I wrote last week what I think is a pretty good explanation for how the world has no choice but to live with the (euro)dollar as its global reserve currency regime. It has little or nothing to do with how oil is priced, and while it’s sexy to talk about a petrodollar the truth is that idea never really mattered. What does is infrastructure and depth – financial infrastructure and depth.

A credit-based currency requires credit capacities. And currently there are none to challenge the offshore dollar system. The eurodollar.

While they may be its most substantial and vocal critics, even the Chinese agree.

For the third year in a row, China’s Communist government is likely to float offshore, dollar-denominated bonds. And this one is rumored to be the biggest one yet. Why? What I wrote about it the first time still explains the reasoning, why the dollar isn’t anywhere close to being dethroned:

The Chinese government has sold its first dollar bond issue in thirteen years. Given that fact alone, the idea is causing more than a little confusion, perhaps consternation. Why now? What are they really up to? It seems as if it is contradictory, especially given China’s very public positions against the dollar as hegemonic reserve (the coming market for oil in CNY, for one)…

Another alternative is the bond market; in the very same way using the very same vehicle US and European companies turned to in early 2009. If you couldn’t get liquidity financed via bank-drawn dollars, you could at least build up a liquidity cushion, in dollars, via the floatation of longer-term paper.

This, however, comes at a cost. Bank-derived dollars are almost always the shortest-term, meaning largely overnight, if occasionally termed out a week or maybe a month. There is a huge interest rate differential between obtaining bank-funded eurodollars and longer-term Eurobonds. So while you can get dollars via this workaround, you have to pay up for the privilege.

The Chinese government in issuing its dollar bond in the coming weeks is trying to reduce the cost that Chinese corporates (largely financials) might have to pay if they increasingly go this route. Bond markets, like other markets, work on benchmarks. The cheaper the government can get on its coupons, the cheaper it will be for China’s corporate sector that follows along after it (in theory).

November 2017, again in November 2018, and once again it’s time in November 2019. By issuing an even larger float this year, China is betting on setting the market benchmark for its own in a big way.

By doing so, though, the Chinese government is also conceding how there is no replacement for the eurodollar system; it is, in fact, bowing to that very reality.

And it’s just what I wrote just last week:

Unless and until the banking [financial] system moves away from dollars, diversifying national reserve holdings means absolutely nothing. Nothing. In fact, more than anything, diversifying [reserve holdings] signals that there are still big problems in the eurodollar system.

In other words, even as it struggles and creates thorny issues for the whole world economy and financial system, it continues to dominate no matter how many dissatisfied customers. It tells you how a great deal about how difficult and how substantial it must really be to create and maintain this reserve system; that despite a decade’s worth of noise, fury, and quite often heartache, there is simply no realistic alternative.

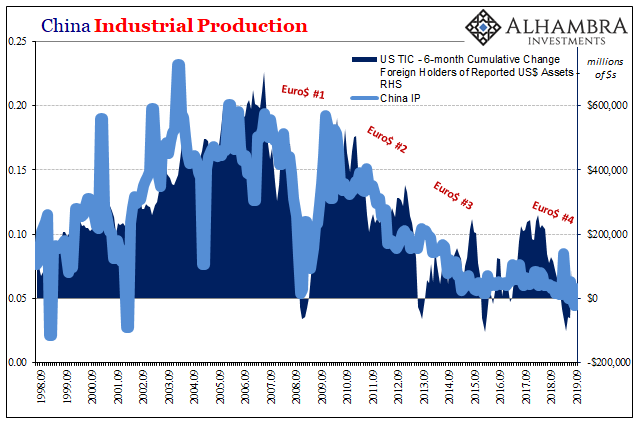

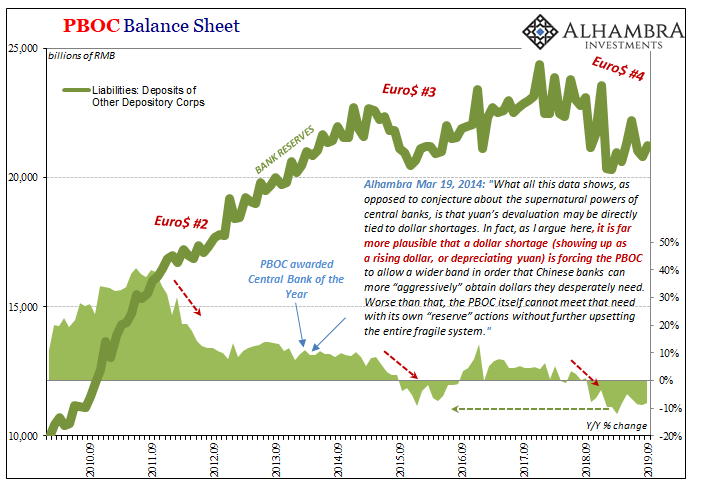

China’s government is attempting to pry open the Eurobond door a little more to help its beleaguered corporates in their difficult dollar deficiencies. Replacing their dollar short, their dollar requirement: if they could have they would have years ago before being driven into a real precarious economic and financial state by it. But they can’t, so they, and everyone else, is stuck to trying to make the best with what’s available.

It is the eurodollar’s world, even the Chinese are just trying to live in it.

Stay In Touch