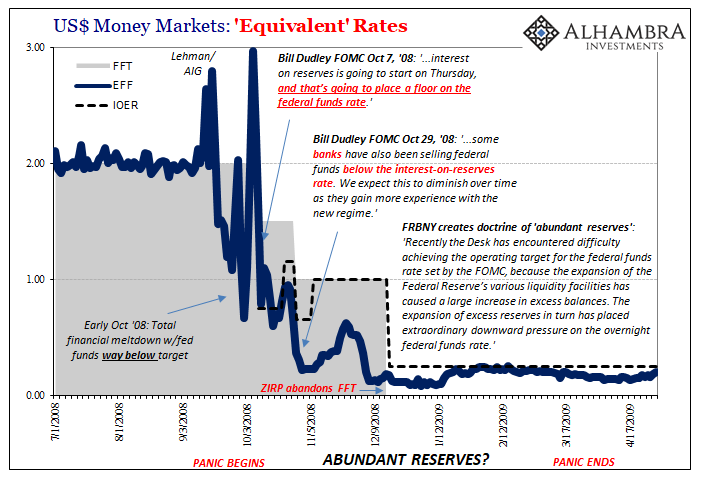

For central bankers like Bill Dudley and Ben Bernanke, the Global Financial Crisis was a godsend. So much had been a disaster it was hard to pin down specific failures. Where does one begin? Practically everything went wrong, so take your pick. The Financial Crisis Inquiry Commission (FCIC) did its part pointing the finger at those greedy Wall Street bankers and the toxic waste of their subprime mortgages.

The saga of IOER proves there’s so much more to the story.

For his part, Dr. Bernanke was able to refocus; forget about the panic, Mr. and Mrs. John Q. Public, pay attention only to the beautiful recovery we are making for you. Just look at all those bank reserves, created by the science of quantitative easing. If not for our heroic actions, it would’ve been worse. So many jobs were saved.

If nothing else, it made for a powerful puppet show.

FFT was quietly added to the dustbin of history back in December 2008 when the Fed introduced ZIRP. In place of a single target, and acknowledging the need for some wiggle room via complexity, moving forward the FOMC would allow EFF to trade within a specified range.

At the bottom or floor of that range currently sits the reverse repo rate. The central bank had conducted small-scale tests of the reverse repo program (RRP) as far back as October 2009. As noted before, the FOMC throughout the panic period had thrown together some reverse repos which were ended with the introduction of ZIRP in December 2008.

When considering how to exit from the crisis measures and ZIRP, the RRP was brought back specifically to become the floor that IOER never was. Conducting “technical exercises” beginning in September 2013, in its Policy Normalization Principles and Plans introduced on September 17, 2014, the Fed named RRP as an important mechanical device.

Federal funds would remain the focus; as the plan spelled out, officials were worried that if the Fed shifted to using something other than EFF to “communicate” its intentions, monetary policy might be less powerful if the public didn’t fully understand or wasn’t familiar with any new policy tools. It was less about money, nothing about money, really, and mostly about communications.

In actual money, the RRP would be the lower limit for wholesale money market transactions. This was the floor.

What to do about IOER, then? It was repurposed, the system was given a “double floor.” This other one would be set equal to the upper bound of the federal funds range (where it had been since ZIRP). IOER on top, RRP down below. EFF would therefore be corralled effectively in between.

Therefore, in terms of the primary policy communications tool, federal funds, this second floor was placed at its ceiling. Huh?

According to the doctrine of abundant reserves, this was necessary. Again, the only entities operating in federal funds are FHLB’s and a few spare banks or nonbanks here or there, all those ineligible to be paid IOER. With bank reserves into the trillions, the thinking goes, there just isn’t demand for this other spare “liquidity.” Therefore, what gets dumped into fed funds, what comes out at EFF, is the lack of demand.

In the double floor system, IOER is a bank rate rather than a wholesale rate like RRP. And that’s how it is described in the most recent literature. According to FRBNY:

The overnight reverse repo program (ON RRP) is used to supplement the Federal Reserve’s primary monetary policy tool, interest on excess reserves (IOER) for depository institutions, to help control short-term interest rates.

IOER is not so much a floor as it is a filter. Banks, meaning eligible depository institutions, don’t want to receive less than that amount so they only get involved in wholesale markets like fed funds when there is a reason. That reason would be when some or all of the wholesale market is priced better than IOER.

Where and how exactly does that work? How does the doctrine of abundant reserves combine with this double floor-ed ceiling?

They don’t really know.

Here’s what Ben Bernanke wrote (for Brookings) in September 2016:

With the enormous quantity of reserves now available, however, small changes in the supply of reserves no longer suffice to control the funds rate. Today, the Fed influences it and other short-term rates primarily by varying the interest rate it pays banks on their reserves (known as IOER, or interest on excess reserves).

This approach relies on the presumption that banks are unlikely to want to borrow or lend in private markets at an interest rate much different from what they can earn on the reserves they hold at the Fed. To further improve its control of interest rates, the Fed now also allows other private-sector institutional lenders, such as money market funds, to earn a fixed rate of interest on cash held for short periods with the Fed, through a program known as the overnight reverse repurchase (RRP) program. [emphasis added]

Always the crafty one, notice what the former Chairman specifically left out. There’s no mention of a floor or even a description that sounds like one. All he said was, not much different than what they can get from IOER. That can mean a lot of things. After the experience in 2008, Bernanke is being purposefully nonspecific.

It’s a far cry from calling it a floor even for depositories. Having learned the hard way, and having been removed from the responsibilities of toeing the company line, Bernanke is free to say IOER just kinda does stuff. The implication is that they really aren’t quite sure what that stuff is or when it applies.

Either way, from the point of view of fed funds this second floor is more like a filter or an attractor and it starts out on the ceiling because they aren’t really sure what can happen. But why filter from the ceiling?

It sort of goes like this: if money market rates rise near or even above IOER, this would incentivize money dealers or anyone with spare liquidity parked as excess reserves to pull them out of the Fed’s pocket and place them in these money markets. That would then, in theory, cause the money market rate in question to fall back to where it “should” be.

In order to be specific, let’s translate what I wrote above into the Fed’s terms:

If this one wholesale rate (EFF) were to rise near or above the ceiling which is a double floor (IOER), this would incentivize depository money dealers eligible to receive IOER to then pull them out of the Fed’s pocket and place them into wholesale fed funds. The floor for banks acts like a soft ceiling (filter) for wholesale.

But, again, there is no brightly defined point of demarcation. It really seems like there should be, but in practice it is always much more complicated; thus, Bernanke’s careful phrasing.

https://twitter.com/ErikSTownsend/status/1150828530864984065

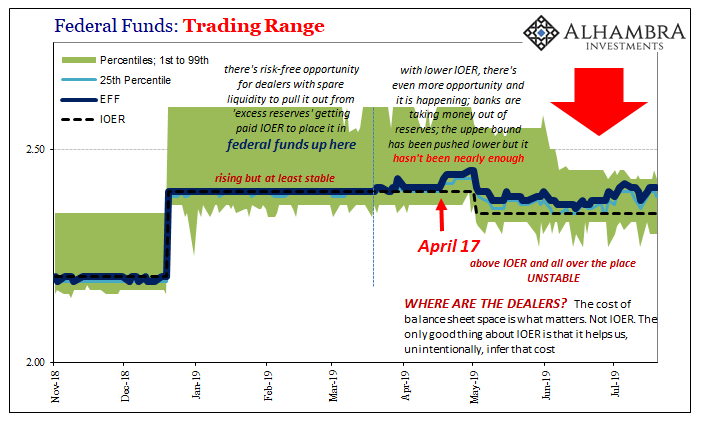

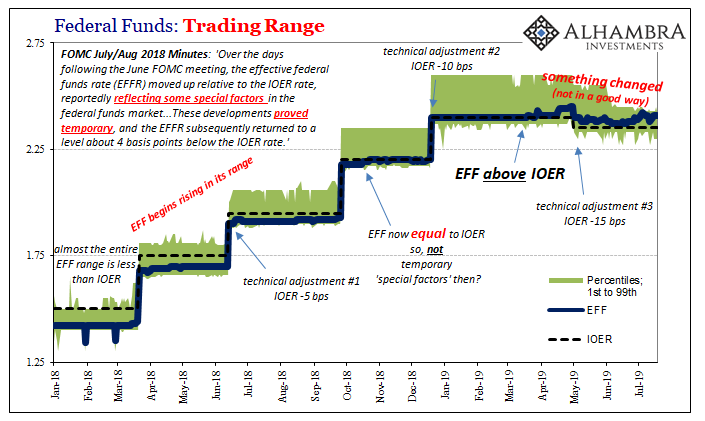

This gets us to where I was last week on MacroVoices with Erik Townsend. The wholesale markets are colliding with the depository rate double-floored-ceiling. The two are, in fact, mixing. There’s been an increasing part of the fed funds range, as I described, taking place above and even well above IOER.

In order to influence that wholesale rate (EFF), to make sure it stays within the range, the FOMC has voted three times (so far) for “technical adjustments” to the bank rate (5 bps each). Right now, IOER sits 15 bps below the upper bound of the federal funds policy range – now closer to the floor floor (RRP) than the top. Therefore, some people don’t like the term “ceiling”, either.

What are those supposed to accomplish? Simple, in theory. Reducing the double floor means a lower ceiling whereby that filtering process starts: more eligible banks already receiving the bank rate (IOER) are increasingly incentivized to consider shifting, and shifting more of, from the one (bank reserves) into the other (wholesale EFF).

It isn’t quite working out that way (shocking, I know). For reasons that we aren’t privy to, the lower bank rate isn’t triggering an effective reduction in the wholesale rate. As the two floors converge, EFF is right back to where it was when the second floor (IOER) started moving. Worse, the wholesale federal funds market has been turned into a volatile mess more recently – and it transitioned to this more unstable behavior right at the point when the effective rate met the floor-as-ceiling filter.

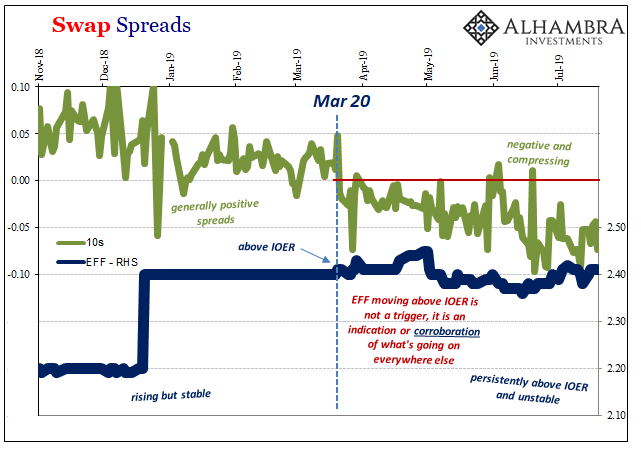

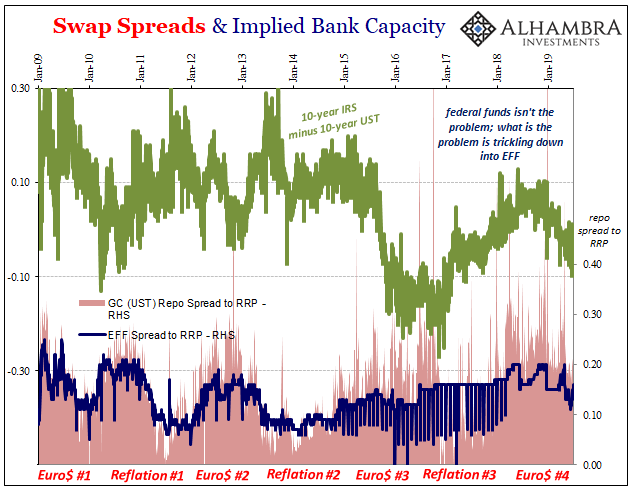

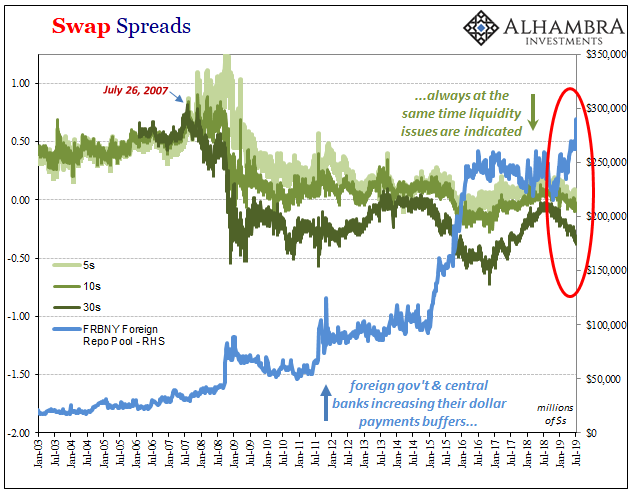

This isn’t actually some big mystery. It is only by way of this narrow focus on EFF, IOER, and whether questionable floors can make effective ceilings. What the rest of the wholesale world tells us is that there is considerable dollar constraint and balance sheet pressure evident practically everywhere. Swap spreads to TIC, we know what’s going on where it actually matters the most – the rest of the dollar system outside the nearly static market for reserves.

What’s significant about fed funds, then, is one datapoint telling us something about the nature and degree of that other stress. When we ask why the filter might not be working out so well, what is it that is keeping banks from participating in wholesale, EFF and IOER tell us something important about their reluctance as well as reminding us of the complexities that always sit in between.

Sweeping a reserve balance into a federal funds transaction isn’t a pure substitute; there are frictions involved. But as the double floor/filter ceiling moves lower, those frictions should, in theory, matter less (you get paid more for the pain in the ass). And as EFF pulls above IOER, what’s significant about that is how almost the entire range of this wholesale market is taking place at rates greater than the bank rate.

In other words, what was a foggy question about questionable bank participation becomes quite visible, unquestionable lack of participation. We don’t have to wonder if natural frictions or the fuzzy nature of “at an interest rate much different” are to blame for EFF; once it pulled above IOER, it’s perfectly clear this is a conscious choice banks are making to stay out.

One theory is that abundant reserves may not be so abundant any longer (QT). But if you are going to take the FOMC’s word for all these things, then you also have to on this issue. According to the Fed, reserves right now remain abundant.

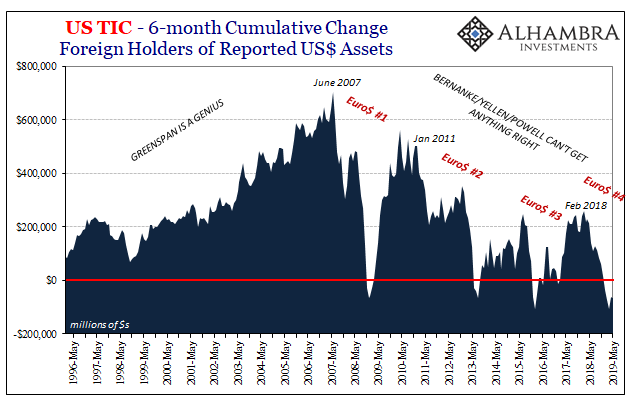

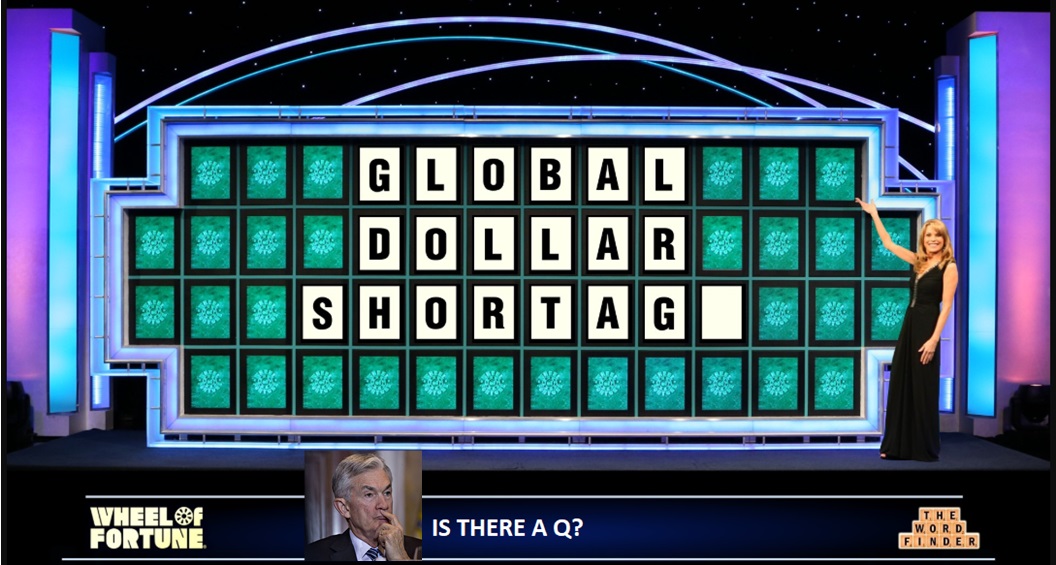

On the other hand, history tells us that bank reserves are more or less irrelevant to the wider dollar situation. It may be the first time EFF has crossed IOER, but this isn’t the first dollar shortage of the last decade. It’s actually the third.

Because of so many inconvenient questions, that may be why officials are openly hedging themselves. Not only have there been three adjustments to IOER, the FOMC is almost certainly going to unveil a standing repo facility in the near future. I’d be surprised if it wasn’t given some testing before it becomes operational, but there does seem to be some rush or at least urgency (the minutes for the last policy meeting contained an unusual amount of text right at the start devoted to the standing repo, and from that we can infer a serious internal discussion).

This after dismissing EFF throughout 2018 as being due to temporary “special factors” or nothing at all to be concerned about. It snuck up on them just like everyone else who only paid attention to bank reserves.

The bigger issue is more immediate. All fed funds and IOER really do is confirm that something must be going on. It must be something substantial if it is rippling all the way into this otherwise irrelevant wholesale market. As we saw in 2008 and after, these money markets are a lot more complex than what you’ve been told. There’s ample room for something like this to develop (for a third time) regardless of the level of bank reserves (the lesson of 2011).

It’s not about EFF moving above IOER. It is how EFF’s changes over the last year and a half corroborate everything else, and by moving above IOER it leaves little doubt as to what that corroboration really means. Something is holding depositories out of wholesale. QT is one theory, but one that doesn’t explain all the rest of the evidence.

When what is irrelevant suddenly becomes slightly relevant, banks refraining from meeting a slight uptick in the wholesale demand for inert bank reserves, even in just a little amount that is significant. It doesn’t say a crash is imminent, or anything is imminent, but it does suggest that what’s going on outside of fed funds should be taken seriously. At the same time, the history of IOER says that the claims the Fed is taking it seriously shouldn’t be.

Stay In Touch