In early January, much of the world was dazed and confused. What the hell just happened? Two weeks before, in the middle of December 2018, Jay Powell stood in front of the microphones confidently declaring his rate hikes justified by an extremely strong economy. Yet, even the stock market had turned against him.

When the calendar changed to 2019, not even the Fed’s Chairman was so sure. What followed was merely the first step in what was always going to be a long, drawn-out process. It began with the epic flip flop on inflation, allowing policymakers their Fed “pause.”

Even since, it has been entirely predictable. I wrote on January 8, the day right before the flip flop, what was going to happen. It wasn’t especially insightful on my part. We’ve seen all this before:

In the short run, aided by promised RRR cuts and stimulus in China, softening in Mario Draghi, and whatever else some central banker might dream up, optimism can catch on and drive the [stock] markets for a while. Maybe even months at a time. In fact, if a months-long rally failed to materialize it would be the first time.

All that dovishness though cheered would inevitably fail, largely because it’s only ever called stimulus when in reality it’s nothing more than a puppet show. The world needs effective monetary management when instead its collected officials expend so much effort and resources on how they can better trick the world’s population into not caring. I really wish I was making this up.

You have to give them credit, though. They do know their audience. There’re just no money dealers in it.

Back to January:

This is going to be a give and take; action and reaction like always. The more serious it becomes, the more serious the counterpunching. Powell’s already moved on skipping higher dots and going right to a “Fed pause.” It’s really easy if maybe he starts to sound more dovish still – hinting at rate cuts “if conditions warrant.”

You know it’s coming.

[Stock] Markets will jump when he does. They always jump for the Fed in the short run.

You get the point. Yesterday was the day.

My emphasis back in January was on the sentence immediately following what I quoted above: “Then the anesthesia wears off and everyone feels the pain again.”

How in the world did the myth of the “maestro” survive 2008?

If anyone deserves the credit it is Ben Bernanke. He allowed the financial system to be wrecked and the economy to be forever (or, at least to this point) impaired but his true genius flowed through in the aftermath – he skillfully focused the whole world’s attention on only the aftermath.

The former Fed Chairman didn’t invent the term “jobs saved” but he sure used it to great effect. Combined with what he has claimed are limitations beyond his control, the Zero Lower Bound plus a bunch of idiot Wall Street bankers peddling NINJA mortgages, by his recollection the courageous former official barely managed to stave off the total collapse of Western civilization by the skin of his skilled teeth.

Bernanke in 2015 wondering why he’s been denied the parade:

That’s why, yes, the policy did lower interest rates — that’s right — but even after lowering them, they were still too high. They were too high because of the zero lower bound. They were too high to get to the rate that was consistent with growth and recovery. If the Fed had not done what it did, we would still be in a much worse position.

Why was the world in any danger to begin with? That’s the only question that matters, and all central bankers, not just Bernanke, have managed to rewrite the official history of the last decade as if the calendar began on March 9, 2009. In the mainstream canon, apparently there was only one single thing worth remembering. Subprime mortgages.

But even Chairman Bernanke’s boast is only half-baked.

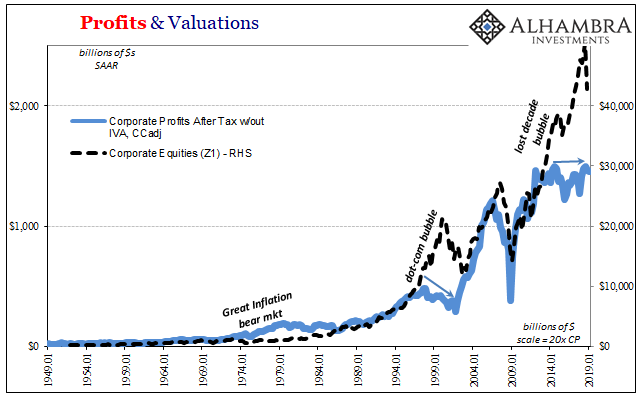

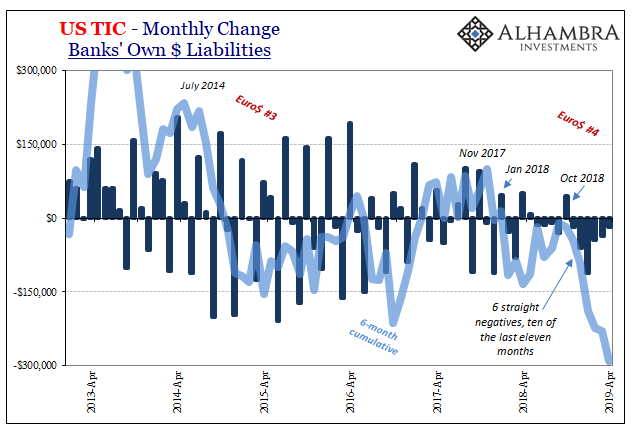

The updated version of “jobs saved” is time; the overuse and abuse of the word “transitory.” In other words, give them enough time and you’ll see. Four QE’s later and the promise of 2014 became the “transitory” interruption of 2015 and 2016, followed by globally synchronized growth in 2017 which instead became more “transitory” stuff in 2018.

And now 2019 is back to rate cuts all over again. There was supposed to be only rate hikes and recovery, which everyone everywhere has been waiting for, and now there will only be rate cuts to dispel grave uncertainty.

How does one focus on the good the cuts are supposed to do without factoring the uncertainty none of the cutters saw coming?

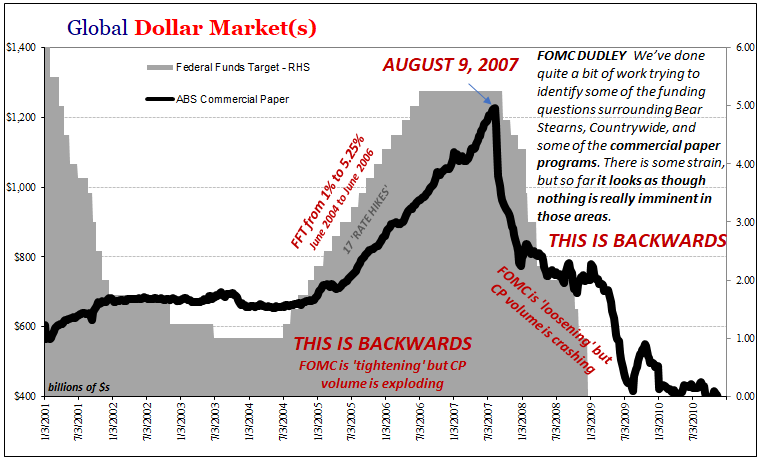

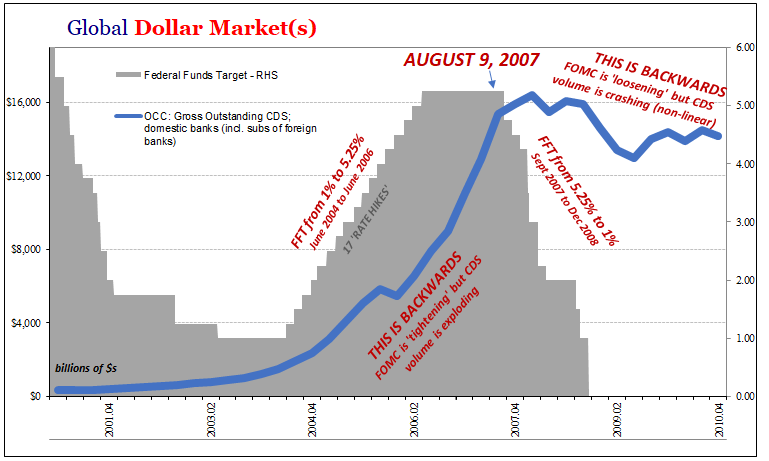

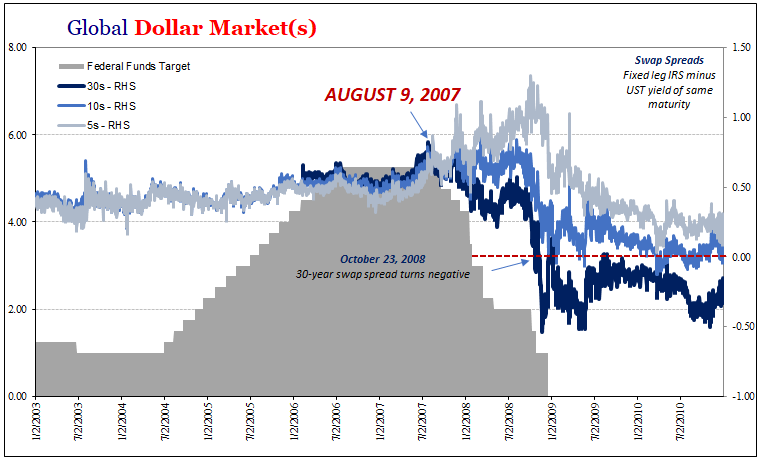

For me, it’s a lot more basic than any of that. The Fed raised rates throughout the middle 2000’s – rather than tightening, as intended, the whole world experienced only amplified and out of control mania. Beginning September 2007, Bernanke’s Fed began to reduce them – rather than accommodating, the whole world experienced only amplified and out of control panic.

As a reminder, stocks rallied to record highs in October 2007. It’s not actually unusual.

One reason is how the world’s got central banks entirely backward. It’s the real legacy of Bernanke:

That’s really all central banks offer. People have said monetary policy is like speed or heroin, some sort of highly effective stimulant. That’s not really an accurate characterization (especially given how there is no money in monetary policy; it is entirely psychology). The Bernanke’s of the world can only dull the pain for a little while at a time, so that you might forget all the big stuff that’s bothering you.

There might not be big stuff bothering you or the computer screens installed at the NYSE right now, but that doesn’t mean there isn’t any big stuff you should be worried about. If Powell’s Fed is about to administer his first dose of anesthesia, what is it that’s injured and what must be the extent of the injury to get him off the fence on the bond market’s, not his, schedule?

Stay In Touch