People have started to look back fondly upon the Asian flu. It was as global disaster, a dollar shortage which spread all across mostly Asia but not exclusively. The reason why it is talked about positively nowadays is LTCM and rate cuts. Popular myth has it that Greenspan’s Fed properly handled any economic fallout due to the former by enacting the latter.

Beginning September 1998, faced with “overseas turmoil”, the FOMC began a series of only three rate cuts. According to convention, this saved the US economy from sharing the same fate as Japan, Thailand, or perhaps Russia. LTCM was thereby rendered little more than a footnote, a weird curiosity (even though it shared so many of the same characteristics as Bear Stearns and Lehman Brothers).

In mainstream Economics, this is called the “soft landing.” Confronted by weakness, our best and brightest monetary stewards spring into action thereby, as Economists proposed in the eighties, filling in the troughs without shaving off the peaks. While the rest of the world experienced rough recession, Greenspan’s genius kept us to a mild slowdown.

A soft landing.

About two years later, toward the end of 2000 there was only talk of the same thing. Economists not only believe there is no good in recession, they really had thought by that point the modern central bank was the perfect vehicle to ensure there would never be another one. Academic papers talking about banishing the business cycle were rather trendy.

By 1999, Greenspan’s Fed began seeing an inflationary boom ahead. The unemployment rate was low and threatening to go below 4%. The stock market was booming, as was, importantly, the real economy. Rate hikes began and continued into the year 2000.

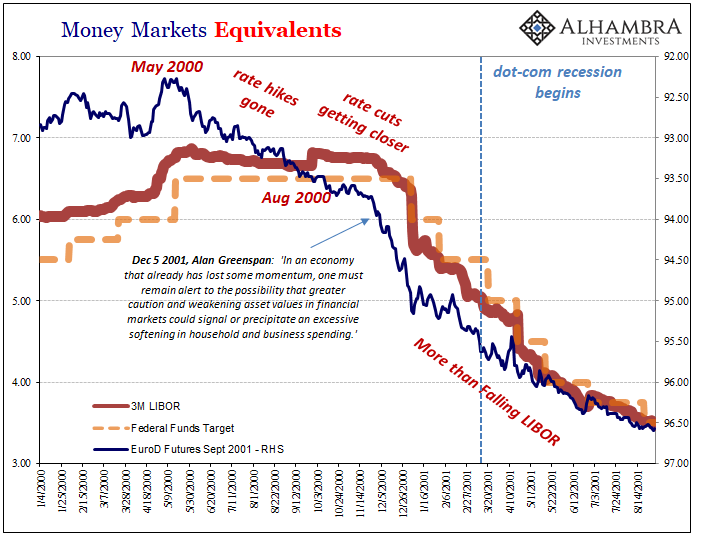

By the spring and summer of 2000, the US economy started to show signs of weakening. The Federal Reserve continued to push ahead anyway, clinging to their inflation risk scenario no matter the data. Among the most concerning was a determined shift in eurodollar futures – which by June 2000 had already started to bet against Greenspan.

Don’t fight the Fed?

The “maestro” was still thinking about more hikes. It wasn’t until almost the end of the year, December 5, 2000, that he changed his tune. Even then, he would only admit:

In an economy that already has lost some momentum, one must remain alert to the possibility that greater caution and weakening asset values in financial markets could signal or precipitate an excessive softening in household and business spending.

On that day, stock markets surged. Nineteen ninety-eight’s genius was back, surely putting the US economy on a path to the second such soft landing in the span of just a few years. From this view, rate cuts are to be celebrated.

Greenspan’s Fed would undertake its first one just weeks later, right at the outset of 2001. Unlike 1998-99, however, they wouldn’t stop until June 2003, with the federal funds target starting from 6.50% before finally registering just 1% two and a half years (and little recovery) later. No soft landing, just recession.

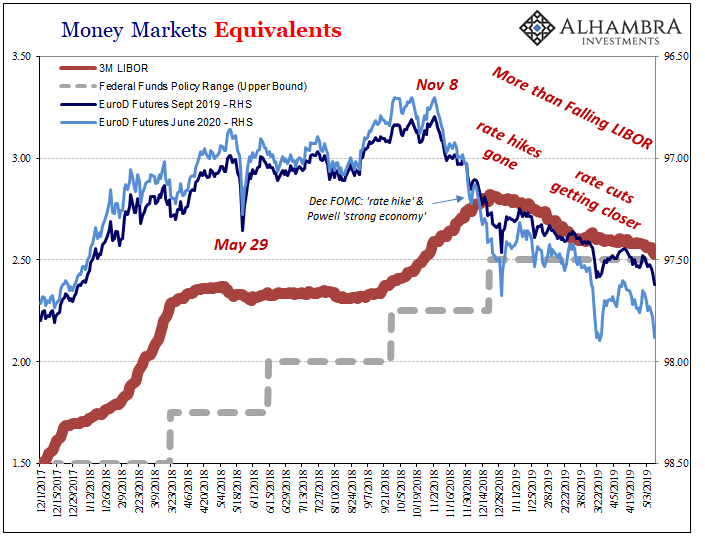

Here we are again. The question of recession grows louder as the question about rate cuts is more and more settled. The market is almost certain that they will begin in 2019. They grow closer with each step down (in economy as well as things like UST yields). The progression in this alarming direction is very familiar.

Starting with another Federal Reserve Chairman and his lengthy series of denials; seeing inflation where there is none. At least Alan Greenspan had an actually booming economy at his back from which to suggest something like that. Powell’s has been entirely imagined. Apart from the unemployment rate and stock market valuations, in 2019 of the factors that actually matter there is nothing at all similar to 1999.

Given that background, a soft landing seems beyond far-fetched now that rate cuts are nearly upon us. Going back to November 8 last year, global economic weakness has become more and more entrenched.

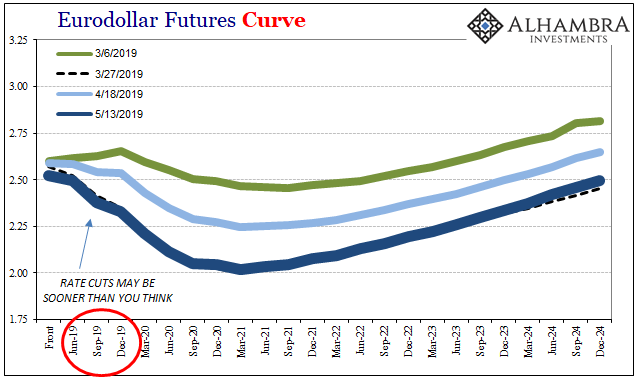

That’s trade wars, many have said. Sure, the possibility of tariffs and restrictions haven’t helped. But as the eurodollar futures curve and contracts have showed, even during those months this year when there was pretty strong consensus about a trade deal, rate cuts were continually forecast by the market. It isn’t Trump vs. Xi which first raised the eurodollar futures alarm (inversion) and then has caused the downturn. And it won’t be any trade deal which will magically reverse it.

As of today’s session, the eurodollar futures curve has matched and exceeded (on the downside) the last “trough” set in late March. Importantly, the market has moved up its assessment for rate cuts when compared to March 27 – the 2019 contracts are priced a little higher today than that earlier date.

There hasn’t been a soft landing since 1999, and even then it had little or nothing to do with Alan Greenspan and his ridiculous 25 bps tinkering. The economy of the late nineties was really booming, and so it could withstand “overseas turmoil.” The global economy in 2019 is even more closely tied together than it was twenty years ago, especially since it hasn’t legitimately seen a boom over the last decade.

The rate cuts are very nearly a done deal; LIBOR follows eurodollar futures no matter what FOMC officials at the top say. The only question now is, why? What’s the downside here lurking just over the horizon? US tariffs amounting to a few billion on Chinese goods? Not likely. It’s got to be a lot more than that.

Stay In Touch