- Are we going to get a repeat of 1937-38? Are rate hikes going to put us into recession?

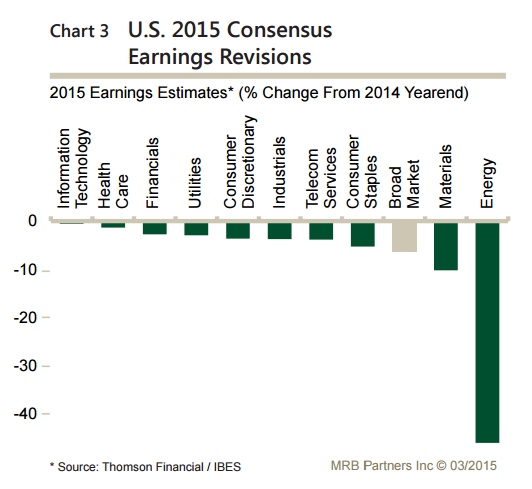

- Analysts Earnings revisions have been extreme. Are we going into recession?

- Where does one invest?

1937-38 Comparisons

When one compares 2008-2009 to the great depression, there is a natural progression in the narrative to look for the “double-dip” that was 1937-38. Caution, these comparisons have been making headlines every year since 2011. The issues have been plenty: Europe, fiscal cliffs, debt ceilings, (re)elections, Obamacare, tapering, deflation. And now the rate hike cycle. The stock market is up over 60% since the convenient comparisons began in 2011. Those still looking for that 40-60% stock market pull back now finger the likely end of the 0% interest rate policy as the newest culprit.

Why is the FED going to hike? Europe is finally improving. US real personal consumption is growing annually by 3.4%. Loan growth is positive in all major categories. And, providers of capital (banks) would like to earn a better return.

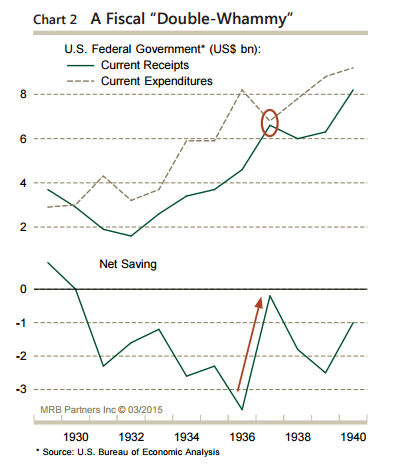

The 1937-38 recession was not caused by any 1 factor, but a more complicated, combination and interaction of factors in the economy. These factors included excess credit expansion (large capital inflows and easy money), fiscal expansion (public works) followed by high cost fiscal policy (reduced spending, higher taxes and more regulation) in combination with more restrictive monetary policy (higher reserve requirements, lower loan demand and falling asset prices). In 2011-2015, the Fed has been more complimentary than their 1937 rendition.

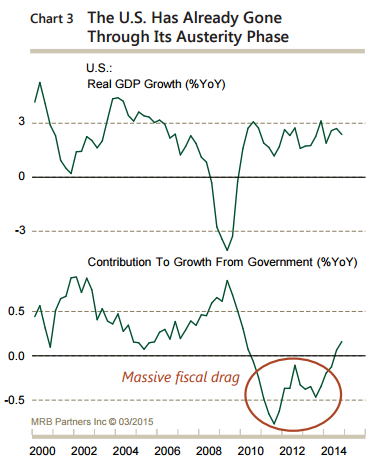

I’m sure there will be questions and fears about the government, especially as we near another election year. But, for now, government is becoming more of a tailwind for GDP. This is different than 2011-2014 and very different than the “pinch” experienced in 1937.

In 1937 the government increased receipts (taxes) at the same time they reduced spending. Increased government savings is a contraction for the economy.

After big government stimulus in 2009-10, the government became a relative headwind for the economy from 2010-1014. With bond buying, GDP was relatively stable during this period, as the private economy has (hopefully) improved.

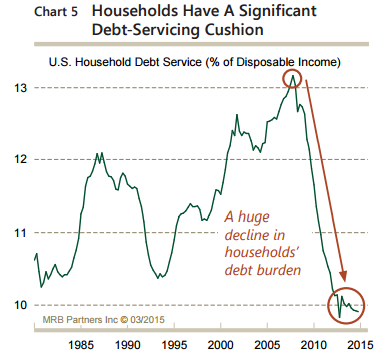

Changes in FED language indicate that we are on the doorstep of interest rate hikes. All indications are that the economy is ready and that there is “room” to move. Household debt-servicing is at the lowest level of the last 35 years. The FED will be patient to make sure 1937-38 analogies do not become reality.

Earnings Revisions

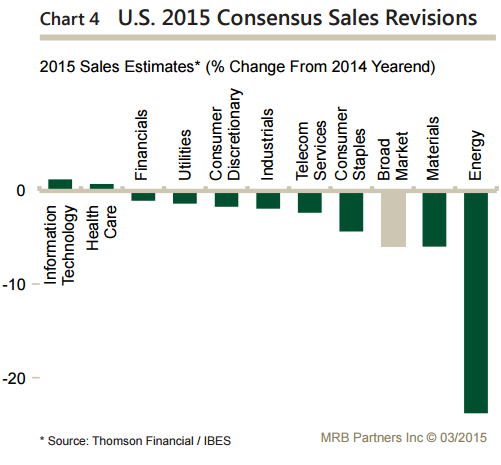

Analysts have made large adjustments to earnings’ expectations. This is mostly about a stronger dollar which has caused lower oil prices and lower dollar denominated levels of international revenue. The energy sector has had revenue expectations lowered by 25% and earnings slashed over 40%. Other sectors have not been affected so harshly. An interesting observation is that equity assets have held firm despite the slashing of expectations. Analysts are likely not as forward thinking as the market. As the 9 month extreme dollar strength abates, look for downward earnings’ revisions to cease and move higher later this year.

Where to Invest

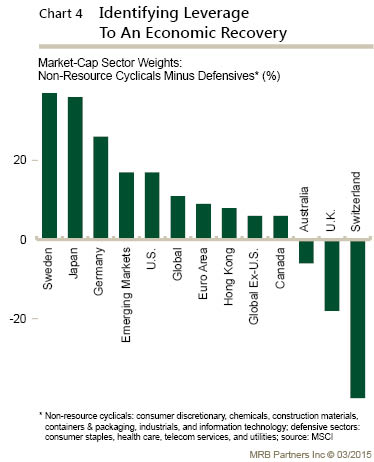

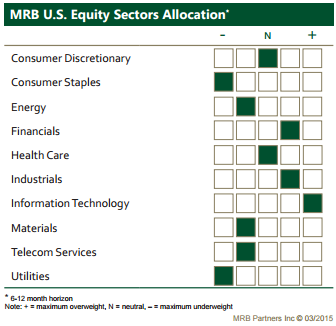

Look at sectors, industries and countries not reliant on commodity related revenue but leveraged to global growth and innovation. And, it might be a good time to look outside the US for better values.

As always, please feel free to contact me with any questions or concerns.

Find out about your personal risk profile and working with Alhambra

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product.

Stay In Touch