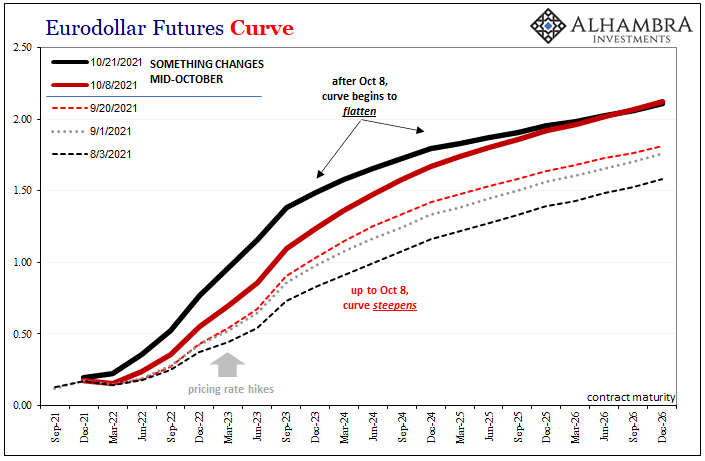

Rate hikes weren’t even a twinkle in Chairman Powell’s eye, not really. Taper was barely on the table at that time, let alone double-taper or today’s rush into QT. Back in October, they all (correctly) still used the word transitory, therefore officials were taking their sweet time winding down QE6.

With the Fed barely evolving from full-on – so it couldn’t have been forward guidance – something else must explain the fact we keep finding October 2021 (as we will March 2022) all over the place.

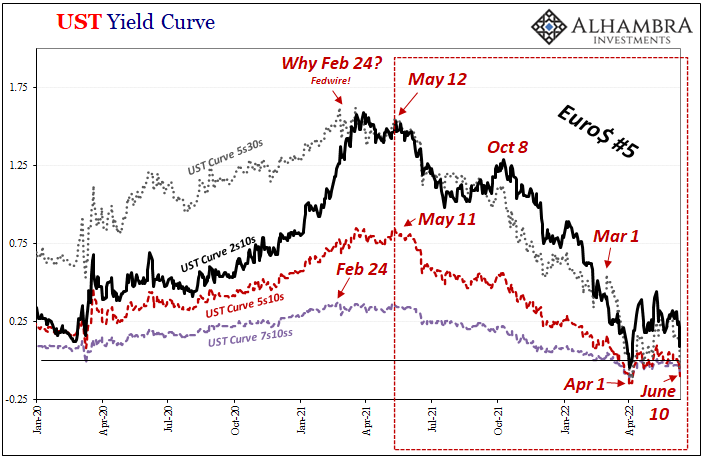

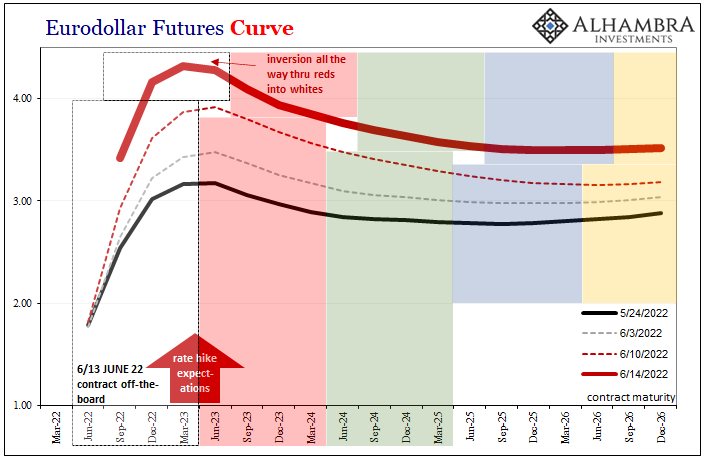

This was when the UST yield curve only modestly flatter from the beginning of Euro$ #5 (which started while the Fed was full-blown QE, I’ll again point out) took its ominous and obvious turn for the much worse. And that turn included eurodollar futures. Each’s pivot toward the dramatic inversions of today trace back specifically to last October.

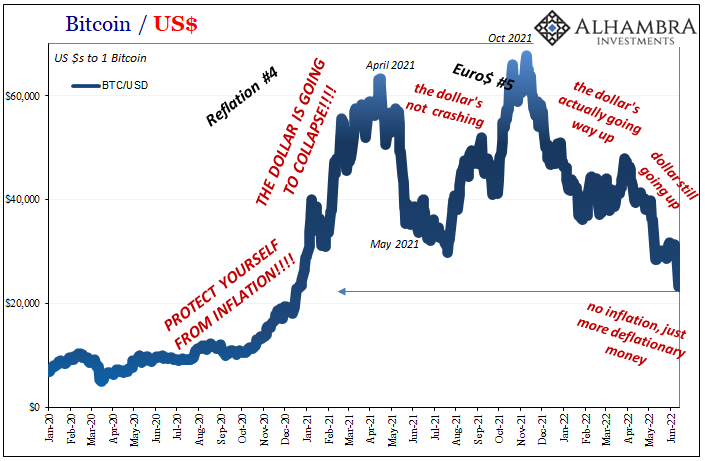

Even Bitcoin!

October. October. October.

While this repetition makes the “when” really easy, the “what” is only a little less obvious. I’ve cataloged a whole bunch of candidates, the usual deflationary money characteristics typically associated with these eurodollar phase transitions. Everything from the debt ceiling disruption in the way-too-important T-bill collateral flows to Eurobond rejection equally a plague on collateral.

There was the flood of inventory which finally began arriving on American shores last October, a deluge which was largely produced in China. Maybe only a nudge at first, we have to wonder if American wholesalers started to scale back their ordering a touch around that time especially when combined with increased funding difficulties from the visibly worsening Euro$ #5.

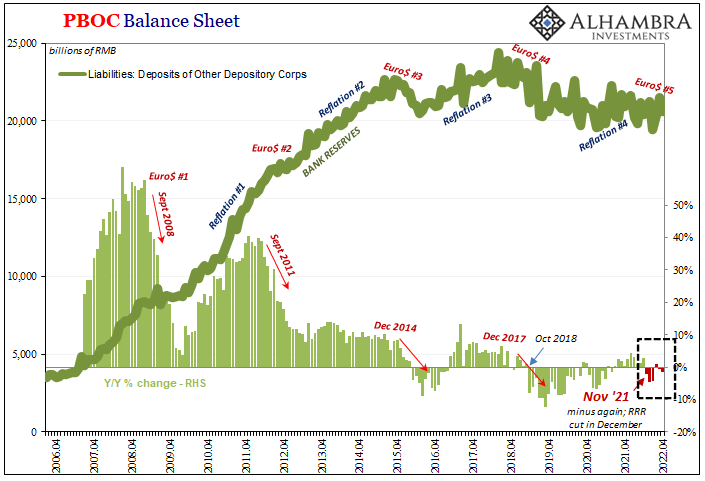

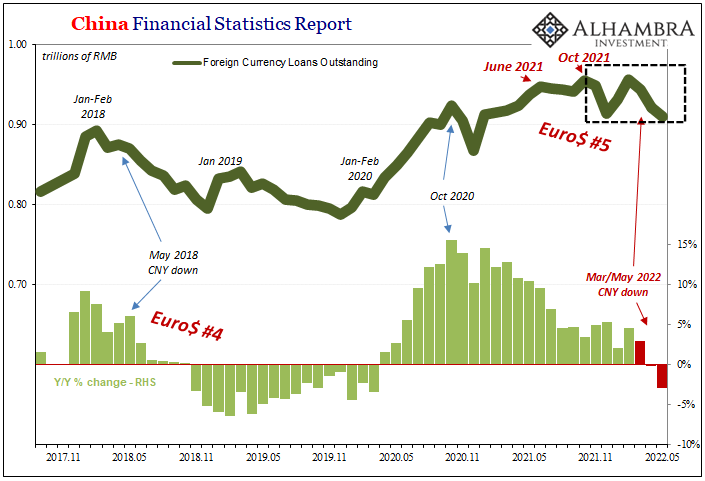

After all, October 2021 shows up as a top for key Chinese monetary balances, too. The month following, November, suddenly Corporate China has difficulty securing foreign currency loans (data from the PBOC’s Financial Statistics Report; below) and, yet again, the level of bank reserves (PBOC balance sheet; below) begins to decline as in every other Euro$ case.

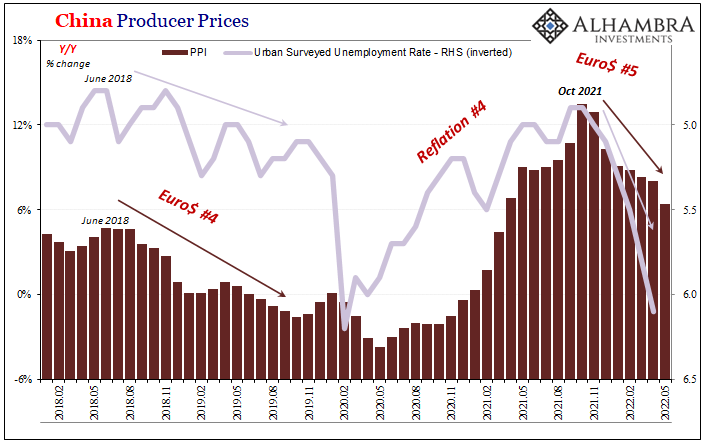

That’s not all; just the beginning. As noted yesterday, China’s crucial measure of producer prices peaked, yep, October 2021. Ever since, this stat highly correlated with the rest of the global economy has been on a downturn (though no one knows is aware of this fact with all mainstream focus devoted entirely to US or European CPIs).

As the Chinese PPI gives us important clues about the state of the global economy, it also corresponds with the state of China’s domestic economy, too.

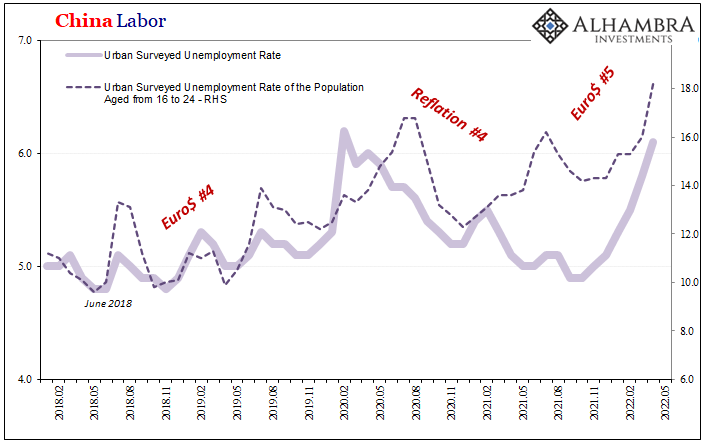

Most people probably don’t realize China has a growing employment problem, and by growing problem I mean shrinking employment. This, too, has been lost in the noise only this one blamed entirely on Xi Jinping’s Zero-COVID.

But like the PPI, China bank reserves, foreign currency loans, etc., etc., this dangerous, recessionary labor market setback also predates the latest run of pandemic political madness. The unemployment rate started to rise in, you guessed it, November.

October was China’s peak, too.

Hand in glove, market prices and actual economic circumstances. USTs or eurodollar futures, both picking up the deflationary money along with the probabilities for the prolonged consequences from it spreading globally across several key points where general weakness (see: China’s youth unemployment above) rather than inflationary full recovery had always been.

This isn’t about the Fed; it is nothing about the Fed except what again the FOMC will get wrong (tomorrow and the shortest run). It’s about how there was never inflation and that the global economy and its reserve currency are, over time, highly globally synchronized.

Again.

It never left.

— Jeffrey P. Snider (@JeffSnider_AIP) June 14, 2022

Is it really too much to ask the financial media to know how curves work and behave? Don't answer that. Economics. https://t.co/STfTUcF11X

Recession risk isn’t a new thing in June 2022, it’s the same thing that’s been coming for a long time already. Every chance to deviate, every excuse offered over these many months, markets, money, economy, they all continue down this same path. Therefore, curve inversions including the eurodollar futures curve in the whites isn’t about some far-distant economic and financial problem.

Far-distant would’ve been well before last October.

Stay In Touch