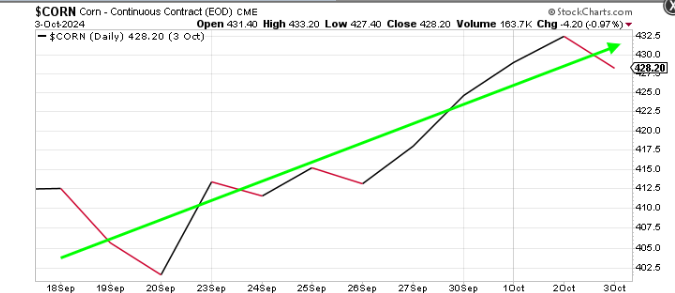

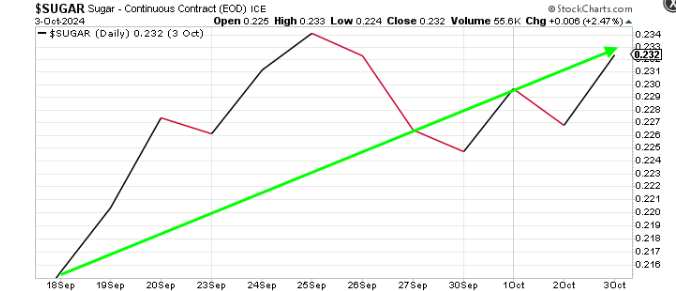

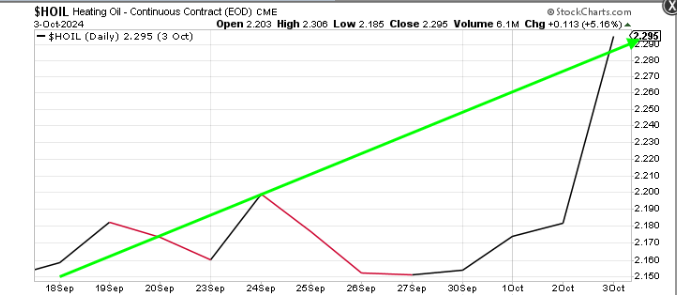

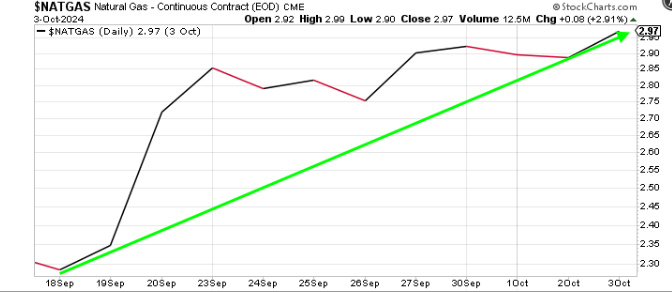

What do you get when the Central Bank lowers interest rates by 50 basis points in a good economy? Just what we’ve seen since this happened on September 18, a surge in commodities.

Is your portfolio diversified? Ebbs and flows in the market can sneak up on us and today’s markets react quickly and sometimes violently. Did you see the surge in commodities coming? Did you know commodities, broadly, are up over 6% since the Fed decision to lower interest rates by .5% on Sept 18, 2024. Natural gas, one of the more ubiquitous fuel sources, is up over 25% in just the last 2 weeks and winter is coming. We strategically own hard assets to diversify and hedge against inflation. Starting on 9/18, we’ve slowly added some additional exposure to commodities and sold some duration in our most active strategy.

Because of the mechanics of inflation calculations this month’s data should continue to show it coming down. This will give Powell and Co. room to cut again, exacerbating the issue. The slope of inflation has a high probability of starting to go back up. And if commodity markets continue to rise, inflation will surely not be tamed and have Powell seeing ghosts though he is to be blamed (not port strikes). I’ve tried to illustrate this using Crude Oil. The green lines show the slope of inflation coming down. This changes starting later in the quarter and the red line shows the slope of oil as a proxy here going back up on both a 1 and 2 year trend basis.

A 1913 dollar has been debased by over 96% since the Federal Reserve was established in that year. A multi-asset class portfolio with exposure to hard assets like commodities, gold, real estate and foreign stocks in addition to you domestic stocks and bonds brings the benefit of diversification. The hard assets have been a good hedge against this deliberate inflation.. Call or email us for more information, the contact info is at the bottom of the post.

Inflation caused by our Central Bank affects you. And, The Fed’s global peers added some fuel to the fire this past 2 weeks. Here’s the inflation in pictures.

Food and Clothing:

Fuel:

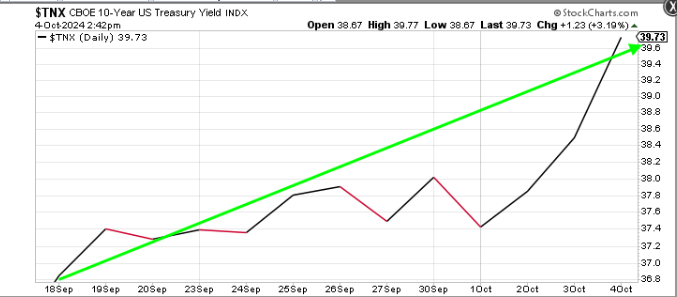

Mortgages:

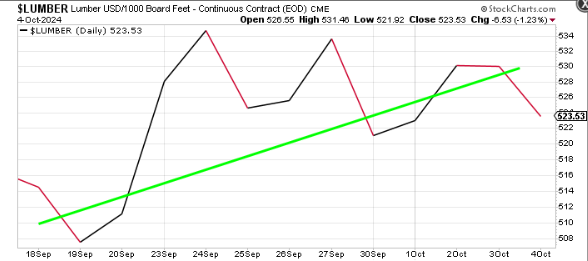

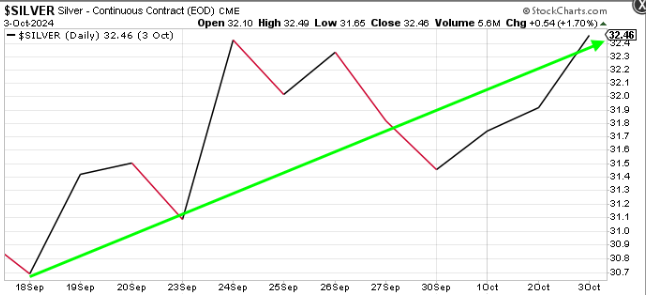

Lumber and Metals:

Stay In Touch