The employment report released last Friday offered contradictory views of the state of the economy. The Current Employment Survey (also called the payroll or establishment survey), which comes from a survey of 119,000 businesses, showed a gain of 272,000 jobs for the month of May, which is right in line with the monthly average since April of 2022. On the other hand, the unemployment rate rose to 4%, up from 3.9% last month and 3.4% in January of 2023, the low for this cycle. If we’ve been adding 250k jobs per month since then, why is the unemployment rate rising? That isn’t as hard as it sounds since there is a numerator and a denominator in that equation, but it is unusual.

The first thing to realize is that the two figures come from different surveys. The establishment survey is a survey of 119,000 businesses. That sounds like a lot but in a country of 336 million people and approximately 33 million businesses, it’s a drop in the proverbial bucket. And it isn’t very accurate with a +/- of about 130,000 in any given month. The unemployment rate, on the other hand, comes from the Current Population Survey (also called the Household survey), which is a survey of 60,000 households. This report also produces a jobs figure every month in addition to the unemployment rate and it is even less accurate with a +/- of 600,000. The revisions to the employment reports take months and can easily turn a positive to a negative and vice versa. Just to pick one at random, the April 2022 report was initially released as +428,000 with an unemployment rate of 3.6%. Today, after multiple revisions, it is 272,000 and an unemployment rate of 3.4%. This is true of all economic data and is why making big decisions about the economy based on the most recent report of anything is not a good idea.

So, if you just look at the CES survey and that 272,000 jobs, you would obviously think everything is fine. But if you just look at the CPS survey, you might think things are headed in the wrong direction. What’s more important? The CES survey, in general, doesn’t turn negative until after the recession starts while the unemployment rate does tend to rise before the onset of recession. But the official start of a recession is determined by the NBER well after the fact and usually is pegged at a time when recession wasn’t obvious. If you go back and look at the economic data from December of 2007 you’d be hard pressed to see a recession. It wasn’t until well into 2008 that recession started to show up in the data. And that’s why from the official start of that recession in December of 2007 until May of 2008, the S&P 500 was down less than 5%.

And while the monthly CES survey was negative every month from February to May 2008, the initial figures were much milder than the final revisions. May, for instance, was initially reported as a drop of 49,000 jobs and later revised to -190,000. The unemployment rate rose every one of those months too from 4.8% in February (later revised to 4.9%) to 5.5% in May (later revised to 5.4%). Because negative monthly job figures and a month or two of a rising unemployment rate are not unheard of outside of recession, both surveys need to show deterioration over time to make portfolio decisions. A month or two isn’t a trend.

The reason I’m going through this history is because there has been a significant divergence in the two surveys over the last year. The Household survey shows a total job gain of just 376,000 over the last year while the Establishment survey shows a gain of 2,516,000. I don’t usually pay much attention to the number of jobs in the Household survey on a month to month basis because of the sample error but this is a trend that has persisted for too long to ignore. While we can’t say for sure which is wrong, we do have other data pointing to the Establishment survey as having overstated the jobs gains.

The Bureau of Labor Statistics produces a quarterly report called the Quarterly Census of Employment and Wages that is produced from unemployment insurance tax records filed by more than 12 million businesses. It is, obviously, a more comprehensive reading than the monthly figures – in some ways. It doesn’t, for instance, pick up undocumented immigrants since they aren’t eligible and won’t file for unemployment benefits while the CES and CPS likely do include at least some. The latest report was released last week and suggests that the Establishment survey overstated the monthly job gains by about 60,000 a month in 2023. That would reduce the monthly average from about 250,000 to about 190,000 which is still a pretty healthy number but doesn’t close the gap much with the Household report.

In a country this large and in an economy this diverse, it is impossible to know the exact current macro-economic situation. One industry could be in contraction while others are still expanding. The people in the contracting industry will think the economy is awful while the ones in the expanding one will think it’s just great. But, as investors, we need to do our best to focus on the economy as a whole and trust that the markets will provide us with guidance.

So, where are we now? Does this divide between the Household and Establishment surveys mean anything? If we look at some of the other labor data available to us, like the JOLTS survey that was also released last week, a picture of a softening labor market comes into view. Job openings have dropped from over 9 million last August to around 8 million now. That, along with the QCEW and the Household survey seems pretty good evidence. But 8 million job openings is still higher than pre-COVID; softening does not mean soft and it doesn’t mean recession. The quits rate, also in the JOLTS report, is also down, from about 4.5 million in May of 2022 to 3.5 million now. A high quits rate shows confidence in the economy because workers don’t quit at a high rate unless they are pretty sure they can get another – better – job. But the 3.5 million is consistent with pre-COVID and has recently stabilized at this level (it’s about the same now as in November).

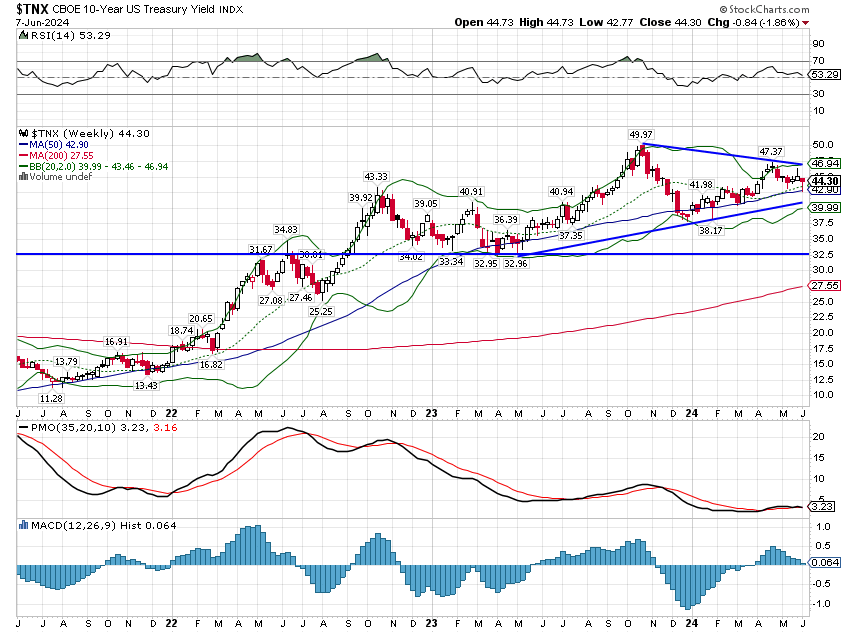

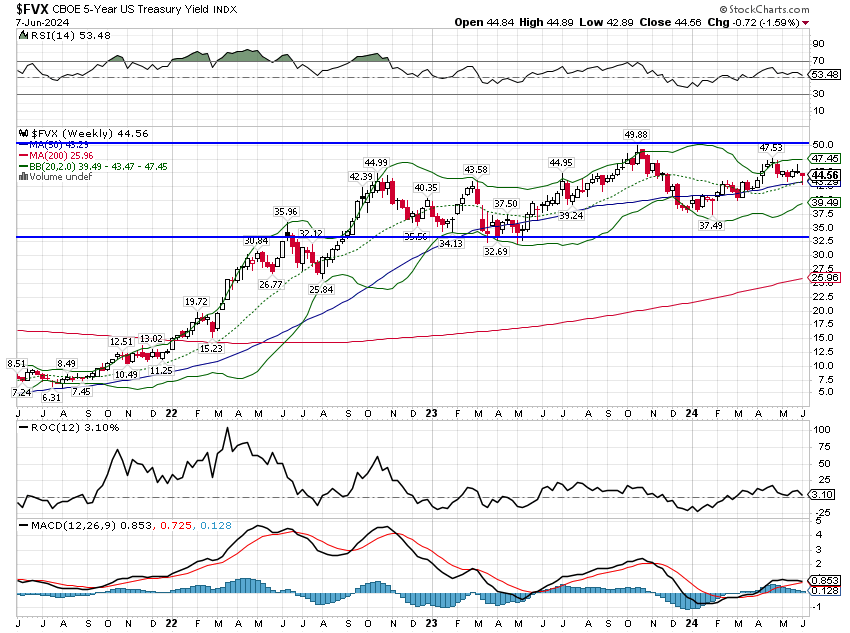

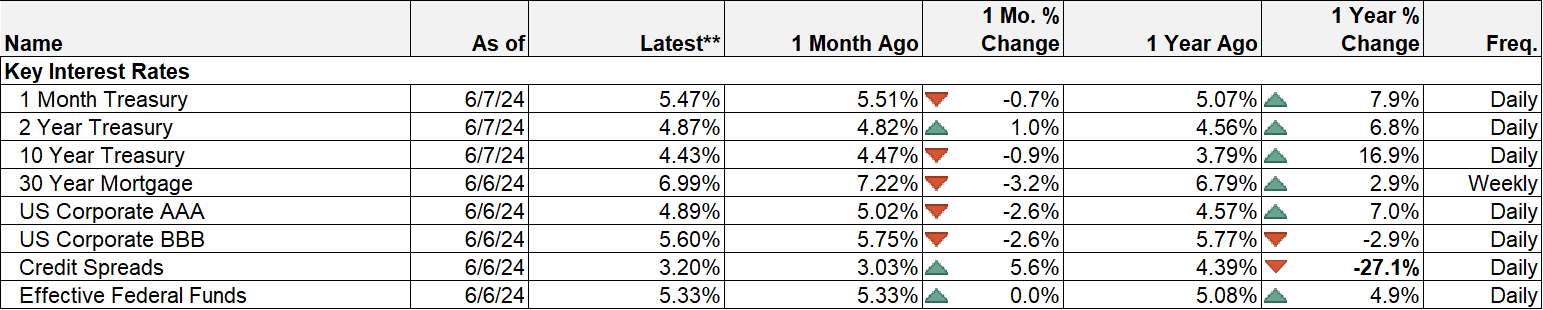

I don’t know when the next recession will start and neither does anyone else. The economic data, as it has been released recently, certainly doesn’t point in that direction right now. And markets are not yet pointing in that direction either. I think rates have peaked for this cycle but peak rates isn’t a signal of anything. In the pre-financial crisis cycle, the 10-year Treasury rate initially peaked in June of 2006, returned to a slightly higher peak in June of 2007 and then fell by almost half by the first quarter of 2008. The 2-year note yield also hit peaks in those months but fell from over 5% to 1.25% by the first quarter of 2008. The Fed had also cut rates from 5.25% (sound familiar?) to 3% by February of 2008. Those were pretty obvious signs that the economy was deteriorating. We currently still have rates, short and long term, near their peaks and the Fed hasn’t cut once yet.

I have been talking about normalization for two years and this is just part of it. The economy is headed back to trend growth (for now) of 2% and everything we see in the labor market is consistent with that. So is most of the other data we’ve been getting. Rate cut expectation, as measured by the SOFR futures market, have been trimmed from 4 or 5 at the beginning of the year to 1 or 2 now; the odds for September are currently no better than a coin flip. Recession? We aren’t there yet.

Joe Calhoun

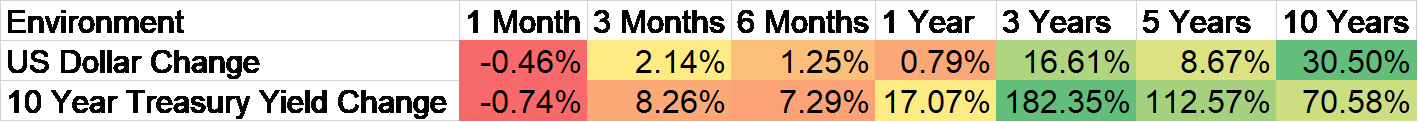

Environment

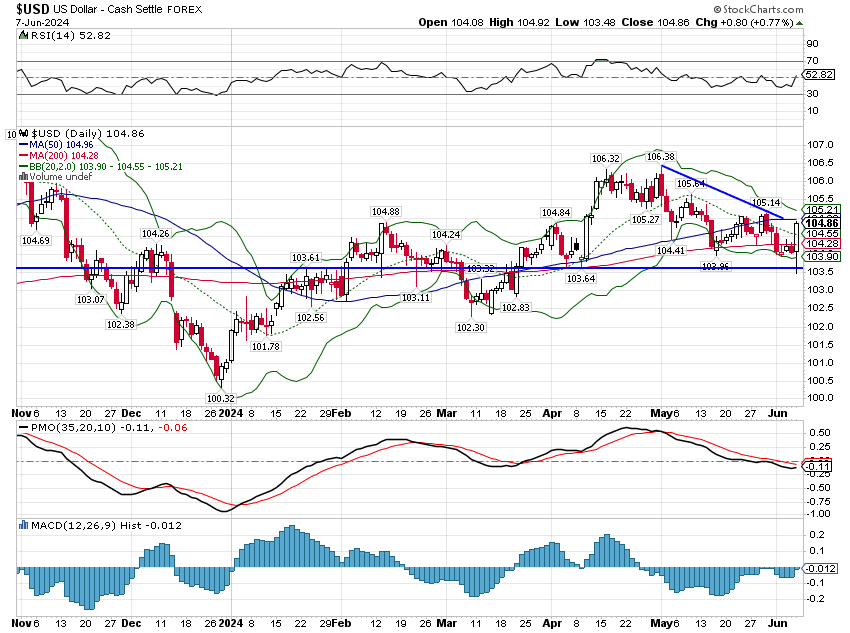

The DARP (Dollar And Rate Paradigm) continues to be marked by a lack of trend over the short to intermediate time frame. It is interesting though that assets that generally do well in a weak dollar environment, such as gold, commodities, technology and international value, are performing well. Investors seem to be more confused on the rate environment with rising rate assets (commodities, gold, energy, and tech) doing well but some assets that perform well when rates are falling (LC growth stocks, communications services, and dividend growth) also doing well. That actually may make sense as the secular trend in rates has shifted to an uptrend (after a 40-year downtrend) but the cyclical trend for rates may be peaking. Confusing markets are.

Before Friday’s employment report, the 10-year Treasury note yield had fallen 36 basis points over the prior 6 trading days and broken its short-term downtrend line. After the better-than-expected employment report, yields surged higher, the 10-year rate rising nearly 15 basis points on the day. I think the rise was unwarranted because the employment report wasn’t all that great but it really doesn’t matter in the big picture. Even after Friday, nothing has changed in bond land. It still appears, at least to me, that rates are peaking for this cycle although I can’t say that for sure. The 10-year, the 5-year and the 2-year are all trending sideways as they have been for roughly 20 months. That may seem like a long time but multiple years of trendless action are actually pretty common.

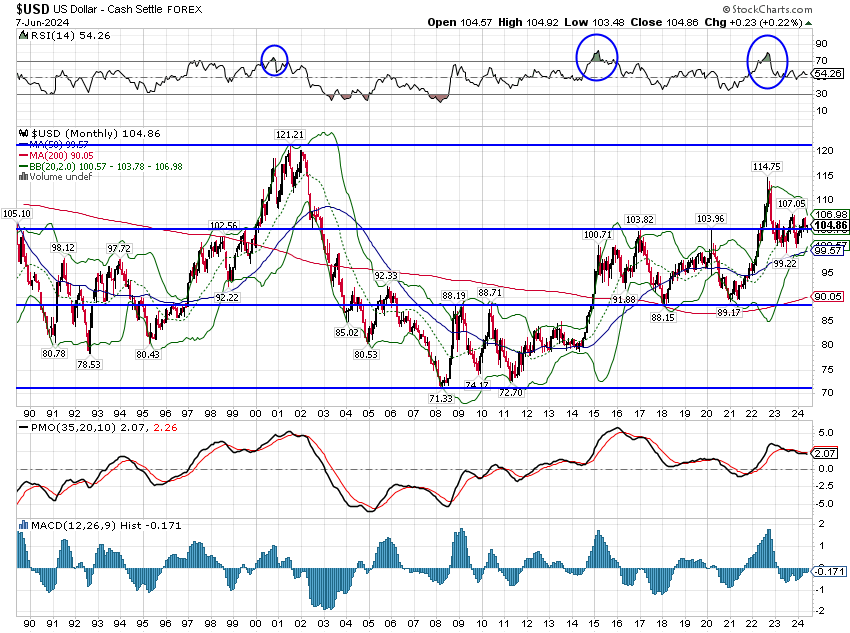

The dollar trend was also unchanged last week and like rates, continues its trendless trend, essentially unchanged for the same 18-20 month period as the 10-year. And like interest rates, long periods of stability are not uncommon. The dollar is still relatively strong, trading at the top of its very long term 35+ year trading range. The lack of volatility is reflected in the futures markets where large spec accounts are essentially flat, not short, not long. My expectation is for the dollar to eventually trade lower but I have no idea how long eventually is.

Markets

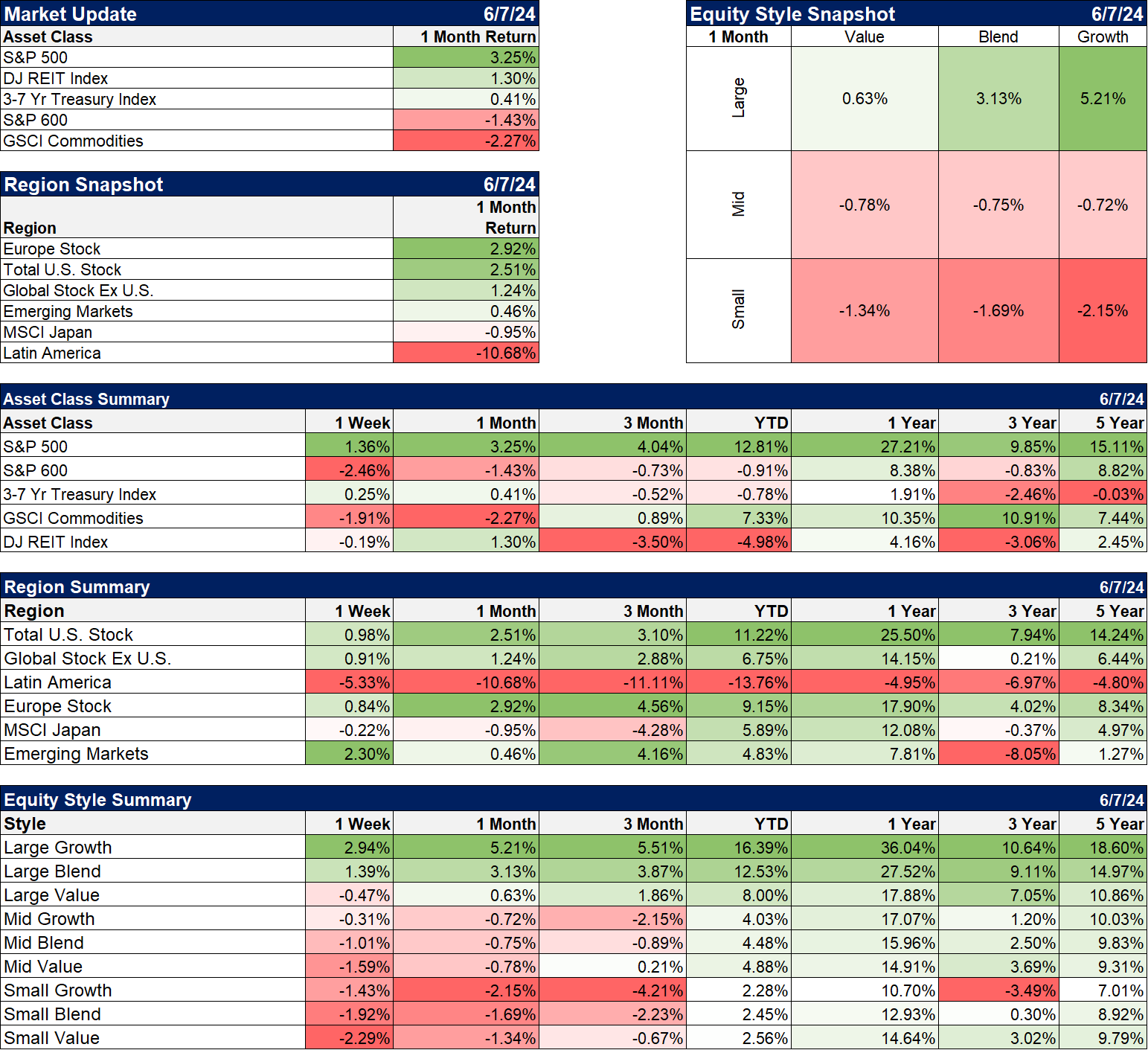

Large cap stocks and intermediate-term treasuries were the only asset classes that managed a gain last week while small caps and commodities were both quite weak. The source of that weakness is not obvious as both would generally be negatively affected by weak growth, which wasn’t in evidence over the last week despite interest rates falling for most of the week.

Latin America was the big loser on the week as Mexican stocks took a beating in the wake of the election. Fear of socialists in Latin American markets isn’t anything new and it usually isn’t as bad as feared. Indian stocks also reacted negatively to the election as Modi lost his mandate but they managed to recover to a gain by the end of the week. Despite Mexican stocks dropping nearly 12%, emerging markets managed a gain on the strength of Asia. That is starting to look like a trend with EEM and EMXC (ex-China) up 17.3% and 21.6% since October 27 of last year. That still lags the S&P 500 but EM has performed so poorly for so long that investors are a bit gun shy; I know I am. EM is also another classic weak dollar asset that is performing better than expected with the stable dollar.

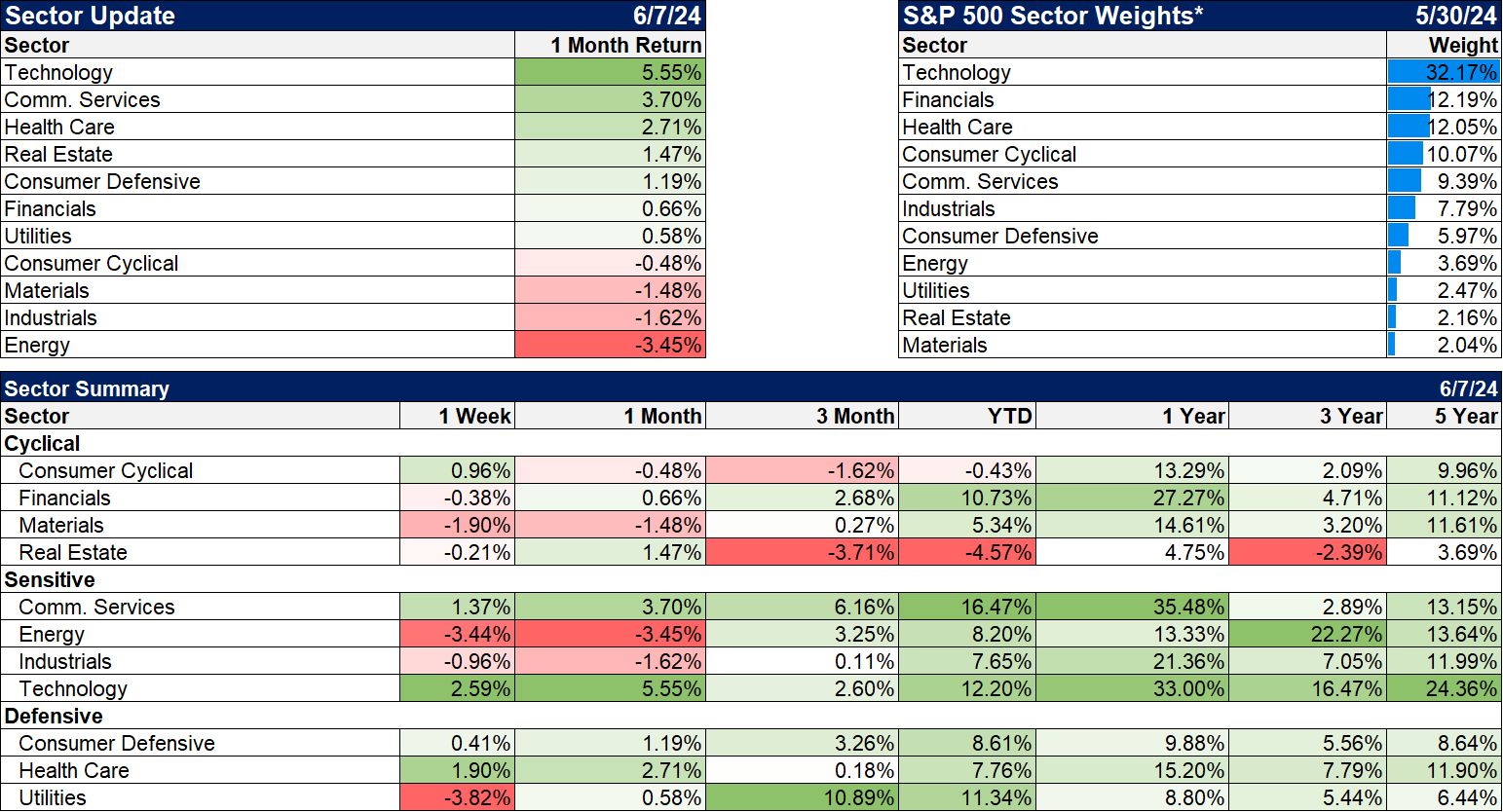

Sectors

Utilities and Energy were the big losers on the week. While the utilities run was overdone and due for a pullback, energy stocks have been in correction mode since the beginning of April and are likely nearing some kind of bottom. Energy stocks are still the best performing sector over the last 3 years and are still quite cheap, trading for about 13 times expected earnings with sales and cash flow growth of around 13%. The industry is also seeing a lot of buyback activity and rising dividends.

Market/Economic Indicators

With interest rates falling all week until Friday, one could be excused for thinking we must have gotten some weak economic reports. But the data was actually pretty good with the exception of the ISM manufacturing survey:

- S&P Global US mfg. PMI 51.2 and over 50 for the fifth month in a row.

- ISM mfg. survey 48.7; below 50 for 18 of the last 19 months but with a low of 46, never recessionary. Has been trending higher since July of 2023 but in a choppy fashion

- Construction spending -0.1%. Negative 3 of the last 4 months but up 7.3% yoy

- JOLTS – job openings at 8.06 million down from 9.35 million last August. Still above the pre-COVID level. Quits rose to 3.5 million and appear to have stabilized after peaking in May of 2022 at 4.45 million. Current level is consistent with pre-COVID (3.5 million in January of 2020).

- S&P Global US Services PMI 54.8, way up from last month’s 51.3. S&P Global US composite 54.5 also up from 51.3. Economy reaccelerating?

- ISM svcs. PMI 53.8 up from last month’s disappointing 49.4.

- Exports and Imports both up in April and over the last year (5% and 7.1% respectively).

- Jobless claims 229k, trending higher since hitting 194k the week of January 13th this year

- Non farm productivity up 0.2% which isn’t great but at least it’s positive; unit labor costs +4% which sounds bad but was better than the expected 4.9%

- Non farm payrolls +272k better than expected but unemployment rate up 4% and participation rate down to 62.5% vs 62.7% last month

- Average hourly wages were +4.1% yoy vs expectations of 3.9%. This is likely why bonds sold off hard on the news, not the headline jobs figure.

Stay In Touch