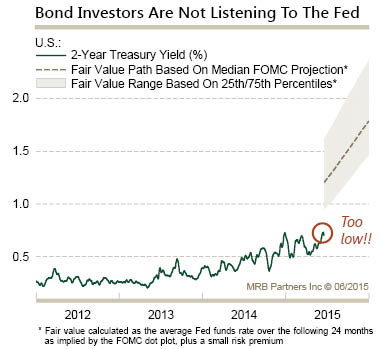

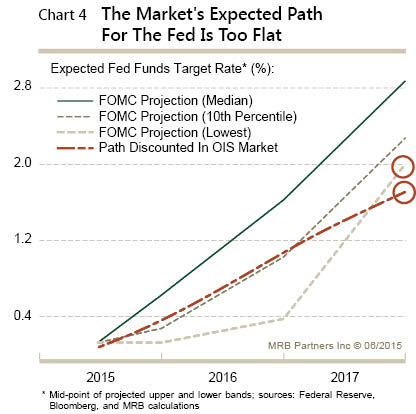

The Fed has weighed in with their opinion of the economy. Given their economic assessment, they have presented their opinion of the appropriate level for interest rates. Interestingly, investors don’t seem to be of the same opinion as the committee on the appropriate level for rates or the timing of upcoming interest rate moves. Perhaps they view the economy as weaker than the Fed. Perhaps some large investors have no choice and are buyers of these securities regardless of price. Whatever the reason, the disconnect and its implication should be noted when making investment decisions.

The Fed has weighed in with their opinion of the economy. Given their economic assessment, they have presented their opinion of the appropriate level for interest rates. Interestingly, investors don’t seem to be of the same opinion as the committee on the appropriate level for rates or the timing of upcoming interest rate moves. Perhaps they view the economy as weaker than the Fed. Perhaps some large investors have no choice and are buyers of these securities regardless of price. Whatever the reason, the disconnect and its implication should be noted when making investment decisions.

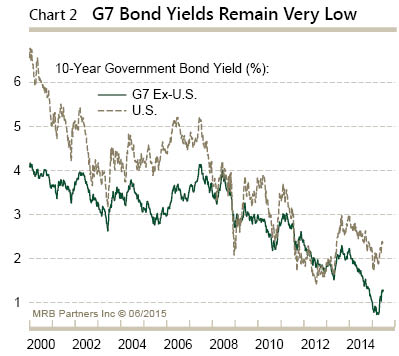

Interest rates today and Fed projections.

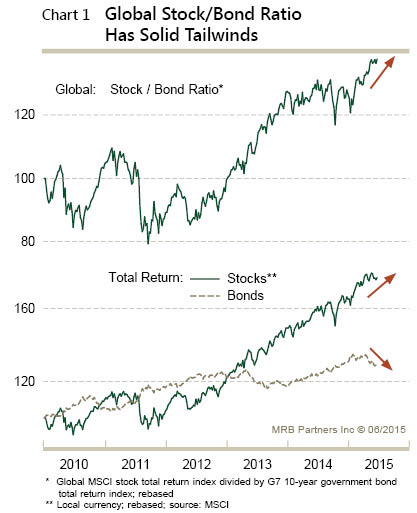

Equities should continue to outperform bonds.

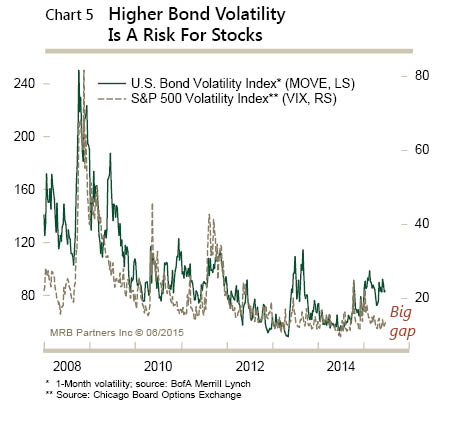

But beware of volatility and turbulence.

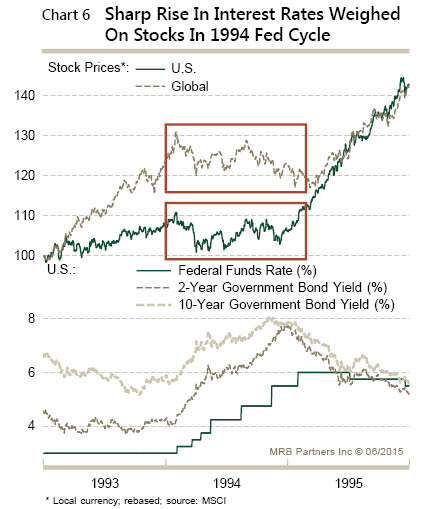

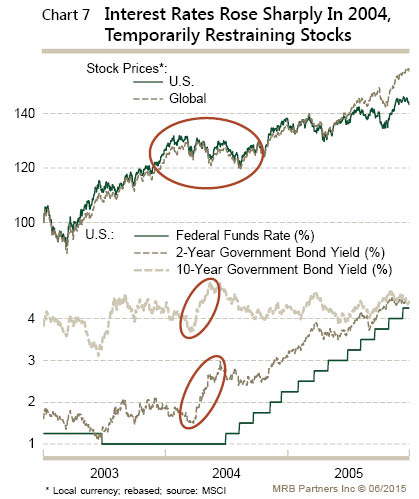

Fed hikes have restrained stocks in the past.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch