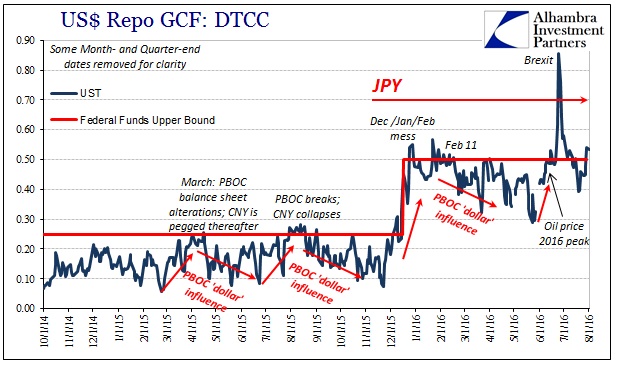

On January 25, there was sudden burst of MBS repo volume in the DTCC statistics. This only covers the repo market that is visible taking place on the exchange, but without any other data for the vast majority of hidden transactions we have to assume that these are decent approximations for the whole. Since the published GC rates as well as volume do seem to correspond with financial indications and events elsewhere, this is a reasonable assumption.

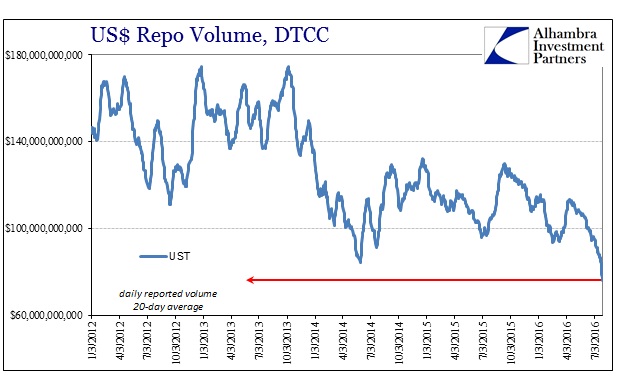

In early January, overall repo volume was falling as GC rates were rising, all concurrent to global liquidations and thus signifying the “dollar” as the catalyst. On the 25th and 26th, volume in MBS surged to $145 billion, more than 50% above the 20-day average. Treasury volume was steady to slightly lower, meaning that overall volume (including agency) was noticeably different at the end of January due to MBS activity. GC rates, which had been as high as 62 bps in MBS and 57 bps in UST on January 22, dropped back to under 50 bps in both by the start of February (including a very subdued month-end uptick).

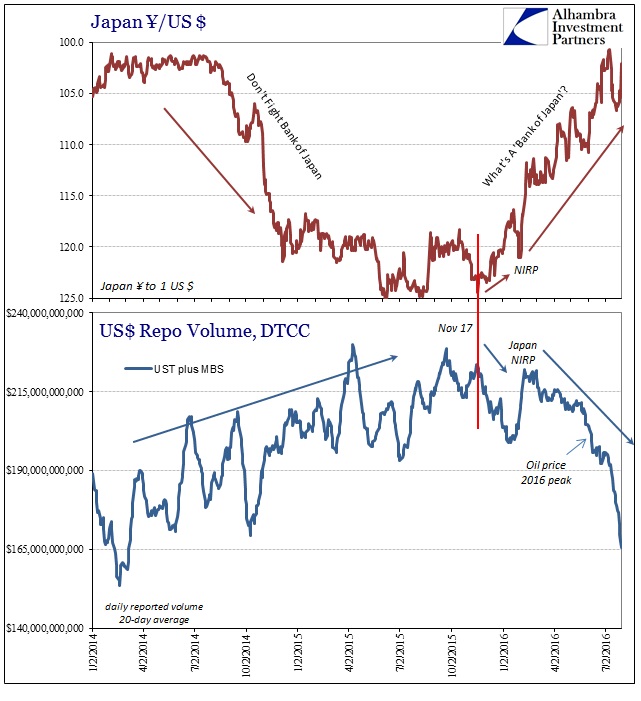

These dates all correspond with the Bank of Japan’s announcement concerning NIRP. It wasn’t officially unveiled until the end of the month, but the yen was already moving by January 21 in anticipation of what had already leaked. In fact, the announcement itself marked the end of the sought-after (from the BoJ standpoint) devaluation, and JPY was moving upward again by February 2. That day was also the last time MBS repo volume was above $145 billion. Not too much longer after that, volume averages resumed their conforming (to JPY) decline.

The episode offers yet more evidence, very compelling evidence, that events drive these financial indications and market conditions, not regulations. It is and has been easy to assign any negative factor or occasion as if related to nonspecific “tougher” regulation, as if the funding and financial markets would have been completely free of turmoil without it. That is the excuse that many have used in order to bridge the divide between what we have seen and what “should” have been had QE actually had the positive effect on money markets and global liquidity its proponents still claim.

Regulations don’t explain the general but tight correlation between JPY and repo volume (and rates by extension); Japan does, as does the “dollar” confounding Japan.

Repo rates remain elevated under these conditions, where volume disappears in tandem with the BoJ’s credibility. On Friday, GC rates were above 50 bps again, 57.9 bps in MBS and 53.9 bps UST, but it wasn’t clear if that was more JPY or just month-end. Today’s GC rates indicate it was far more of the former. In UST, the repo rate barely edged back at all, fixing at 53.2 bps; in MBS the rate was still above 50 at 51.5 bps. Both of those days, UST volume was under $50 billion; today’s volume was barely $40 billion. There’s not a lot of margin for error under that shrinking capacity.

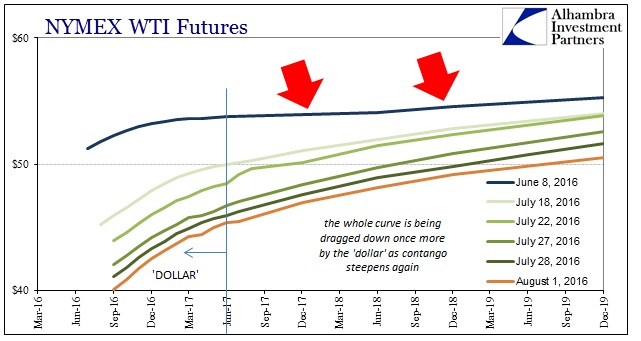

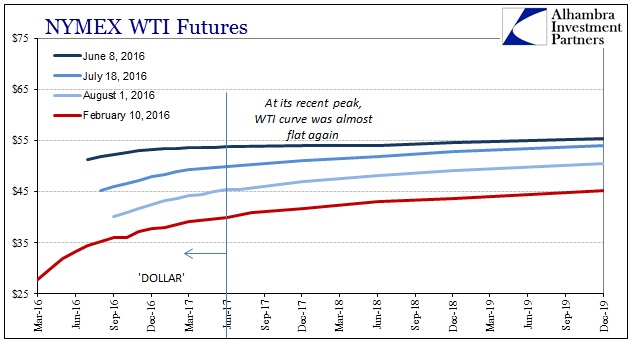

All of this indicates an unusual degree of funding and financial stress (“dollar”) that is only variably and partially related to other efforts and policies (such as PBOC and CNY/”dollar”). After a one-day rise on Friday snapping a six-day losing streak, WTI was down sharply again today, steepening the curve a little more even though CNY has been pushed all the way back to 6.63 (from just below 6.70 on the 18th).

This is not to say that regulations are having no effect at all; quite the contrary, increased capital inefficiency can only make it an easier decision for money dealing banks to exit unprofitable money dealing activities. What is left, however, is a degree of “tightness” globally (even to the point of demonstrated seasonality) that directly and emphatically defies the easy explanations.

Stay In Touch