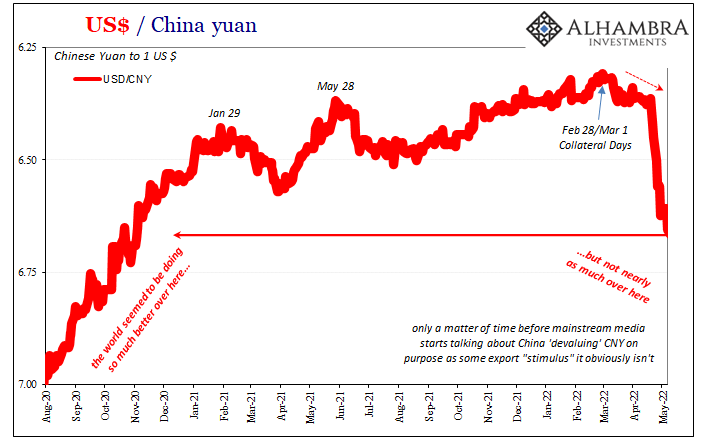

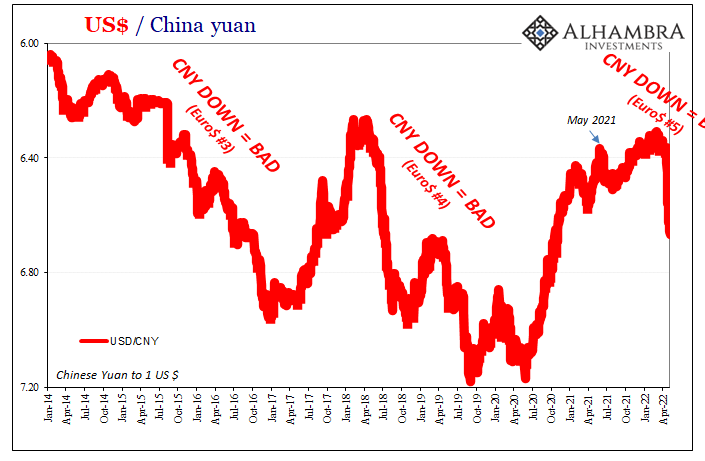

The US$ continues on its rampage, particularly zeroed in on China for simple if misunderstood reasons (that have nothing to do with “devaluation”). What about the rest of the marketplace, the other stuff which identifies the eurodollar’s various cycles? You know about T-bills, which, yet again today, are more like what the dollar is suggesting.

Other than those, what’s the yield curve, eurodollar futures, swaps, even the forward Treasury spread up to?

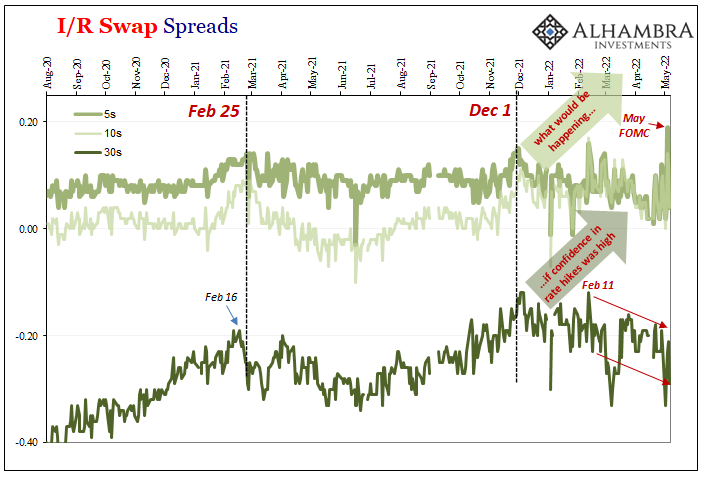

In March – seasonal low point – these were all curve crazy, major fireworks and broad-based inversions. Since, many have calmed down a tad, apart from IRS swaps which have been less improvement-fluctuating than the others (though these popped this week on the May FOMC, which is not unusual). This is almost certainly because the swap market’s close connection with collateral therefore T-bills.

After all, if collateral becomes scarce (its multiplier drops, for example), not only would that induce an overall deflationary, tight-money collateral ripple systemwide then leading to “notable selling of foreign reserves” which correlates with falling IRS spreads, at the same time it prevents dealers from arbitraging those same spreads (meaning they fall more than they “should”) to moderate the resulting nonsense. It explains both why IRS spreads fall in the first place, before then failing to come back up to any substantial degree.

T-bills are just as ridiculous today as ever, both 4- and 8-week seriously below RRP while the 3-month inches lower toward it. Thus, swap spreads, especially the 30s, these aren’t really budging when they should be rocking decompression if the market “bought” rate hike fever (and a solid rationale rather than the rationalizing behind it).

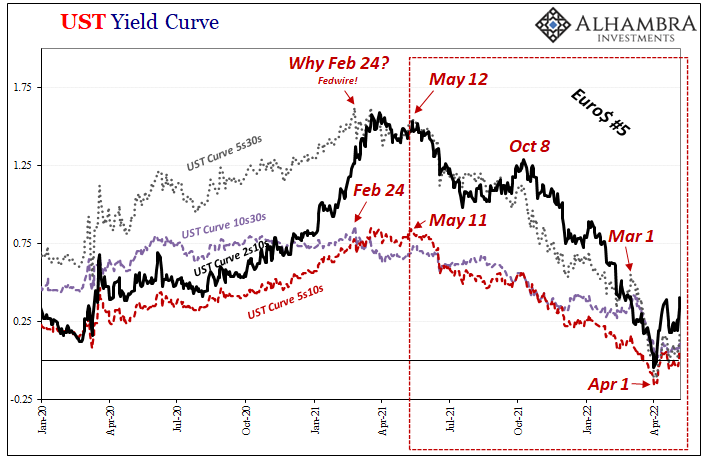

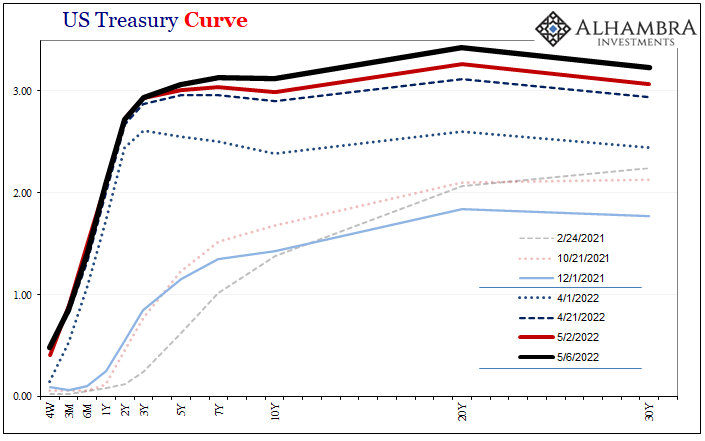

The rest of the yield curve, by contrast, has steepened somewhat particularly between the 2s and 3s, an improvement upon March then April. As of today’s close, only a tiny bit inverted between the 7s and 10s (also 20s to 30s, but I don’t count that as inverted inverted). Again, normal fluctuations that the curve goes through during similar periods; it’ll invert, un-invert, and then re-invert multiple times along the way.

Forward spread, however, this one remains deeply upside down – also typical – which is one way of confirming what I just wrote.

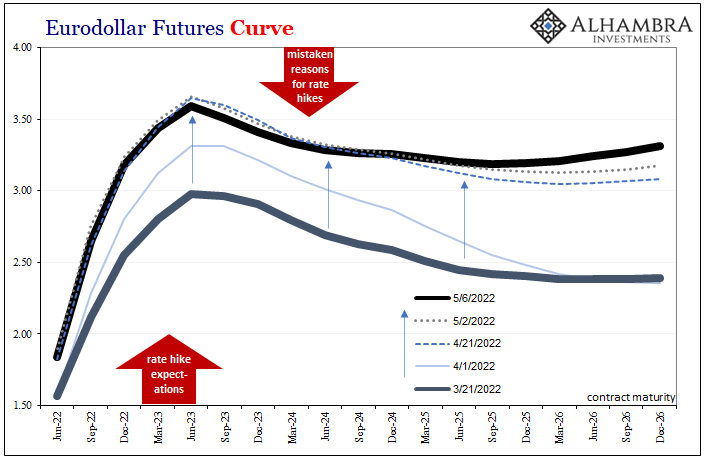

Over in eurodollar futures, its curve has essentially moved itself upward as the FOMC reveals itself to be more hawkish. The shape from before late April has been revisited in early May. Still wildly inverted, yet the whole curve moved higher nominally given a more aggressive hawkish stance on hikes.

This is likely because Fed policymakers, Mr. Powell in particular, have made it perfectly clear (press conference) that rate hikes aren’t really attached to economic conditions. Yes, that’s what he said and “they” will continue to say, that hikes are in response to inflation plaguing an otherwise awesome economy, but that’s not what’s going on here as the balance of market positions will attest.

Rate hikes because politics until the politics can’t justify more rate hikes due to a plainly obvious deterioration in overall financial and economic condition. This is what’s being priced in every place.

It’s the obviousness and immediacy which remain absent at the moment, therefore why following so many March disruptions there doesn’t appear to be so much drama presently. The hedging therefore pessimism all still there, if not nearly as headline-grabbing.

The dollar has streaked ahead, taking up the task given collateral and maybe thanks to Mao Xi. The rest of the market curves and positions have only moved now behind its lead.

Stay In Touch