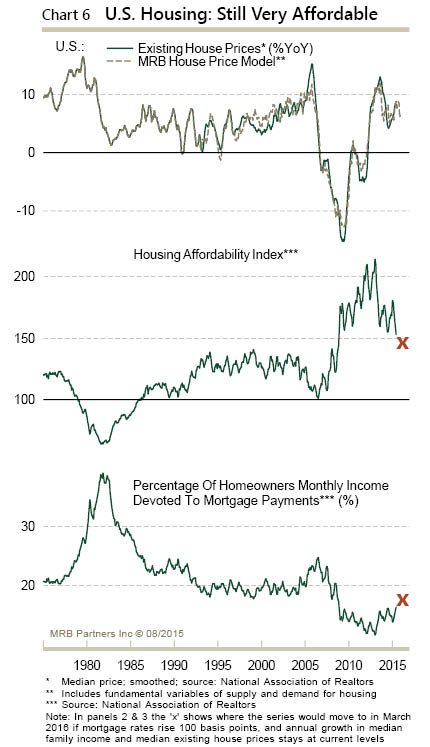

US Housing remains Affordable:

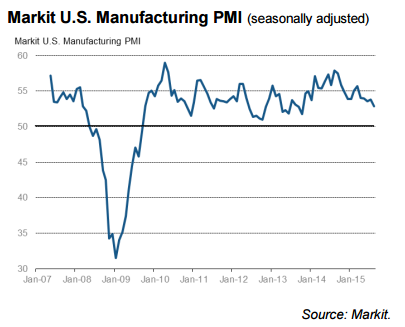

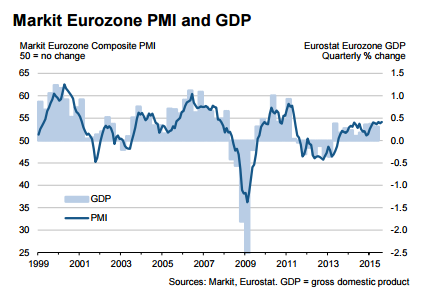

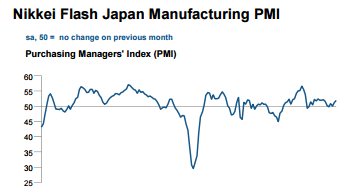

Flash PMI’s indicate that the Major Economies are Expanding:

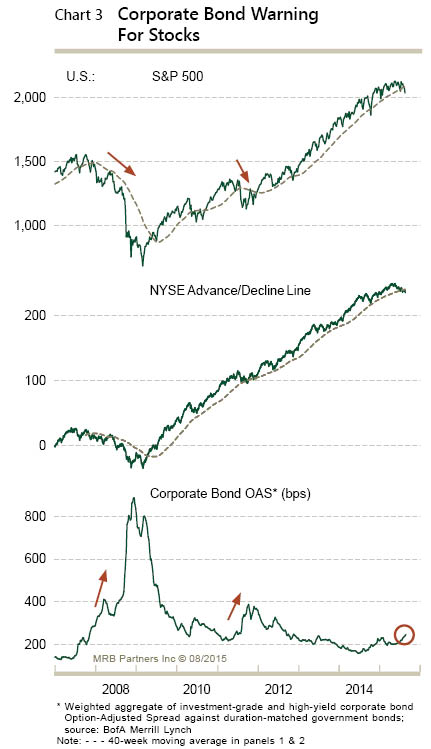

The bond market is giving off some initial warning signals, as are stock indices. There is a disgruntled patron and an argument has erupted on the edge of the party. Let’s hope that he is shown the door before he causes problems.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch