The insurance rate cut has been issued. Telling the assembled members of the press this is nothing more than a “mid-cycle adjustment”, Chairman Powell was cautious not to betray too much concern. The first rule of central banking is not to make anything worse. Subprime must always be contained.

Yet, he has the unenviable task of explaining what is a complete (and for many an unnecessary) 180-degree turnaround. Mere months ago, inflation and acceleration, an economy risking becoming too good. Now it needs a little insurance?

In his prepared remarks, Powell said as little as he could:

Through the course of the year, weak global growth, trade policy uncertainty, and muted inflation have prompted the FOMC to adjust its assessment of the appropriate path of interest rates. The Committee moved from expecting rate increases this year, to a patient stance about any changes, and then to today’s action.

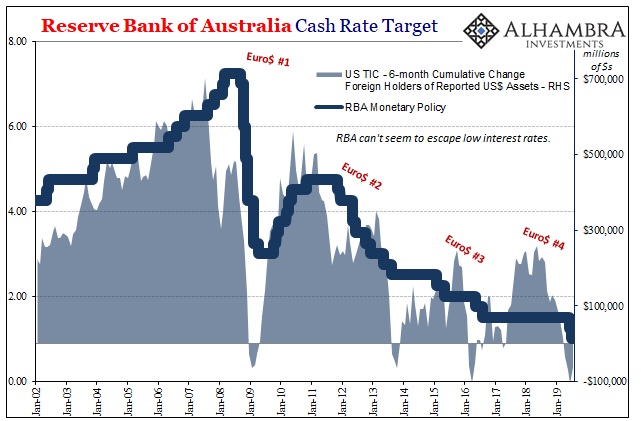

But he also said something interesting. With regard to weak global growth, his overseas central banking counterparts have already faced a much rougher environment. For several, these are no mere prospects for a downturn.

As such, they’ve responded. From New Zealand and Australia to South Korea and many more to come including Europe. There’s a global tide of “dovishness” and “accommodation” coming on. As the Fed Chairman said:

Foreign growth has disappointed, particularly in manufacturing, and notably in the euro area and China. In response to this weakness, many central banks around the world are increasing policy accommodation or contemplating doing so.

Powell is already on record recently talking about the interconnectedness of the global economy, which is, the Fed is finally appreciating, a big factor in how things unfold domestically. For anyone outside of committed Economists, you can see why; the US isn’t an island and because it isn’t a closed system what happens notably in the euro area and China is a risk here.

But what is that happens overseas, exactly?

It’s taken far, far too long, but some scholarship has finally zeroed in on the US dollar as a potential cause for this constant economic upset. Primarily coming from the BIS, even committed Economists are being forced to accept an interconnected global system made so by the dollar as reserve currency.

The Fed’s New York branch wrote something not long ago about this in the context of the fed funds mess. It seems as if the message is filtering its way down into the monetary policy world, slowly and in piecemeal fashion.

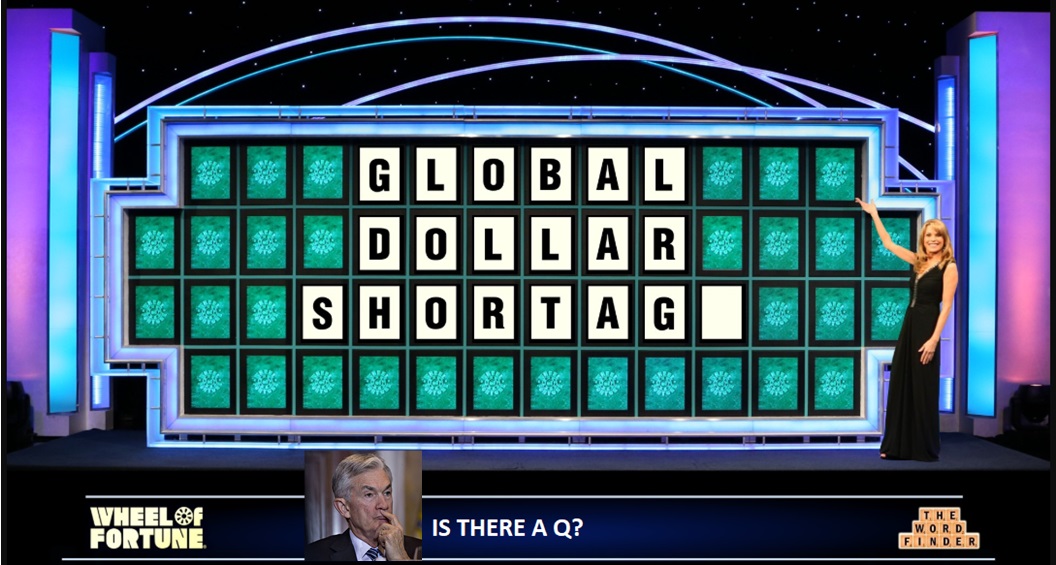

This doesn’t mean they’ve accepted the dollar shortage for what it is, but it does suggest that circumstances being so different from how they were supposed to be this year, along with how we’ve seen all this dollar stuff before, policymakers are being made to confront a global dollar. It’s a risk they aren’t even remotely prepared for.

When you have had enormous balance sheet expansion leading to the doctrine of “abundant reserves” you can’t quite get to a dollar shortage. Right now, that’s way too far away as an intellectual and theoretical matter.

So, the dollar is rising again and producing an entirely too familiar “overseas turmoil” which is already making the FOMC’s foreign counterparts spring into action. Putting yourself in Powell’s chair, if your ideology has ruled out a shortage, what else could it be?

Gotta be interest rate differentials.

It is still widely believed especially by those yet to realize the central bank isn’t central that if one central bank is raising rates while another isn’t – or is reducing them – this can have a dramatic effect on the currency. Thereby if, say, the Fed is “hawkish” and the ECB “dovish”, the dollar might rise against the euro.

In years past, Yellen’s Fed would have said, and did say, so what? Given the repeating correlations and overseas turmoil, the burgeoning scholarship recognizing the dollar’s much more central role, Powell’s Fed might be reacting in concert with those other central banks around the world. Among the top of the list of BIS talking points has been more “coordination” among central banks.

The current Fed Chairman isn’t going to want to make a surprisingly and unaccounted for bad situation worse by increasing the differential. If foreign central banks cut rates, in his limited view of the situation he almost has to, too. It’s not Trump that has bullied Powell’s group into reverse.

You have to add it to the list of things which are bothering policymakers at the moment. I don’t believe they are truly convinced the US economy, anyway, is in bad shape. There were, in fact, two dissenters against this rate cut – the usual hawks like Esther George (Eric Rosengren was the other) who has never seen a moment when the US economy is less than outrageously strong.

There’s housing, manufacturing, and perhaps most of all the dollar. Overseas turmoil may have finally come home, at least partway.

To make sure these cross currents don’t get worse and blow the economy further off course than the small amount (in their view) it already is, what is the insurance? In Chairman Powell’s estimation:

These changes in the anticipated path of interest rates have eased financial conditions and have supported the economy.

It’s just like I wrote yesterday, this is all continues to be a puppet show. Even now being confronted with a more external factor, the FOMC still thinks it can steer everything including the dollar doing nothing more than managing expectations.

Rate cuts merely take things a step further than symmetry – an explicit rather than implicit change in policy. Both are supposed to change real interest rates today.

Symmetry was supposed to have been insurance for an economy that was perceived to be awesome. Rate cuts are supposed to be insurance for an economy that is perceived to be questionable. The only things that have changed: the so called insurance becomes more explicit as questions about the economic condition become harder to answer.

One small step forward – hey, we never have before but maybe we need to pay attention to the dollar – and then one bigger step right back – we can fix it with a rate cut!

The Fed Chairman was unusually purposeful when he said this was not the start of an easing cycle (again, he called it a mid-cycle adjustment). He’s wrong in that by thinking about everything this way it will only ensure Euro$ #4 keeps coming on, and therefore today’s move will just be the first in a series whether he currently wants it or not (kicking and screaming).

And he’s also right because even though it will turn into a cycle, no matter what the Fed does it won’t be easing.

One of these days, though, maybe they will get the hang of this dollar thing. Imagine his surprise the day Chairman Powell, probably one of his successors, figures all this out – and then realizes just how superfluous the Fed is and has been. They are starting to see it, but they remain far away from saying it.

Stay In Touch