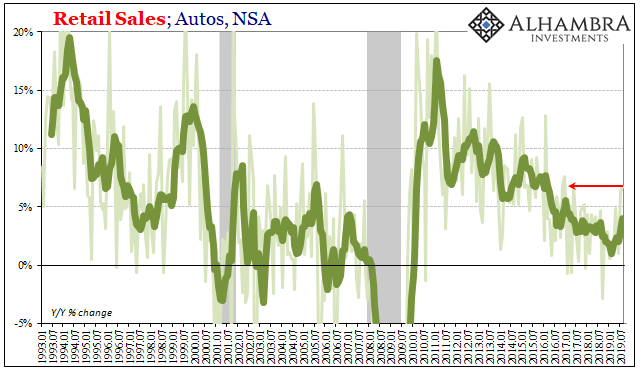

According to the Census Bureau, auto sales in the US may be on the upswing. Rising 6.8% year-over-year in August, it was the highest rate in nearly three years for retail sales of automobiles. This follows an upward revised 6.3% increase during July, the best back-to-back months in the beleaguered sector since the end of 2016.

Are auto sales experiencing a rebound in the second half of 2019, just as Jay Powell has been predicting for the overall American economy? Or is it just another short-term fluctuation, the natural ebbs and flows in any economic segment wherein this particular one had been far more ebbing than flowing?

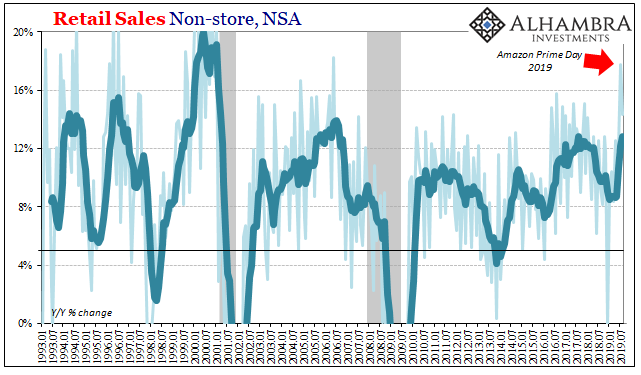

To go along with cars and trucks, there was still an afterglow of online expensing last month, too. July had Amazon’s huge Prime Day and though it was revised downward by the Census Bureau (from off-my-scale huge to visibly-in-the-upper-range huge) there were still major gains in August.

The big problem with such an unusual event, a true outlier, is that it is an outlier. A statistical issue rather than a macro one, the Census Bureau just doesn’t know how to model this kind of thing. What “should” July and August have looked like given that this past July was truly unique.

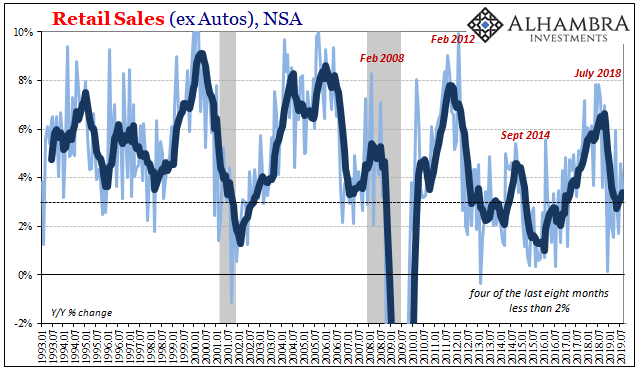

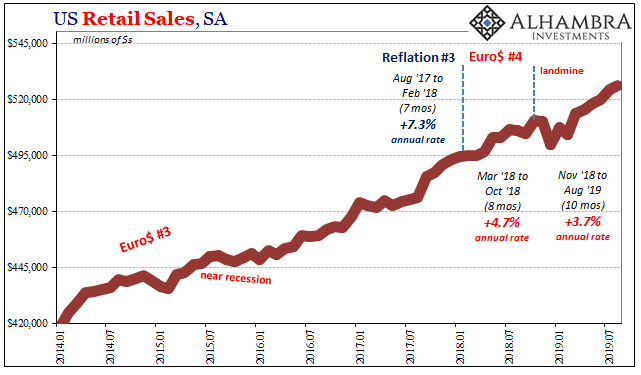

Even with online retail sales plus retail auto sales, the headline number for August 2019 still wasn’t much above 4%. At 4.2% year-over-year, it remains well below last year as well as the historical range as cause for concern (anything under 6%). Excluding auto sales, the growth rate was back down in the threes (an ugly 3.6%). Outside of autos and the internet, there’s not much spending going on – still.

On the one hand, it might be encouraging that consumers are for two months anyway back at dealer showrooms picking up new pick-up trucks. And that more than Amazon has been robust in virtual retailing.

On the other hand, only 4.2% overall despite what should have been much larger positive contributions. Buying a few more autos at the expense of other goods does not seem the recipe for a sustained economic comeback.

The trend in retail sales is much the same as in the Establishment Survey; there’s always a “good” or at least good-looking month or two no matter what. What counts beyond the month-to-month changes is the frequency of those. Like the payroll numbers, there’s been fewer of the ones which sound good in the headlines; in the case of retail sales, near and above 5% (going back to last October, just two out of ten: July and Prime Day was 4.93% plus April’s one-off 5.76%).

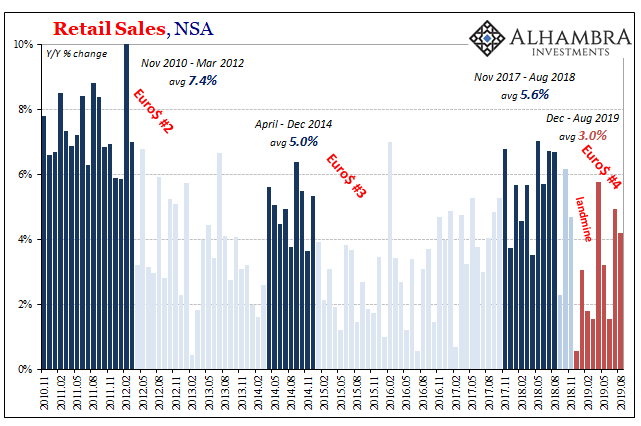

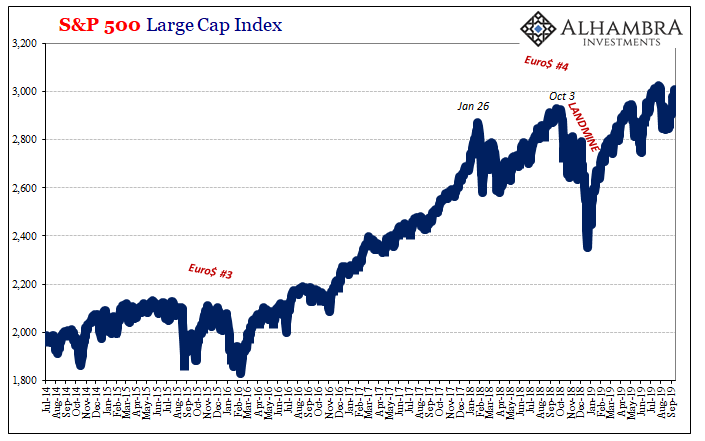

What’s somewhat intriguing is how the intermediate trend in retail sales resembles the plight of the NYSE. Why was spending down so much in December at last Christmas? For consumers, perhaps the landmine was their reading of the economy filtered through the lens of stock prices.

After a few months trending back toward new highs (though not much higher than the last highs), retail sales are back closer to being on track – but not quite on track as the latest month shows.

There are any number of Economists and central bankers who believe this is actually the case. Not because the stock market creates wealth, higher share prices that lead Americans to cash them in and spend the windfall, rather it is purely expectations. The very bailiwick of modern monetary policy. I wrote late last month:

Today, “the” economy is far less personal and tangible. To most if not the vast majority, it is an outside view from afar. What’s GDP? How’s the unemployment rate? Someone check the NYSE ticker. These are things which shape a distant view of what must be going on over the horizon. How it is for everyone else out there in the world.

Most don’t really follow the in and outs of the global economy all that closely. Everyone is taught, however, that Wall Street surely must whether it’s true or not. Therefore, the S&P 500 equals the macro picture for a good many, especially when combining at record high prices with a longtime low unemployment rate.

Put the DJIA into a 20% tailspin, though, and what might have been nagging if non-specific day-to-day concerns become a hard brake on spending in too many households. I don’t get the feeling the economy is booming but now all of sudden share prices are reflecting those same concerns so I’m going become a little more cautious.

There is some reasonable basis for expectations policy. How people feel about economic conditions does play a significant role in the way in which the economy will turn. To believe that overdue pessimism is the sole cause of recession, on the other hand, is taking it way too far. There are times when the math, meaning money and for consumers income, just doesn’t add up no matter how positive anyone else might feel about it.

It’s certainly one reason why politicians as well as central bankers love to focus on stock indices – but only when they are up. If they are ever down, damn those evil speculators.

And even that leaves the economy of H2 2019 in questionable shape. Stocks are back up, sure, but there’s been an obvious change in trend. Ever since that first burst of Euro$ #4 at the end of January 2018 – eighteen not nineteen – the upside has been visibly contained; rate of change has like retail sales and the economy downshifted to obviously less.

In other words, it actually fits the economic slowdown as it has unfolded thus far.

Not a collapse, not a full-blown recession (to this point), but serious risks and downside questions all around. A few positives, though noticeably fewer of them. The math of dollar money against what’s now left for sentiment meaning rate cuts and renewed QE (globally at first). Can the latter hold share prices up should the math of the former strike again?

Those who argue Jay Powell’s rate cuts are overdone should look at these relationships, as I’m certain he has.

Stay In Touch