Economic Reports Scorecard – 8/3/15 to 8/14/15

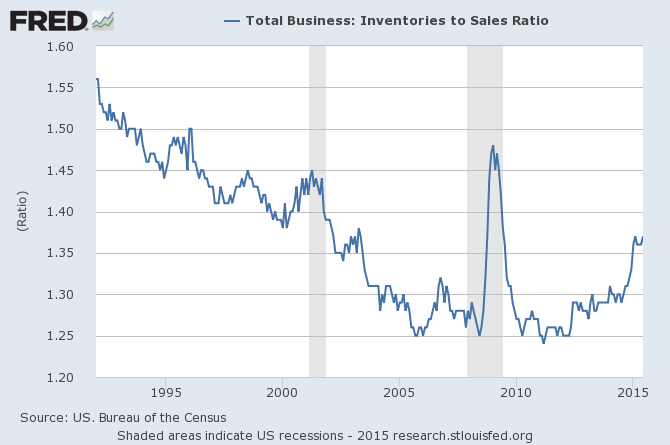

The economic reports since my last update two weeks ago are exactly equally split between better than expected and worse than expected. The narrative hasn’t changed much, consistently inconsistent and wholly unsatisfying. Autos are doing well, funded by what appears to be increasingly shaky sub-prime financing, manufacturing in general though is doing poorly, the service sector continues to do well, but incomes are stagnant, consumption weak. Employment continues to put up so-so numbers but as has been the case for a long time now, low quality, low paying jobs are leading the way. Inventories continue to build, probably the most worrying sign among all the economic indicators we follow. The inventory to sales ratios are well above where they were at the beginning of the last two recessions and continue to trend higher as sales continue to disappoint. At some point that is probably going to have a bigger impact on production, probably in the third quarter which is looking a lot less robust than last year’s version.

The problem with the current inventory situation is not that the inventory to sales ratio has risen but rather the magnitude of the recent build. As you can see, the economy goes through mini-inventory corrections all the time outside recession. But this one is larger and more sustained than non-recession versions. Whether it is leading – recession is coming – or coincident – we’re in recession now – or neither – this doesn’t develop into a recession – is something we won’t know for sure until the future arrives. But it sure ought to be concerning for anyone wondering where the economy is headed.

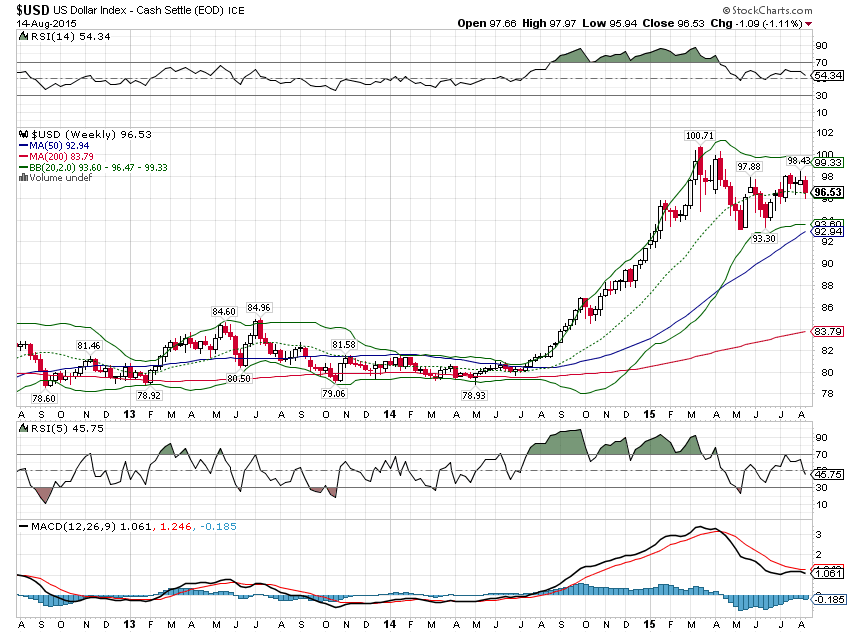

The ambiguity of economic indicators like the inventory to sales ratio is why I depend more on market indicators. Markets are pretty good discounting mechanisms and there is a certain wisdom in crowds. Market indicators right now aren’t looking so hot either though. The Dollar index, despite all the focus this last week on China’s currency, appears to be peaking. It is a little odd if that turns out to be true in that the rally hasn’t lasted all that long by currency market standards where trends tend to persist. On the other hand, everybody and his brother thinks the buck is headed higher and we all know that markets act to embarrass the maximum number of people.

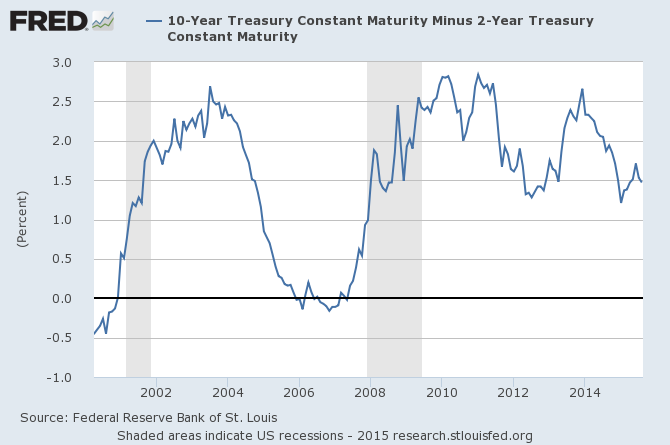

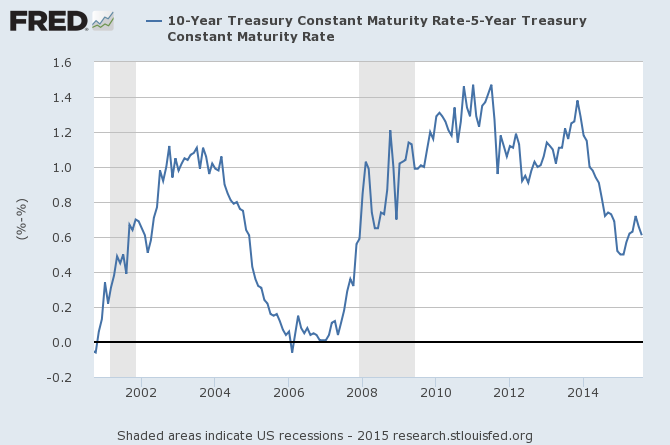

The yield curve continued to flatten since my last update as well. In this case that appears to be primarily a function of falling inflation expectations as TIPS yields have barely budged. If the Fed does follow through on their promise – threat – to raise rates in September, I’d expect the flattening trend to accelerate.

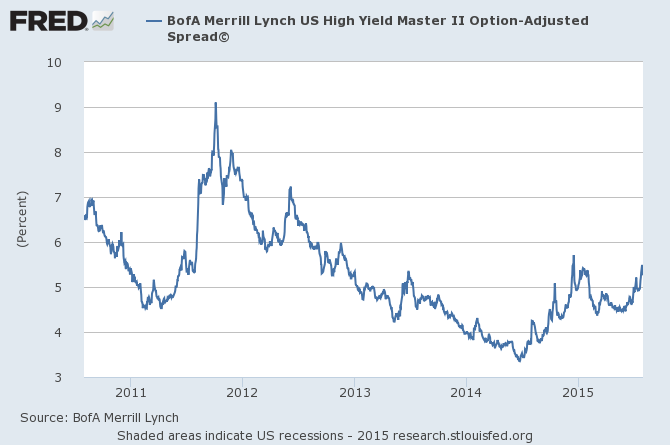

Credit spreads are also a major concern right now as spreads across the ratings spectrum continue to rise. There’s been much talk that this widening is solely due to energy but that is probably wishful thinking. Markets don’t really work that way. Most people selling junk are selling junk funds – or ETFs – and when they sell they don’t just sell the energy issues. In fact, since energy is likely the area where there is the least liquidity, the fund manager might be more inclined to sell something else entirely. The point is that selling in that market is unlikely to be confined to the energy sector even if that is where the stress begins. And spreads, along with the yield curve, are about as good as you’ll find in the recession warning category. Whether wider spreads creates economic weakness or the other way around is irrelevant.

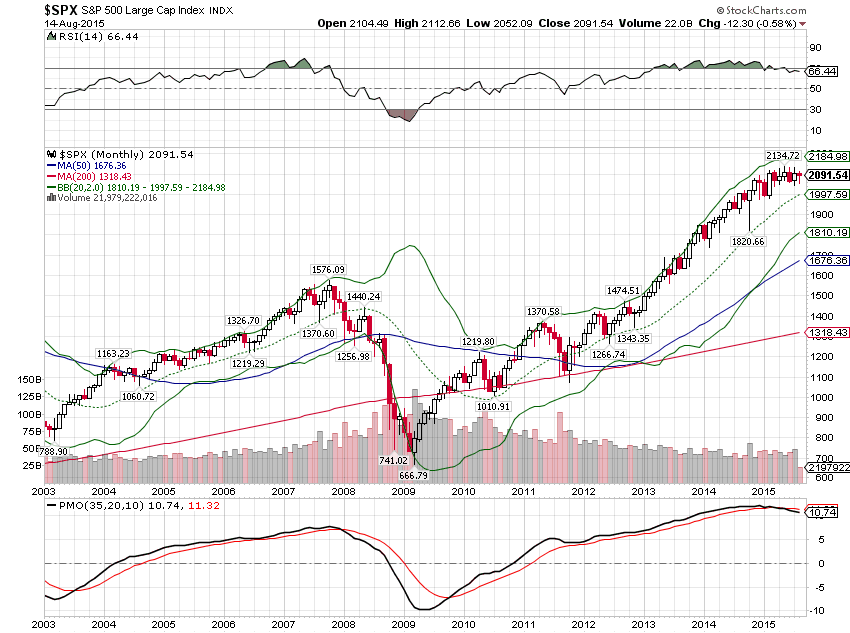

The stock market itself is a pretty good economic indicator and the sideways action that is now extending into eight months is a reflection of the uncertainty surrounding the economy right now. We see this also in the sentiment surveys where the most recent AAII poll has almost equal numbers of bulls, bears and neutrals.

In any case, as I’ve been pointing out for several months now, long term momentum in the S&P 500 has already rolled over, a sell signal not seen since late 2007. Interesting too that the end of 2007 also coincided with the end of a sideways period for the market that started in May 2007 and ended as 2008 dawned. I’m sure that’s just coincidence….

Stay In Touch