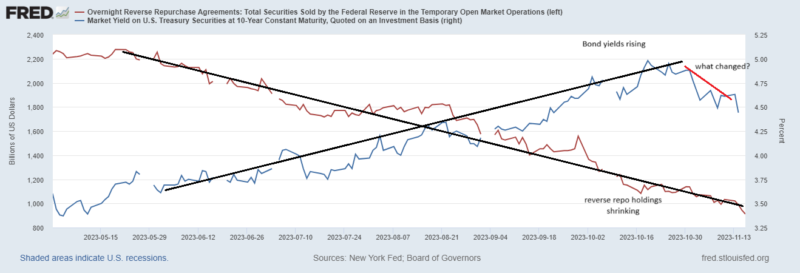

For the first time since March we are seeing a positive correlation between bond yields and reverse repos sold by the Fed. The change started during the last week of October and has continued throughout November. The correlation in March coincided with bank failures, mainly Silicon Valley Bank and Signature Bank.

In between March and the end of October, the was a steady exit from reverse repos and into other assets like longer dated treasuries. Given the negative correlation between yields and repo balances, one can surmise that as longer dated yields rose, banks exited repos to slowly take advantage of better longer term yields. The implication of market action and correlations the last few weeks is that banks are aggressively exiting repos to purchase the duration.

Previously, these large players would work the bid and slowly roll into longer dated securities. But the recent action is best described as an aggressive player lifting the offer. Action like this leaves the sellers of these bonds holding cash (liquidity). And that liquid cash goes searching for a new home.

It is fairly obvious that some of it has found its way into a relatively illiquid stock market. About $225B have rolled out of repos since the end of the month and about $645B since the end of Q3. One wonders how the stock market can go up in the middle of a banking crisis. When asset owners get displaced from their assets by an aggressive buyer it can be like a game hot potato or musical chairs as the money often looks quickly for a new home.

Back in March, this was big players de-risking. Why is this happening now? We believe it’s large players reaching for duration because the economic news has soured a bit and it doesn’t appear they will receive a better rate from Powell. The Treasury lowering their expected issuance likely added to the expediency to rebalance into longer dated bonds.

Presently I’m not categorizing this as a risk on event for an asset class like equities, just a pop in liquidity. The commodities market does not share the same the same sentiment as the stock market. Bull markets based on underlying fundamentals don’t tend to move like this, we’ll have to see if there is any follow through.

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the information herein constitutes an investment recommendation, investment advice or an investment outlook. The opinions and conclusions contained in this report are those of the individual expressing those opinions. This information is non-tailored, non-specific information presented without regard for individual investment preferences or risk parameters. Some investments are not suitable for all investors, all investments entail risk and there can be no assurance that any investment strategy will be successful. This information is based on sources believed to be reliable and Alhambra is not responsible for errors, inaccuracies, or omissions of information. For more information contact Alhambra Investment Partners at 1-888-777-0970 or email us at info@alhambrapartners.com.

Stay In Touch