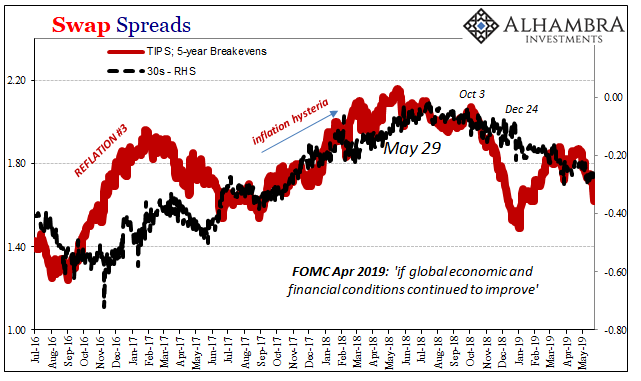

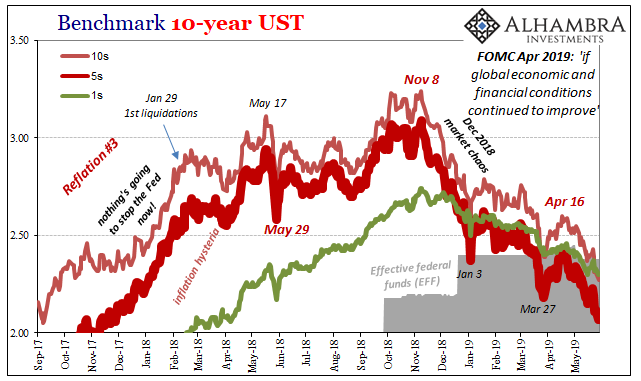

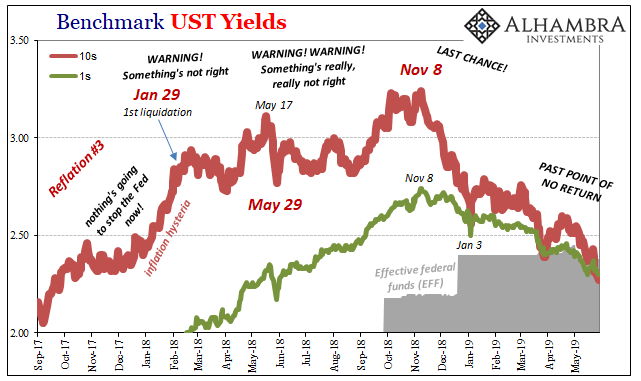

Tomorrow will be one year since the global monetary system broke. Or, for the sake of accuracy, broke again this for the fourth time. There had been warnings going all the way back to September 2017 about how all was not right in the realm of reserve currency. These would take on added importance at the outset of 2018, an outbreak of global liquidations that swept up even stock markets which were supposed to be giving central bankers their much-desired parade after a decade of struggle.

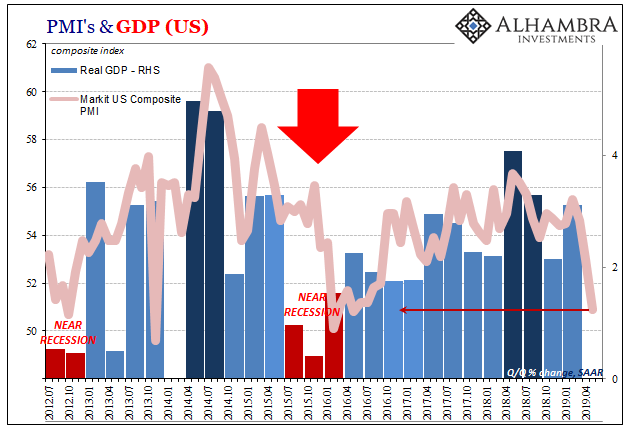

In between February and May 2018, things really got serious. Officials did not. They reacted in their usual unserious fashion, one of the single biggest reasons why we’ve never really left this predicament. Dismissing the clear warning shot of the bond market worldwide on May 29, everything has now bent backward into what sure looks like recession.

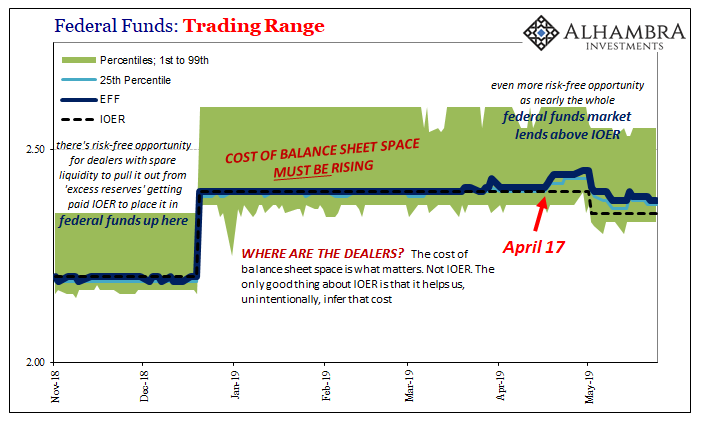

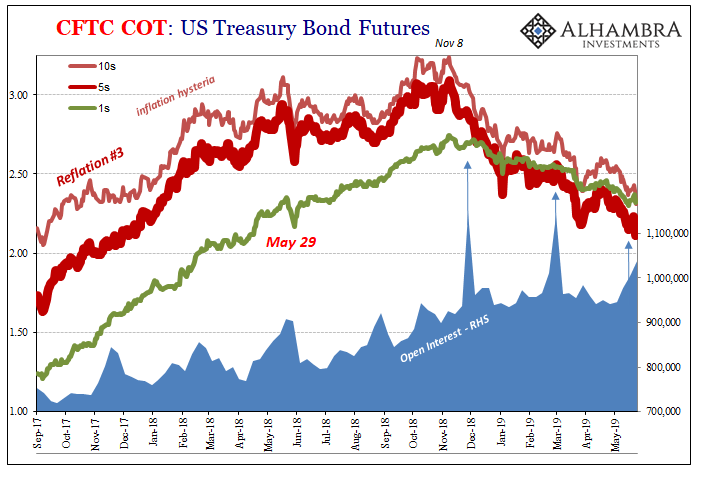

It’s not trade war, it is money war. In one of the biggest ironies of all, federal funds has been right in the thick of it. The fed funds market is nothing, the leftover pocket change of the what’s left over of the FHLB’s. There’s no one there; and yet, federal funds has played a central role in signaling what has already transpired; and what might still.

That’s the irony. The Federal Reserve in 2013 and 2014 decided to keep the federal funds rate as its primary focus for that reason alone. Rather than switch to a repo rate, like everyone else around the world, or even some amalgamation of rates which are relevant, the FOMC voted to keep to federal funds because all that matters to these central bankers is signals.

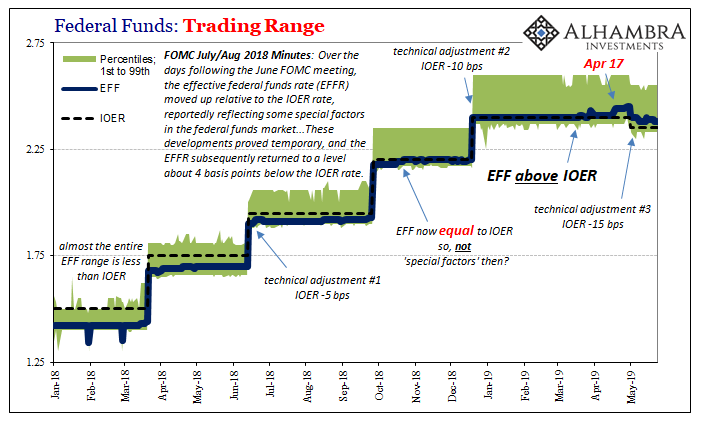

Leading up to May 29, however, the effective rate (EFF) in that market was gesturing more and more about the monetarily obscene. I wrote on June 11 last year, just days before the first “technical adjustment” to IOER, why, especially in the wake of May 29, this charade in fed funds was actually important.

What’s really going on is again very simple. The mainstream and central bankers at the front of it are trying their absolute hardest to deny what in their world cannot be; even though what “cannot be” is just a repeat of what has already happened several times before to uniformly tragic effect. They have to propose the utter absurd (and easily disproved) in order to avoid realizing and confessing to the fact there is no money in monetary policy, and that central bankers have no idea what they are doing on the most basic level.

With that in mind, what happened between January 2018 and May 29 makes sense. Things go wrong in global liquidity, meaning money, and it becomes more and more clear just how little central bankers know their jobs. The one thing the Federal Reserve is supposed to know and be good at above anything else is federal funds. If they can’t even get that right…

It pertains exactly to risk perceptions, liquidity risks first and foremost.

Rather than display even a modicum for sympathy, these Economists plunged ahead talking about an economic boom that was already being erased. To deal with federal funds alone, the FOMC specifically downplayed the action (“special factors”) and then unleashed their joke (IOER).

This was June 13.

Satisfied with setting IOER 5 bps below the top of the federal funds policy range (it had previously been set at the top), the rest of the bond market took it the other way. These guys and gals are not to be taken seriously – except for the nominal case of the short-end interest rate.

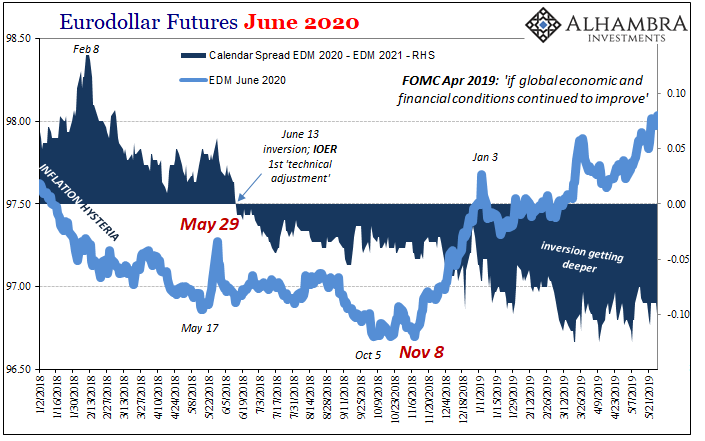

I don’t find it coincidental how just two weeks after May 29 (WARNING!!) the eurodollar futures curve first inverts the day that first “technical adjustment” was made. The market on May 29 pled with officials to take it seriously; which they didn’t.

In between May 29 and November 8, things only got worse. Risk perceptions kept rising even if nominally the bond market would price more “rate hikes” at the front. That would stop after November 8 – the next big warning in the series. I wrote a few weeks later, on November 19:

The 2021-22 inversion is now gone, a positive calendar spread in its place. This doesn’t suggest Powell is in the clear, quite the opposite. This market is now hinting that perhaps the FOMC will realize their big forecast mistake sooner than previously thought.

In other words, things are getting so bad, so many negative indications spreading over the globe, there is a very good chance Jay Powell won’t be able to remain in his “transparent” bubble as long as he would like. The wage data from August and September payrolls aren’t very compelling in November.

Indeed, that was what happened. Chairman Powell came out in December talking “strong” economy like always, the FOMC voting for one more “rate hike.” Then, a mere three weeks later the Fed “pause” proved the market viewpoint.

Once again, officials responded to signals of illiquid behavior all over the world finally reaching federal funds with little more than a second “technical adjustment” to IOER.

At the time, what stood in the way of an outright plunge in bond yields was only the short end. By January 3, the UST curve was distorted badly but the drop in nominal rates itself paused as the market’s long end found itself suddenly in conflict with the short end. However, the short end isn’t the monolithic lever it is made out to be in orthodox dogma.

I wrote at the end of February how Powell was very likely facing the point of no return:

Unless economic conditions actually, meaningfully pick up and soon, the short-term policy alternative boundary won’t stay much of one. At some point, like an avalanche, the whole curve might just sink under it as Jay Powell watches from the sidelines in horror. Like Alan Greenspan, the current Fed Chairman is no doubt flabbergasted by the bond market not acting like a series of one-year forwards as he has been trained to expect.

And so, here we are. The long end has plowed under the short end like it was nothing. The benchmark 10-year UST is today 11 bps below the effective federal funds rate; the 5-year UST note yields an absurd 29 bps less than the 6-month T-bill. I have no doubt officials will try to claim this is nothing to be worried about (financial conditions have improved, they did recently say).

It was federal funds which has again played a central role in this latest outbreak of warnings. The UST curve (along with eurodollar futures) was moving slightly reflationary up until the middle of April. The 10-year yield had even reached a local high of 2.60% on April 16.

Then, “out of nowhere”, beginning April 17 the effective federal funds rate suddenly drove well above IOER. While the financial press was filled with the usual benign explanations of money market funds, tax refunds, and whatever else anyone might come up with, the UST curve would renew its collapse in nearly a straight line to where it rests today.

In between, what else? A third “technical adjustment” to IOER which registers in monetary reality as a third strike. These people who we are told are in charge of such things, the markets have all the necessary information and evidence to hold them in contempt. They are not to be taken seriously because, again, they are entirely unserious people.

So far, it has been a preamble in three parts. January to May 2018, EFF rises within the range and bad things start to happen all over the globe culminating in May 29. Technical adjustment #1. June to November, bad things then start to happen closer to home, the US and Europe, federal funds reaching IOER for the first time. Technical adjustment #2. December to recently, bad things everywhere and federal funds goes way above IOER. Technical adjustment #3.

The rate cuts are looming because monetary officials cannot take seriously these monetary problems. If they did, that would undercut everything they’ve said about anything: from the boom to the actual shape of the financial system. To acknowledge what federal funds really signals would be to erase everything you’ve been taught in the mainstream about how the system works.

Only, now it’s probably too late. With the curves this far distorted, yields plunging this low, there’s no getting the toothpaste back in the tube. May 29 was probably their last chance, given the way things have worked out over the past year, but it wasn’t a realistic one because to have prevented this course would’ve required an epiphany no central banker is currently equipped to have.

That’s what the yield curve is now saying, what it has been saying all along. And federal funds, surprise, surprise, is right there in the middle of it sharing that very fact this whole time. The FOMC was right about sticking with tradition, except keeping federal funds it has only communicated how they really have no idea what they are doing.

And now the rate cuts are just about here. As is, importantly, the economic justification for them.

Stay In Touch