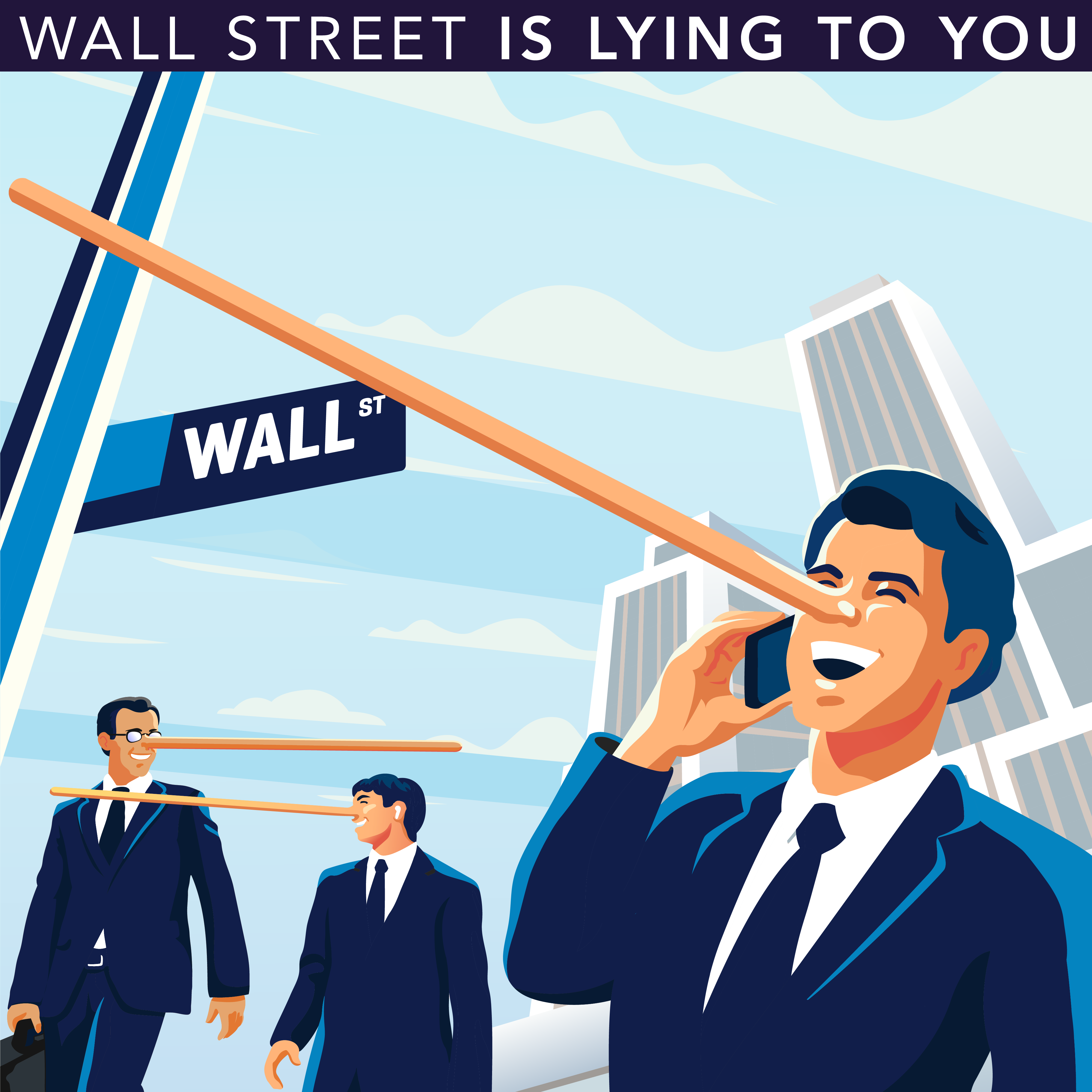

Wall Street is Lying to You

Wall Street is just a street in Manhattan. But “Wall Street” is an industry that preys on your emotions. From the investment guru on TikTok to the former hedge fund trader with an X account to the big investment firms to your stock broker, they’ll do anything to get your attention. They have a story to tell you, a great [...]

7 Keys to Investing Success

#1 Know Where You’re Going Yogi Berra famously quipped that if you don’t know where you’re going, you might end up somewhere else. The first key to successful investing is to figure out where you are and where you want to go. What is your current situation and what are your financial goals, short and long term? You may find [...]

7 Investment Scams, Tricks, and Fine Print to Beware

#1 The Financial Advisor Bait and Switch There are hardworking, honest financial advisors. Then there are those who will do a bait and switch. The bait is the promise of low fees and costs. The dishonest advisor proclaims the low fee they will charge for their services. And the upfront fees are low. The switch is in what they end [...]

7 Ways Financial Advisors Fool You

#1 Hidden Costs Some financial planners and stock brokers have built a business model on hidden costs. Fees are in financial products from mutual funds to annuities. A load mutual fund carries a sales charge that gets paid to the person selling you the fund, as well as a fee to market the fund to others. Another hidden cost is [...]

Year-End Financial Checklist

It seems like we just rang in the new year and here we are almost at the end of 2023. My dad told me the older I got, the faster things would go, and he wasn’t wrong. So, with the time left before the end of the year, there are some financial matters you need to attend to before you [...]

Yep, Medicare is Going Up in 2024 Too

Well, it’s that time of year again when leaves change color and the federal government tells you how much more Medicare will cost you next year. The Bureau of Labor Statistics (BLS) says that 13% of spending by the typical senior goes to healthcare. For 2024, folks with Original Medicare will see increases to all premiums and deductibles. Medicare [...]

2023 Standard Deduction and Tax Rate

It won’t be long before you’ll be fussin’ and cussin’ again as you gather all the tax information needed to step back in the ring with the IRS on April 15th. The standard deduction and all tax brackets have been adjusted for the 2023 tax year. Here are the numbers that will be used to determine what you owe. [...]

Stay In Touch