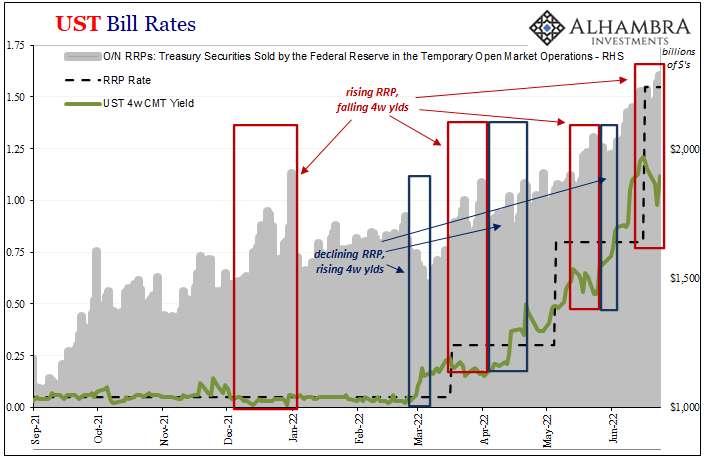

It’s not just the 4-week T-bill rate which is defying the Fed’s illusion of control, though that’s where the incidents are most evident. The front bill is nowhere close to the official RRP “floor” which can only mean one thing: collateral shortage, a large and persistent liquidity premium. Therefore, the further under said floor, the more the competition for the best collateral meaning severe shortage.

Joining the 4-week bill is its 8-week neighbor, while the 3-month bill is near RRP though has been above while sticking close to around IOER.

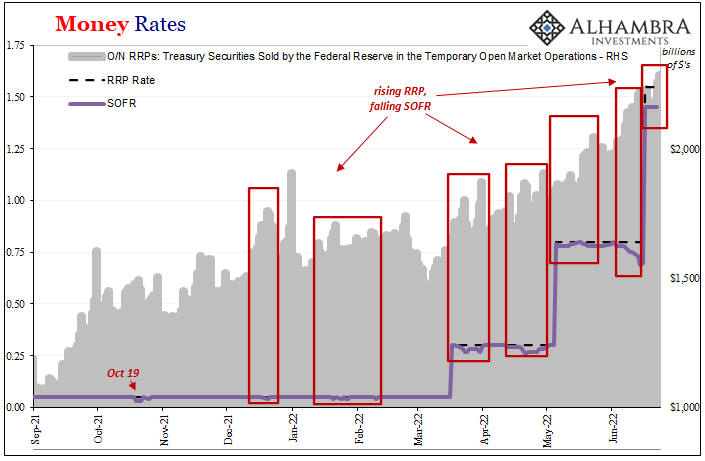

Beyond strictly collateral prices, there’s a premium showing up in GC repo. As mentioned before, SOFR parallels T-bills to an extent. Since the previous rate hike, this Fed-constructed rate is now firmly planted well underneath RRP, too, which means a wide variety of repo rates are indeed defying the Fed “floor” in broad fashion.

These indications closely correlate with RRP usage, which continues to rise even though the FOMC is moving on toward balance sheet runoff, QT, draining reserves from what everyone still says is too much money (even as every last market is gripped by powerful deflationary forces, only starting with those direct affected by no collateral).

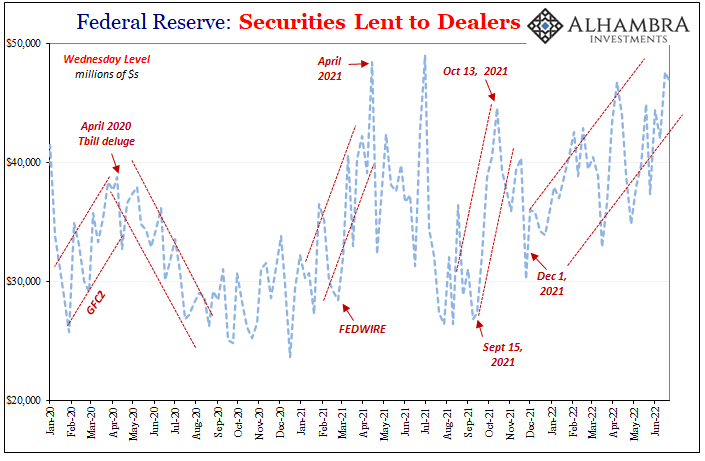

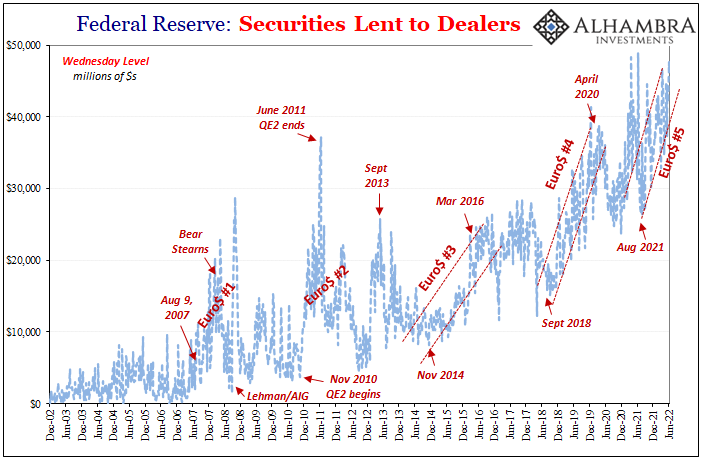

FRBNY has collateral because policymakers have stupidly done nothing but take it away from the marketplace. The only way in which some might come back is through the New York branch’s Securities Lending program which, sure enough, has been hit up by dealers toward new highs.

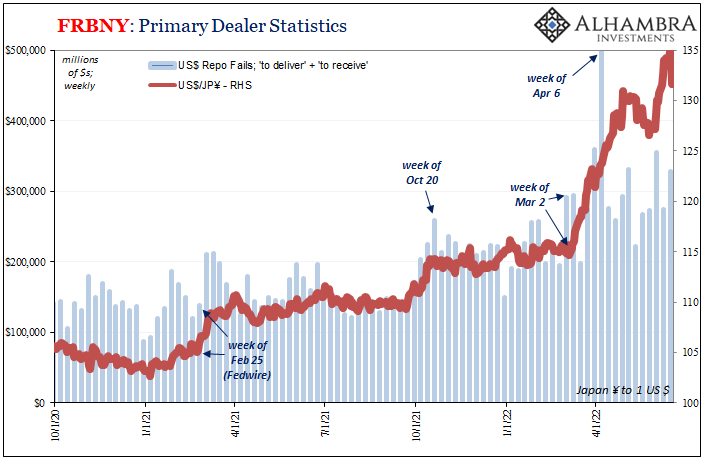

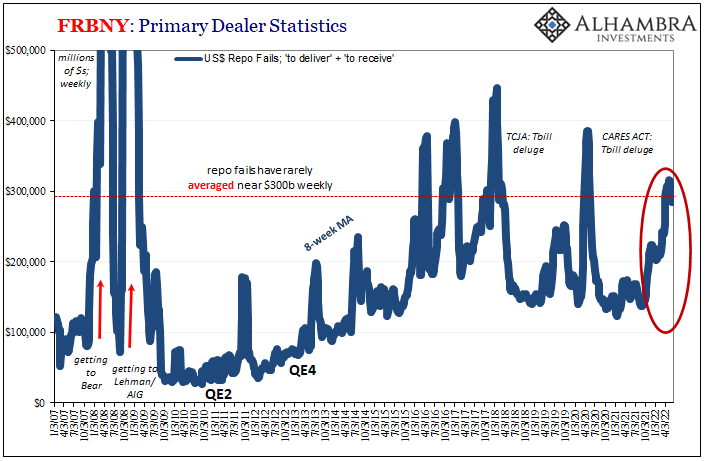

Beyond that, unsurprisingly primary dealers also report another big week (last week) in repo fails. The chart immediately below actually understates, I think, just how dire the situation has become. This seriously elevated level of fails, which does indeed correspond too nicely with all of the above including T-bill price premiums, has been sustained for several months (the same several months as recession and deflationary notices have gone way up).

The 8-week average for fails is near $300 billion which, as you can see just above, is a rarity even for the post-crisis era of constant collateral scarcity and repeated Euro$ episodes. This is a huge issue, unappreciated and, as always, under the radar.

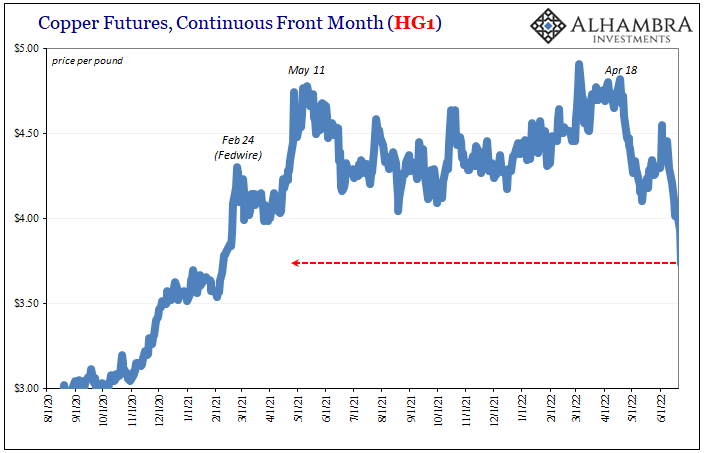

With growing risk aversion spreading across, well, everything including commodities now, are we likely to see the backbone of global money suddenly get much better?

That’s been the whole thing about all of this from the beginning of last year, including how misunderstood the RRP use has been all along. Treasury supplied a lot of useful bills in the immediate aftermath of March 2020, but then, as is its standard practice, began to take them back, terming out its debt structure favoring more notes and bonds.

Under normal conditions, the dealer collateral multiplier should have made up that difference through higher rates of reuse and repledging (even the occasional rehypothecation). As Treasury removed several hundred billion in supply, a higher reuse rate from dealers would’ve made up for lost issuance (and then some).

But – and here’s the thing, the same thing we see in swap spreads – for dealers to make up any direct supply shortfall they have to willingly offer balance sheet capacity.

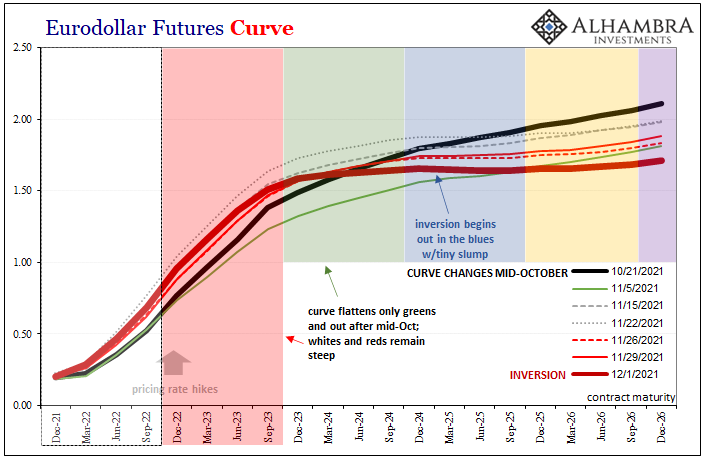

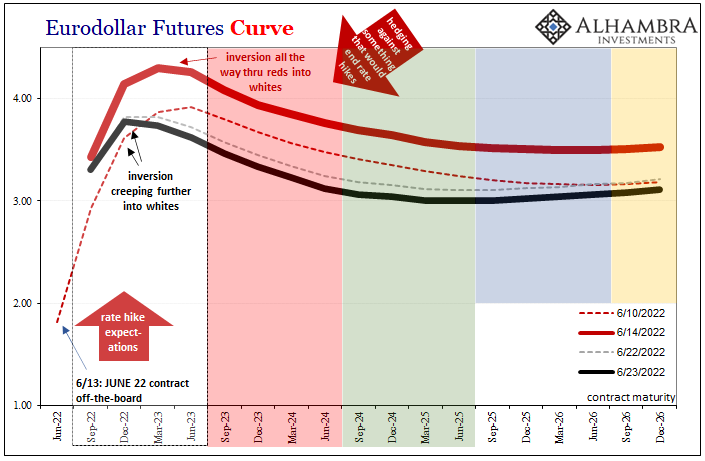

It didn’t happen. Instead, to the contrary, there is every indication of procyclicality starting from the unnecessary debt ceiling dance in early October which took place (again) what today can clearly be seen as the least opportune time.

Euro$ #5, not rate hikes. While the potential started to “leak” into markets before, it was October when it became “real” right in the thick of all that collateral nonsense.

The combination has left the entire global monetary system with fewer bills directly supplied by Treasury to go along with an indicated, validated lower reuse or multiplier rate as dealers have also become risk averse thereby balance sheet constrained.

And that, ladies and gentlemen, is the biggest danger. Deflationary danger, if you haven’t noticed by now.

Stay In Touch